Andrii Dodonov

Co-produced by Austin Rogers for High Yield Investor

The World Is Starved For Energy

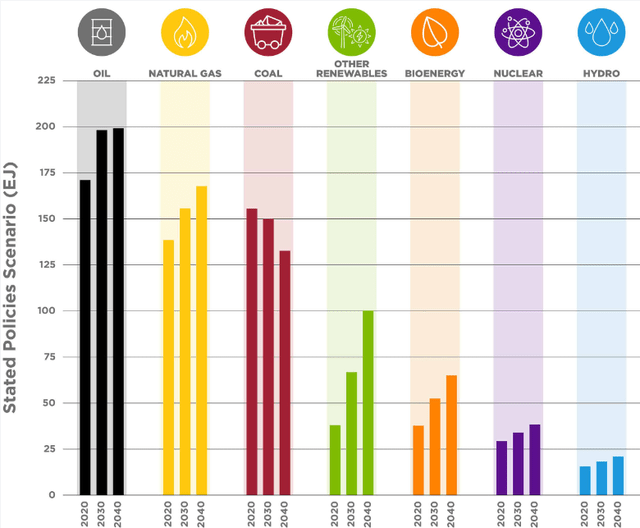

The International Energy Administration projects that global energy demand will grow 47% in the next 30 years.

Unless there is a massive technological breakthrough, this virtually assures that all sources of energy production except coal will see growth during that time.

Though renewables like wind and solar are expected to see the fastest growth in usage, oil and natural gas will remain much larger sources of energy for the world.

Due in no small part to sanctions on Russian oil and gas, this year has demonstrated to Western nations the importance of energy for the functioning of the world economy. When energy prices are low, it is easy to let our reliance on energy fade to the background. But this year, the need for energy is very much in the foreground.

Even coal, the dirtiest burning fuel that almost everyone agrees should be phased out of use for electricity production, is making a comeback this year. According to the IEA, coal demand has returned to its record high level this year as European supplies of Russian gas have been largely cut off.

When it comes to end users of energy, it’s easy for our minds to jump to two sources: the utility sector and transportation.

While the transportation sector’s reliance on oil for fuel will likely continue for a long time to come, the utility sector is in the midst of a rapid transition toward renewable energy and battery storage.

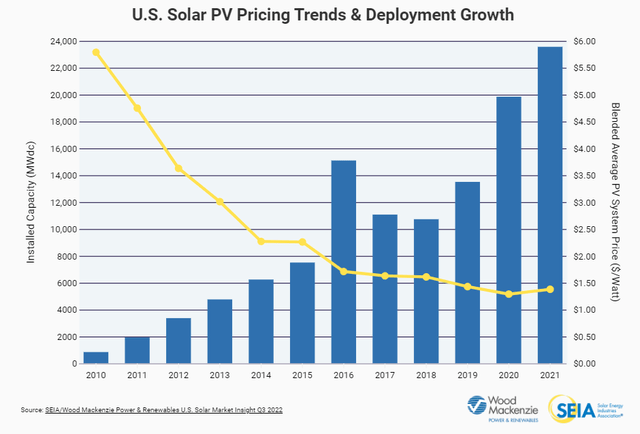

This has been driven largely by a dramatic drop in the cost of producing solar panels and generating electricity from them over the last decade.

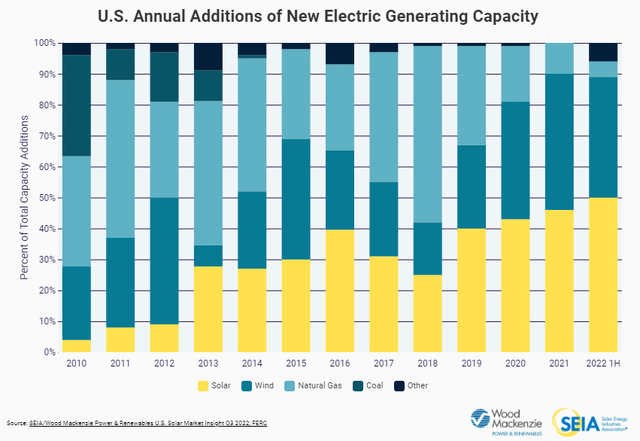

Solar Energy Industries Administration

Indeed, in 2021 and the first half of 2022, around 90% of all new electricity generation capacity added to the grid came from wind and solar.

There has not been any new coal generating capacity added in the U.S. since 2014. Since then, though, the vast majority of new additions to the grid have been from renewables and natural gas, and now gas’s share of new additions is shrinking as well.

There are some fair criticisms of renewables as an unreliable energy source that is not readily dispatchable at will like fossil fuels. That’s what makes natural gas so valuable as a reliable and dispatchable fuel source to complement renewables.

But it would be foolish to ignore the massive growth trend in renewable energy production from the decarbonization of the utility sector.

On the other hand, consumers are not switching over to electric vehicles nearly as fast as the utility sector is switching to renewables. Internal combustion engine vehicles, air travel, petrochemicals, and other sources of demand ensure that oil will continue to be used in growing amounts for decades.

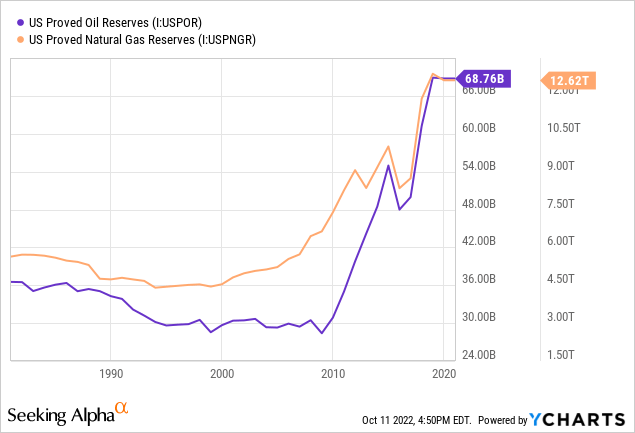

That is great news for the United States, which is sitting on one of the world’s largest deposits of oil and natural gas.

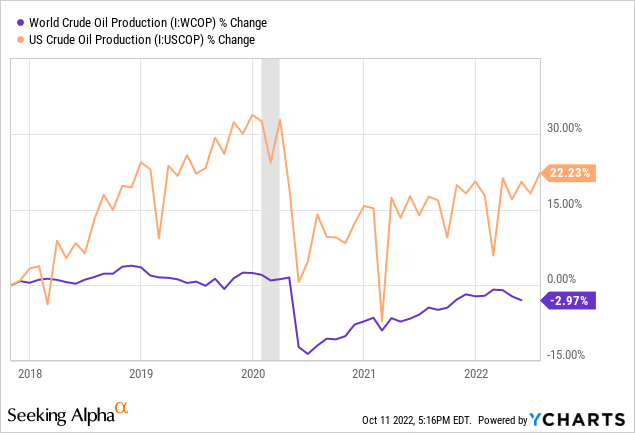

Moreover, while the rest of the world has not grown its oil production at all in the last five years, U.S. producers are picking up the slack.

Of course, even U.S. production is still below its pre-pandemic level. But it’s useful to note that the U.S. is growing its levels of production faster than the rest of the world.

Like it or not, the world is almost certainly going to have an “all of the above” policy on energy for the foreseeable future. As such, regardless of one’s personal preference as far as the energy landscape goes, it appears likely that returns will be strong for all kinds of energy companies going forward.

The world is simply starved for energy, and, as the old saying goes, “beggars can’t be choosers.” If the choice is between having one’s preferred energy sources and keeping the lights on or the car running, we think most of the world will choose the latter.

With that said, let’s take a look at two energy stocks that look likely to keep generating high-yielding dividends for a lifetime.

1. Clearway Energy, Inc. (CWEN, CWEN.A)

CWEN is a renewable energy yieldco. The business model is similar to that of a REIT, in that the company issues a combination of equity and debt to acquire stabilized renewable energy projects and distribute a large share of their available cash flow to shareholders as a dividend.

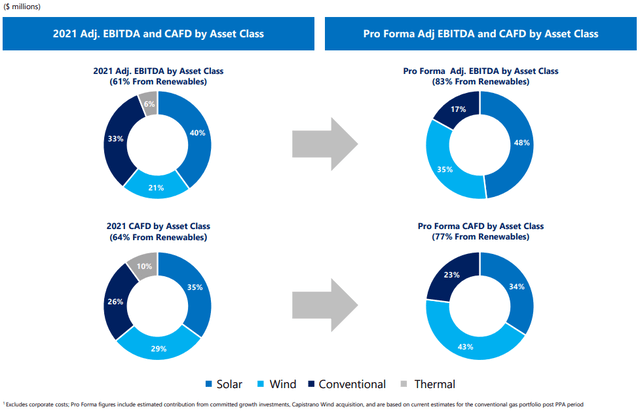

Recently, in a major transaction, CWEN sold its thermal energy generation plants to a private equity firm. Since then, the company has reinvested a little over half of the proceeds into its bread-and-butter renewable energy assets. Once all the proceeds are reinvested, CWEN expects its EBITDA and cash available for distribution (“CAFD”) profiles to look like what you see on the right side below:

Though CWEN will still retain some legacy gas-fired plants in California, most of its portfolio will be in wind, solar, and battery storage assets.

The company already has $300m of capital committed for dropdown investments over the next year from its sponsor, which is the renewable energy development company, Clearway Energy Group.

Moreover, CWEN’s pipeline of future investment opportunities expanded even further with the recent announcement that TotalEnergies (TTE), the French energy supermajor, purchased half of Clearway Energy Group. This should significantly increase the number of stabilized projects available for CWEN to acquire into its portfolio.

Another $330m of proceeds from the sale of CWEN’s thermal generation assets remains available to deploy into new investments, and perhaps some of the proceeds will find their way into assets currently owned by TTE.

Management expects to achieve the upper end of CWEN’s annual dividend growth target of 5-8% over the next four years, largely because CWEN’s huge war chest of cash lessens the need to raise new capital for investments.

What about the balance sheet?

Well, CWEN had zero drawn on its credit revolver as of the end of Q2 2022.

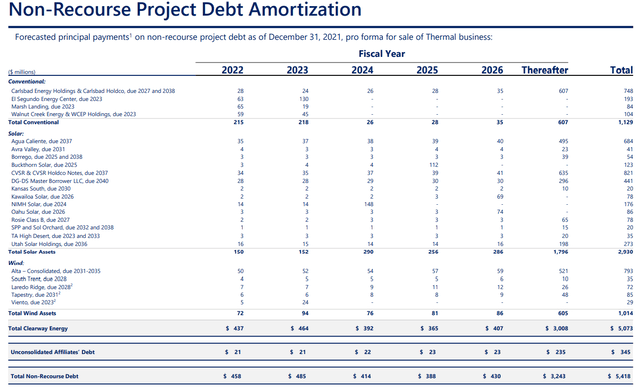

Moreover, 99% of its long-term debt is fixed-rate, and the yieldco has no corporate-level maturities until 2028.

Most of the company’s debt is project-level non-recourse (secured) debt, though. While there are some maturities coming up in 2023, the good news is that these are self-amortizing loans, meaning that much if not all of the debt principal is repaid over the term of the loan, leaving little to repay at maturity.

Though CWEN has been caught up in the market’s selloff of debt-reliant companies recently, it’s important to note that it is far more resilient than the market is giving it credit for.

Between a 4.5% dividend yield and 7-8% annual growth, CWEN’s total returns should easily reach into the low double-digits going forward.

2. Kinder Morgan, Inc. (KMI)

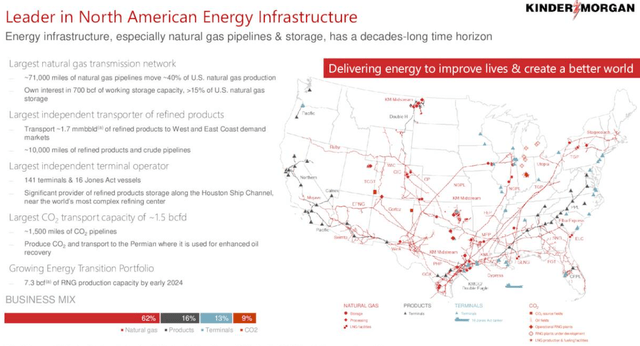

KMI owns and operates the largest network of natural gas transmission assets in the United States, transporting roughly 40% of the gas produced in the U.S.

KMI also has a network of 141 gas terminals, but these are only used for transporting gas between U.S. terminals rather than for export. Even so, much of the gas KMI transports will ultimately end up in liquefaction facilities that turn it into LNG for export to places like Europe and Asia.

KMI is one of the most conservative ways to tap into the cash generated by U.S. natural gas. Almost 95% of its cash flows are generated from stable, take-or-pay or fixed fee-based contracts that do not fluctuate with commodity prices or volumetric usage. With this strategy, KMI’s primary sources of growth are pipeline additions or other ways to transport more gas from A to B. As such, management expects dividend growth to average only around 3% annually.

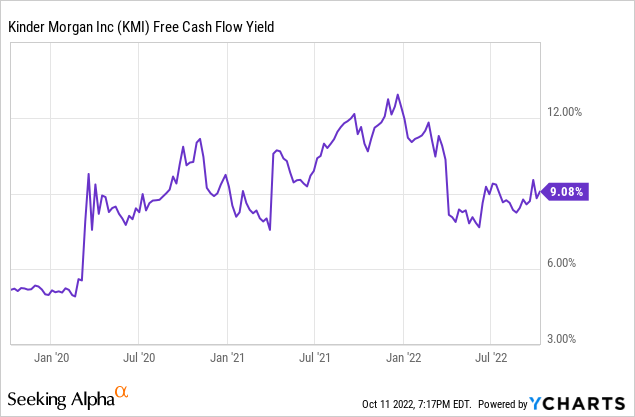

In the last three years, free cash flow has been very strong, and yet KMI’s stock price has not even returned to its pre-pandemic level. This has rendered a very attractive free cash flow (“FCF”) yield:

Though KMI does face a headwind from debt with its net debt to EBITDA of 4.3x, we expect the company to be capable of offsetting the headwind of rising interest expenses with increased revenue and EBITDA from contractual rate increases and new projects set to come online in the next few years. With a 6.5% dividend yield, not much growth is needed to achieve double-digit total returns.

Bottom Line

The global economy needs energy, and most economic actors around the world will generally opt for the cheapest option, if given the choice. Given the projections for increasing energy demand over the next few decades, that likely means continued growth in usage of oil, natural gas, and renewables.

While renewables are rapidly taking market share in the utility sector, oil & gas will continue to be heavily utilized in transportation, petrochemicals, and (in the case of gas) as a stable source of baseload and/or dispatchable power to complement renewables.

With most of the world cutting themselves off of Russian oil & gas, it has never looked safer to invest in the U.S. natural gas space.

Similarly, with the recent passage of the “Inflation Reduction Act,” expanded tax credits for renewables makes it likely that the utility sector and big corporations will push even harder into wind, solar, and battery storage for their energy needs going forward.

These factors make CWEN and KMI look like great ways to generate a growing stream of passive income for a lifetime. While these are not our top picks for either industry, at High Yield Investor, we view them both as solid buys today.

Be the first to comment