JimVallee

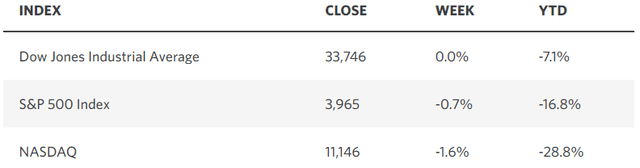

Markets were caught between two countervailing forces last week. On one hand, a combination of weaker-than-expected inflation data and a resilient level of consumer spending strengthened the soft landing narrative and supported risk asset prices. On the other, relentlessly hawkish rhetoric from Fed officials with warnings of continued monetary policy tightening worked to temper investor enthusiasm. The result was modest declines for the major market averages, while interest rates were little changed.

Edward Jones

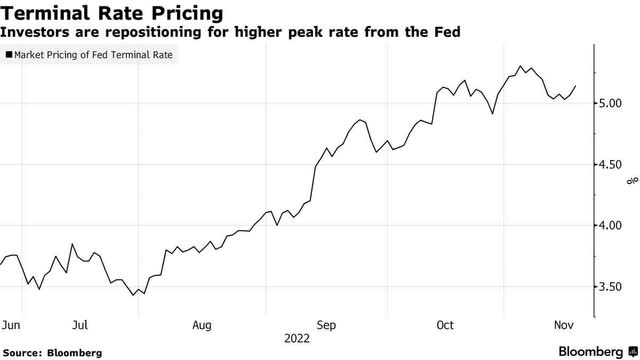

The bears continue to hang on every word spoken by Fed officials, as though they were meant to be taken literally, and the officials delivering them had a track record of forecasting with some accuracy. This is understandable for those hoping to see a retest of the October lows, but the market has not cooperated. The intent of these speeches from day to day is to maintain the level of restrictive financial conditions currently in place. If interest rates fall too much or stock prices rise significantly, then financial conditions loosen and have the potential to stoke demand before the Fed feels comfortable with the downward trajectory of the rate of inflation. Even a modest acknowledgement of success on the inflation front could unleash a surge in financial asset prices. Therefore, the Fed is working relentlessly to keep expectations for the terminal rate pinned at 5% or higher, and that is where the market’s outlook stands.

Bloomberg

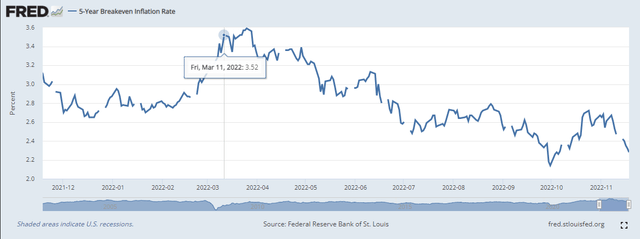

Policy makers will not publicly voice where they see the terminal rate. This is why I have repeatedly advised investors to ignore what Fed officials say and focus on what they are likely to do based on the incoming data. What I find encouraging about the stock market at this juncture is how well it has held up in light of expectations for a higher terminal fed funds rate and the growing consensus that a recession in 2023 is inevitable as a result. I think the market is starting to discount a more optimistic outcome and with good reason. The incoming data suggests that inflation will fall more rapidly than expected, while the economy maintains a very slow but positive growth trajectory. The Fed started raising short-term interest rates in March of this year when long-term inflation expectations, as measured by 5-year Treasury breakeven rates, rose to 3.5%. They have since fallen to 2.3%, which is close to the Fed’s target.

FRED

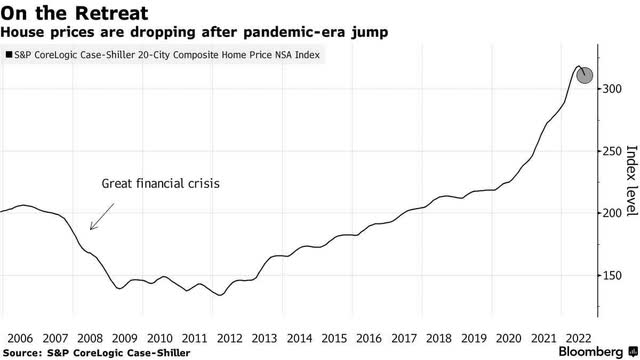

This is the market’s way of saying that the Fed has done its job, because monetary policy tightening works with a long lead time, while the headline inflation number is reported with a tremendous lag. Leading indicators of tomorrow’s inflation number are telling us that it will fall rapidly next year, with home prices serving as the tip of the spear. Existing home sales have fallen nine months is a row and are down 28% over the past year, due primarily to affordability. Finally, home prices are starting to decline and new rental rates are following. As the largest component of the index, this will be a huge drag on the overall inflation rate next year. The Fed does not need to tighten more to accelerate this process.

Bloomberg

Think about a quarterback who wants to throw a touchdown pass to his receiver. Does he wait until the receiver is standing in the endzone to throw the pass? No, he throws the ball well in advance, so that his receiver, who is a moving target, has time to run into the endzone and catch it. Monetary policy is no different in that Chairman Powell is the quarterback, the Fed’s policy rate is the pass, and the targeted inflation rate of 2% is the receiver or target.

If the Fed continues to raise short-term rates to 5% by March of next year, as fed funds futures are now predicting, it is likely to be a pass thrown too far and for too long. The rate of inflation should be in a discernible downtrend by the spring, while monetary policy would be growing increasingly restrictive. This is why there are recession fears. It is also why I think another 50-basis-point rate increase at next month’s meeting that results in a terminal rate of 4.25-4.5% will conclude the Fed’s rate-hike cycle and be sufficient to bring inflation down to 2-3% by the second half of next year. Fed officials will not acknowledge that in hopes of preventing investors from loosening financial conditions in the process. Therefore, recession fears will linger.

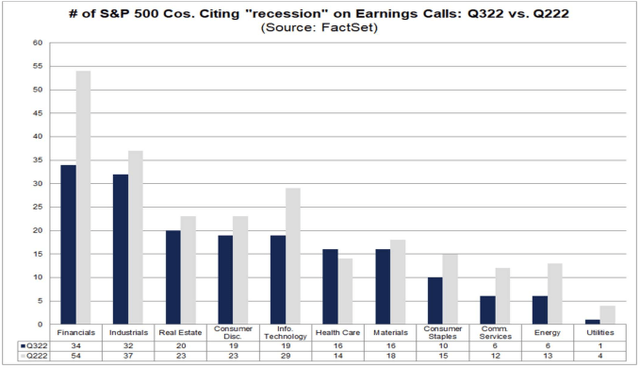

It was encouraging to see a notable decline in the number of references to “recession” on third-quarter earnings calls. Management teams in every sector with the exception of healthcare appear to see an economic contraction as less likely than they did three month ago, which is a positive rate of change.

FactSet

My soft landing scenario is based on expectations that the inflation rate falls below the rate of wage growth over the coming 6-12 months, while excess savings from pandemic-relief programs continue to serve as a bridge between now and then. The real wage growth that should ultimately result will sustain a very modest increase in consumer spending and prolong this expansion. As a result, interest rates should fall modestly from current levels and the dollar should weaken in 2023, as these two headwinds become tailwinds for risk assets next year.

Be the first to comment