AsiaVision

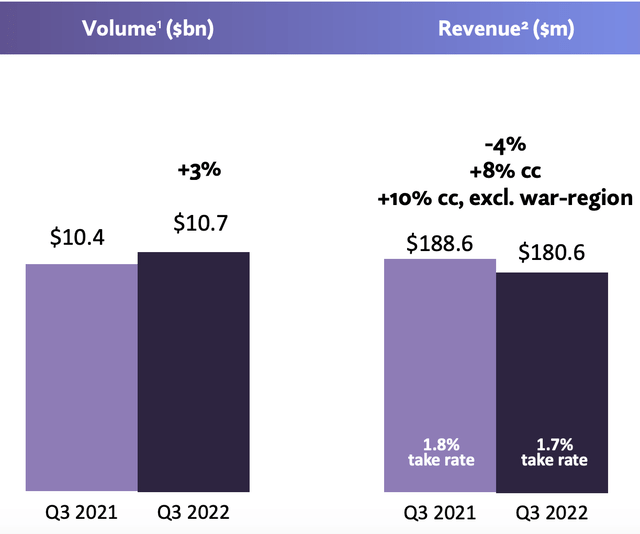

Paysafe Limited (NYSE:PSFE) is a global payments company that was founded in 1996, two years prior to PayPal Holdings, Inc. (PYPL). Since that point, the two businesses have taken massively divergent paths with PayPal growing its market capitalization to over $83 billion and Paysafe now trades at ~$1 billion. Paysafe has had an interesting history, the company was originally listed on the London stock exchange, before being acquired by the world’s largest private equity company Blackstone in 2017. In March 2021, the company was spun off via a SPAC merger with Foley Trasimene Acquisition Corp II, on the New York Stock Exchange. Similar to many SPACs and growth stocks, the rising interest rate environment compressed its valuation multiple and caused the stock price to plummet. Paysafe is now deeply undervalued intrinsically. In this post, I’m going to break down its business model, financials, and valuation, let’s dive in.

Business Model

Paysafe offers a variety of payment solutions from online payments, to integrated software payments and even Point of Sale [POS]. The company also offers Digital Wallets “Skrill” and “Neteller.” In addition, Paysafe offers the latest authentication method for payments, called 3D Secure 2. The major card providers (Visa, Mastercard, and America Express) stopped support for 3DS 1, in October 2022. In Europe, a Payment Services Directive [PSD] mandate was introduced in January 2021. Therefore to comply with this, merchants with need to migrate their payments over to the latest 3DS 2, authentication method. In the U.S, there is no mandate in place, however, an increasing number of merchants choose to adopt 3DS 2, in order to help with international payments. Paysafe is poised to benefit from this regulatory shift towards more secure authentication technology.

Paysafe products (Paysafe website)

Paysafe also offers an interesting product solution called “Paysafecash.” This bridges the gap between offline cash and the digital world. For example, a customer can simply head to a store and use cash to pay for online services, such as bills, loans, mortgages, etc., with the simple scan of a barcode. “Viacash” owned by Paysafe is the largest bank-independent payment infrastructure in Europe and has signed up over 200,000 stores to support this solution. The service can also be used to get cashback through the scanning of a bar code, integrated with your banking app. The retailers signed up are mainly mainland European stores such as the German supermarket chains, REWE, DM etc. Therefore, if you are unfamiliar with these, it would not be a surprise. Fintech giant Block (SQ) offers a similar solution in the U.S and has signed up major partners such as Walmart to offer customers an easy way to add cash to their digital cash app.

Third Quarter Results

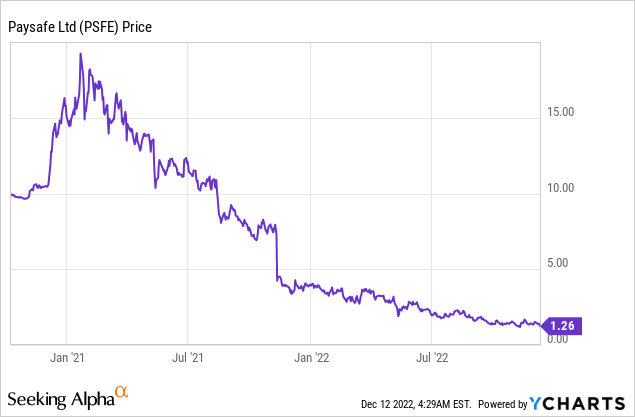

Paysafe reported strong financial results for the third quarter of 2022. Revenue was $366 million, which increased by 4% year-over-year and beat analyst estimates by $13 million. This revenue growth may not seem very fast, but it was impacted massively (negative $23m) due to unfavorable foreign exchange rates from a strong dollar. This is because the company derives a large portion of its revenue from Europe, but now they are listed on U.S exchanges, the company reports in dollars. On an FX-neutral basis, revenue actually increased by 10% year over year, driven by growth in both its U.S.-acquiring business and Digital Commerce. Payment volume increased by 5% year-over-year to $32.5 billion.

Paysafe Payment Volume and Revenue (Q3,22 report)

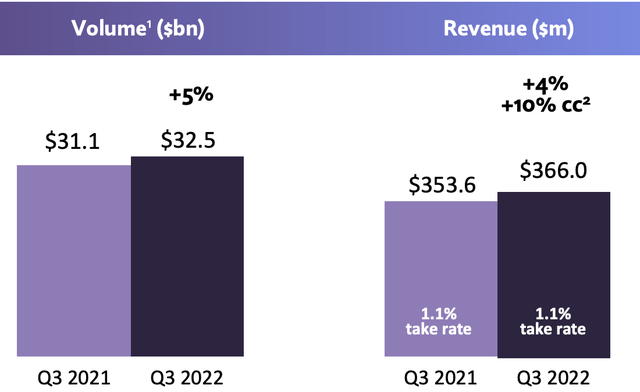

Breaking revenue down by business segment, U.S acquiring payment volume was $21.8 billion and increased by 5% year over year. Revenue was $185.4 million, up a strong 12% year-over-year. This was driven by a 0.1% higher take rate (0.9%), which was driven by strong growth and expansion into the U.S SMB retail market.

US Acquiring Revenue (Q3,22 report)

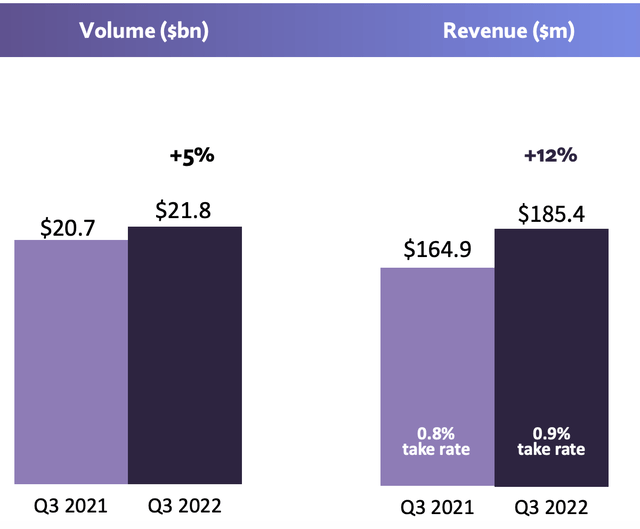

Paysafe’s Digital Commerce business reported $10.7 billion in payment volume which increased by just 3% year-over-year. Its Revenue was $180.6 million, which was actually down 4% year-over-year. However, it should be noted that this was driven primarily by the aforementioned unfavorable exchange rates and hit in war regions such as (Ukraine/Russia). On a constant currency basis, revenue actually increased by 8% year-over-year. If we exclude the war region, constant currency revenue increased by 10% year over year.

Paysafe Digital Commerce (Q3,22 report)

The company also reported growth in its digital wallet business which increased by 2% year-over-year. Total deposits increased 9% year-over-year and 100,000 new accounts were funded in the third quarter.

Breaking down results by region, The company launched with 10 new merchants in Latin America and with the iconic bet365 gambling company in Mexico. Its iGaming market was also strong in North America with over 45% revenue growth in the third quarter. Paysafe is currently live in 23 states, the business recently launched in Kansas with DraftKings, Caesars, and PointsBet. In the next few quarters, Paysafe plans to launch into Maryland and Ohio.

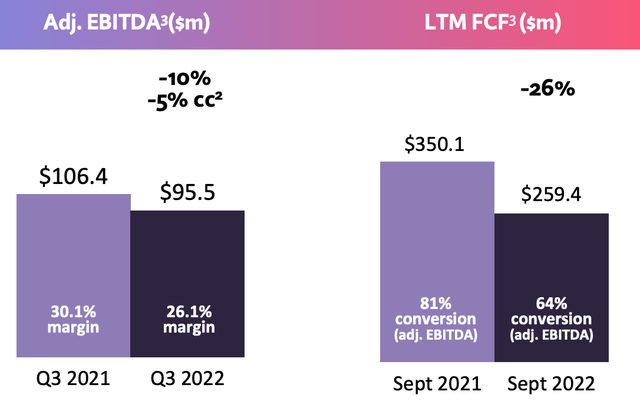

Profitability and Cash Flow

On a GAAP basis, Paysafe finally became profitable, reporting a net income profit of $1 million, which was substantially better than the negative $147 million generated in the prior year. This growth was driven mostly by an intangible “impairment” expense. Adjusted EBITDA was $95.5 million which declined by 10% or 5% on a constant currency basis. This was driven by higher interest expenses mainly. Overall, the company reported Non-GAAP earnings per share of $0.04 which beat analyst estimates by $0.02.

Adjusted EBITDA (Q3,22 report)

The business reported $259.4 million in free cash flow for the trailing 12 months, at a 64% conversion ratio. Moving forward the company is expecting a 60% to 70% adjusted EBITDA to cash flow conversion ratio. The company has a robust balance sheet with $220.2 million in cash and short-term investments. The company does have high long-term debt of $2.2 billion, but just $10.2 million of this is current debt, due within the next 2 years.

Advanced Valuation

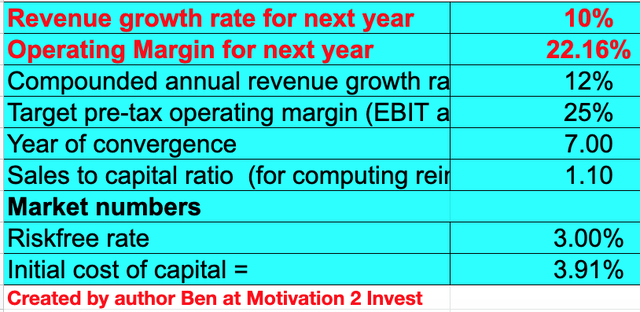

In order to value Paysafe, I have plugged the latest financials into my advanced valuation model, which uses the discounted cash flow (“DCF”) method of valuation. I have forecasted 10% revenue growth for next year, which is similar to this year on a constant currency basis. However, in years 2 to 5, I have forecasted a slight improvement to 12% per year, as economic conditions are likely to improve.

Paysafe stock valuation 1 (Created by author ben at Motivation 2 Invest)

The company also has a healthy pre-tax operating margin of 22.16%. I have forecasted this to increase to 25% over the next 7 years, as the business continues to scale and execute a greater number of upsells.

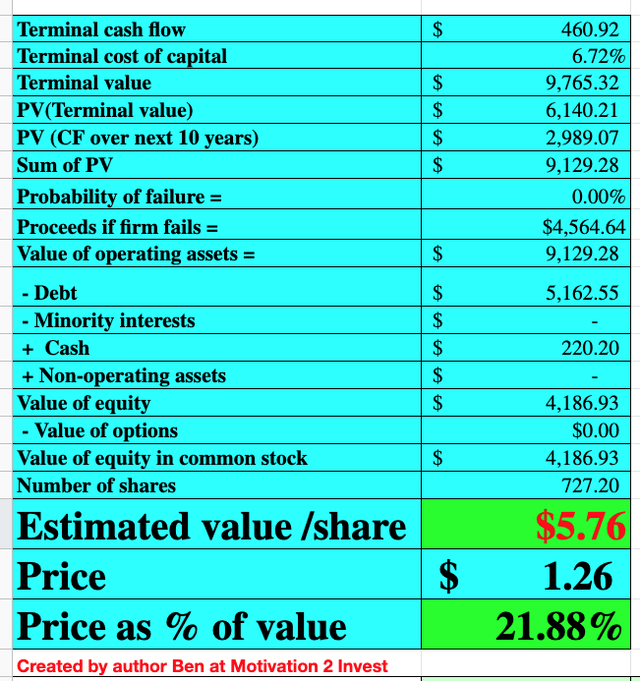

Paysafe stock valuation 2 (Created by author Ben at Motivation 2 Invest)

Given these factors, I get a fair value of $5.76 per share. The stock is trading at $1.26 per share at the time of writing, and thus it is ~78% undervalued, which is significant.

Note: Paysafe is having a meeting in December 2022 to seek shareholder approval for a 1 to 12 reverse stock split. As Paysafe’s share price has fallen to just over $1, this would make sense in order to make the company look safer for investors. However, it should be noted this is mainly a psychological difference.

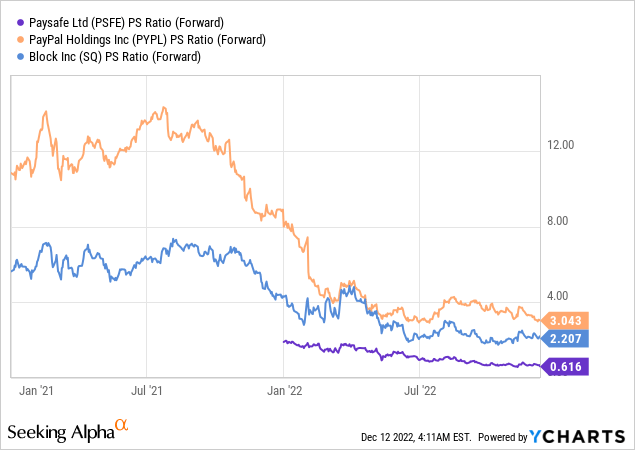

As an extra datapoint, Paysafe trades at a Price to Sales ratio = 0.62 which is cheaper than historic levels. In addition, Paysafe trades much cheaper than fintech peers such as Block and PayPal, although those businesses are substantially larger.

Risks

Recession/Payment Volume

The high inflation and rising interest rate environment have caused many analysts to forecast a recession. During a recessionary environment, both consumers and businesses have their input costs squeezed which generally results in lower spending and thus lower revenue for fintech companies.

Final Thoughts

Paysafe is a global fintech company that is continually innovating its product range. The company is facing headwinds from unfavorable FX exchange rates and the macroeconomic situation. However, the business has still managed to grow its financials steadily in the third quarter. Paysafe’s stock is substantially undervalued at the time of writing and thus could be a great long-term investment.

Be the first to comment