Dilok Klaisataporn/iStock via Getty Images

A Quick Take On Informatica

Informatica (NYSE:INFA) went public in October 2021, raising approximately $841 million in gross proceeds from an IPO that was priced at $29.00 per share.

The firm provides software for data integration and management functions in organizations worldwide.

Given the company’s slow revenue growth, worsening operating results, and forward guidance reduction, I’m on Hold for INFA at this time.

Informatica Overview

Redwood City, California-based Informatica was founded first to provide on-premises data integration and management solutions and has since completed a transformation into a cloud-based SaaS company.

Management is headed by Chief Executive Officer, Amit Walia, who has been with the firm since October 2013 and was previously an executive at Symantec and at McKinsey & Company.

The company’s primary offerings include:

-

Data Integration

-

API & Application integration

-

Data Quality

-

Master Data Management

-

Customer and Business 360

-

Data Catalog

-

Governance and Privacy

The company markets its offerings via a direct sales team and through strategic partners which include cloud hyperscalers, global system integrators, resellers, and cloud data platforms.

Informatica’s Market & Competition

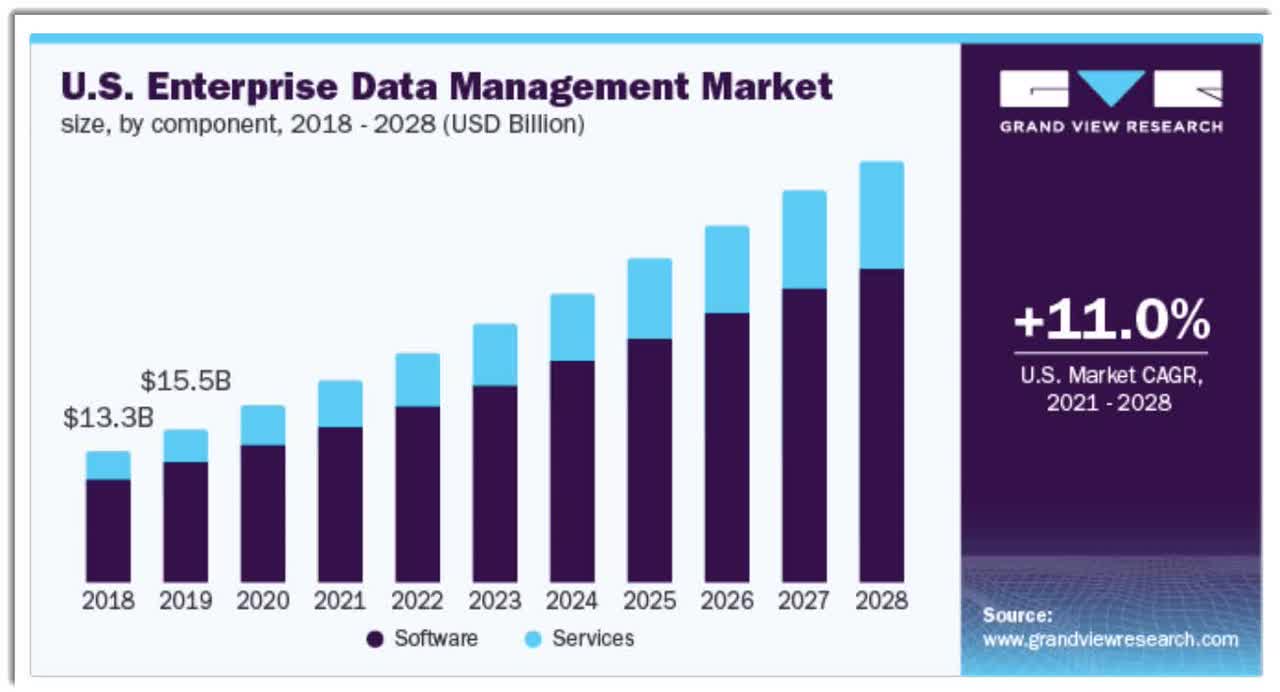

According to a 2021 market research report by Grand View Research, the global market for enterprise data management was an estimated $72.8 billion in 2020 and is forecast to reach $204 billion by 2028.

This represents a forecast CAGR (Compound Annual Growth Rate) of 13.8% from 2021 to 2028.

The main drivers for this expected growth are the outbreak of the global pandemic, increasing demand from off-premises locations, and increasing need for real-time information from across the enterprise.

Also, below is a chart showing the historical and project future market trajectory for the U.S. enterprise data management market:

U.S. Enterprise Data Management Market (Grand View Research)

Major competitive or other industry participants include:

-

Talend

-

Collibra

-

AWS

-

Microsoft

-

Google

-

IBM

-

Oracle

-

Cloudera

-

SAP

-

Broadcom

-

Teradata

-

Micro Focus

-

Mindtree

-

Others

Informatica’s Recent Financial Performance

-

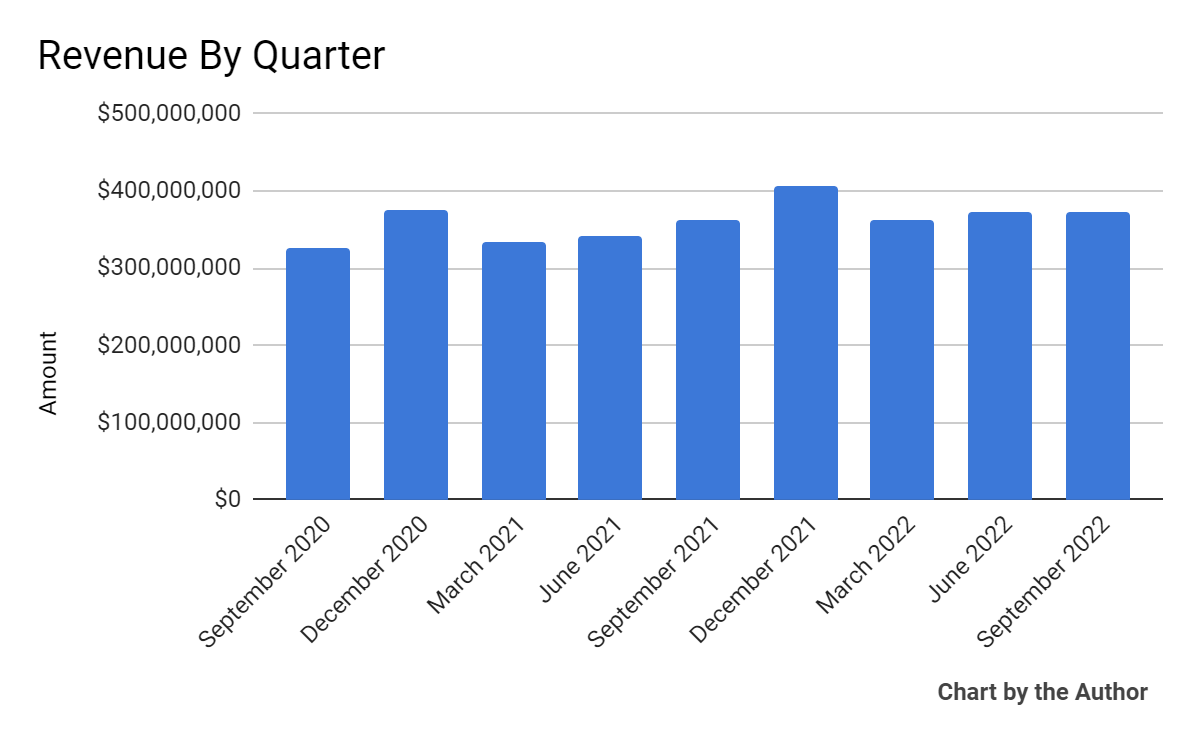

Total revenue by quarter has grown according to the following chart:

9 Quarter Total Revenue (Seeking Alpha)

-

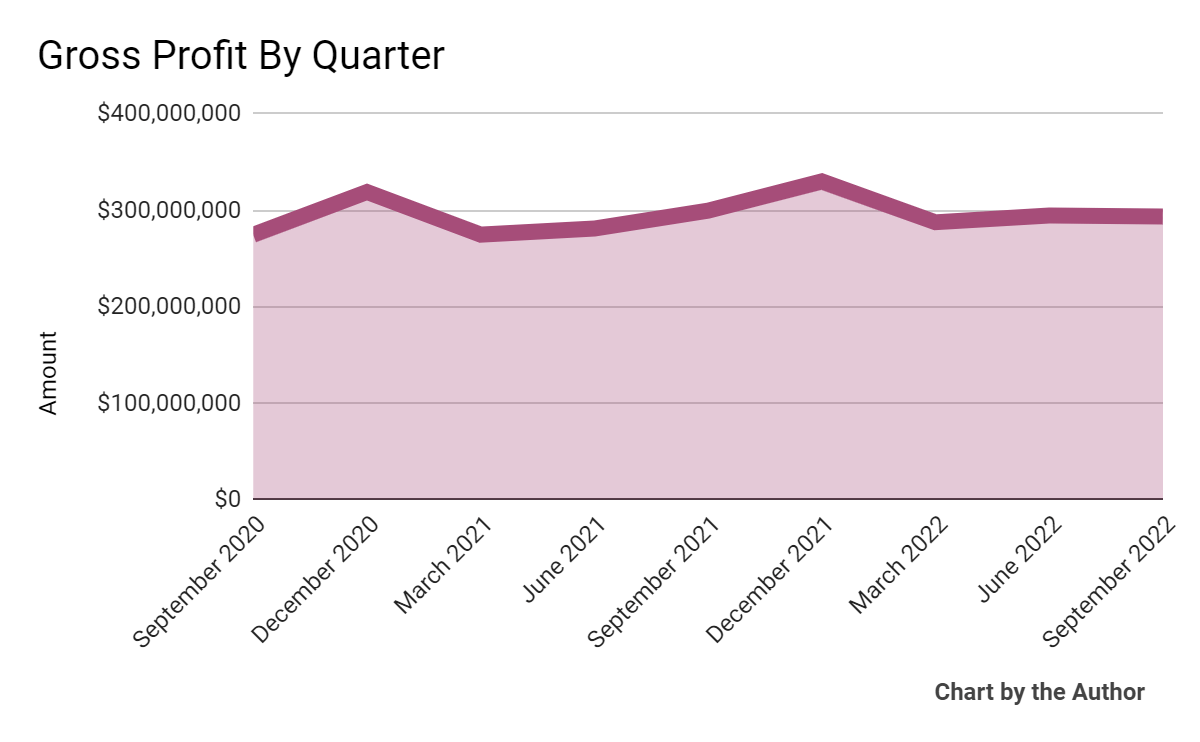

Gross profit by quarter has largely flatlined in recent quarters:

9 Quarter Gross Profit (Seeking Alpha)

-

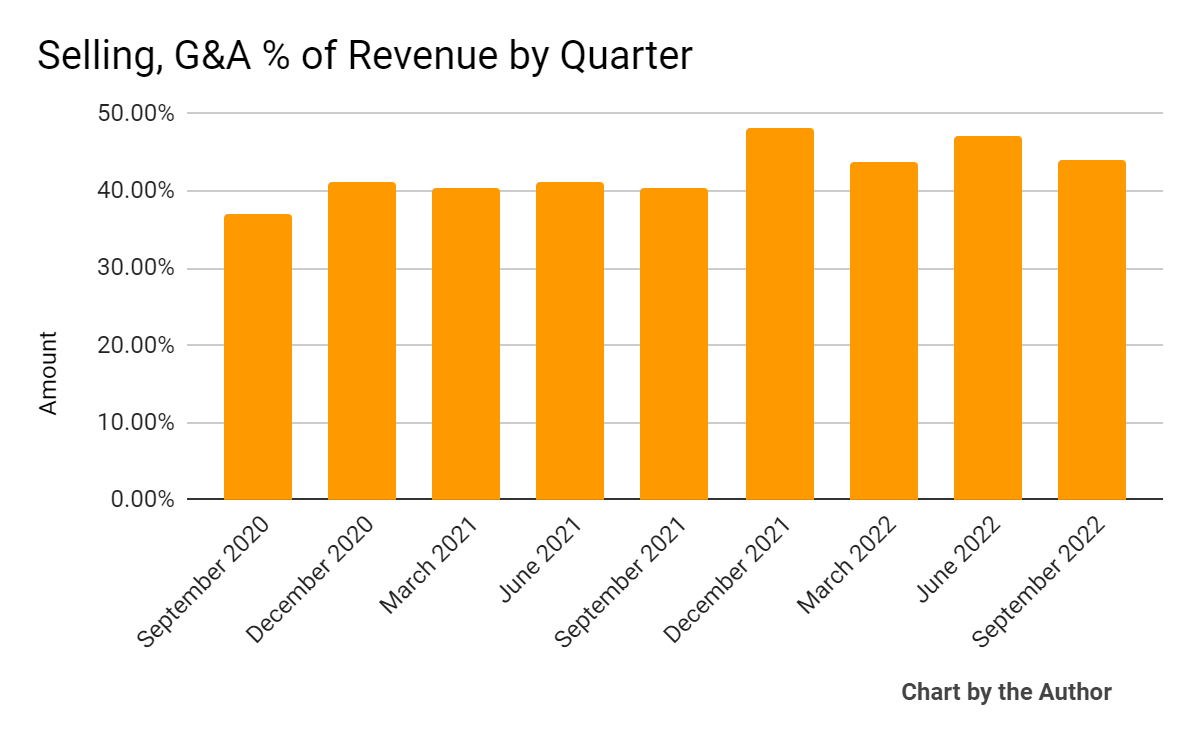

Selling, G&A expenses as a percentage of total revenue by quarter have trended higher in recent reporting periods:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

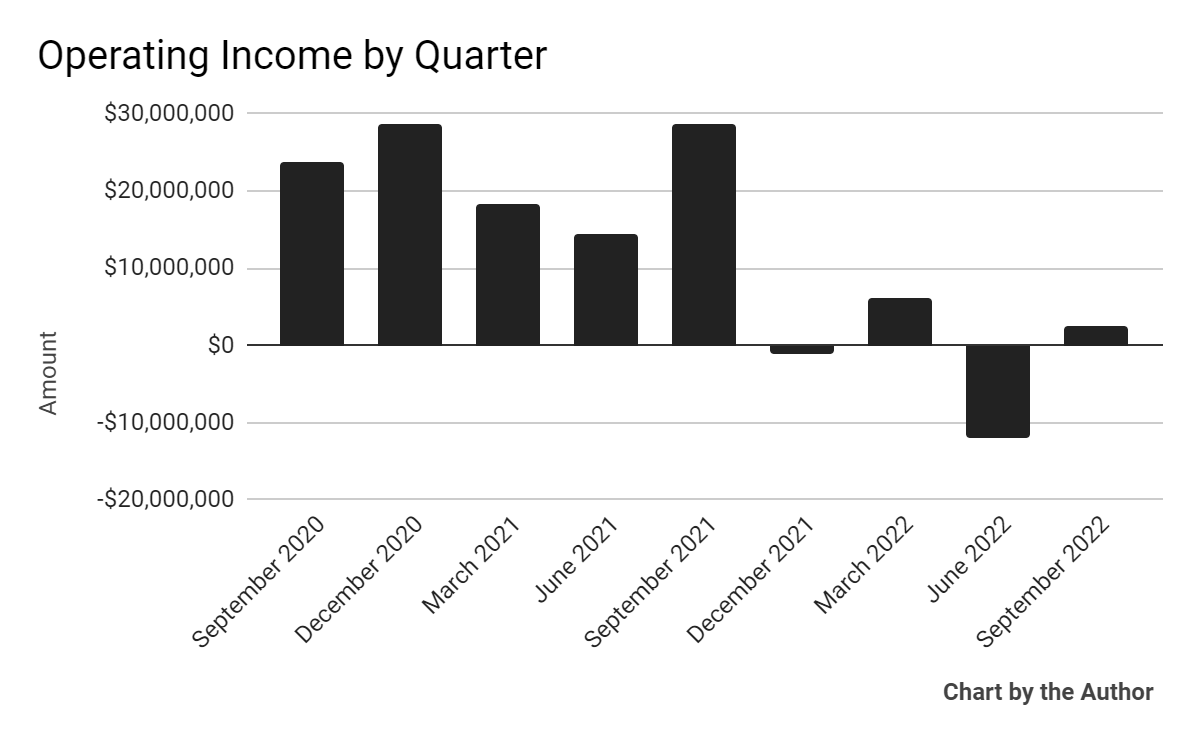

Operating income by quarter has dropped substantially or turned negative in recent quarters:

9 Quarter Operating Income (Seeking Alpha)

-

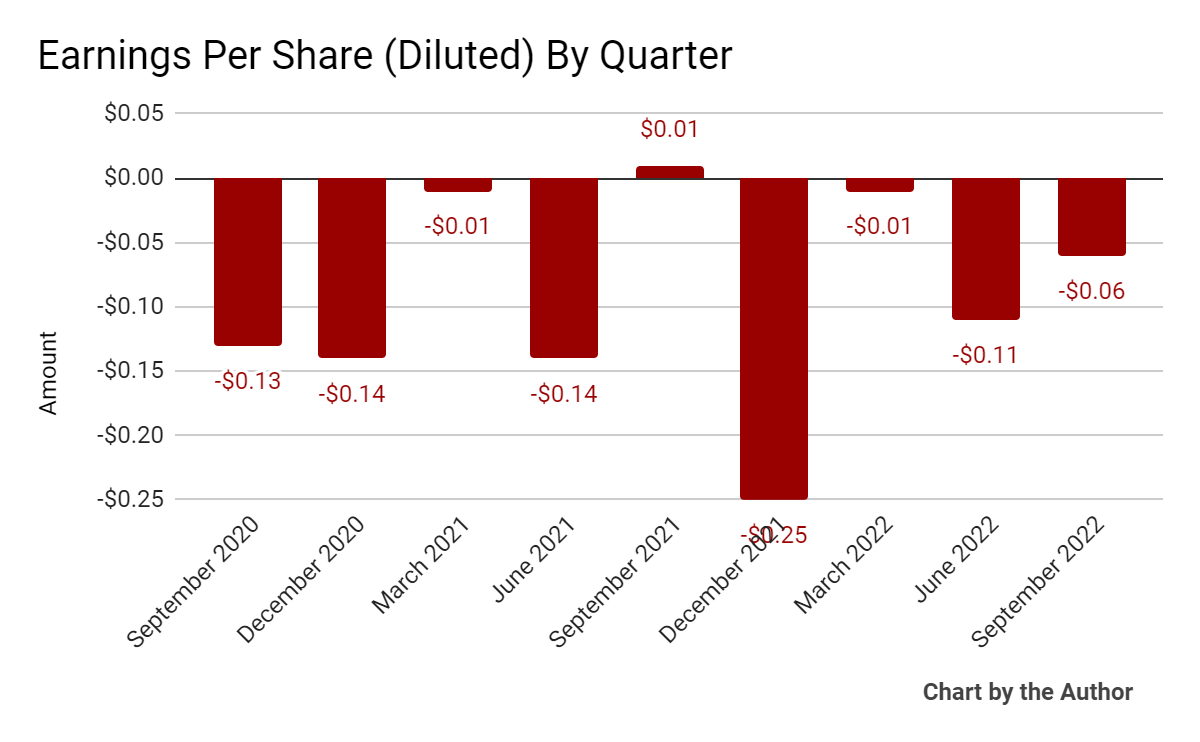

Earnings per share (Diluted) have largely remained negative as the chart shows here:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

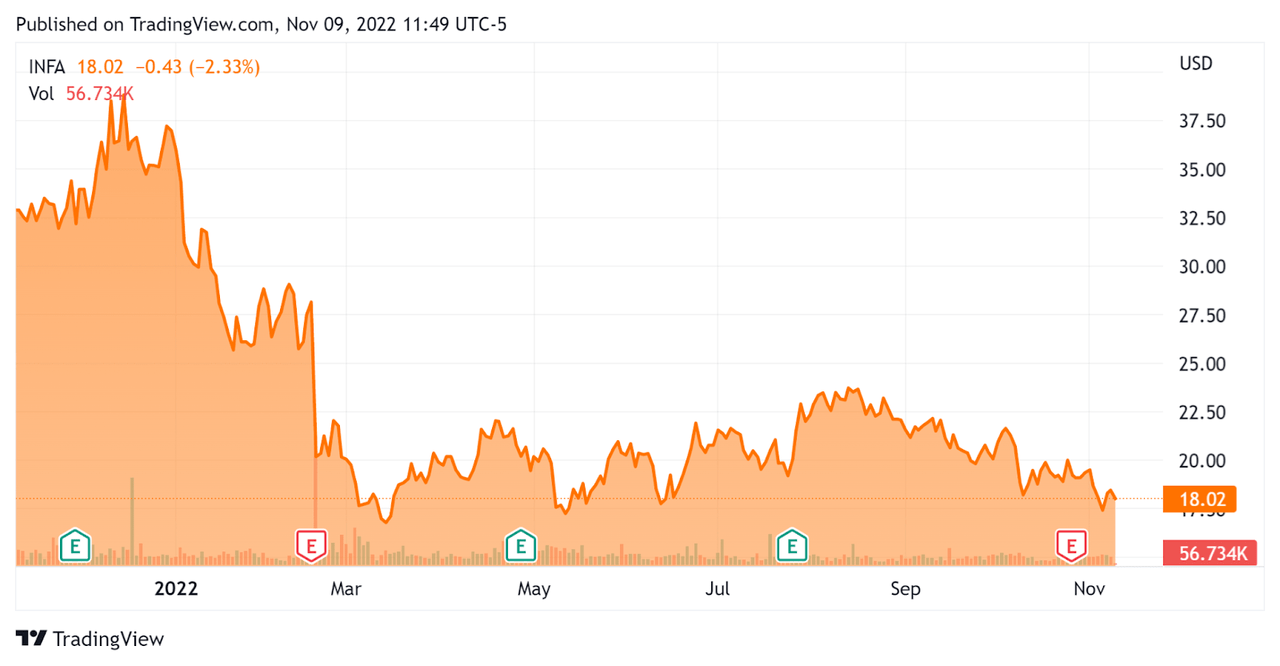

Since its IPO, INFA’s stock price has fallen 44.8% vs. the U.S. S&P 500 Index’s drop of around 18.7%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Informatica

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (TTM) |

Amount |

|

Enterprise Value/Sales |

4.26 |

|

Revenue Growth Rate |

3.0% |

|

Net Income Margin |

-7.6% |

|

GAAP EBITDA % |

11.7% |

|

Market Capitalization |

$5,180,000,000 |

|

Enterprise Value |

$6,440,000,000 |

|

Operating Cash Flow |

$225,640,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.43 |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

INFA’s most recent GAAP Rule of 40 calculation was 18.7% as of Q3 2022, so the firm needs improvement in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

7.0% |

|

GAAP EBITDA % |

11.7% |

|

Total |

18.7% |

(Source – Seeking Alpha)

Commentary On Informatica

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted growth of its subscription annual recurring revenue (ARR).

However, growth was negatively impacted by a strong US dollar and longer sales cycles ‘that required higher-level approvals for new deals.’

So, the firm’s customers are slowing down their purchasing processes and subjecting new deals to tighter cost controls.

As to its financial results, topline revenue rose 3% year-over-year but $13 million below the low end of previous guidance.

The company’s subscription net dollar retention rate was 112%, indicating reasonably good product/market fit and sales & marketing efficiency.

The firm’s Rule of 40 results have been less than impressive at 18.7% in the most recent annual period ending Q3 2022.

Selling, G&A as a percentage of revenue has trended higher, resulting in worsening operating income results and continued negative earnings.

For the balance sheet, the firm finished the quarter with $647.65 million in cash, equivalents and short-term investments and debt of $1.91 billion.

Over the trailing twelve months, levered free cash flow was $310.5 million.

Looking ahead, management lowered its full year 2022 revenue guidance as well as ARR but reiterated its non-GAAP operating income (excluding stock-based compensation) and unlevered free cash flow.

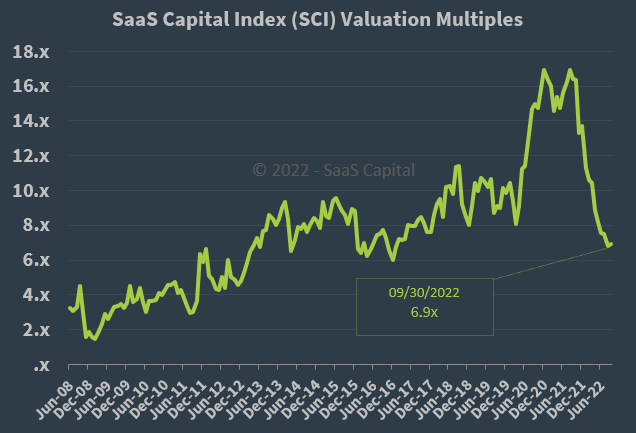

Regarding valuation, the market is valuing INFA at an EV/Sales multiple of around 4.26x.

The SaaS Capital Index of publicly-held SaaS software companies showed an average forward EV/Revenue multiple of around 6.9x at September 30, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, INFA is currently valued by the market at a discount to the broader SaaS Capital Index, at least as of September 30, 2022.

The primary risk to the company’s outlook is an increasingly likely macroeconomic slowdown or recession, which can accelerate new customer discounting, produce slower sales cycles, and reduce its revenue growth trajectory.

Given the company’s slow revenue growth, worsening operating results, and forward guidance reduction, I’m on Hold for INFA at this time.

Be the first to comment