JHVEPhoto/iStock Editorial via Getty Images

For a while, Hancock Whitney Corporation (NASDAQ:HWC) looked like a bank that was underperforming its potential. Active across the Gulf South, Hancock had the kind of attractive deposit base I like to see in a lender, but turning that into industry-leading profitability was where it perhaps came up a little short.

That was then, and recent years have seen the bank really tighten its previous weak links. What’s more, the operating environment is also looking a lot better for banks in general at the moment. Interest rates are rising, loan growth guidance looks pretty solid, and asset quality has held up exceptionally well throughout the turbulence of the past two years. All told, there’s potentially quite a lot to like at Hancock right now, and really not an awful lot to grumble about – not something that has always been the case.

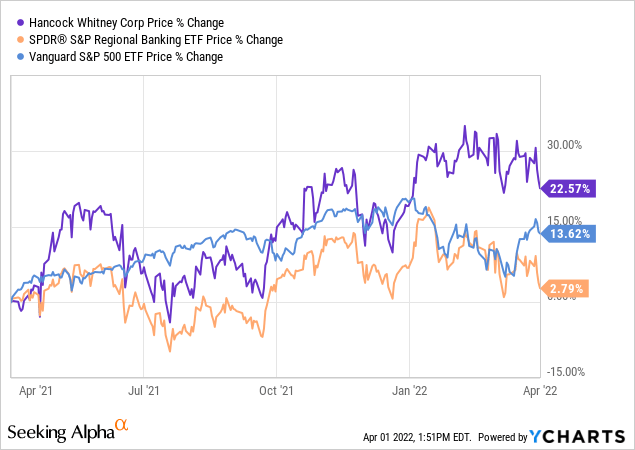

While it does appear that all of the right pieces are falling into the place here, investing is about wedding that to an acceptable valuation, and this is where things become a bit less clear cut. Hancock stock has had a better run of things recently, outperforming its peer group (and the S&P 500) on a YTD, one-year and two-year basis as it recovers back to its record highs. While that doesn’t leave the shares standout cheap on a P/TBV basis, there’s still some upside to the current valuation, and ‘more of the same’ in terms of growth can lead to double-digit annualized returns overall.

Tightening Up The Weak Links

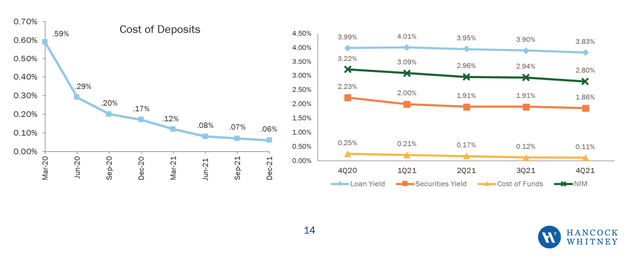

With a good chunk of its $36.5bn asset base funded by non-interest-bearing deposits, Hancock has the kind of strong core deposit franchise that many investors typically look for in a lender. That has afforded it relatively low funding costs and nice net interest margins even as interest rates have fallen.

Source: Hancock Whitney Q4 2021 Results Presentation

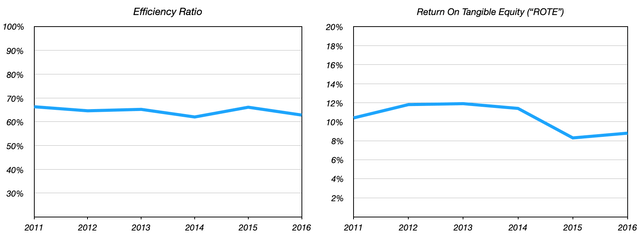

While that aspect of the story has been reliably attractive here, Hancock wasn’t the most efficient operator in the past, and ultimately it wasn’t posting anything more than a mediocre ROTE either.

Source: Hancock Whitney Annual 10-Ks (2011 – 2016)

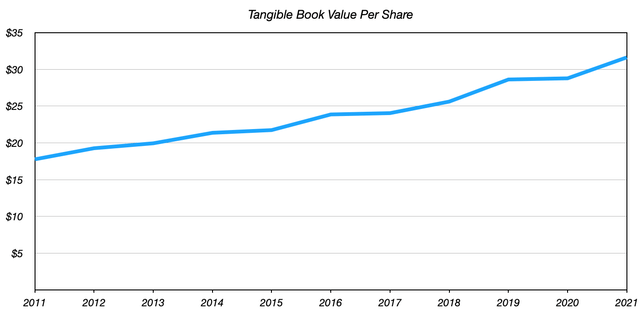

Similarly, growth hasn’t exactly been stellar, with a tangible book value per share (“TBV”) CAGR of 6% over the past ten years okay, but by no means spectacular.

Hancock Whitney Annual 10-Ks (2011 – 2021)

I’d also note that the bank has had significant exposure to the oil & gas industry in the past, with the 2015-16 downturn (energy sector loans accounted for a double-digit share of the book at the time) unsurprisingly weighing on asset quality and profitability and generally knocking the wind out of its sails.

The good news is that Hancock has by-and-large tightened up these weak links in the past few years. A branch rationalization program and work on headcount has helped moderate expenses growth, which combined with reasonable top line growth has helped push its efficiency ratio down into the sub-60% region. The bank has also moved to de-risk its balance sheet, with loans to the energy sector only accounting for around 2.2% of C&I loans (~1.3% of total loans) at the end of last year.

Near-Term Performance Picks Up

Unsurprisingly, Hancock’s near-term performance hasn’t been all that different to the other regional banks I’ve covered recently. Credit quality hasn’t been an issue, and nonperforming loans fell to just $59m last year, or circa 0.29% of total loans, with reserve releases providing a nice boost to the bottom line.

Reported loan growth has been weak, with the roll-off of around $1.5bn worth of PPP loans leading to a year-end loan balance of $21.1bn, down around 3% on year-end 2020 levels. ‘Core’ loan growth was better, though, increasing a little over 4% last year based on year-end balances, and there was real momentum in the latter part of the year, with reported loans up 1% sequentially in Q4 and core loans up around 3% on the same basis.

Other Pieces Now Falling Into Place

Looking ahead, it does feel like a lot of other pieces are now going to fall into place here. For one, that momentum should carry on into 2022, with management guiding for 6-8% core loan growth this year. Remaining PPP balances will weigh on reported loan growth in the first half, with around $530m still outstanding at the end of 2021, though things should pick up in the second half.

Furthermore, interest rates are obviously now increasing, and Hancock is reasonably asset sensitive. Its most recent sensitivity disclosure has a 100bps shock increase in rates producing a 7% lift to net interest income in the first year, which is about average among its peer group. The bank is also still sitting on a fair amount of excess liquidity – much of which will go towards aforementioned loan growth, but with some scope to invest in higher-yielding securities too.

While these are largely industry-wide tailwinds, at least for the asset sensitive banks, there are some Hancock-specific points to consider that make things a bit more interesting here. Firstly, and notwithstanding the inflationary pressures seen at other banks, management is actually guiding for a circa 2% reduction in non-interest expenses this year. Also, Hancock has quite a bit more leeway left on provisioning, with its loan loss allowance still at around 1.80% of total loans at the end of last year. At the very least, it isn’t going to be facing the same degree of pressure to near-term EPS, which should actually increase in FY22.

Still Some Upside To The Valuation

It isn’t always easy recommending a stock after it has been on a strong run, and Hancock has outperformed its peer group to varying degrees recently (with the degree of outperformance depending on which regional bank index you use) as well as the S&P 500.

Granted, these shares don’t really look all that cheap at around 1.65x TBV, but for a bank posting a mid-teens ROTE I’d argue for a fair value closer to 2x TBV. All said, I can see that contributing to double-digit annualized returns here in the medium term, with that ultimately consisting of circa 6% annualized TBV per share growth, in line with its historical rate; the current dividend of $1.08 per share, equal to a yield of 2.1%, growing at the same rate as TBV per share; and, finally, a low single-digit annualized tailwind from an expanding P/TBV multiple. Buy.

Be the first to comment