peterschreiber.media

Co-Authored With Matteo Koulias

Industry Growth Rates Are Strong and Accelerating

Eaton Corporation (NYSE:ETN) is an investment play on accelerating growth trends for electrification, energy transition, and digitalization. ETN is a top holding in the following thematic ETFs: IQ Cleaner Transport ETF (CLNR), Clean Edge Smart Grid Infrastructure (GRID), Self-Driving EV and Technology ETF (IDRV), Smart Transportation & Technology ETF (MOTO), Carbon Transition & Infrastructure ETF (NBCT), and Sustainable Energy II ETF (SOLR). The company is made up of 5 operating segments: Electrical Americas, Electrical Global, Aerospace, Vehicle, and eMobility.

Electrical Americas and Global (70% Sales)

Two segments, Electrical Americas and Global (70% sales), produce highly engineered electrical components relating to energy storage and grids that are sold to a wide variety of industrial, government, commercial, and residential end users.

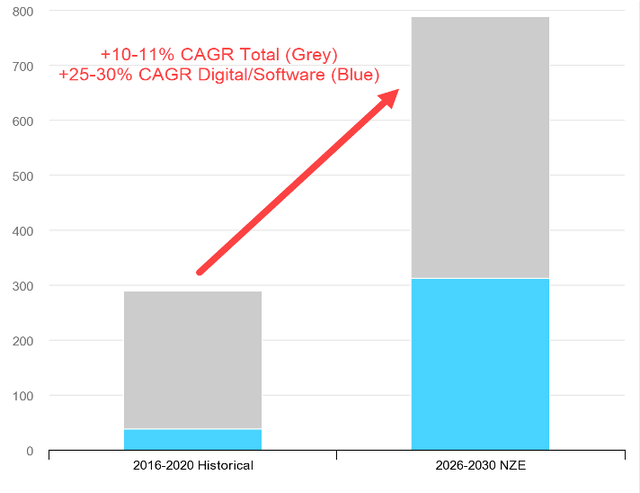

Market forces (high fuel prices, energy inflation, supply chain bottlenecks, geo-politics, and climate change urgency) are driving +10-11% annual sector growth for clean energy and electrical grid products and service, positioning this industrial segment to more than double by 2026-2030. Of all energy investments, renewables, grids, and storage account for more than 80%. With Eaton focusing on residential smart grids and industrial grid modernization, they are poised to expand their sales rapidly as they expect the sector to grow by 4.6x in 2025 compared to 2021.

Investment spending in electricity networks, 2016-2020 vs. 2026-2030 in the Net Zero 2050 Scenario ($ Billions) (IEA)

Aerospace (14% Sales)

The next largest segment is Eaton’s Aerospace (14% sales). This segment consists of fuel, hydraulics, and pneumatic systems for both commercial and military use. The commercial/military end user markets each represent 50% of sales.

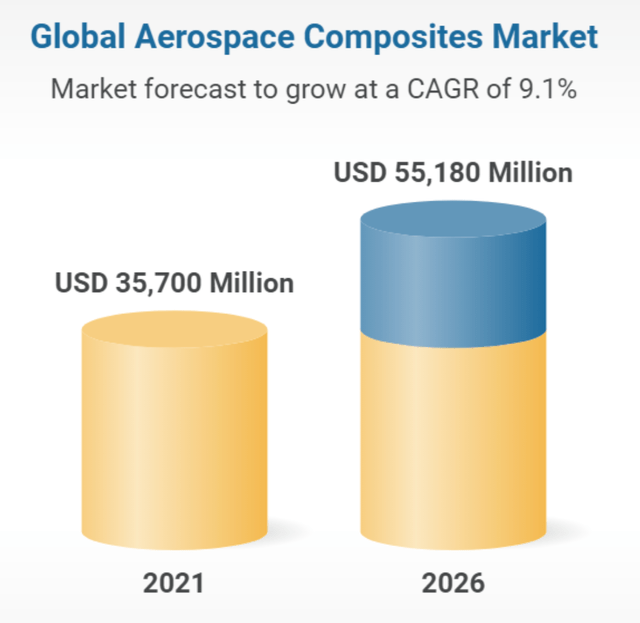

After significant lows due to the pandemic, the aerospace industry is set to rebound with international flight restrictions being loosened, and high demand for air travel. This will lead to pre-pandemic or higher levels by 2024 and according to Research and Markets will grow at a CAGR of 9.1% to 2026.

United States Aerospace CAGR Growth 2021-2026 (Research and Markets)

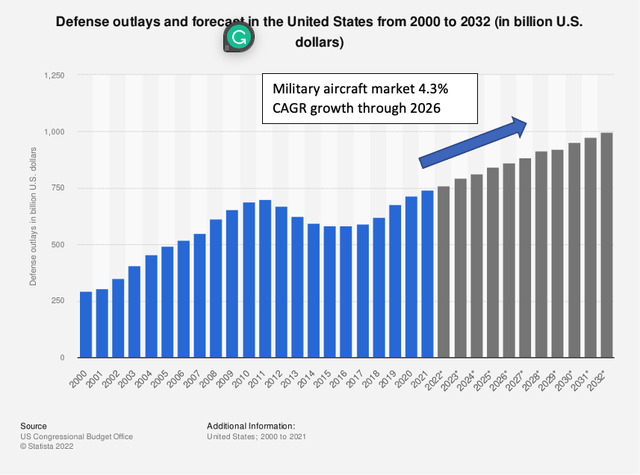

The White House FY 2023 defense budget request of $872B represents a +8% increase in spending. Speaker Pelosi’s trip to Taiwan, which predictably led to saber rattling, indicates the high degree of bipartisan domestic support for this issue. Rising geopolitical tensions in Europe (Ukraine) and Asia (Taiwan) are leading to traditionally “dovish” countries devoting more resources to boost military spending commitments. Overwhelmingly PWC expects that for every dollar in increased global defense spending, 70% will be categorized as “aerospace” weapon systems.

United States Government Defense Spending and Military Aircraft Market CAGR through 2032 (Statista)

eMobility (3% Sales) and Vehicle Segment (13% Sales)

The last two segments are the mature Vehicle (13% sales) and rapidly growing eMobility (3% sales). Both these segments design and manufacture vehicle parts to improve power management, fuel economy, and performance of cars, trucks, commercial vehicles, and off-road vehicles, with eMobility focusing primarily on the electrification of vehicles.

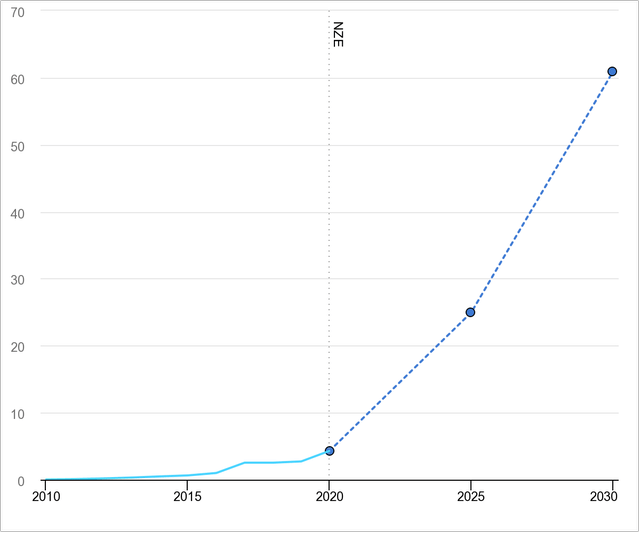

The eMobility segment is poised to have exponential growth in the coming years with the growing adoption of electric vehicles and cars. In Eaton’s 2022 investor presentation, the company estimates it can get +27% total CAGR for the segment through 2025. The eMobility segment’s growth potential for Eaton will be felt in the coming years when it should have a major impact on the company and its overall revenues and profits. By 2025-26, this division could have $1B of sales and an operating margin of around 8%-12% and be on track for $2-$4B in sales and a 15% operating margin by 2030.

Electric Car Sales 2010-2030 % Share in the Net Zero Scenario 2050 (IEA)

The slower growth Vehicle division generates solid cash flow for Eaton, which the company uses to redeploy into other, more promising areas. In addition, this division could be a candidate for a sale, at the right price.

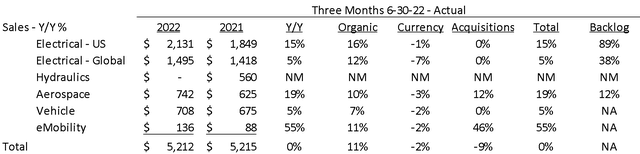

Secular Fundamentals Driving 11%-13% NT Organic Sales Growth

These promising industry trends are currently being reflected in recent financial results. ETN has recently had a string of higher-than-expected reported quarterly financial results. Near-term organic growth rates are now tracking 11%-13% and backlogs have spiked Y/Y.

Q2 2022 Financial Results – Components of Growth (Eaton and Sapling Wealth Management, LLC)

In light of across-the-board higher demand, management has increased its sales growth guidance twice in 2022.

Management Guidance Increasing in Line with Secular Growth Trends (Eaton)

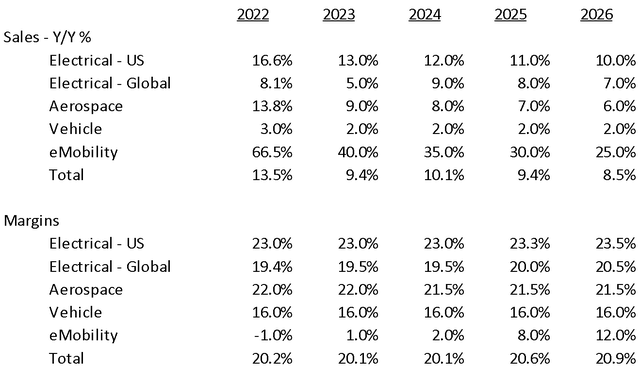

9%-12% Top-Line Growth 2023-26 with Expanding Operating Margins

We expect the Electrical segment (U.S. and global) will deliver high single-digit/low double-digit sales growth and that this will anchor long-term growth rates for this company. We project margins for the Electrical Divisions will uptick slightly by 2026, reflecting strong demand dynamics and anticipating payoffs in upcoming valued added engineered products. As the eMobility division’s sales growth compound, this promising division will really begin to move the company’s revenue meter in the 2025-2026 period. Management guidance for eMobility operating margins is 15.0% in 2030, however, this could be conservative.

Projected Sales and Margins Eaton Corporation 2022-2026 (Sapling Wealth Management, LLC)

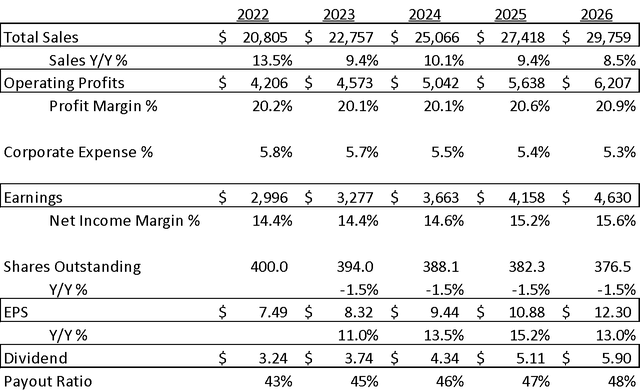

EPS Growth +11%-13% Range Through 2026

Without making any heroic assumptions on sales or margins, ETN’s historical EPS growth rate jumps to +11-13%, which is well above its historical EPS growth and makes the company appealing to a wide range of investors. The current payout rate of 43% is below its historical rate of around 50% and therefore could grow at an annual +15%-20% rate over this time period.

Accelerating Sales and Rising Margins Drive Strong EPS & Dividend Growth Prospects (Sapling Wealth Management, LLC)

Lots of Options for Free Cash Flow Capital Allocation

Free cash flow, after capex, was $201 million in Q2 2022 (about 3.8% of sales). There are plenty of uses for this capital, including share repurchases, acquisitions, and investments in new products and technologies. We estimate that the company’s ROE is 16.7% and investments in new technologies and services could yield even higher results. The allocation of this free cash flow is baked into our model with annual share repurchases of 1%-2% of shares outstanding and a modest level of acquisitions.

$35.1 billion in assets/$16.4 billion equity ratio for the company was 214%, which is reasonable for this company. The future mix of business will likely involve a higher portion of maintenance contracts, which will create a more stable pool of revenue and profits. This dynamic could support a higher degree of leverage in the future, but it is not a part of our assumptions.

Valuation Seems Low Relative to Long-Term EPS Growth

If S&P 500 P/E multiples are hovering around 16-17x 2022, we believe Eaton deserves a 20x P/E multiple, which represents a 25% premium to the market. This premium is justified due to the company’s strong long-term EPS growth prospects and a leading position in its target industrial markets. In 2026, Eaton could trade at $246/share (20x EPS estimate of $12.30), which would deliver +13% annual capital appreciation + 2.5% yield = +15.0%-15.5% annualized returns over this four-year period.

Looking at the company from another perspective, we think Eaton could trade to price in a dividend yield between 2.0%-2.5%, and our projected dividend of $5.90/share would support a stock valued between $236 and $295 (midpoint of $265). This valuation is well above the company’s historical yield in the 3.0%-4.0% range, however, it is justified due to the much better secular 2022-26 growth trends in Eaton’s core business segments and the current low interest rate environment

Near-Term Risks Are Muted by Huge Spike in Backlog

Near-term risks on this stock include the effect of a mild or severe recession on this economically cyclical company. However, given the backlog growth in H1 2022, we believe the company will be able to weather any recession storm without sacrificing too much in sales and earnings momentum. The secular growth trends in this industry segment are too powerful and broad-based to derail the company for too long.

Many Types of Investors Should Find Merit in This Name

Eaton is clearly one of the leading industry players in the electrification and energy transition, and its boat will be lifted in this rising tide. We believe the long-term merit of this promising industrial segment far outweighs the near-term challenges in a slowing economy. The company is at an inflection point in sales growth and expanding margins, as shown by management’s higher guidance (twice) in 2022, which may not be fully appreciated by investors.

Growth at a reasonable price (GARP) investors should look favorably on this stock now, and Value Investors could consider loading up the truck if ETN approaches spring lows of $125-$130. As the payout ratio normalizes over the next three to five years, we believe that dividend growth investors can anticipate greater-than-expected dividend bumps. Thematic investors will find several long-term secular trends embedded into the fundamentals of this story and even momentum investors may get excited if Eaton begins to catch a tailwind from recently passed Federal legislation in the Inflation Reduction Act.

Be the first to comment