kali9/E+ via Getty Images

Investment Thesis

Cleveland-Cliffs (NYSE:CLF) is cheaply priced. But the question is how cheap? If 2023 turns out to be relatively similar to 2022, or even slightly worse, this would put the stock offering approximately 20% free cash flow yield.

If, on the other hand, 2023 turns out to be a tough period, it’s possible that Cleveland will only offer investors a 10% free cash flow yield.

There are a lot of different assumptions and unanswerable questions, but in a nutshell, this is it. The stock is cheap, but its outlook is very fuzzy.

All considered, I rate the stock a buy.

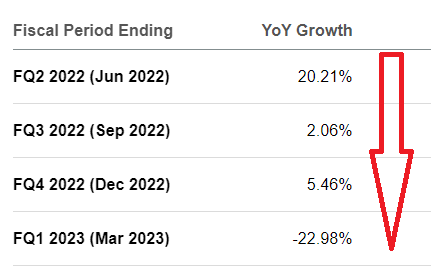

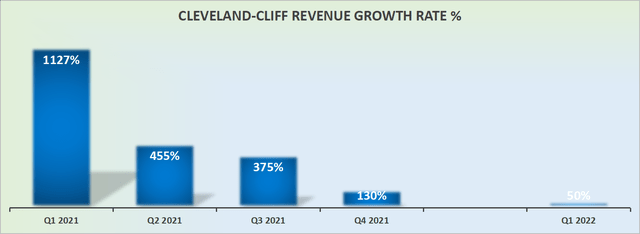

Revenue Growth Rates are Cyclical

The graphic above is something that is troubling investors. It shows that after a sizzling performance in 2021, the best of its strong revenue growth rates are now in the rear view mirror.

CLF analysts’ revenue expectation

Moreover, as you can see above, analysts’ expectations for Cleveland-Cliffs’ revenue growth rates are expected to rapidly slow down in H2 2022.

In fact, the single biggest consideration laying on investors’ minds right now is all coalescing on the following. Are we going into a recession in 2023? And how long will this recession last?

I have no answer to these questions. Indeed, I do not profess to have any idea where the business cycle is headed to. I believe that’s an impossible task.

The slightly easier task is to attempt to ascertain whether or not there’s value to be held in Cleveland-Cliffs while the company is priced at approximately $10 billion market cap.

Cleveland-Cliffs’ Near-Term Prospects

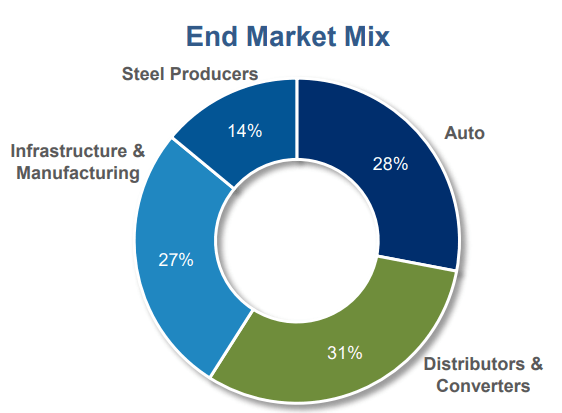

From the demand perspective, Cleveland-Cliffs asserts that its end markets are substantially diversified.

Cleveland-Cliffs June Presentation

While from the supply side, Cleveland-Cliffs contends that many of its peers have been over-reliant on lean supply chains and that they have been left over-exposed to the tough macro environment.

For its part, Cleveland-Cliffs declares that its vertically integrated business model offers its operations an advantage relative to other steel manufacturers.

Cleveland-Cliffs June Presentation

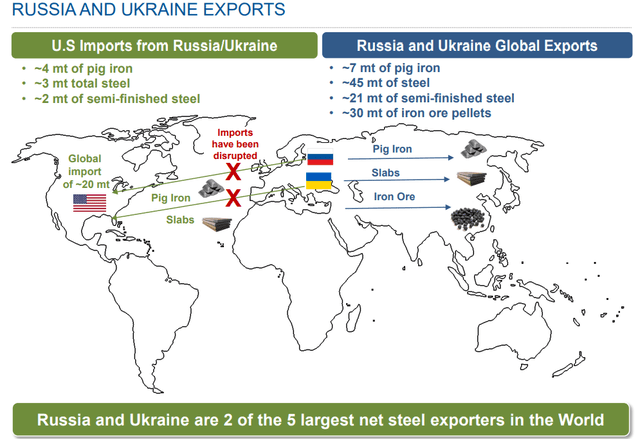

When it comes to investing in the steel industry, the big question is always around supply. Cleveland-Cliffs believes that Russia and Ukraine are 2 of the largest steel exporters in the world and that this supply has now essentially gone offline.

And that this leaves Cleveland-Cliffs in an advantageous position, given the somewhat tight steel supply discussed above.

Cleveland-Cliffs June Presentation

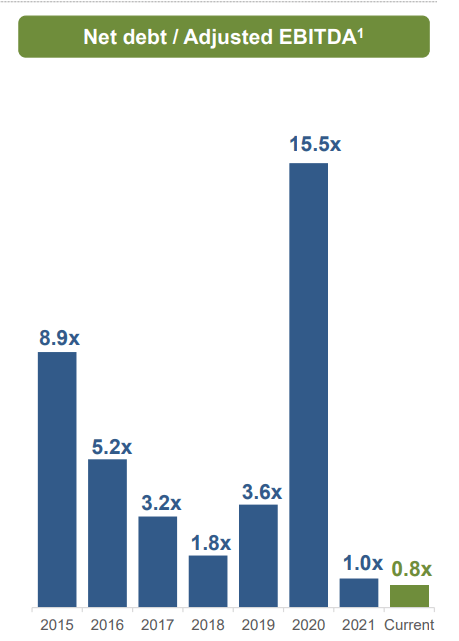

Also, keep in mind that the Cleveland-Cliffs’ present balance sheet is the least leveraged it has been over the past several years, at less than 0.8x net debt to EBITDA presently.

Profitability Profile in Focus

In 2021, Cleveland-Cliffs’ free cash flow reached approximately $2.0. Meanwhile, when Cleveland-Cliffs reported its Q1 2022 results, it contended that it was on target for a record amount of free cash flow in 2022.

Consequently, this implies that Cleveland-Cliffs is probably on target to generate slightly more than $2 billion of free cash flow.

Cleveland-Cliffs June Presentation

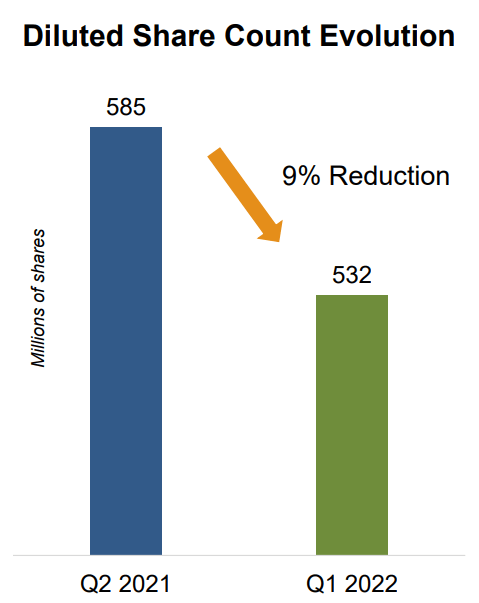

Meanwhile, Cleveland-Cliffs believes that its shares offer tremendous value and has retired approximately 9% of its y/y since Q2 2021.

Furthermore, Cleveland-Cliffs has an open-ended share repurchase program of up to $1 billion worth of shares on the cards.

Realistically, it’s difficult to know exactly how aggressive Cleveland-Cliffs will be with its announced share repurchase program.

That being said, if Cleveland-Cliffs bought back its total announced program, this would amount to a 10% capital return to investors. Something to keep in mind.

CLF Stock Valuation – Priced at 5x Free Cash Flow

Cleveland-Cliffs is priced at 5x its 2022 free cash flow. The bearish thesis here is the unspoken assumption that you don’t buy cheap cyclical when the multiple is low.

The other consideration, that’s perhaps more pertinent, is that there is the expectation that as the economy slows down as we progress into 2023, Cleveland-Cliffs’ ability to generate impressive free cash flows, as it has in the past 2 years, will rapidly retrace back down.

The Bottom Line

Investors find themselves in a “risk-off” mode. Investors don’t want to deploy capital into cyclical commodity companies when there is the overhanging expectation that the US may be moving towards a recession.

The other looming expectation is that Cleveland-Cliffs has a lackluster 2023. What was a company generating more than $2 billion of free cash flow in 2022, could be a company generating around $1 billion of free cash flow in 2023.

That would then price this cyclical steel company at 10x free cash flow which would not be all that attractive for the risks involved. That would put the stock priced on a 10% free cash flow yield when the risk-free 10-year bonds are priced at 3%.

Personally, if the biggest worry is that if things go sour that stock is “only” generating 10% free cash flow yields, rather than 20% free cash flow yields, that doesn’t appear to me to be such a bad bet. All in all, I rate this stock a buy.

Be the first to comment