Ridofranz

Real Estate Weekly Outlook

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on October 14th.

U.S. equity markets dipped to two-year lows on another volatile week as a disappointing slate of inflation data suggested that the potential window for an economic “soft landing” may be narrowing. There wasn’t much to brighten the mood this week as the closely-watched consumer and producer inflation reports failed to show the cooldown that investors had hoped. Beneath the headline metrics, however, there were more indications that real-time price pressures have cooled considerably and with equity and bond markets already on-pace for the worst year of collective performance in a century and with investor sentiment near historical lows, there’s hope that earnings season and midterm elections may be catalysts to finally form the market-bottom.

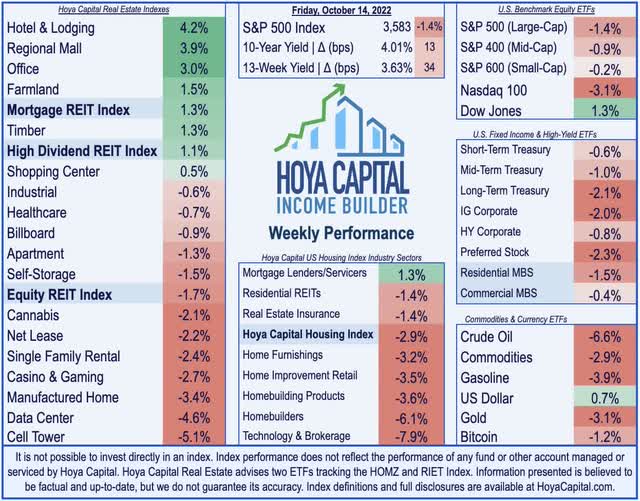

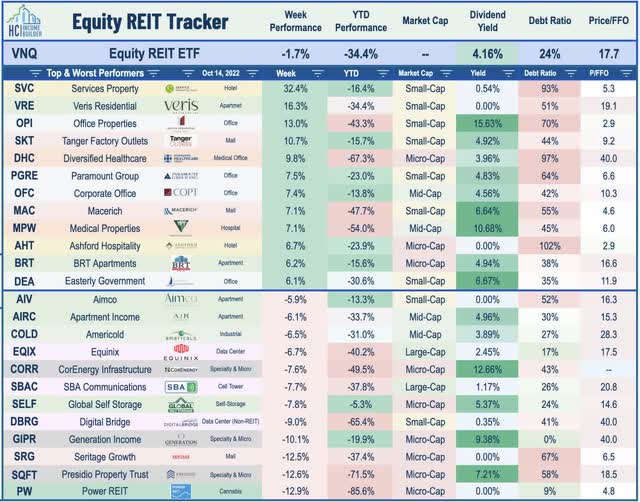

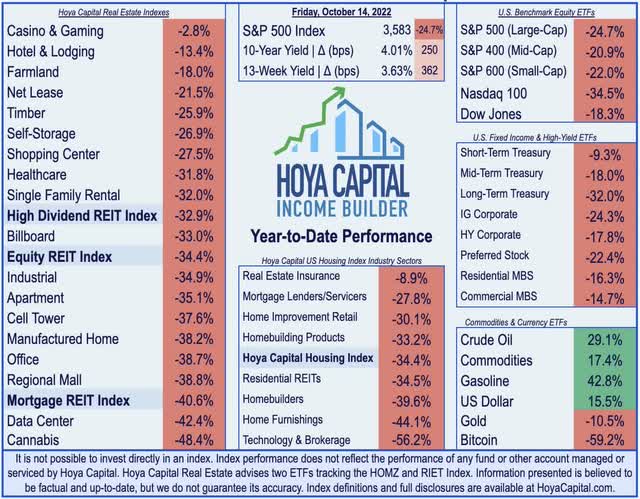

Declining in seven of the past nine weeks and finishing at the lowest level in two years, the S&P 500 declined 1.4% on the week while the tech-heavy Nasdaq 100 dipped 3.1% to extend its drawdown to over 35%. The downward pressure on real estate equities continued this week as long-term interest rates – including the benchmark U.S. 10 Year Treasury Yield – climbed to the highest levels since before the Great Financial Crisis. The Equity REIT Index dipped another 1.7% on the week as another week of selling pressure across the heavily-weighted technology REIT sectors offset strength from more economically-sensitive property sectors. The beaten-down Mortgage REIT Index rebounded 1.3%, however, following a handful of preliminary third-quarter earnings results.

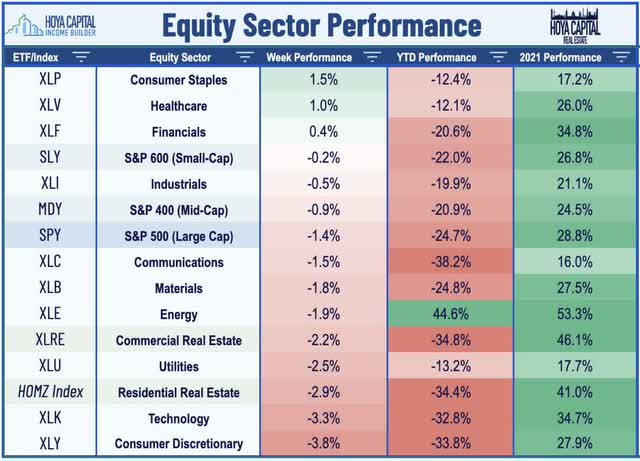

With many major international markets certainly facing even more significant challenges than the United States – the U.K., China, and Eurozone in particular – the U.S. Dollar remained near two-decade highs while Crude Oil dipped nearly 7% – erasing half of its post-OPEC-cut surge – on concerns over the demand outlook as the International Monetary Fund again downgraded its forecast for the global economy and warned of the possibility for a deep global recession, commenting that “the worst is yet to come.” Citing the Russia-Ukraine war, high inflation, and slowing growth in China, the IMF downgraded global growth by another 0.2 percentage points since July while it expects the U.S. to grow by just 1.6% this year and 1% in 2023. Eight of the eleven GICS equity sectors finished lower on the week with Utilities (XLU), Technology (XLK), and Consumer Discretionary (XLY) stocks dragging on the downside.

Real Estate Economic Data

Below, we recap the most important macroeconomic data points over this past week affecting the residential and commercial real estate marketplace.

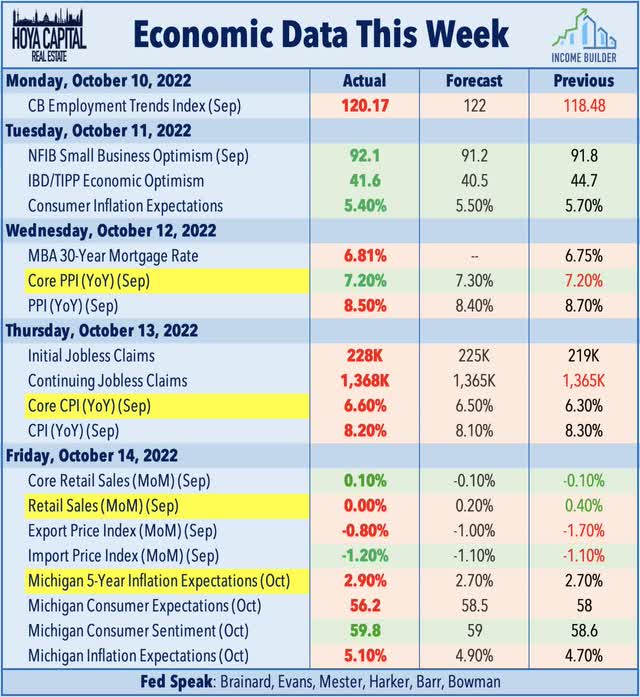

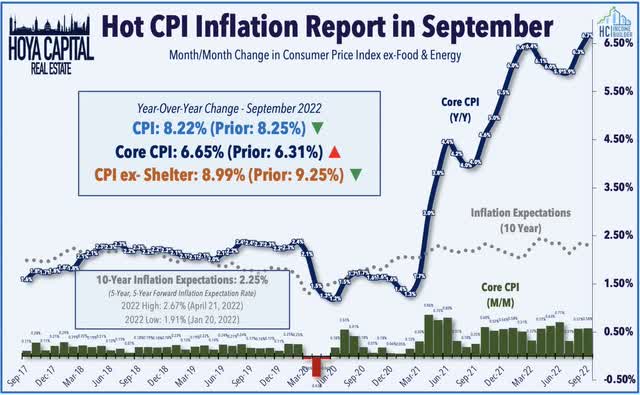

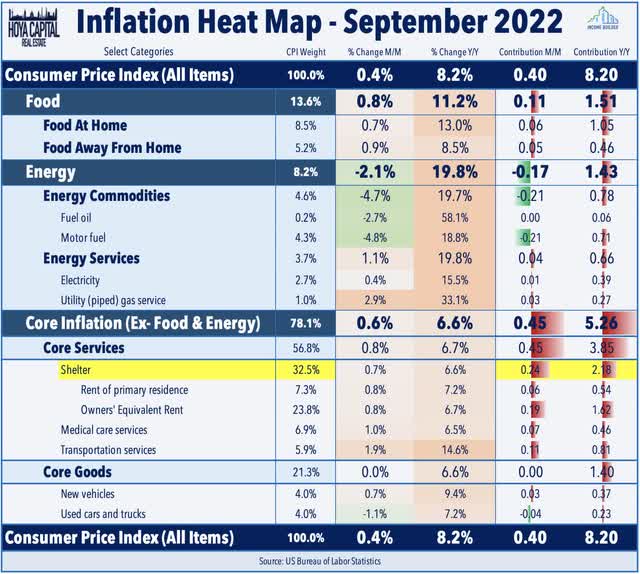

‘Bad news’ on the inflation front was the theme of the week, highlighted by the most closely-watched measure of US consumer prices – Core CPI – rising by more than expected to a 40-year high in September, lifting treasury yields back towards their highest levels since the Great Financial Crisis. The Core Consumer Price Index, which excludes food and energy, increased 6.6% from a year ago, the highest level since 1982. From a month earlier, the core CPI climbed 0.6% for a second month – also hotter than anticipated. Despite the decline in gasoline prices last month, the overall headline CPI increased 0.4% last month and was up 8.2% from a year earlier – just fractionally below the annual rate in August. The hot CPI print followed similarly disappointing PPI data earlier in the week, which together has likely solidified the additional 75-basis point interest rate hike at the Fed’s November meeting.

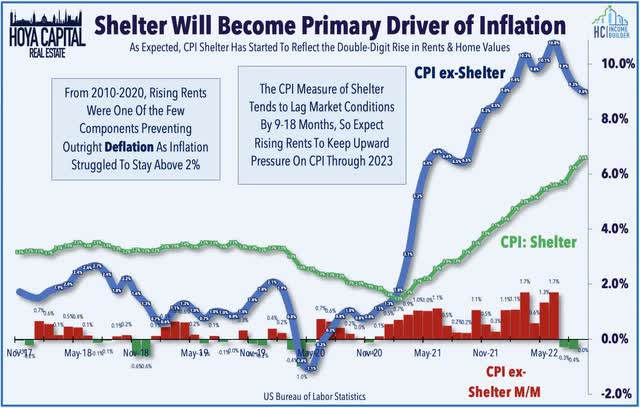

What goes around comes around. As we’ve cautioned for the last year, the CPI Index was substantially understating the real-time increase in the single-largest component of the index – Shelter – since mid-2021 due to the sampling methodology which only collects “same-unit” data twice per year. The Bureau of Labor Statistics published a report this week which confirmed the significant lag in shelter inflation reporting in the CPI metrics – an issue that we’ve highlighted for several years. The BLS confirmed that rent inflation for new tenants leads the official BLS rent inflation by 4 quarters and noted, “As rent is the largest component of the CPI, this has implications for our understanding of inflation dynamics and guiding monetary policy.” The delayed effects of this Shelter inflation are beginning to show up – and it’s hitting quite hard.

The shelter index rose 6.6% over the last year – the highest annual increase since 1982 – accounting for over half of the total increase in all items less food and energy. But while the month-over-month headline CPI increased by 0.4% in September, the CPI-ex-Shelter Index – which we believe should be the metric that officials most closely watch given the distortion – posted a third straight monthly decline – suggesting that “real-time” inflation is indeed decelerating even as headline metrics suggest otherwise. Using this metric, Fed officials would have seen the sharp upward spike in inflationary pressure beginning in early 2021 alongside the dramatic fiscal expansion under the new Administration and Congress with this metric posting double-digit annualized inflation beginning in March 2021 – a full year before we saw these trends show up in the headline CPI metric. Market-based indexes of rents and home values recorded 10-20% year-over-year rental rate increases beginning in June 2021, but these double-digit increases have since moderated to levels that are more in-line with post-GFC averages.

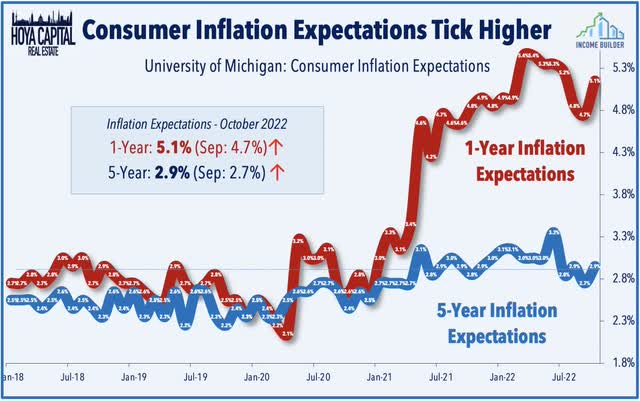

The week of disappointingly-hot inflation data concluded on Friday with the University of Michigan’s Consumer Sentiment survey showing that inflation expectations accelerated in early October – reversing an encouraging trend of easing over the prior five months. The survey showed that one-year inflation expectations accelerated to 5.1% from 4.7% last month while the five-year inflation expectations metric drifted higher to 2.9% – but still below the 3.3% peak in June. Also on Friday week, the Census Bureau reported that retail sales activity was flat in September – and slightly below estimates – as consumers pulled back spending on “big ticket” items amid the Fed-driven surge in financing costs and broader concerns over slowing economic growth.

Equity REIT Week In Review

Best & Worst Performance This Week Across the REIT Sector

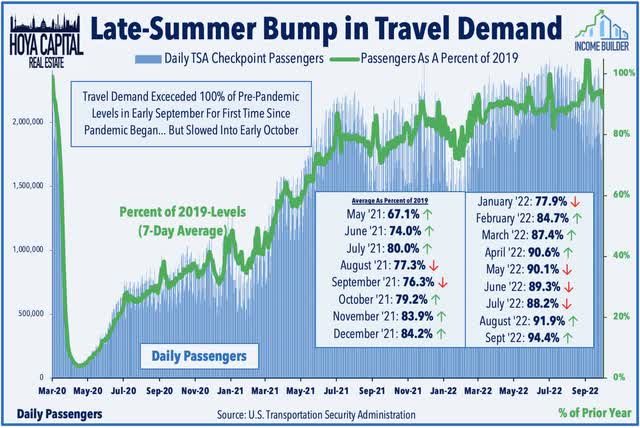

Hotel: Beginning with the upside standouts this week – externally-managed REIT Service Properties Trust (SVC) surged more than 30% after it resumed its previously-suspended quarterly dividend at $0.20/share, representing a dividend yield of 14.47%. SVC announced last week that it had amended its credit facility to remove the restrictions on paying common dividends. The dividend represents a 37% payout ratio based on Q2 2022 normalized funds from operations. Braemar Hotels (BHR) advanced 4% on the week after it reported strong preliminary Q3 metrics which were highlighted by Revenue Per Available Room (“RevPAR”) levels that were 19% above comparable pre-pandemic levels in Q3 2019. BHR noted continued momentum into September with RevPAR levels that were 16% above September 2019. Ashford Hospitality (AHT) rallied nearly 7% after it reported that its RevPAR was 4% below 2019-levels in Q3, but returned to pre-pandemic levels in September with comparable RevPAR that was 0.4% above September 2019. In our report last week – Hotel REITs: Winter Is Coming – we noted that recent TSA Checkpoint data has indicated that domestic travel throughput briefly exceeded 100% of pre-pandemic levels in late August.

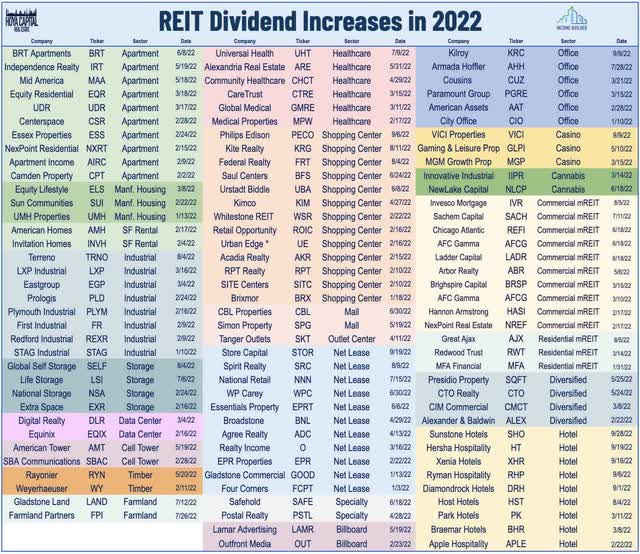

Malls & Net Lease: On the topic of dividend hikes, Tanger Factory Outlet (SKT) rallied more than 10% after it hiked its quarterly dividend by 20% to $0.22/share, representing a forward yield of roughly 5.95%. For Tanger, it’s the second dividend hike this year, but its payout remains well below the pre-pandemic quarterly rate of $0.36 paid in 2019. Elsewhere, net lease REIT Agree Realty (ADC) slumped 2% despite also hiking its dividend for the second time this year. Mall REIT Simon Property (SPG) advanced 3.5% on the week after it announced a strategic partnership with Jamestown, a global real estate investment and management firm whereby Simon will acquire a 50% interest in Jamestown from its founders – which will continue to operate independently. Simon – which has looked outside the traditional mall sector for its investments over the past several years – commented that the partnership “creates a platform for future growth in the investment management sector.”

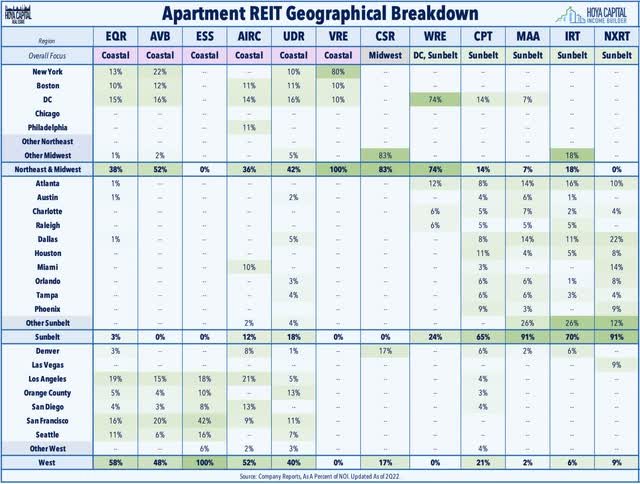

Apartment: Veris Residential (VRE) – formerly known as Mack Cali – surged more than 16% on the week after it announced an agreement to sell Harborside 1, 2, and 3 in Jersey City for an aggregate price of $420M as it nears the completion of its transition from an office REIT into a pure-play multifamily REIT. VRE also announced the closing of its sale of 101 Hudson Street for $346M. Following the close of Harborside 1/2/3 and the stabilization of Haus25, multifamily will represent approximately 98% of Veris’ Net Operating Income, up from 39% as of the end of the first quarter of 2021. Since early 2021, Veris has closed on roughly $1.4B in office sales while adding approximately 1,900 units to its residential portfolio, which is now comprised of roughly 7,700 units – primarily in the NYC metro area.

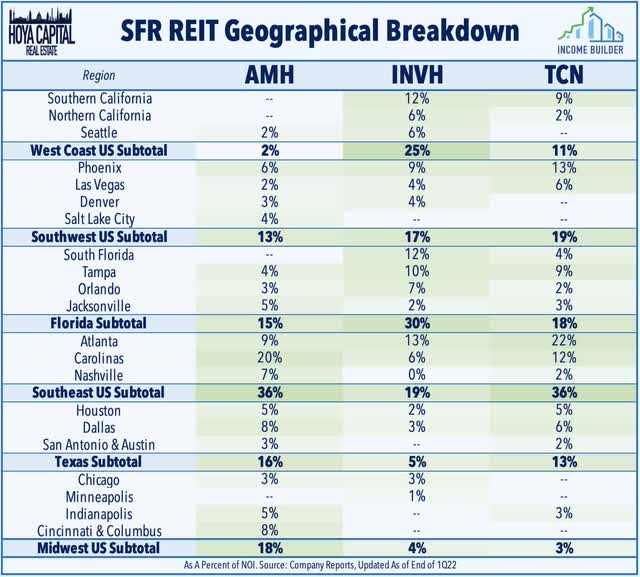

Single-Family Rental: While one REIT is going all-in on the multifamily sector, another REIT is now all-out. Tricon Residential (TCN) advanced 2% on the week after it announced an agreement to sell its 20% equity interest in a portfolio of 23 Sunbelt apartment buildings for $315 million, which the company noted represents “a significant step in our quest to simplify our business and focus our balance sheet exposure primarily on single-family rental, where we continue to see strong demand and growth opportunities.” The interest is being acquired by a “vertically integrated residential real estate investment and property management company” which will assume all asset and property management responsibilities after a customary transition period. The transaction remains subject to customary closing conditions and is expected to close on or around October 18. Last October, Tricon Residential completed its dual-listing in the U.S. in a $570M IPO after trading exclusively on the Toronto Stock Exchange since 2010.

Shopping Center: Supermarket chain Kroger (KR) – the second-largest grocery chain – announced an agreement to merge with Albertsons (ACI) – the fourth-largest grocery chain in a $24.6 billion all-cash merger agreement. Following the deal announcement – which some analysts doubt will survive scrutiny from antitrust regulators – Kimco Realty (KIM) advanced about 2% on the week after it announced that it raised $300 million in a partial sale of its stake in Albertsons, selling 11.5 million of its 39.8 million shares in Albertsons, generating net proceeds of $301.1 million. Kimco still retains 28.3 million shares of Albertsons and agreed not to sell its shares in Albertsons for a period of up to seven months. After the lock-up expires, Kimco will have “full flexibility” over its Albertsons holdings, including the ability to further sell down its stake. Kimco now expects to pay a special dividend from its Albertsons investment. Unlike their mall REIT peers, Shopping Center REITs have enjoyed fundamentals that are as strong – or possibly even stronger – than before the pandemic.

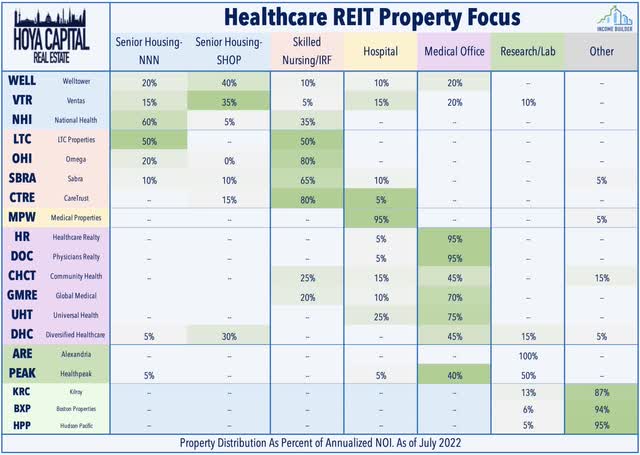

Healthcare: Hospital owner Medical Properties Trust (MPW) – which has dipped more than 50% this year and recently come into the crosshairs of short-selling firms – rallied 7% this week after its board authorized the repurchase of up to $500M of stock before October 2023. MPW also announced that it plans to sell its portfolio of 11 hospital properties in Australia operated by Healthscope, which it acquired in 2019 for $840M. MPW dipped sharply last week after one of its smaller tenants, Pipeline Health, filed for Chapter 11 bankruptcy protection on Monday while also announcing plans to sell three Connecticut hospitals to Prospect Medical Holdings for $457M.

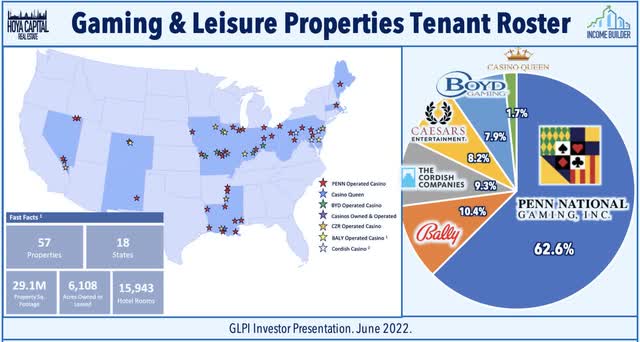

Casino: Gaming and Leisure Properties (GLPI) traded slightly lower this week after it announced that it agreed to create a new master lease with PENN Entertainment (PENN) for seven of PENN’s current properties to facilitate funding to support PENN’s pursuit of relocation and development opportunities at several of the properties included in the new master lease. The new master lease will add Penn’s properties in Aurora and Joliet, Illinois; Columbus and Toledo, Ohio; and Henderson, Nevada. In addition, the existing leases for the Hollywood Casino at The Meadows in Pennsylvania and Hollywood Casino Perryville in Maryland will terminate and these properties will be transferred into the new master lease. GLPI has agreed to fund up to $225M for the relocation of PENN’s riverboat casino in Aurora at a 7.75% cap rate and to fund up to $350M for the relocation of the Hollywood Casino Joliet as well as the construction of hotels at Hollywood Casino Columbus and a second hotel tower at M Resort Spa Casino at then-current market rates.

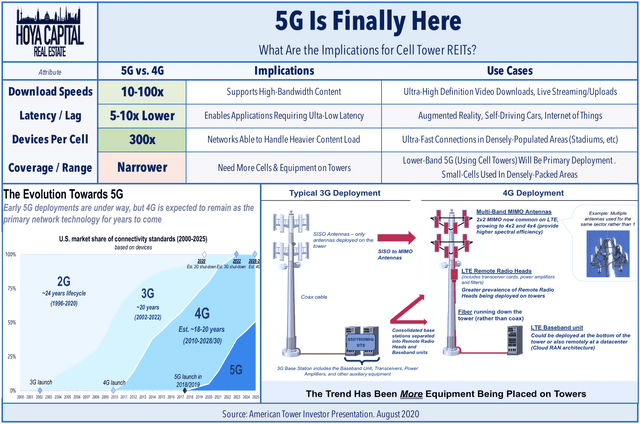

Cell Tower: The slump continued for the largest real estate sector by market capitalization – cell tower REITs – which have been slammed harder than any property sector over the past three months, weighed down by tech-related weakness and disruptive threats to the long-term competitive positioning. As analyzed in Cell Tower REITs: 5G’s Killer App, concerns over emerging – and potentially competing – satellite technologies came to a head when Apple announced that its new iPhone lineup would be capable of sending text messages over satellite networks. Awed by impressive rocket launches, the market has overlooked more meaningful industry dynamics – the accelerated rollout of fixed wireless access (“FWA”) – which have further solidified the competitive positioning of land-based wireless networks – a market that is effectively “cornered” by the three cell tower REITs.

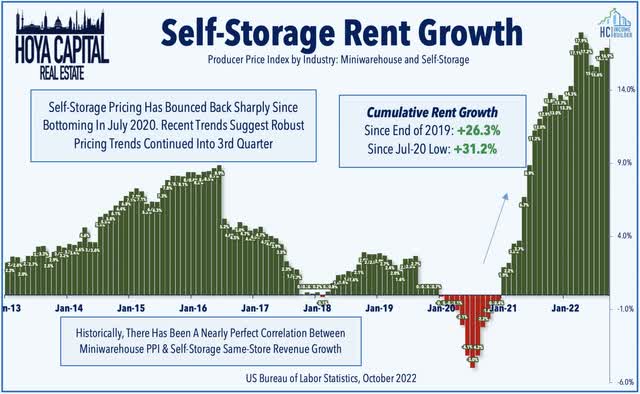

Storage: Also of note amid a busy week of inflation data, the Producer Price Index for self-storage facilities – which has historically exhibited a near-perfect correlation with rent growth – showed another brisk month-over-month gain of 1.5% in September, pushing the year-over-year advance to 16.9% – just below the record-high rate of 17.9% set in April. Earlier this week we published Self-Storage REITs: Locked-In and Sticky which discussed how storage REITs have defied expectations to the upside as comprehensively as any real estate sector since the start of the pandemic, delivering earnings growth of over 50% since 2019. While the rate-driven slowdown in housing market activity is expected to temper incremental storage demand, recent data and interim REIT updates have indicated “sticky” demand trends continued deep into the third quarter. Given the deeply discounted valuations, we like the risk/reward at these levels, given the strong balance sheets, low cap-ex needs, and operational track record.

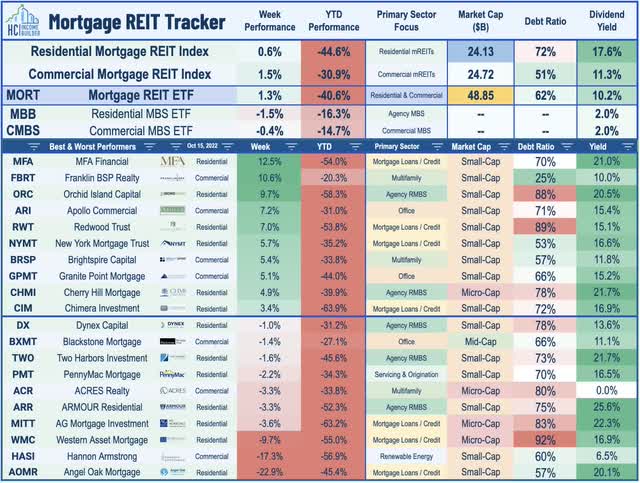

Mortgage REIT Week In Review

The wild day-to-day performance swings for Mortgage REITs calmed a bit this week after several of the largest residential mREITs provided preliminary Q3 results which showed that conditions aren’t quite as dire as some feared amid the worst year of returns for credit markets in history and as interest rate volatility remains near the highest levels since March 2020. Redwood Trust (RWT) gained 7% on the week after it reported that its estimated Book Value Per Share (“BVPS”) was $10.20 as of the end of Q3 – down just 5% during the quarter. Orchid Island Capital (ORC) rallied nearly 10% after it reported that its estimated BVPS was $11.42 at the end of Q3 – down 21% from the $14.35 last quarter – but less steep than the nearly 40% decline during that period. Annaly Capital (NLY) advanced 2% after reporting that its BVPS was estimated at $19.85-$20.05 – lower by roughly 15% in Q3 – but also “less bad” than the 40% decline in its stock price during that period.

Elsewhere, AGNC Investment (AGNC) was roughly flat on the week after holding its dividend steady and reporting that its BVPS stood at $9.06-$9.10 on September 30 – lower by roughly 20% in Q3 compared to a 40% decline in its stock price. Dynex Capital (DX) ended the week lower by about 1% after also holding its dividend steady while estimating its BVPS at $14.15-$14.45 at the end of Q3, down roughly 15% during the quarter. Two Harbors Investment (TWO) slumped 2% after it pegged its BVPS at $4.11 at the end of Q3 – down 19% from the $5.10 at the end of Q2. Finally, ARMOUR Residential REIT (ARR) slipped about 3% on the week after reporting that its book value per share was $5.81 at the end of Q3 – down about 19.8% in Q3. Residential mREIT earnings season formally kicks off on October 24th.

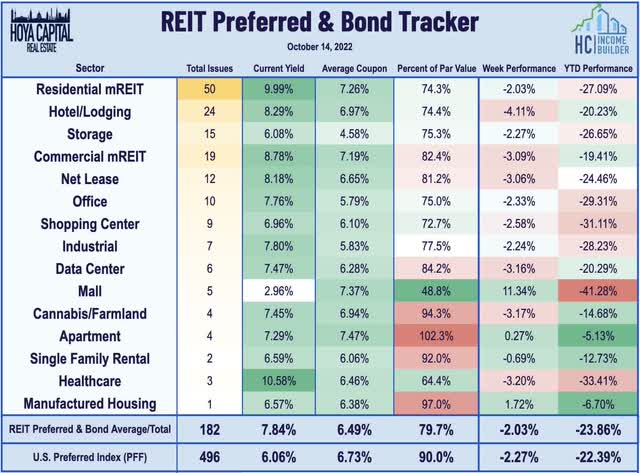

REIT Capital Raising & REIT Preferreds

The REIT Preferred Index (PFFR) dipped 2.0% this week – slightly outperforming the broader iShares Preferred and Income Securities ETF (PFF) which ended the week off by 2.2%. While not as drastic as in recent weeks, we again observed significant dispersion between otherwise similar securities – symptomatic of disruptions caused by the clashing of large passive and/or programmatic fund flows with relatively illiquid individual securities. Some examples this week included the roughly 5% performance spreads within the Annaly, AGNC Investment, and Chimera (CIM) preferreds. Other notably moves included the 8-10% declines across the preferred series from hotel REITs Ashford (AHT) and Hersha (HT), a 20% average gain from the PREIT (PEI) preferreds, and 6% declines from the DigitalBridge (DBRG) preferreds.

2022 Performance Check-Up

Now two weeks into the fourth quarter, Equity REITs are now lower by 34.4% on a price return basis for the year – the worst YTD performance for the REIT Index on record through this date – while Mortgage REITs are lower by 40.6%. This compares with the 24.7% decline on the S&P 500 and the 20.9% decline on the S&P Mid-Cap 400. Within the real estate sector, all eighteen property sectors are now in negative territory for the year including eleven that are lower by more than 30%. At 4.01%, the 10-Year Treasury Yield has surged 250 basis points since the start of the year – the highest weekly closing level since May 2010 – and well above its prior ten-year highs of 3.25% seen back in late 2018. As a result, the US bond market is on pace for its worst year in history with a loss of 15.8% on the Bloomberg US Aggregate Bond Index, which is 5x larger than the previous worst year back in 1994 (-2.9%).

Economic Calendar In The Week Ahead

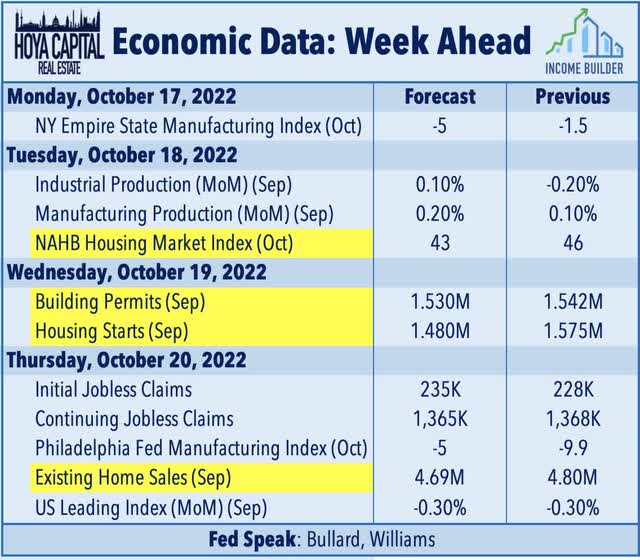

As corporate earnings season kicks into gear, we’ll also see another busy slate of economic data in the week ahead with the U.S. housing market in focus – the industry that is bearing the brunt of the aggressive tightening path through the historic surge in mortgage rates. On Tuesday, we’ll see NAHB Homebuilder Sentiment data for September which is expected to decline to the lowest level since 2014 – excluding the brief pandemic dip in April and May 2020. On Wednesday, we’ll see Housing Starts and Building Permits data which is expected to show a further pull-back in home construction activity to levels below that of late 2019 before the pandemic boom. On Thursday, Existing Home Sales data is also expected to dip to the lowest levels since 2014 excluding the pandemic shutdown months. We’ll also be watching Jobless Claims data on Thursday, which has exhibited notable weakening since late September across both initial and continuing unemployment claims.

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Be the first to comment