Pavel Babic

At the risk of upsetting those who disagree (or perhaps to do just that), I feel it’s high time someone pushed back on a very popular (but false) narrative that solar and wind energy (or “green energy” in general) is somehow responsible for the recent global energy crisis. As I mentioned in the bullets, arguably it wasn’t “green energy” that causes the crisis. Quite the opposite: It was the EU’s addiction to Russian natural gas and oil that is at the root of the problem. And that became quite obvious when Putin decided to weaponize natural gas supply to the EU by cutting off pipeline supplies as punishment for the support EU and NATO countries are giving Ukraine.

Meantime, as I have been advising energy investors for years on Seeking Alpha, we really do live in an “Age of Energy Abundance,” and I will prove it in this article. Energy investors, whether it be O&G, hydrogen, renewables (solar, wind, battery backup, etc) or even EVs should be aware of the abundance of O&G reserves – and potential reserves.

EIA

Technological Disruption In Shale O&G

As most of you already know, the O&G sector in the United States was totally disrupted by technology: Specifically, fracking combined with horizontal drilling and the ability to combine them by drilling and steering long-laterals into seams of shale rock to unlock and recover the oil and gas molecules that called that rock home.

As a result, this technological disruption led to some huge changes in global O&G markets as compared to the days when conventional reservoirs ruled the industry, and huge sums of money were made – and lost – by drilling ultra-deep offshore wells in an attempt to find new reserves to meet global demand.

Today, instead of spending billions of dollars to drill and bring online “long-cycle” ultra-deep water off-shore production, energy companies can take advantage of “short-cycle” shale oil and gas wells that have the following advantages:

- Wells can be drilled for a few million instead of a few billion.

- Wells can be drilled and completed with a near 100% success rate.

- Wells can be drilled and completed in a matter of weeks, not years.

- Wells can be brought online to existing land-based oil and gas pipelines.

- Multiple wells can be drilled by a single multi-pad drilling rig into multiple zones in multiple directions.

Now, after U.S. energy company CEOs marketed shale and its advantages (listed above) as “short-cycle” resources that can be easily and economically be ramped up (or down) relatively quickly in response to market conditions, the narrative now is that somehow it will take “years” to develop them. False. Shale is still a “short-cycle” resource (just as these same CEOS said it was for a decade…). The CEOs only need to decide to drill the wells. But after the “lost decade” of over-producing into an already over-supplied market during the idiotic “drill-baby-drill” days, and after shareholder returns were abysmal, these companies now prefer to restrict supply. But it does not mean the resource somehow isn’t there – it certainly is.

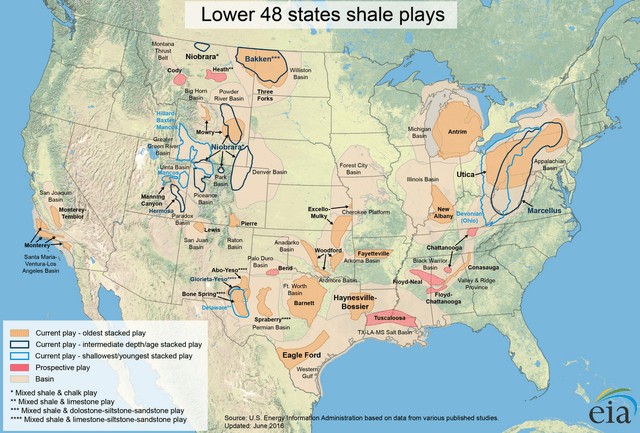

Indeed, with a plethora of major shale plays across the U.S. – including the Marcellus, Utica, Haynesville, Permian, Eagle Ford, Bakken, SCOOP/STACK, the Niobrara and DJ Basin – among others (see graphic above), the U.S. now has an abundance of oil and gas resources.

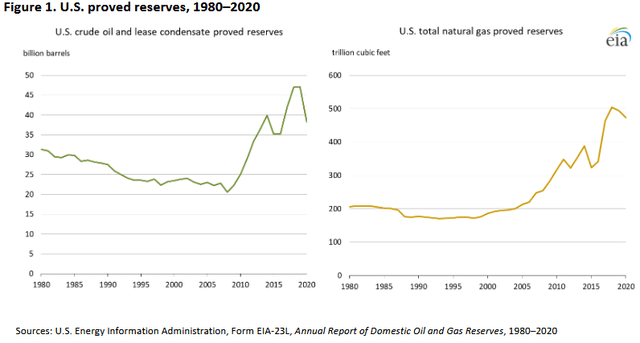

This is clearly indicated by the huge increase in proven oil and gas reserves over the past decade or so. The following graphic was taken from a study of U.S. proved reserves by the EIA as of year-end 2020:

EIA

As you can see, proven reserves of both oil and gas more than doubled from their recent lows. Indeed, the abundance of supply unleashed by technological disruption in the shale patch led the Obama/Biden administration to repeal the U.S. crude oil export ban in 2015 – a ban that had been in place since 1975 – and to approve numerous LNG export terminal applications. Most all of those LNG terminals are now in operation and is the reason the U.S. was able to bail the EU out of its current dilemma with Russia – which has proven itself to be an unreliable energy supplier.

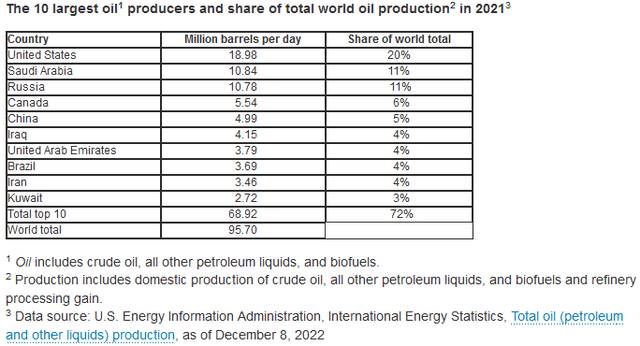

Today, and despite the false narrative being spun by many American politicians – who apparently wish it were not true (?) – the U.S. is, by far, the largest petroleum liquids producer on the planet:

EIA

All that oil and NGLs productive capacity is one reason that the O&G sector suffered from a relative “lost decade,” when even Exxon delivered a negative total return over a 10-year time frame. Over-production into an already over-supplied market led to a collapse of margin – and in the case of Exxon, arguably exacerbated by significantly over-spending on capex “growth projects.” Exxon has since got “religion” and has wisely greatly reduced capex spending to focus on Guyana and the Permian (see How Tiny Engine #1 Was Able To Turn ExxonMobil Around).

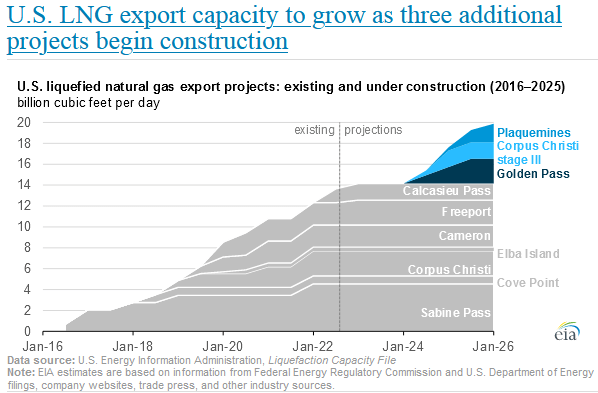

Meantime, this year the U.S. also became the largest global exporter of LNG and the volume of LNG exports will continue to grow as new planned LNG export terminal capacity comes online between now and 2026:

EIA

Investors also should consider that “proved reserves” are not the only metric that should be considered here. There are additionally 10s of billions of barrels of probable and possible reserves of O&G that will move to the “proved reserves” column as these shale plays continue to be drilled, appraised, and produced over the coming years. Indeed, the EIA estimates total recoverable U.S. shale oil reserves at 58 billion bbls and total recoverable shale wet gas at a whopping 665 Tcf.

Other Production

But of course the U.S. does not operate in a vacuum: as you know, huge reserves of oil in the form of Canadian tar sands exists: Alberta oil sands proved reserves are estimated to be a massive 165 billion barrels. The Montney play in British Columbia, Canada, is another source abundant natural gas and NGLs. Canada’s problem is, and always has been, a lack of strategic pipelines to its west Coast to access global markets – it certainly isn’t an issues of a lack of resources.

Exxon Mobil (XOM) and Hess (HES) teamed up to make an elephant field discovery in off-shore Guyana. Indeed, in October Exxon announced two more new discoveries in Guyana’s offshore waters – making a total of 30 discoveries since 2015. These two new discoveries will add to Exxon’s estimate in April that its Guyana resources total 11 billion boe of recoverable resources.

Q3 production in Guyana already had ramped up to 360,000 boe/d and the current plan is to grow to 1 million boe/d by 2030. Using a recoverable reserves estimate of 11 billion boe, a 1 million boe/d production rate would last 30-plus years.

In natural gas, there are huge gas reserves potential in off-shore East Africa and in the Eastern Mediterranean.

For the entire world, technically recoverable resources are estimated to be 3.4 trillion bbls of oil and 22,882 Tcf of natural gas and NGLs. Point is, the world has more than adequate reserves of oil and truly abundant reserves of natural gas.

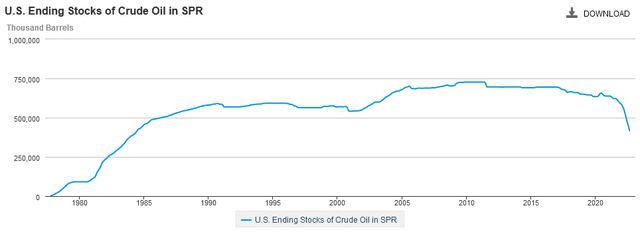

The Strategic Petroleum Reserve

President Biden ran into significant criticism for his decision last November, in partnership with China, India, Korea, Japan, and the UK, to release 50 million bbls of oil from the U.S. Strategic Petroleum Reserve (“SPR”) to address the lack of supply (not a lack of resource, a lack of supply …). In March of this year, after Putin’s invasion of Russia, and after U.S. shale oil companies generally refused to respond to significantly increase production with stepped-up drilling plans (a first in terms of the U.S. oil industry not responding during a time of war …), Biden announced plans to release an additional 1 million bpd from the SPR for six months. Shale oil producers and some politicians howled in protest even as Biden said the government would buy back oil at or below $67-$72/bbl to put a floor under the shale oil producers’ price to address their concerns about a “crash.” Even many Americans … getting absolutely hammered at the pump … did not like the plan.

EIA

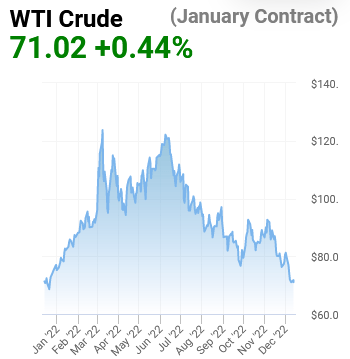

No doubt, the SPR dropped from a high ~726.6 million bbls in 2011 to 416.4 million bbls in September – a move some called “dangerous.” However, the naysayers fail to point out that Biden sold “high” and can now buy “low,” as the price of WTI has dropped significantly and is now below where it was after Russia invaded Ukraine, with the January contract notably selling at the price in which Biden said the government would start buying:

OilPrice.com

Yet in the bigger picture, and what hardly gets mentioned at all, is the amount of “strategic petroleum reserves” the U.S. has in the ground in the form of proven shale oil. As I mentioned earlier, this oil can be easily and economically produced – with a near 100% drilling success rate – in a matter of a couple of months. This is a huge strategic advantage for the United States.

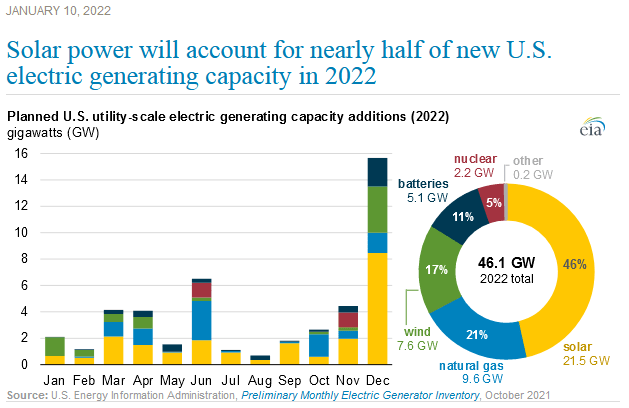

Renewables

Meantime, of course, there’s an abundance of energy potential shinning directly on Earth every day from the sun. That energy can now be easily and economically captured by solar and wind arrays. Indeed, and just like last year, the majority of new incremental U.S. electrical power generation capacity this year will come from solar, wind, and battery backup:

EIA

As you can see from the graphic, 74% of new incremental power generation (a total of 34.2 GW) will be added from solar (46%), wind (17%), and batteries (11%) this year. Indeed, there’s so much economic solar and wind and natural gas power generation potential – and realized – that dozens of coal plants continue to be shut-down and more will be shut down going forward. Indeed, 12.6 GW of coal capacity is expected to be shuttered this year alone). This trend is not only the recent past, and the present, but the certainly the future as well.

Investment Takeaways

There’s a big difference between energy supply disruption due to war and the weaponization of supply vs. a “lack of supply” or a false narrative that somehow “green energy” was responsible for that lack of supply and the big jump in O&G prices. The fact is, we live in an Age of Energy Abundance when even a decision by OPEC+ to keep millions of bbls of crude oil off the global market combined with the decisions by multiple large U.S. E&P companies not to raise production (even in a time of war …), could not prop-up the price of oil for long.

The global O&G markets are fascinating to me – I’ve been tracking them for over 40 years. They are also very complicated. From OPEC+, to China demand, to COVID-19 implications and the global economy’s impact on the supply/demand balance, there are a plethora of interlocking factors that can move markets.

Of course part of the recent drop in oil prices are expectations that global demand will fall as the result of the high-inflation and, currently, that a serious COVID-19 outbreak in China is a real possibility and therefore oil demand from the world’s largest importer will crater.

Meantime, I find it ironic (and somewhat humorous were it not for the serious under-lying implications …) that those currently decrying high inflation and blaming it on the “green energy” agendas of “liberals” and “greenies” don’t even consider the possibility that it was the previous administration – and its supposed “conservative” party – that pivoted away from America’s traditional Democratic and NATO allies toward the world’s worst dictators like Putin and MBS, that created the problem. Note that Putin and MBS have teamed up to keep energy prices high and punish Democracies around the world.

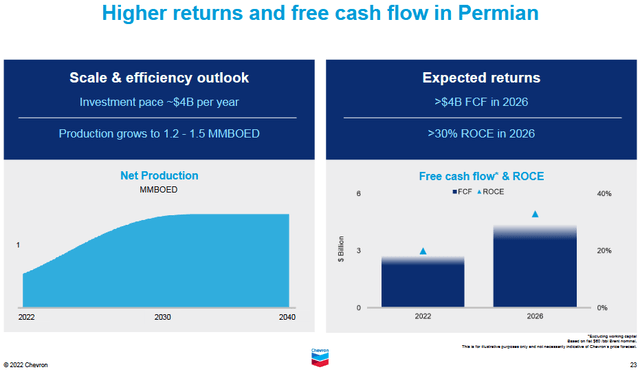

American energy company CEOs have chosen to be very disciplined in this environment – not for the lack of readily available shale resources, but because their companies have arguably been terrible investments over the past decade. Indeed, Exxon Mobil shareholders are so happy that the stock recently simply recouped the level it attained back in 2014 that they are doing a victory “happy dance.” However, that doesn’t mean companies like Chevron (CVX) and Exxon are not focusing on growing Permian production, they are. In fact, XOM’s recent success is because it finally stopped over-spending on capex to focus on Guyana (see above) and the Permian. Indeed, Exxon’s Permian production reached 560,000 boe/d in Q3 and is expected to grow 20% this year as compared to last. In addition, this slide from the November Presentation shows that Chevron plans to raise its Permian production to an estimated 1 million boe/d by 2025 and up to 1.2-1.5 million boe/d by 2030 and to hold that production relatively flat for a decade after that:

Chevron

And of course there are other major players in the Permian that also could very easily, economically, and quickly increase Permian production: ConocoPhillips (COP), Pioneer Natural Resources (PXD), EOG Resources (EOG), and Occidental Petroleum (OXY) – to name just a few – could all significantly increase production if they simply chose to do so. However, consolidation across the sector (OXY buying Anadarko, COP buying assets from Concho Resource and Shell, Exxon buying large private companies, etc.) has strengthened these large companies’ hands. Their scale and ability to contract large volume commitments for gas processing and pipeline capacity – for example – give them the upper hand as compared to smaller and private companies. Bottom line is that these big shale companies can now much more effectively and easily throttle U.S. O&G production (as they are currently doing) by simply deciding not to drill. That despite the fact that the price of WTI is currently ~2x above their breakeven point. Note that they did not even plan to increase production was WTI was over $100/bbl last spring.

Luckily, in this new age of energy abundance, U.S. LNG exports more than doubled this year (see, shale really is “short-cycle”) to help mitigate what would otherwise have been an energy and humanitarian crisis in the EU. Through October of this year, American LNG exporters shipped 48 billion cubic meters of gas to the EU – some 26 bcm more than in 2021. That was considerably above President Biden’s target of and additional 15 bcm of exports to our European allies back when Putin first weaponized Russian gas by shutting down nat gas pipelines to the EU.

However, Russia’s action have significantly raised the cost of LNG throughout the world, and many countries outside of the EU are likely re-considering investing in LNG import terminals. This could be a “new normal” in that – given both sides’ strong claims on Crimea – the war in Ukraine appears to have no end in sight. And I doubt the EU will ever depend on Russia for gas again – certainly not unless Putin is ousted and a new regime takes over. And even then Russia would have to prove its reliability very slowly over time.

In the U.S., and as the previous graphic clearly displayed, the shift to clean energy in the U.S. utility sector remains in full swing. Indeed, given the billions of dollars for Federal tax-credits in the IRA Act (which I prefer to call the “Clean-Tech Act”), major utility companies in the U.S. will only accelerate the clean-energy transition – and that means more solar and wind power with hybrid systems that include battery-backup. And it means more EV-charging stations. And it means that the SPDR Utilities ETF (XLU) may not be quite as “stodgy” going forward as it has been in the past. And it means that the United States will no longer roll over and let China control the clean-tech supply chains of the 21st Century – and the good-paying manufacturing jobs that go with them.

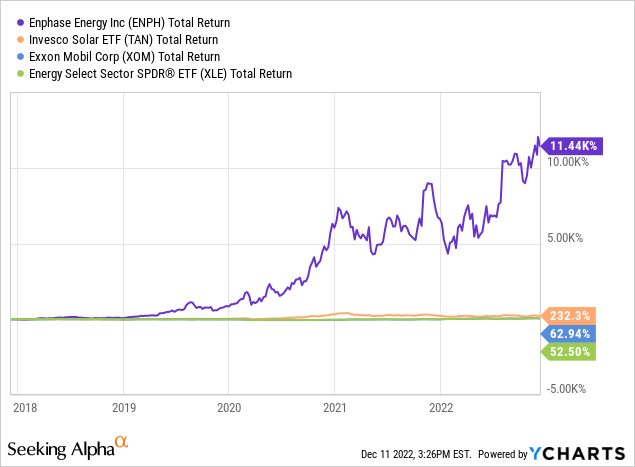

This is the reason that a company like Enphase (ENPH) – which builds micro-inverters for solar panels – and the Invesco Solar ETF (TAN) have, despite the 2022 bear market, greatly out-performed a recently surging Exxon and the O&G sector as represented by the Energy Select SPDR ETF (NYSEARCA:XLE) over the past five years:

In my opinion, this trend is likely to continue going forward.

The EV transition also remains in full swing, with a plethora of new car and truck models giving consumers excellent options as compared to the day when Tesla (TSLA) dominated the sector. I’m not surprised at all by the correction in the price of Tesla stock this year, as real competition from BYD (OTCPK:BYDDY) in China and from Ford (F) and General Motors (GM) in the U.S. is now a reality. In addition, Elon Musk’s recent Twitter and political related drama is certainly not helping the Tesla brand at exactly the same time that a host of global EV competitors are introducing EVs in all ranges – from economy models to first-class luxury vehicles. Even though I expect Tesla vehicles to see relatively strong demand, its market share and margin are both going to fall going forward.

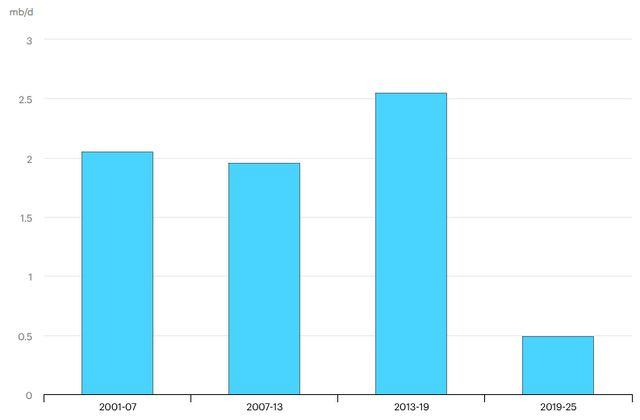

By 2030, expectations are that more than half of new vehicle sales will be EVs. That has huge implications for the global refining sector. Indeed, after growing between 2-2.5 million bbls/year over the three previous six-year periods, from 2019-2025 the EIA expects global gasoline to grow by only 500,000 bpd:

IEA

That being the case, investors in big refining companies like Valero (VLO), Marathon Petroleum (MPC), and Phillips 66 (PSX) will need to consider how their companies will perform between 2025 and 2030 when EV sales will be ramping-up even faster. That’s because – even in an Age of Energy Abundance – the economic laws of supply and demand still hold. In this case, supply could certainly outstrip demand over the mid-term.

In fact, I would argue that the recent surge in oil and gasoline and diesel prices – and the false narratives about an energy “shortage” – have already caused big changes in consumer behavior. Anecdotally, I have two neighbors that recently sold their ~20 mpg vehicles and bought hybrids – both Toyotas (TM). One bought a Venza and the other a RAV-4. The Venza owner has owned it for a month now, has yet to fill it up, and is averaging ~47 mpg. The car has a 500 mile range per gas-up. Two other friends said they would have already bought full EVs had they been able to actually get their hands on them: One, a Ford Mustang Mach-E, the other the Lightning F-150 truck.

Summary And Conclusions

There are a lot of false – and typically politically oriented – narratives floating around about the energy sector these days. However biased any particular investor is from a political or environmental perspective (which is typically one and the same), it’s never good to ignore data in order to fit a narrative that simply does not reflect reality. The truth of the matter is that we truly live in an Age of Energy Abundance – from U.S. shale, to the Canadian oil sands, to Guyana and East Africa, there’s a vast global resource base of oil and gas for the world to exploit. Yet the fact is, if all that O&G is produced and consumed, we will quite likely melt the polar caps, cause sea level to rise dramatically, and simply burn-up the planet.

That being the case, governments across the planet – including the three largest economies of the U.S., China, and the EU – have put in large-scale government incentives for renewable green energy and EVs. That – combined with the recent high price of oil and gasoline, Putin’s horrific war-on-Ukraine, and OPEC+’s willingness to cut back production – will likely only accelerate the clean-tech and EV transitions that were already in full-swing. As for there being some kind of “shortage” in oil and/or natural gas supply or reserves, as I showed in this article – that’s simply not the case.

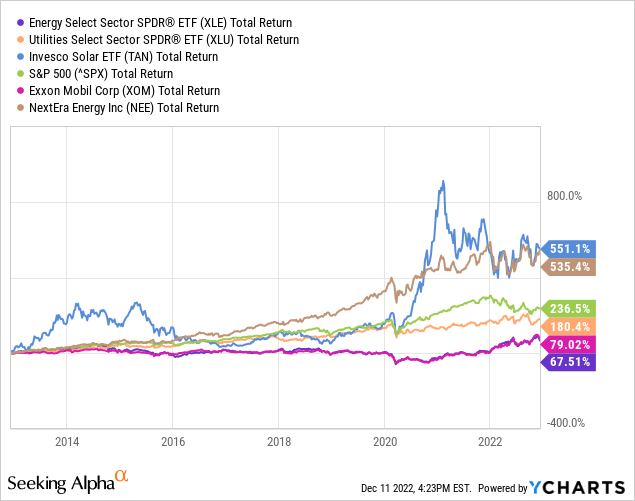

I’ll end with a 10-year total-returns comparison of the performance of the S&P 500 with two oil and gas related investments (XOM and XLE) with that of two utility related investments (NextEra (NEE) and the XLU ETF), along with the (TAN) Solar ETF:

As you can see, despite the big rally in the O&G sector over the past couple of years, NEE and the TAN ETF were far-n-away the best performers of the group. Also, note that the two O&G proxies significantly under-performed the S&P 500 and even the XLU Utilities ETF as well.

I see no reason to believe the coming decade will be any different. In my opinion, these trends are likely to accelerate. The planet is quickly moving toward electrification and away from oil. Will oil be in demand for decades to come? Yes. Will global demand grow for decades? Certainly not. We could easily see global oil demand peak, and begin to decline, prior to 2030. I’m much more bullish on the outlook for natural gas, which feeds in well to the electrification theme due to being a superior electric power generation fuel as compared to coal.

Be the first to comment