Juan-Enrique

Construction company Tutor Perini Corp. (NYSE:TPC) is expected to benefit from increased government expenditures on new massive infrastructure projects over the next few years. As an additional kicker, it may also be a buyout target despite some of their arguably questionable accounting practices that have resulted in very large account receivables. TCP has been involved in many mega construction projects recently, such as Hudson Yards in New York City and the new Terminal A at Newark Airport. Some mega projects still in the final planning stages include the $519 million replacement of the Raritan Bridge in New Jersey and the $5 billion toll road and bridge project in Maryland.

Accounts Receivable – Major Issue

I am going to start by covering a major issue that investors have focused on for a number of years, including an article by Jeremy Blum a few years ago. Their accounts receivable item on their balance sheet is problematic, in my opinion. If the accounts receivable numbers are overstated, that would mean that current and prior revenue numbers are overstated, which would mean that income has been overstated. Many of these are very old. For example, according to their 3Q 1-Q: “As of September 30, 2022, the amount of retention receivable estimated by management to be collected beyond one year is approximately 47% of the balance.”

TPC often “low” bids on construction projects and then comes back to requesting a change order. They have been doing this for years. They bill a certain amount and record that amount as an account receivable, which is then also considered revenue. The problem for TPC is collecting on the account receivable. A recent New York appellate court decision is indicative of this problem. The court ruled against TPC, and the company filed an 8-K on December 9 stating that there would be a $43 million pre-tax charge in 4Q. One has to wonder how much of their accounts receivables are actually going to be paid or at least partially paid.

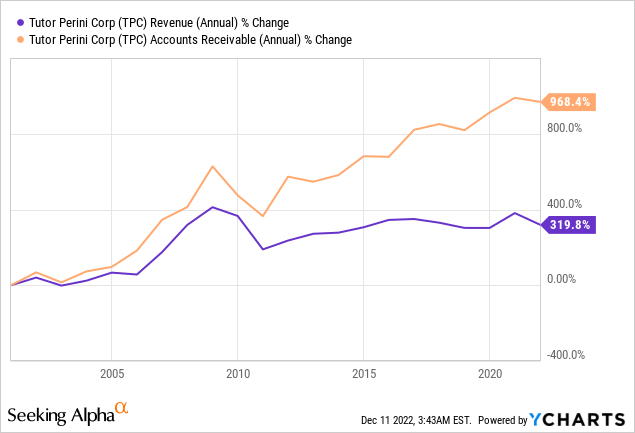

It would normally be expected that revenue and accounts receivable amount would increase about the same percentage over time. That is not the case with TPC as can be seen by the chart below. Revenue increased 319.8% but accounts receivable increased much higher at 968.4% over the last twenty years.

Percent Change in Annual Revenue and Accounts Receivable – 20 Years

For many companies, account receivables are not really important factors in valuation models, but for Tutor Perini, it is a critical factor. The latest total accounts receivable per TPC share is $35.67 compared to a stock price of $7.54. This is a significant increase per share from $23.79 at the end of 2012. The reality is that it is very difficult to estimate an appropriate value for TPC stock because the ability of their lawyers to negotiate and/or assert their case in court to get accounts receivable collected is something that most investors can’t predict.

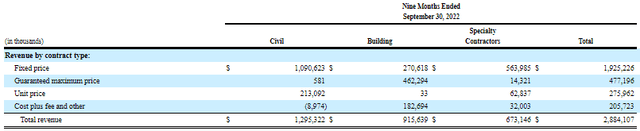

I have not, however, been able to determine if certain types of contracts or project categories result in increased disputes over payments and thus a resulting increase in accounts receivables.

Types of Contracts and Project Categories

Reported GAAP Income vs Actual Cash Flow

Usually when valuing a company investors focus heavily on GAAP income statements, but with TPC that does not really reflect their operations. There is again the issue with actually getting paid. The GAAP income reflects billed items and not actual cash received. The first nine months of 2022 is a striking example of this issue. The reported GAAP loss for the nine months was $104.9 million, but net cash provided by operating activities was a positive $251.3 million. In 2021, the nine months report was the reverse. The 2021 GAAP income was a positive $93 million, but they had a negative operating cash flow of $152.6 million. Management does not seem to even have a good handle on GAAP results. Last May they maintained their 2022 EPS guidance of $1.15-$1.60. The actual reported EPS for nine months has been a loss of $2.28 per share. The 4Q would have to be extremely high to get to their May guidance numbers, which is very unlikely since they just announced the $43 million charge that will be included in 4Q.

Since it is almost impossible to accurately forecast when they will get cash, it is very difficult to value TPC. For example, in New York for government agency projects they first try to negotiate the cash collection and if there is no agreement it would then go to the New York City Contract Dispute Resolution Board. If TPC is unsatisfied with that outcome, they would go into court for a trial. That could be followed by an appeal to the New York Appellate Court. This process often takes years to resolve, which also explains why the accounts receivable numbers are so high. (Great for lawyers, but not so great for TPC investors.)

I think the GAAP results for the next two years could be weak as major projects are completed and before new mega projects become fully operational, but I also expect cash flow to be robust as prior collection issues are resolved. Management stated during their early November conference call that they plan to use $100 million cash to pay down their debt in 1Q 2023. During the same call, management talked about future stock repurchases and dividends, which they currently don’t pay, but this “will depend on the significance of our collections, and the success of all of the cash flow”. It was interesting, in my opinion, that these items depend upon cash and not the typical earnings focus that other companies use to determine returns to shareholders.

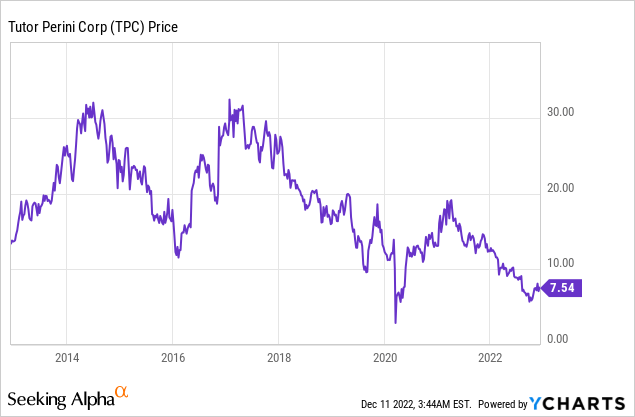

Prior and Potential Future Buyout Target

Just before the start of the pandemic, there were reports that Apollo Global Management (APO) was interested in buying TPC for $17 per share. The stock was trading at about $12 before Reuters broke the story. That potential purchase fell apart because of the implosion of the economy and volatile market conditions. I don’t know if Apollo still has any interest, but I think the fact that CEO Ronald Tutor, who owns 16.3% of the stock, is 82, could be an incentive for TPC to find a buyer. A potential buyout is one of two major reasons why I consider TPC a buy.

New Mega Infrastructure Projects

The second major reason why I consider TPC a buy is that I am expecting a large number of new modest $50 million to $100 million infrastructure projects over the next few years as a result of the 2021 Infrastructure Act that authorizes $110 billion for infrastructure projects, such as roads and bridges, and some mega projects such as the $5 billion Maryland Toll Road projection. This toll road and bridge project is going to be privately owned by a joint venture headed by Macquarie Capital, an affiliate of an Australian Bank. TPC also won the Raritan Bridge replacement project with a $519 million bid, but it will be some time before this project is reflected on their income statement.

There are many mega multi-billion projects that are still in the planning stages, such as a $3 billion new jail facilities project in New York and a $1.5 billion light rail project in Los Angeles. TPC is hoping to win some of the bids on these and other mega projects in the near future, but they have a reputation problem. Even media publications mention that “Tutor Perini has a reputation for being litigious on infrastructure projects and issuing so-called “change orders” (modifications to contracts) to try to boost profits. It is involved in several lawsuits…” In my opinion, they have had this reputation for many years, but they still win new bids on mega projects. So, I am not sure if this is going to be a factor in winning new mega bids.

Conclusion

Investing in Tutor-Perini is not a low-risk investment as reflected in their 6.875% 5/1/25 notes that are rated B- and yield 11.9%. Much of the risk is based on their very large account receivables.

I sold my Perini shares in the early 1980s after making a very nice gain that was based on their accounting, but in that case, it was that their equity investments in various old commercial projects were carried on their balance sheet at an adjusted cost basis and not the very much higher market value. I have not owned any shares since until a few weeks ago when I bought after they reported terrible earnings, but impressive positive cash flow.

Since I think Tutor Perini will greatly benefit from new mega projects and is a potential buyout candidate, I consider TPC stock a buy.

Be the first to comment