onurdongel

Investment Thesis: Hyatt Hotels Corporation could see further upside on the basis of a strong recovery in revenue and earnings, along with growth across the luxury hotel sector potentially shielding the company from the effects of inflation.

In a previous article back in August 2021, I made the argument that Hyatt Hotels Corporation (NYSE:H) might have potential for upside in the longer-term as a result of a continued acceleration in luxury travel demand.

However, I also made the argument at the time that the stock could see downside in the short to medium-term as a result of revenues still remaining significantly below 2019 levels along with rising costs potentially eating into the company’s margins.

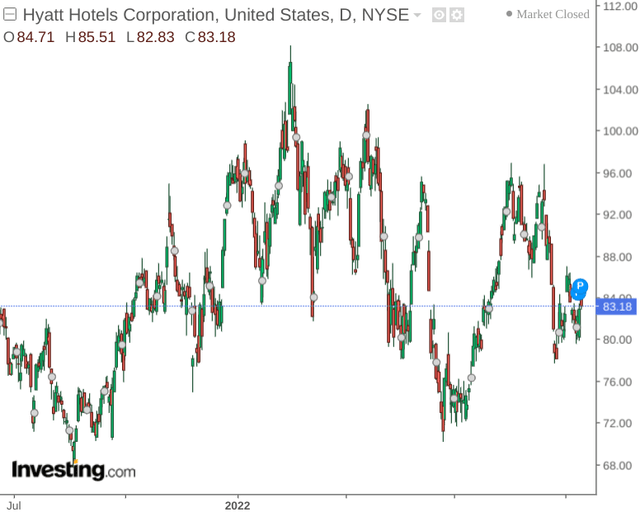

With that being said, it appears my view was overly pessimistic as the stock is up by just over 16% since my last article:

The purpose of this article is to assess why Hyatt Hotels Corporation has outperformed my expectations, and whether we could see further upside from here.

Performance

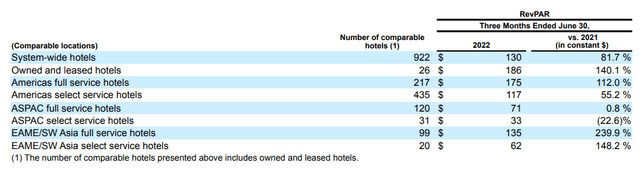

When comparing RevPAR (or revenue per available room) for June 2022 to that of the same month last year – we can see that this metric has grown by over 100% for full service hotels in the Americas, as well as both full service and select service hotels across EAME/SW Asia.

Hyatt Hotels Corporation Quarterly Report For The Year Ended June 30, 2022.

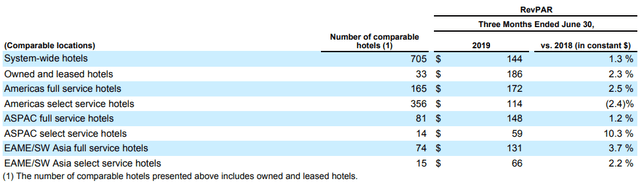

Interestingly, when comparing revenue figures to that of June 2019, we can see that current RevPAR across owned and leased hotels is back to previous levels, while that of system-wide hotels is marginally lower than that seen in 2019:

Hyatt Hotels Corporation Quarterly Report For The Year Ended June 30, 2019.

When looking at the company’s quick ratio (defined as current assets less inventories all over current liabilities), we can see that the quick ratio has risen above 1 since December 2021 – indicating that Hyatt Hotels Corporation is in a better position to service its current liabilities than previously:

| December 2021 | June 2022 | |

| Current assets | 2062 | 2892 |

| Inventories | 10 | 8 |

| Current liabilities | 2232 | 2411 |

| Quick ratio | 0.92 | 1.20 |

Source: Figures sourced from Hyatt Hotels Corporation Quarterly Report For The Year Ended June 30, 2022. Figures provided in millions of dollars, except the quick ratio. Quick ratio calculated by author.

From an earnings standpoint, Hyatt Hotels Corporation has seen a strong recovery in earnings – with diluted earnings per share having recovered from -$0.08 in June 2021 to $1.85 in the most recent quarter.

Diluted earnings per share came in at $1.19 on a six-month ended basis, which is approaching the level of $1.39 that we saw back in June 2019.

Looking Forward

When considering most recent results, it would appear that I underestimated the ability of Hyatt Hotels Corporation to grow its revenue and earnings back to 2019 levels. The past year has illustrated that the company has been capable of doing this, and the stock has seen growth accordingly.

Going forward, while Hyatt Hotels Corporation faces the risk of inflation and a broader macroeconomic slowdown – the fact that Hyatt caters significantly to the luxury end of the market means that we could see less of an impact to revenue in this regard.

In terms of upcoming earnings results, I take the view that investors will look for evidence that Hyatt Hotels Corporation can continue to bolster revenue and earnings past 2019 levels. Should the company succeed in being able to do this in an inflationary environment – then I take the view that the stock could see further upside under such a scenario.

Conclusion

To conclude, Hyatt Hotels Corporation has seen a significant rebound in revenue and earnings growth over the past year. My previous analysis underestimated the degree to which the company could see a recovery in this regard, and should we see further growth from here, then I take the view that further upside could be ahead.

Additional disclosure: This article is written on an “as is” basis and without warranty. The content represents my opinion only and in no way constitutes professional investment advice. It is the responsibility of the reader to conduct their due diligence and seek investment advice from a licensed professional before making any investment decisions. The author disclaims all liability for any actions taken based on the information contained in this article.

Be the first to comment