JamesBrey/E+ via Getty Images

Marathon Petroleum Corp (NYSE:MPC) just reported its latest Q2 earnings highlighted by a solid beat to estimates. As one of the largest oil refiners in the U.S., the company has capitalized on tight supply conditions and record high gas prices to drive a surge in earnings. Indeed, it was a windfall scenario in Q2 for the broader energy sector.

Recognizing solid fundamentals, our attention turns to the forward outlook. A recent trend of falling gas prices and an expectation for crack spreads to pullback likely represent some softer operating conditions for the rest of the year. Marathon reported a system utilization rate at capacity this last quarter which also leaves a tough benchmark to be maintained. We like the stock but see the upside as limited in the near term.

MPC Earnings Recap

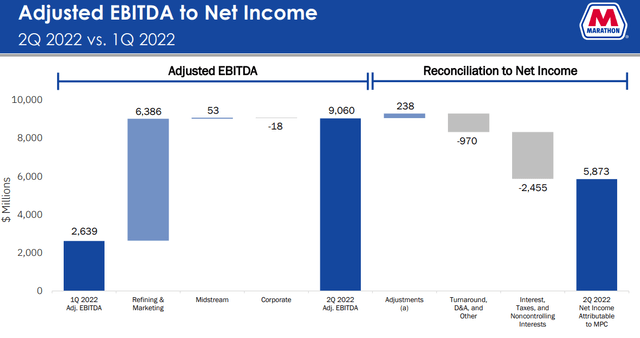

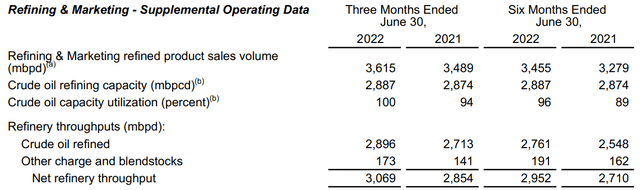

MPC Q2 non-GAAP EPS of $10.61, was $2.14 above the consensus. Revenue of $54.2 billion, up 82% year-over-year considers the higher refined products pricing environment over the period. Total adjusted EBITDA of $9.1 billion climbed from $2.6 billion in Q1. Here the story was the jump from the refining & marketing (R&M) margin to $37.15 compared to $12.45 in Q2 2021. The midstream segment also performed well contributing to higher income.

Total throughput of 3.1 million barrels per day at a utilization rate of 100% climbed from 2.9 million in the period last year when it only reached a crude capacity utilization of 94%.

Management notes that the construction of its “Martinez” refinery is ongoing receiving an environment impact report certification in May. The company expects a mechanical completion by the end of this year with the facility ramping up production through 2023 as a firm-wide growth driver. The Martinez plant is set to be one of the world’s largest renewable diesel facilities in the world which highlights MPC’s focus on sustainability.

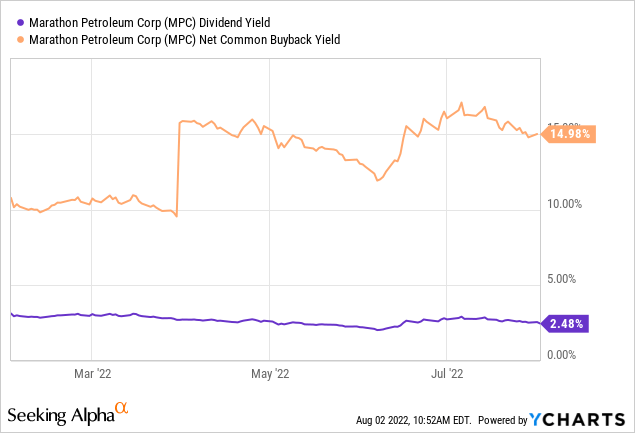

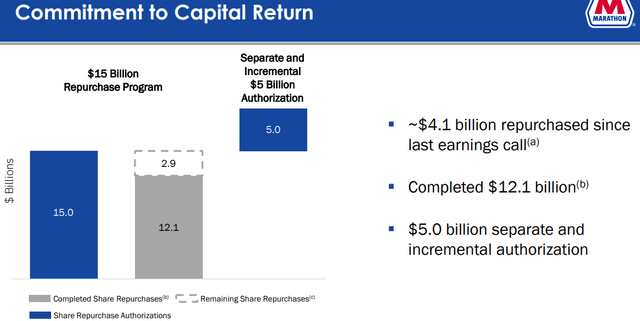

A theme for the company has been the use of its significant cash proceeds of $21 billion since closing the sale of its “Speedway” gas station and retail business last year. Marathon has been active with share repurchases, buying back $12.1 billion in stock from the existing $15.0 billion program including $4.1 billion over the last quarter. The outstanding share count currently at 499 million shares has been reduced by over 22% in the past year. The update today is a new and incremental $5 billion authorization.

MPC is reporting $13.0 billion in cash against $7.0 billion in total debt, excluding liabilities related to its MPLX subsidiary. The gross debt to capital ratio of 21% highlights the solid balance sheet position. Notably, MPC’s quarterly dividend of $0.58 per share has been held flat since the last increase in Q1 2020, just before the start of the pandemic. While nothing has been disclosed, we see room for a dividend hike which will largely depend on how the board of directors chooses to deploy cash considering their apparent preference for buybacks.

The strong point here is to consider that with a current dividend yield of 2.6% together with an implied buyback yield of 16% based on $7.9 billion remaining authorization, we estimate a total shareholder yield of nearly 19% on a forward basis.

What’s Next for MPC

There’s a lot to like about Marathon considering gasoline refining has likely been one of the best businesses to own this year as national gas prices climbed above $5.00 per gallon in the U.S. at their peak in June. As it relates to the company financials, the metric that matters are the crack spreads representing the difference between the cost of raw crude to refined products like gasoline and diesel which directly drives the company’s refining margin.

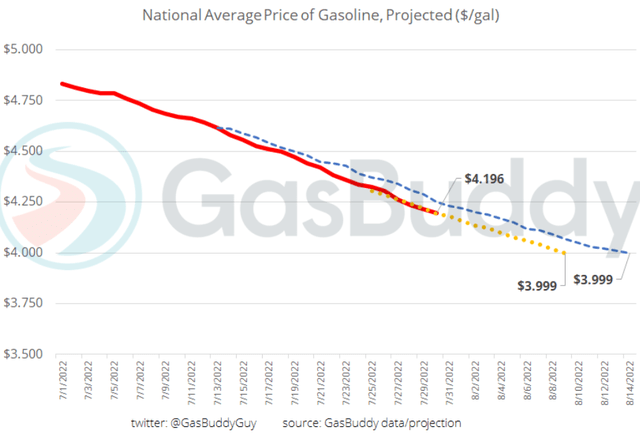

The challenge here is indications that the market has at least cooled off. With data based on gasoline futures prices, the chart below highlights the correction lower over the last few weeks. The U.S. Energy Information Administration notes the oil to gasoline crack spread reached its highest point of the year at $1.40 per gallon on June 3, but since declined to $0.93 per gallon on July 7th.

Refiners nationally expanded output while gasoline consumption has been softer compared to the monthly average between 2015 and 2019. One explanation is that consumers sensitive about the high price at the pump have adjusted spending and automobile traveling habits. Separately, a gasoline inventory build in June was the largest in six months.

The other dynamic at play is simply the declining price of crude. WTI currently trading under $94 per barrel is near the lowest level since February, just before the Russia-Ukraine war headlines. The concern here is that softer economic activity considering the trend of higher interest rates can lead to some further downside in gas prices with a further correction lower in crack spreads.

According to industry publication “GasBuddy“, the national average price of gas has been down more than $0.66 per gallon over the past month and is expected to trend lower, crossing below the $4.00 per gallon level. Diesel has also pulled back. Ideally, we’d want to see this chart trending higher as an operational tailwind for MPC.

Keep in mind that even with the correction, the pricing environment remains above historical levels. That said, the point here is that the apparent Q2 windfall for Marathon and refiners, in general, likely marked a near-term top. We would expect further downside in market benchmarks to weigh on shares of MPC over the near term.

MPC Stock Price Forecast

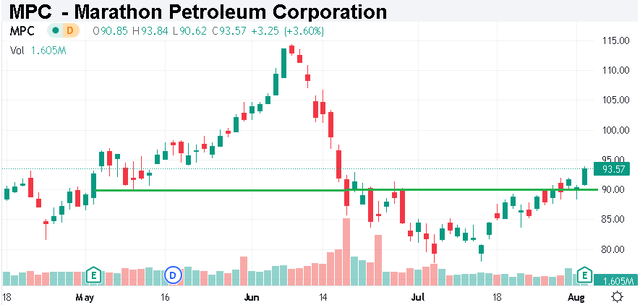

The market reaction to MPC’s Q2 report has been positive with shares rallying over 5% on the report. The stock is still about 15% below its cycle high set in early June, which corresponded to the record high gas prices that month and likely peak sentiment towards the segment.

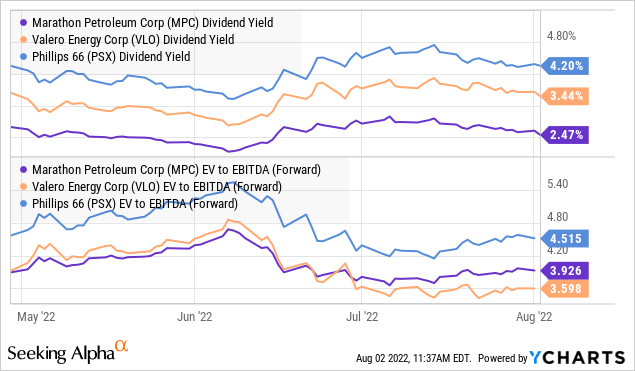

As it relates to valuation, we place MPC in the context of its refinery and marketing peer group with Valero Energy Corp (VLO) and Phillips 66 (PSX). MPC trading at a 4x EV to forward EBITDA multiple represents a discount to PSX which is closer to 4.5x, while slightly above VLO around 3.6x. Income investors may prefer VLO and PSX which offer a higher dividend yield, while other energy sector names provide even larger payouts. In our view, MPC doesn’t necessarily stand out as being exceptionally under- or over-valued. While the current level provides good value, we’re simply skeptical that the market pricing environment is enough to drive a significant expansion in multiples.

Final Thoughts

It was a blowout quarter for MPC with the company demonstrating impressive operational and financial execution. This is a high-quality market leader with a positive long-term outlook. Balancing the strong financials against some near-term market pricing headwinds. We rate MPC as a hold with a sense that it’s probably not worth chasing higher at the current level.

Its unlikely shares can climb to a new high without a surprising resurgence of crack spreads back to peak levels. That said, some sort of geopolitical escalation either from Russia or even China, sending energy prices sharply higher would be the most bullish scenario for the company to play out. In terms of risks, a breakdown in energy prices, as a confirmation of deteriorating economic conditions would open the door for a leg lower in the stock.

Be the first to comment