fizkes/iStock via Getty Images

“The great secret of success in long-term investing is avoiding serious losses”

I like to read books, and not e-books on a Kindle either (do they still make those?). I am talking about cloth and board, dyed in the wool, hardcover books. I even like them so much I wrote one! Not about investing, but about my mathematician grandfather, Merrill Flood, PhD. He never believed in the stock market, and I think that now I know why. He liked to be able to explain things mathematically and with formulas that could be proven. The stock market has an irrational behavior that cannot be modeled in a consistent, mathematical, or scientific way. Many have tried and there are plenty of quant methods, including the one on Seeking Alpha that is quite good in my opinion. But none of them can model the non-mathematical variable of human behavior.

In his book, Winning the Loser’s Game, Charles D. Ellis writes about minimizing your losses. Never risk more than you can afford to lose. Don’t confuse brains with a bull market – meaning that just because you picked winners when everything was doing well does not mean that is a strategy that will always work. He includes similar anecdotes about how to win at investing by focusing on the winners and dumping the losers, or what I call learners.

In another book that I like, The Mental Game of Tennis, author Brian Cain writes about how in life there are winners and there are ?? (most people would say losers). But he says there are Learners, not losers, because the person who did not win got to learn something from the experience. That way, next time he/she can be more prepared to win. The winner performed well using what was learned from earlier defeats, adding to the notion that there are winners and learners in life, not winners and losers.

Chasing Momentum

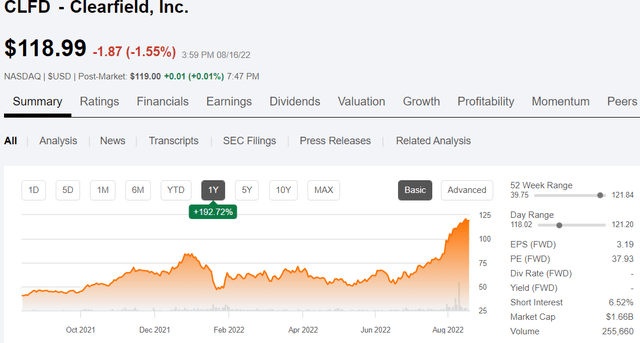

I equate this concept to the stock market because you must learn from your investing mistakes. Everyone makes them. Chasing a momentum stock is one mistake that I have made many times. Right now, there is a fast-growing stock called Clearfield (CLFD) that has rocketed upward by 192% in the past one-year period and is still shooting higher nearly every trading day in August. I would be very careful of investing a large stake in this stock right now, even though there is plenty of reason to like it. But the technical factors indicate that the stock is overbought at the current price.

CLFD is clearly liked by the market right now, and for good reason. The stock is growing like crazy and has tons of future potential in rural fiber buildout with funds from federal bills that were recently passed like last year’s Infrastructure bill and the American Broadband Buildout Act of 2021.

But the momentum in the past few weeks has carried the stock to an all-time high of over $121 and is due to pull back before heading higher, in my opinion. The only way to “beat the market is to exploit other investors’ mistakes” is another quote from Winning the Loser’s Game. And in this example, I would suggest that other investors will continue to bid the price of CLFD up until it suddenly reverses and loses 10% to 20% in a matter of days, especially if something happens to cause the broader market to take a downturn.

So, if you do not yet own shares of CLFD, do not chase the momentum. Wait for it to come to you at a price that you are convinced is a good value. It is currently trading at a forward P/E (price to earnings ratio) of almost 38, which is quite expensive for a stock that has only a $1.6B market cap. I expect the stock price to retreat below $100 and possibly retrace as far as $75 before it starts moving higher again.

CLFD 1-year price chart (Seeking Alpha)

In the stock market, the price of a stock or fund is always about the future value based on earnings potential and/or income yet to be realized. In another interesting book that I am reading (and highly recommend) called Stumbling on Happiness by Daniel Gilbert, he declares that the one thing that makes us humans different from all (or at least most) other animals is that we are always thinking about the future. Thus, the stock market naturally attempts to predict the future in the form of pricing stocks based on the expected future value. And humans are buying and selling based on what they expect to happen to the future price of the stock in question.

The fly in the ointment, though, is the fickle human factor that can change on a whim based on a breaking news event, an economic report that was wildly different than it was expected to be, or some other random event that simply cannot be predicted.

The strategy, therefore, is best described by a quote that is associated with my namesake Damon Runyon (aka Runyan), a newspaper writer, gambler, and socialite, and he said:

“The race is not always to the swift nor the battle to the strong, but that’s the way to bet”

What that means in terms of an investment strategy is to have some core long-term investments in strong companies, that are growing and fiscally strong with a large cash balance and low debt. Stocks that pay a dividend are often a bonus that indicates strong financial performance, especially if the dividend grows over time. The compounding of reinvested dividends has much more investment “power” than many people realize.

Apple at the Core

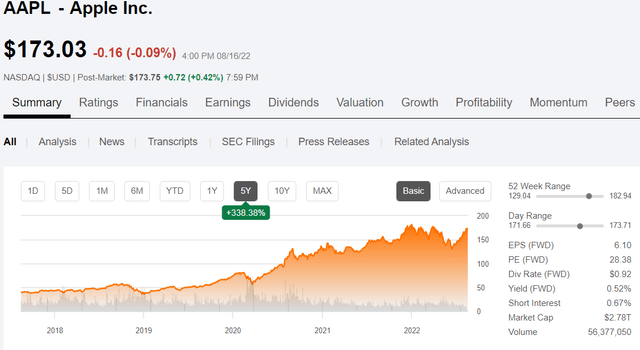

One such stock that I own and believe has good potential going forward is Apple (AAPL). Apple is much more than just a maker of iPhones. There is way too much to say about what Apple does right as a company than I can fit in a couple of paragraphs, but they hit all the right buttons at the right times.

Apple has a very strong brand, a loyal customer base, and a knack for coming out with new products and services that their customers want. For example, the company is expected to announce a new VR/mixed reality headset in the next few months. It is hard to predict what impact that will have on the stock price, but it could move the needle if seen as another revolutionary new product.

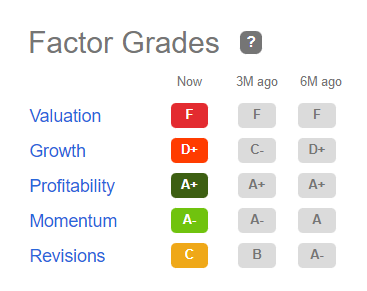

The quant ratings for Apple give it a Hold as the growth has slowed slightly, in large part due to supply chain issues, inflation, China shutdowns, and many of the factors that have been impacting most stocks in the past few months. The company is profitable and has momentum, but I would again caution against buying a large position in AAPL as the price could pull back from recent highs.

AAPL quant factor grades (Seeking Alpha)

On August 10, the stock had bounced 30% from its 52-week low. As an investment, the stock is a Hold right now in my opinion but should be considered a core holding in any long-term investment portfolio that includes individual stocks. Over the past 5 years alone, the stock has increased in value by 338%.

AAPL 5-year price chart (Seeking Alpha)

Fun with Funds

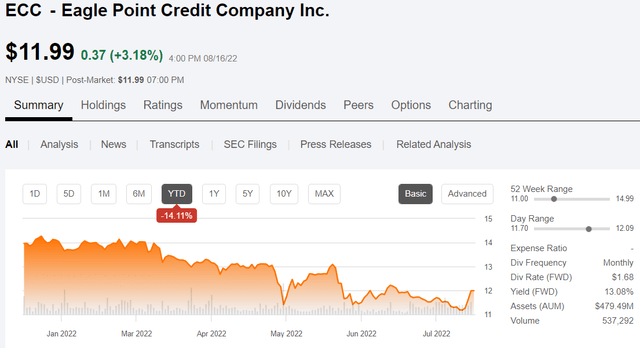

For serious long-term investors who are thinking far enough into the future about how they will generate income in retirement or are perhaps already retired and living off of income from CEFs (closed-end funds), here is one to consider. Recently, there has been a great deal of discussion and debate around Eagle Point Credit Company (ECC). For income investors, ECC is a strong candidate to buy before the price goes up above $12.

ECC YTD price chart (Seeking Alpha)

ECC holds CLOs, which are basically packages of secured senior loans and ECC invests primarily in the equity tranches of CLOs, which are considered riskier but offer higher yields than the CLO debt. ECC pays a monthly dividend of $0.14 which amounts to an annual yield of over 13%. In the first quarter, ECC reported strong results. On August 16, the 2nd quarter report was even stronger with NII of $0.43 beating consensus estimates by $0.06. Another strategy for winning at investing is to go with the earnings “beats”. Most often, the stock price will react positively following an earnings report that beat consensus estimates.

In addition to beating the estimate for quarterly income, the company announced 3 more months of the regular dividend at $0.14 plus a special dividend of $0.25 to be paid in October. Some investors were concerned with the declining NAV of the fund since the start of the year. In other good news for ECC investors, the NAV trend turned upward.

NAV per common share is estimated to be between $10.79 and $10.89 as of July 31, 2022. At the midpoint of the range, this represents an increase of 7.5% from June 30, 2022.

This is an example of a learner for me. I first started investing in ECC back in 2017 when my portfolio was much smaller. But I have gradually grown the position by adding shares over time and reinvested the monthly dividends to grow it even faster. ECC now represents about 3% of my overall portfolio value, but the income it generates helps to grow that value even faster.

In another 5 years, the income generated from ECC will be available to me if I need it to live off of, or I can continue to reinvest the monthly dividends and grow my overall portfolio even faster.

The reason that I call ECC a learner is because if you just look at the price, which is down -14% YTD, you might think this one is a loser, and I should sell it before it loses more. But the nature of the fund and its performance relative to other similar investments, such as other CLO funds, needs to be taken into consideration.

The credit markets were hit hard in June and began to recover in July. Many high-yield income funds as well as stocks across the board lost a lot of value in the first half of 2022 and especially in the month of June. But there is only a “paper loss” if no shares of the fund are sold. In fact, the learning part of this example is that even more shares can be purchased by reinvesting the monthly dividends while the price is low. Thus, the long-term gains in income are increased but at a lower cost of investment – lowering the cost of yield.

These are just a few of the strategies that I have learned over the past 15 years of active investing. I learned some hard lessons in the market crash of 2008/9 and was not well-prepared to take advantage of the March 2020 crash either. But now I am getting my learning on and putting it to good practice. I wish you all success in your investing, and may you find something useful in what I wrote.

Be the first to comment