jetcityimage/iStock Editorial via Getty Images

Last November, storied industrial conglomerate General Electric (GE) announced plans to break itself up. GE plans to spin off its healthcare business in early 2023 as a new standalone company. Meanwhile, it will combine its power, renewable energy, and digital businesses into a new energy-focused company and spin it off in early 2024. That will leave GE as an aviation-focused company going forward.

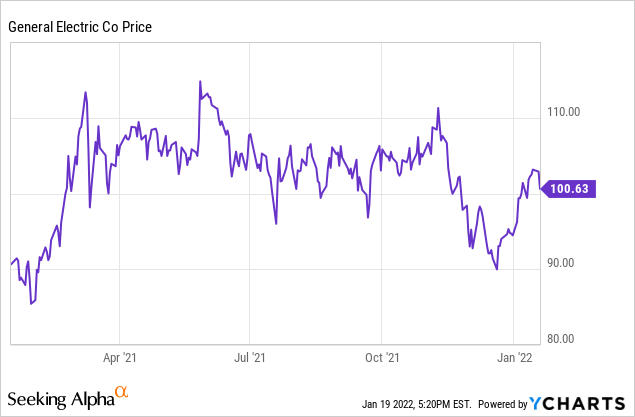

This news drove a short-term pop for GE stock, but the momentum didn’t last. By mid-December, General Electric shares were trading near their lowest levels of 2021, although they have since rebounded to just above $100.

In the long run, the breakup into aviation, healthcare, and energy pure-plays could potentially unlock value for shareholders by addressing the “conglomerate discount” issue. However, a less-noticed development could have a greater impact on GE stock.

General Electric is finally finishing up its multiyear balance sheet repair effort, addressing what has been a major drag on the stock in recent years. By putting the balance sheet bogeyman firmly in the rear-view mirror, GE stock is primed to deliver impressive (spinoff-adjusted) gains over the next several years.

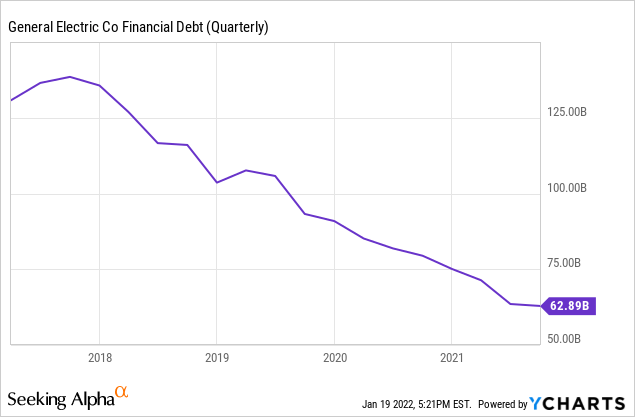

Debt load falls dramatically

At the end of 2018, shortly after Larry Culp became CEO, GE had gross borrowings of approximately $105 billion. Through a series of asset sales, punctuated by the sale of GE’s biopharma business for net cash proceeds of $20 billion, General Electric reduced that figure to $63 billion by the end of Q3 2021.

During Q4, General Electric completed what will likely be its last major divestiture, selling its GECAS aircraft leasing business to AerCap (AER). That deal brought in immediate cash proceeds of $23 billion. GE used that money along with internally-generated free cash flow and excess cash on the balance sheet to execute a $25 billion debt tender offer last quarter.

As a result, General Electric likely ended 2021 with gross borrowings in the $37-38 billion range. Furthermore, GE also received 111.5 million AerCap shares and $1 billion of senior notes as part of the GECAS sale, worth a combined $8.4 billion today. Adding in the value of GE’s remaining stake in Baker Hughes (BKR), the company has nearly $13 billion of debt and equity securities that it can monetize over the next few years to reduce debt further.

Netting out these assets against the company’s remaining borrowings, GE’s pro-forma long-term debt stands at around $25 billion. That’s a very manageable sum given that EBITDA is likely to reach at least $12 billion by 2023 (before adjusting for the healthcare spinoff).

Pension deficit shrinks, too

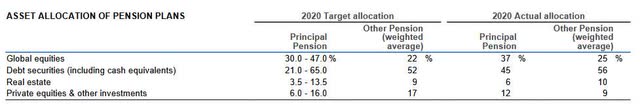

Debt hasn’t been the investment community’s only concern with respect to GE’s balance sheet in recent years. The company’s pension deficit has attracted plenty of scrutiny, too.

GE’s pension deficit peaked above $31 billion at the end of 2016. However, as I noted in late 2019, the pension deficit was not as big a burden as it might have appeared, as long-term asset returns were likely to exceed the discount rate used to calculate GE’s pension liability.

Indeed, GE’s pension assets earned double-digit returns in 2019 and 2020, including consecutive 17% gains for the main U.S. pension plan. Falling interest rates drove some of those gains, but they also led to incremental actuarial losses that further increased GE’s pension liabilities. This offset most of the benefit of strong asset returns. Even so, GE’s pension plan contributions of the past few years had reduced its pension deficit to $20.6 billion by the end of 2020.

In 2021, the pension deficit likely declined dramatically, despite minimal company contributions. First, interest rates rose, with the 10-year Treasury yield jumping from around 0.9% to 1.5% during 2021. Higher interest rates translate to a lower pension liability, as future benefit payments are discounted at a higher rate.

A nearly 1 percentage point drop in the 10-year yield during 2020 contributed to actuarial losses of $9 billion for GE’s pension plans in 2020. This suggests that the rebound in interest rates during 2021 may have led to an actuarial gain of around $5 billion, thereby reducing GE’s pension deficit.

Second, the S&P 500 delivered a 29% total return last year. While rising interest rates presumably caused the fixed-income portion of GE’s pension assets to lose value, debt securities accounted for a little less than half of the asset allocation across GE’s pension plans (on average). As a result, GE’s pension assets likely delivered another year of double-digit asset returns in 2021, potentially reducing the pension deficit by another $5 billion.

When the numbers are finalized, I expect GE to report a 2021 year-end pension deficit in the $10-12 billion range, mostly attributable to the unfunded GE Supplementary Pension Plan for higher-level executives. Rising rates could further reduce this reported pension deficit in 2022, ending this longstanding investor concern once and for all.

Valuing GE as a whole

As of late October, General Electric estimated that it would generate about $5 billion of free cash flow in 2021, adjusting for the impact of discontinuing its factoring programs. The company expects to grow this to at least $7 billion of free cash flow by 2023, mainly driven by the aviation market’s recovery and the power and renewables divisions returning to full health.

Prior to the pandemic, industrial businesses typically traded at an average free cash flow yield of around 4% (i.e., 25 times free cash flow). With its turnaround and balance sheet repair effort nearly complete, GE should merit a similar valuation.

This implies that GE stock would be worth at least $160 by the end of 2023: up nearly 60% from today. If free cash flow were to exceed $7 billion by a significant margin, the stock could rise even more.

Aviation is what I want to own

GE’s breakup plan gives shareholders even more long-term upside by allowing investors to choose which part(s) of the business to invest in. While it’s impossible to know precisely how the market is assigning value to the three future entities, I expect the aviation business to have the most upside after the spinoffs.

A GE9X jet engine in a test cell.

Image source: General Electric.

GE Healthcare is a stable, highly-profitable business. Annual segment operating income is nearing $3 billion, and the healthcare unit has plenty of room for long-term growth. As a result, GE Healthcare will likely garner a solid valuation in the $50-60 billion range, depending on how much debt it takes on. That would make the 80.1% stake being distributed to GE shareholders worth roughly $40 per present-day GE share.

The power/renewables spinoff will be less valuable. Those divisions have shaky track records for profitability, the traditional power business faces secular headwinds from the energy transition, and GE anticipates that the spinoff will generate single-digit operating margins. A valuation in the $20 per share range (roughly $20-$25 billion) seems reasonable, although some pundits have higher estimates.

This leaves an implied valuation in the $40 range (or perhaps $50 at most, if I’m overestimating the valuations of the other spinoffs) for go-forward GE. The company will consist mainly of GE Aviation, but will also include a 19.9% stake in the healthcare spinoff and various legacy assets and liabilities: most notably, GE’s run-off insurance obligations.

The global aviation market will surpass pre-pandemic levels within a couple of years. Indeed, in some regions, demand has already fully recovered from the pandemic. As I have previously discussed, the continuing recovery will lead airlines to restore their fleets to full utilization, driving a sharp rebound in engine service events, which generate the bulk of GE Aviation’s profit. Growth in the military aviation market will also contribute incremental revenue and earnings.

By 2025 or so, the new GE’s free cash flow could exceed $5 billion. At a 4% free cash flow yield, that would imply a fair value of $125 billion-plus ($114 per share). Even a more conservative 5% free cash flow yield would put its intrinsic value at a minimum of $91 per share.

Fear about the insurance business could weigh on GE shares in the period immediately after the spinoffs. However, the projected profitability of the insurance business has been improving for the past two years. So while investors may be assuming that the run-off insurance business has negative value, it probably has positive value that GE can eventually realize through a sale or gradual wind-down of the unit.

Additionally, GE is keeping a 19.9% stake in the healthcare business to provide an extra cushion against any surprises from its legacy liabilities. If no such surprises materialize, GE could eventually monetize that stake and return that cash to shareholders or use it for aviation-related acquisitions, increasing the stock’s upside potential.

In short, GE’s balance sheet improvements will support multiple expansion in the years ahead, unlocking substantial upside for shareholders. The ability to take out cash by selling out of the healthcare and energy spinoffs over the next couple of years (assuming they trade at reasonable valuations) simply magnifies the potential gains.

Be the first to comment