izzetugutmen

Thesis

Cohen & Steers REIT & Preferred Income Fund (NYSE:RNP) is a hybrid closed end fund that focuses on REIT equities and financial services institutions preferred shares. The fund is a premier offering from a well known platform in the space, namely Cohen & Steers, and has been in the market since 2003. The vehicle has robust annualized total returns, which on a long term basis exceed 8%. The fund is nonetheless volatile given its composition, with a 17 standard deviation and a drawdown profile that exhibits -15% pullbacks every two years.

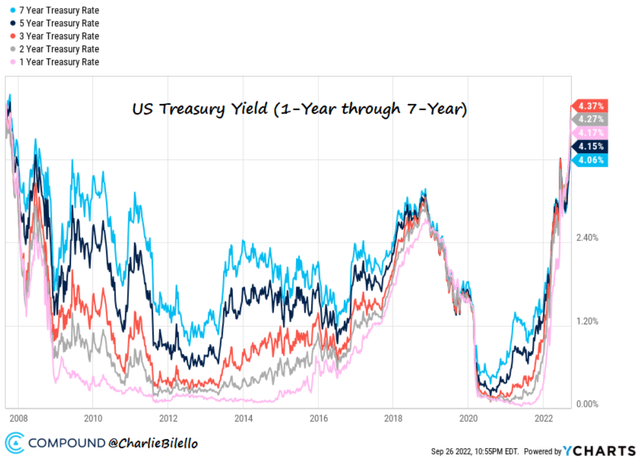

The fund’s performance in 2022 is unprecedented, RNP being down almost -30% on a total return basis. The driven for this performance is not constituted by a toxic asset base but by rising risk free rates and credit spreads. With a parabolic upward move this year, yields have smashed returns for any asset class with a whiff of duration:

Unless there is a banking and insurance crisis which would result in true impairments on the asset class (we do not think there will be one), we expect RNP’s performance to normalize next year. Generally speaking, robustly built funds like RNP tend to have shallower drawdowns when yields rise gradually. However in a vertical move up environment there is not much RNP can do.

The fund is currently trading at a discount to NAV which is well entrenched in the fund’s historic range and fluctuates in accordance with risk-on / risk-off environments. We expect this to persist.

The fund has a granular asset build and a seasoned management team that has steered the CEF through almost two decades of market gyrations. We believe the vehicle is well set up for long term success and this year’s performance could not have been avoided without significant duration hedging. While the future looks bright, we do need to see a plateauing of interest rates to be able to sound the all-clear. We like RNP and its management team but 2022 will prove to be quite a challenging year.

Analytics

AUM: $0.9 bil

Yield: 8.5%

Premium/Discount: -9%

Z-Stat: -1.91

Sharpe: 0.44

St Dev: 17

Leverage: 31%

RNP’s Holdings

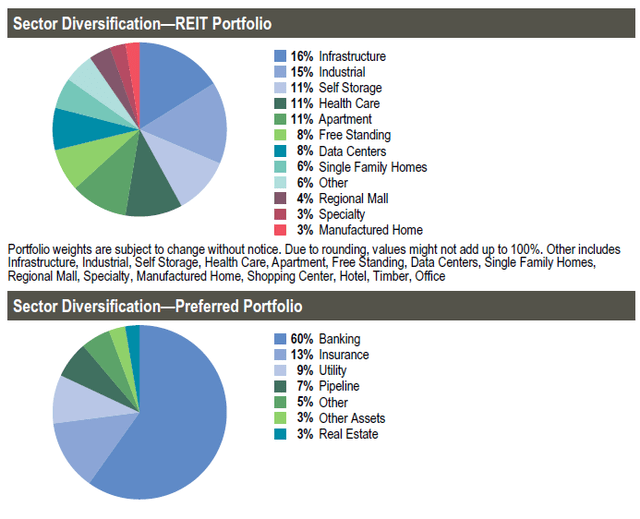

The fund holds a mix of REIT equities and preferred shares:

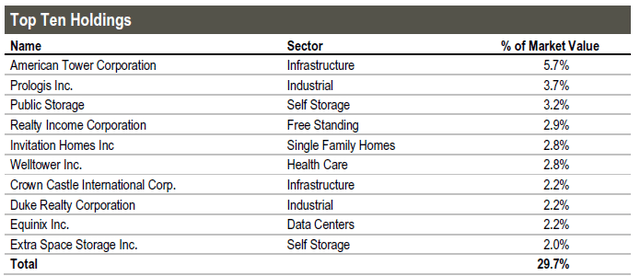

On the REIT equity side the sub-sector distribution is fairly granular, with no single-industry overweight positioning. From a top holdings perspective we find the following names representing the largest weightings in the portfolio:

Top Holdings (Fund Fact Sheet)

On a single name basis the fund is not extremely concentrated, with only American Tower Corporation exceeding a 5% portfolio threshold. The rest of the names are well contained with sub 3% allocations.

On the preferred equity side we can see that financial services names account for over 73% of the portfolio, with Banking and Insurance being the largest sub-groups.

Performance

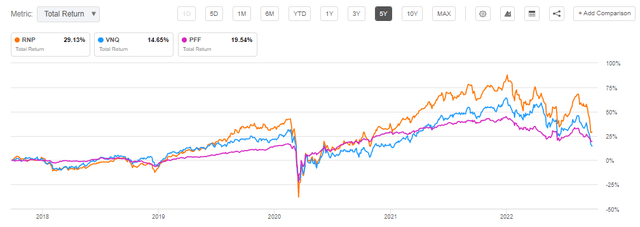

The fund is down almost -30% year to date:

YTD Total Returns (Seeking Alpha)

We can observe an interesting performance related item when comparing RNP to the unleveraged Vanguard Real Estate Index Fund ETF (VNQ) – they exhibit the same year to date total return. This is surprising, and speaks well regarding RNP’s portfolio selection, given that the CEF has embedded leverage.

On a 5-year basis the fund exhibits the characteristics of a buy and hold investment, with a nice upwards sloping total return line:

5Y Total Returns (Seeking Alpha)

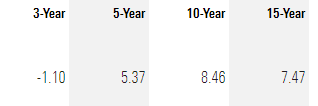

When looking at the long term annualized total returns we can see the CEF has posted solid numbers in the past:

Annualized Total Returns (Morningstar)

While the three year performance has been dragged down by this year’s bear market, the longer term numbers indicate very robust risk/reward figures. Expect long term annualized total returns of 8%+ here.

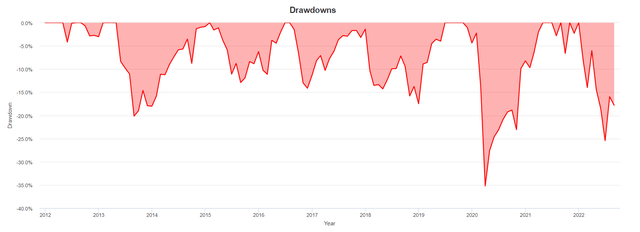

Drawdowns

The fund is fairly volatile with drawdowns that clock in on average at -15%:

Drawdowns (Portfolio Visualizer)

We can see that every two years there is a -15% drawdown, with larger ones such as the 2020 drawdown coming in at -35%. Leverage introduces volatility so it is not surprising we are seeing these sort of numbers, but the frequency of the drawdowns is a bit surprising.

Premium/Discount to NAV

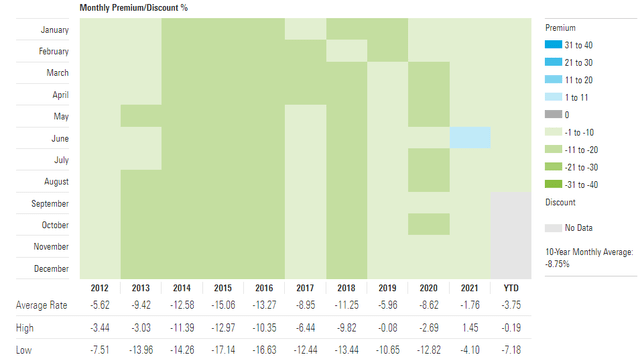

The fund usually trades at small discounts to NAV:

Premium / Discount to NAV (Morningstar)

We can see that historically the fund never traded at discounts wider than -17% and on average the discount is around -6%.

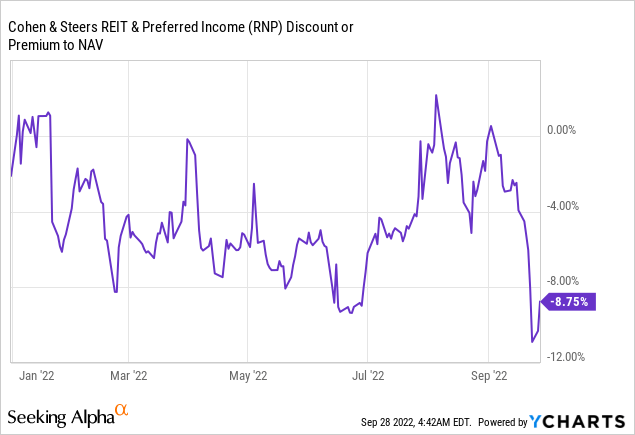

During 2022 there is a nice correlation between the discount widening and risk-off environments:

As the market sold off in June the fund moved to a discount close to -9%. On the back of the August bear market rally the discount moved to a flat to NAV level. Expect more of the same here in terms of correlations.

Conclusion

RNP is a robust CEF that invests in REIT equities and preferred securities from banks and insurance companies. The vehicle has been negatively affected by the violent rise in yields this year, being down almost -30%. Unless there is a true banking crisis with impairments, we see RNP having a much improved 2023. The fund is currently trading at a discount to NAV which has fluctuated with the risk-on / risk-off environments, but has been well established within a historic trading range. RNP is a solid long term choice from a seasoned management team, but the rest of 2022 will prove to be challenging.

Be the first to comment