onurdongel

A Quick Take On Laminera Flow Optimization

Laminera Flow Optimization (LMIN) has filed to raise $8.4 million in gross proceeds from the sale of units of stock and warrants in an IPO, according to an amended registration statement.

The company is developing technologies to improve the flow of liquids through pipelines.

Laminera is still at a pre-revenue stage of development, so the IPO is very high risk.

Overview

Netanya, Israel-based Laminera was founded to develop its low-frequency pressure waves to reduce hydrodynamic resistance and smooth the flow of liquids through pipelines.

Management is headed by Chief Executive Officer Yair Volovitz, who has been with the firm since January 2022 and was previously a business development manager at biotech firm Kaiima Bio-Agritech.

The firm’s active flow device, called PWG, promises to improve pipeline flow for oil, natural gas and water.

The system consists of four elements:

-

Pressure wave generator [PWG]

-

Control panel

-

Measuring instruments

-

Automatic control and optimization program

Laminera has booked fair market value investment of $3.5 million as of June 30, 2022 from investors including Tamrid Ltd., Medigus Ltd., L.I.A. Pure Capital Ltd. and various individuals.

The firm does not currently have any paying customers, but upon completion of development of its latest prototype device, the company will seek customers across the primary industries of water transport and oil & gas pipeline operators.

Laminera is currently in extended beta test development with prominent Israel-based water supply company Mekorot, which provides more than 1.5 billion cubic meters of water annually to homes and businesses in Israel annually.

In return for its collaboration with Laminera, Mekorot also has warrant rights to purchase stock as well as most-favored customer status for seven years after Laminera begins selling its products.

Market & Competition

According to a 2022 market research report by IMARC Group, the global market for pipeline monitoring (as a proxy for the firm’s pipeline-related technologies) was an estimated $13.7 billion in 2021 and is forecast to reach $20.6 billion by 2027.

This represents a forecast CAGR of 6.7% from 2022 to 2027.

The main drivers for this expected growth are an increasing frequency of pipeline leaks and breaks resulting in the loss of pipeline liquids and potential environmental degradation.

Also, various countries are stiffening pipeline operational standards, further incentivizing operators to reduce spills while improving throughput to compensate for higher operating costs.

Major competitive or other industry participants include Rix Industries and Industrial Research Ltd.

Financial Status

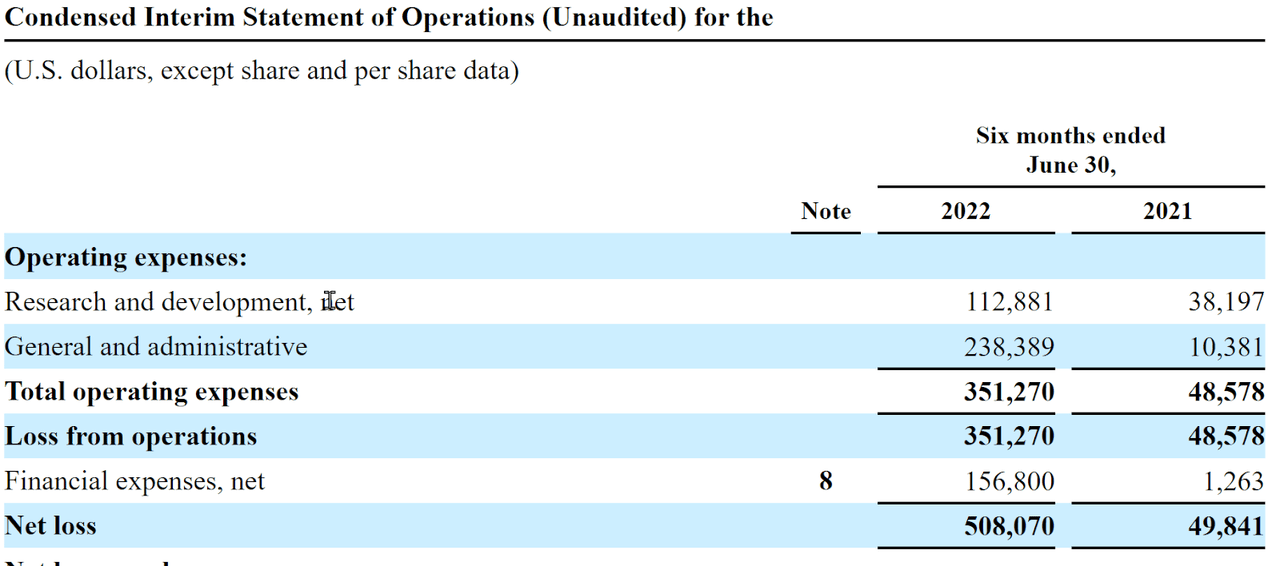

The company’s recent financial results can be summarized as pre-revenue, with some R&D and G&A expenses associated with its product development efforts.

Below are relevant financial results derived from the firm’s registration statement:

Statement Of Operations (SEC)

As of June 30, 2022, Laminera had $256,894 in cash and $238,366 in total liabilities.

Free cash flow during the six months ended June 30, 2022, was negative ($424,602).

IPO Details

LMIN intends to sell 1.6 million units of ordinary shares and two warrants per share at a proposed midpoint price of $5.25 per share for gross proceeds of approximately $8.4 million, not including the sale of customary underwriter options.

Each unit includes two warrants to purchase one share each at a proposed exercise price of $5.00 per share, assuming an IPO price of $5.25 per unit. The warrants will trade as LMINW.

No existing or potentially new shareholders have indicated an interest in purchasing shares at the IPO price.

Assuming a successful IPO at the midpoint of the proposed price range, the company’s enterprise value at IPO (excluding underwriter options) would approximate $16.2 million.

The float to outstanding shares ratio (excluding underwriter options) will be approximately 35.93%. A figure under 10% is generally considered a ‘low float’ stock which can be subject to significant price volatility.

Per the firm’s most recent regulatory filing, it plans to use the net proceeds as follows:

approximately $1.5 million for product development, product testing in beta sites for the purpose of examining our product’s performance and its compliance with certain predefined specifications;

approximately $1.2 million for research and development, including completion of our existing systems and continued development of new products;

approximately $0.2 million for marketing, advertising and pre-commercialization activities;

approximately $0.1 million to discharge our indebtedness to Medigus Ltd. under a loan agreement, which we entered into in August 2022 and used for the operation of our business activities including operation for this offering, with an interest rate of 8% per annum due upon the closing of this offering

the remainder for working capital and general corporate purposes and possible future acquisitions.

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says the company is ‘not currently a party to any material legal proceedings.’

The sole listed bookrunner of the IPO is Aegis Capital Corp.

Commentary About Laminera Flow

LMIN is seeking U.S. capital market investment to fund its further product development, testing, and commercialization requirements.

The company’s financials have shown no revenue and a small amount of R&D and G&A expenses related to its product development efforts.

Free cash flow for the six months ended June 30, 2022, was negative ($424,602).

The firm currently plans to pay no dividends for the foreseeable future and the Israeli Companies Law ‘imposes further restrictions on the company’s discretion to pay dividends.

The market opportunity for improving pipeline flow is likely large and growing, as pipelines are used to transport energy and water, two fundamental resources needed worldwide.

Aegis Capital Corp. is the sole underwriter and the only IPO led by the firm over the last 12-month period has generated a return of negative (45.8%) since its IPO. This is a bottom-tier performance for all significant underwriters during the period.

The primary risk to the company’s outlook is its tiny size and thin capitalization.

The firm has a strategic relationship with Mekorot, which is a positive in terms of product development and potential new business development relationships.

As for valuation, management is asking IPO investors to pay an Enterprise Value of approximately $16.2 million at IPO.

Most non-life science companies at IPO have at least some revenue, however small.

LMIN’s pre-revenue status makes the IPO ultra-high-risk, so I’m on Hold for it.

Expected IPO Pricing Date: To be announced.

Be the first to comment