greenbutterfly

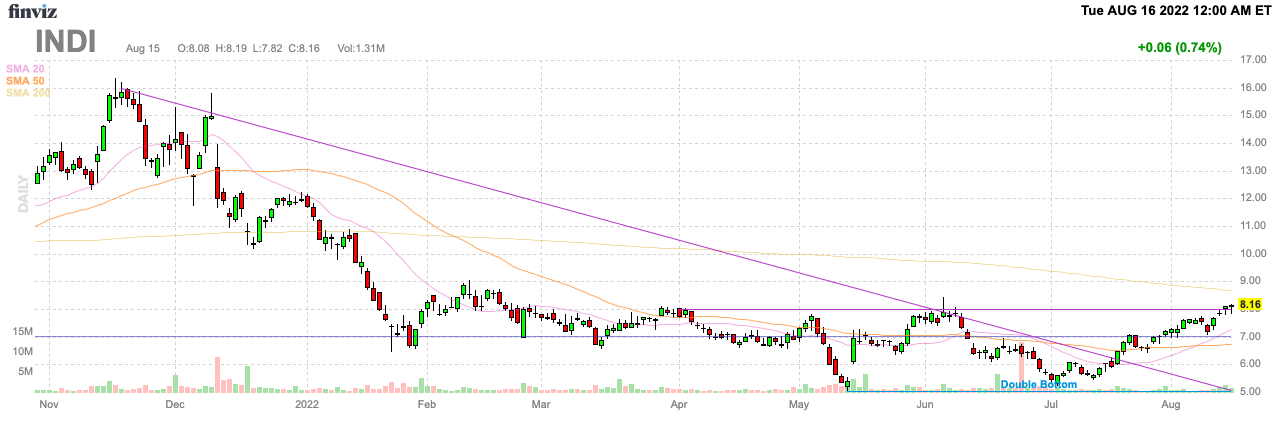

The auto sector continues to remain the bright spot in the semiconductor space, but oddly indie Semiconductor (NASDAQ:INDI) hasn’t gotten much love from the stock market. Even with another great quarter, Indie remains under the radar of market participants. My investment thesis is ultra Bullish on the fast growing company still trading below the initial SPAC price.

Source: FinViz

Autotech Boom

Indie Semi. plays in an autotech market quickly reaching a $50 billion opportunity. The company focuses at the center of the transition to auto safety and electrification boosting demand for technology on every new vehicle.

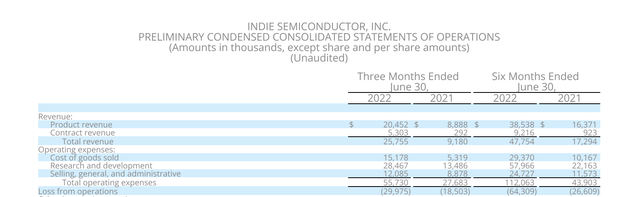

The company reported Q2’22 revenues hit $25.8 million for amazing 181% growth. Naturally, Indie Semi. only reached an annualized sales rate reaching $100 million, so the company has an easier time to printing outsized gains.

Indie Semi. has promising design wins in Lidar, radar, ultrasound and computer vision along with the current focus on wireless charging, advanced lighting and power management. As with other autotech players, the excitement will ultimately be based on the contracted backlog totals and Indie Semi. plans to offer those numbers with the Q3’22 report in 3 months.

In addition, the company is poised to benefit from the shift to electrification within autos due to the market move to EVs. In the 1H22, Indie Semi. generated massive growth despite US auto sales dipping 17%. EV sales grew 75% in the 1H and helped the company overcome the sector headwinds with lower overall volumes.

As typical of their focus on innovation in power efficiency, Indie Semi. benefits from greater attach rates to modern vehicle designs where power innovation is crucial to maximizing vehicle range. The company is poised to ride the wave where the average content in a vehicle soars from only $500 now to over $7,000 in the next decade.

Financial Boom

The market probably doesn’t like that Indie Semi. reported a massive Q2 loss, but the company is headed towards the attractive margins of the semi. sector. Management forecasts 60% gross margins leading to 30% operating margins with a plan to reach initial profits in the 2H of next year.

Source: Indie Semi. Q2’22 earnings release

When stripping out ~$13 million in stock-based compensation and acquisition costs, the operating loss was ~$17 million in the June quarter. As normal for a company this size, Indie Semi. is investing aggressively in R&D with adjusted costs at ~$22 million alone.

The company forecasts revenues jumping to $30 million in Q3’22 with operating leverage from nearly flat operating expenses. Indie Semi. will need to nearly double revenues by next Q3 to $60 million quarterly in order to have a chance for profits on a Q3’22 operating expense run rate of $31 million.

On the Q2’22 earnings call following a question from Ross Seymore of Deutsche Bank, CEO Donald McClymont confirmed this plan:

We have very good visibility of our backlog and our outlook into 2023. And you’re right. I mean, we have to double one more time. We’ve done it twice already. And so there’s nothing that I can see in front of us that would inhibit that happening for us.

Indie Semi. has 149 million shares outstanding for a market cap of just over $1 billion. The stock trades at just 4x 2023 sales targets of $224 million. Not many stocks targeting 100%+ growth next year trade at such a low multiple.

The company has a cash balance of $164 million to fund growth in the year ahead. Naturally, if Indie Semi. isn’t able to approach profits in the 2H of next year cash burn becomes a major concern. Otherwise, the company does have plenty of cash to expand, but Indie Semi. does compete in a sector with giant industry players with substantially bigger balance sheets to muscle smaller companies out of contracts.

Takeaway

The key investor takeaway is that Indie Semi. is an exceptionally cheap stock focused on the booming autotech sector. The market has been slow to recognize the opportunity ahead for the company due to the SPAC deal while a Q3’22 update on the backlog will help solve a lot of the questions on visibility to double sales next year.

Investors should load up on the stock before the market catches onto the growth story.

Be the first to comment