Mario Tama

We take the publication of the 2Q22 figures of Altria (NYSE:MO) and the Food and Drug Administration’s (FDA) negative decision regarding Juul as an opportunity to look at Altria. In particular, we take the perspective of a long-term investor and also look at the current valuation of the stock.

Juul: Let’s put a lid on it and be done with it

On June 23, 2022, the FDA revoked Juul’s approval to sell its products in the U.S. This is bad news for Altria, which has held a 35% stake in Juul since the end of 2018. At that time, they paid a whopping $12.8bn. Now, following the last capital for the time being in a seemingly endless list of write-offs, Juul is now on Altria’s books with a slim $450m. A catastrophe, which had indicated itself in the course of the last 3.5 years, although the grand finale in such a way was probably not expected. From the stock market’s point of view, Juul’s chapter should now be closed with a paltry residual value of less than half a billion USD. As a reminder, Altria’s market capitalization is around $80bn.

Inflationary tailwinds amid regulatory crackdown

The current inflationary environment puts Big Tobacco in a comfortable situation to raise prices. Reuters states:

More than 80% of the price of a packet of cigarettes in Britain goes to the taxman [VAT and cigarette excises], a major lever in the battle against smoking. But such thinking also gives tobacco giants a shield when input costs soar – a 10% leap in raw materials prices translates into an overall rise of 2% or less. Nicotine-craving customers will happily inhale that.

Generally speaking, this allows tobacco companies to pass through a huge chunk (and more) of an increase in input costs to consumers. This is due to the substantial negative price elasticity of demand of tobacco products (nicotine and alcohol in general), i.e., a price increase of, let’s say 10% leads to a decrease in consumption of less (!) than 10%. This leaves manufacturers with additional revenues/ profits despite losing the most price sensitive consumer cohort. This loss is over-compensated by the remaining customers. A feature that is much appreciated by inflation-wary investors as actual profits today are arguably more attractive than potential windfall profits down the road of, let’s say, innovative tech companies.

This, however, is a rather short-term view. In the long-term, investors are potentially more concerned about a company’s odds to continue to exist down the road (ongoing concern assumption). In this regard, serious questions should be raised around the tobacco sector in general. Regulators around the globe continue their decade-long crackdown on the industry. Take New Zealand, for instance:

New Zealand has announced it will outlaw smoking for the next generation, so that those who are aged 14 and under today will never be legally able to buy tobacco.

While New Zealand is home to only about 5 million people, it is also in the U.S. where the Biden administration is poised to deliver the next regulatory blow to the tobacco industry:

The Biden administration intends to pursue a policy requiring tobacco companies to reduce the nicotine in all cigarettes sold in the U.S. to minimally or nonaddictive levels […], a move that would upend the tobacco industry.

The policy, which the administration is expected to announce as early as next week, likely wouldn’t take effect for several years. The FDA first must publish a proposed rule, then invite public comments before publishing a final rule, according to the people familiar with the matter. Tobacco companies could then sue, which could further delay the policy’s implementation.

Ultimately, the tobacco industry is a very successful scheme in which the profits are privatized while the downside is communalized, primarily in the form of health care costs. Against this backdrop, we want to re-iterate that we as (long-term) investors need to do our homework asking ourselves which players of the tobacco squad will survive and which will rather have a hard time.

What’s in there beyond nicotine?

The world ahead of Altria likely looks different from today. Less smoke. Less nicotine. The good news is that this will take several years to materialize. The bad news is that as of today Altria seems less prepared than other major company in the space.

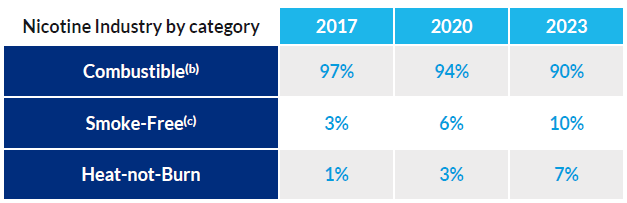

For example, Philip Morris (PM) is aiming to make more than half of its revenues from smoke-free products by 2025 (PM Investor Day 2021) proactively accommodating for anticipated policy changes. Why proactively? Well, the industry is not there yet as the chart below illustrates (only 10% by 2023), while smoke-free products already accounted for more than 30% of Philip Morris’ total net revenues in the first half of 2022 (PM earnings call 2Q22).

Nicotine industry by category (Philip Morris Investor Day 2021)

While Philip Morris is ahead, the regulatory defeat at Juul opens a naked flank for Altria. Product categories beyond traditional smoking products (=combustibles) have been neglected in recent years. Despite diversifying equity investments in Anheuser-Busch InBev (BUD) (mainly alcoholic beverages), Cronos (CRON) (cannabinoid company) and Juul, Altria remains rather a pure-play in terms of combustible nicotine products than pivoting into the new world.

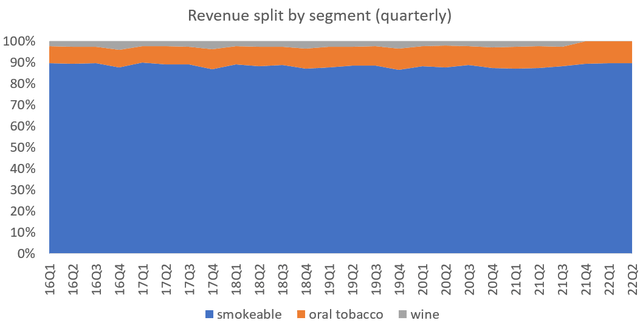

As Altria elected to account for its equity investments under the fair value option, any cash dividends received and any changes in the fair value of these investments are included in income/ losses from equity investments in the P&L. Thus, these figures are not part of the common revenue figures. Yet, the oral tobacco segment has played a minor role for years now accounting for around 8% to 10% of total sales.

Altria: revenue split by segment, quarterly (Altria SEC filings)

Altria stock valuation: Dividend Growth model suggests fair pricing

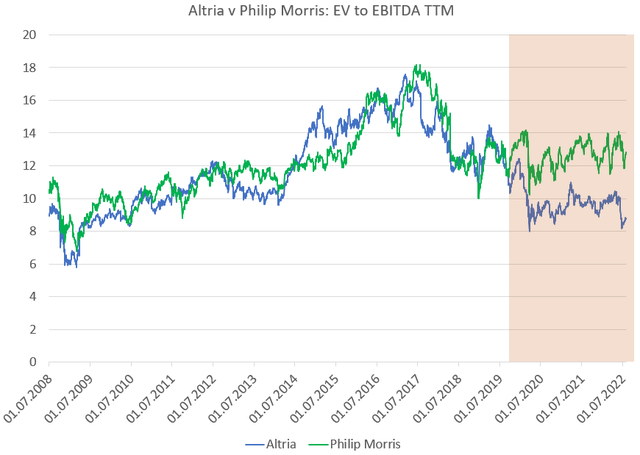

This different approach is what holds the world ahead between Altria and Philip Morris, the latter started to pivot to smoke-free in 2016, which is reflected in valuation levels.

The chart below depicts a de-coupling in terms of the EV to EBITDA TTM ratio. Correlation of both lines in the shaded area is around 68% (January 2020 until today), while it stood at around 89% in the period from July 2008 to December 2019. Similar patterns can be observed for other common valuation metrics such as price-earnings.

Altria v Philip Morris: EV to EBITDA TTM (author with data from Bloomberg)

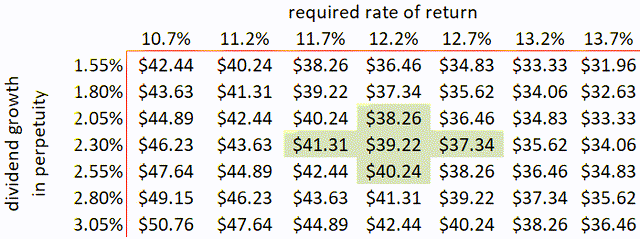

We ran a simple Dividend Growth Model based on the latest estimates. Our assumptions are as follows (data from Bloomberg):

- Dividend consensus for the next twelve months is at $3.88.

- Expected dividend growth rate at 2.33%, which is the CAGR over the most recent three years; this is substantially lower than the ten year CAGR (7.4%) and thus to be considered conservative.

- We fix the required rate of return at 12.2%, which corresponds to two times the current WACC of 6.1%.

Based on the share price at the close on Monday (August 01, 2022) of $44.05, the range of a potential target prices is roughly around $39. This indicates a downside potential of roughly 11% relative to the current price. The sensitivity table below provides additional insight.

Sensitivity of Dividend Growth model (Author)

Conclusion

Altria stock is often a fixed component of dividend investors’ portfolios. The ability to hoist (hidden) price increases on consumers makes the tobacco industry sort of appealing. The other side of the same coin is characterized by a high level of regulation. These regulatory aspects make the air for the business with classic tobacco products increasingly thin. At stake is nothing less than reducing the costs that smokers drain from society or the health care system. While regulations usually take a few years before they take effect, the direction has been clear for decades: Nicotine addiction is to be reduced, and young people are to be discouraged from smoking whenever possible. Against this background, the tobacco industry, at least in Western countries, has to (partly) reinvent itself.

Some players have proactively taken up these challenges. In our assessment, this is not the case with Altria (to date). This does not mean that Altria will not continue to be a reliable dividend payer in the years to come (regulatory implementation takes time, profitable price hikes due to negative price elasticity of customers). Nevertheless, investors should take a (more) critical look at the longevity of Altria’s business model. The Juul defeat should be seen as a wake-up call for all stakeholders and ideally should result in a critical review of strategy, both on a corporate (Altria management) and a portfolio level (investors). For the latter, this comes with juicy dividend distributions for the time being.

We believe that there are currently more attractive alternatives in the tobacco sector if the long-term perspective is taken as a yardstick. Our Dividend Growth model indicates that Altria is presumptively fairly valued at current price levels. Accordingly, we rate the stock with a Hold for the next 12 to 18 months.

Be the first to comment