Michael Vi

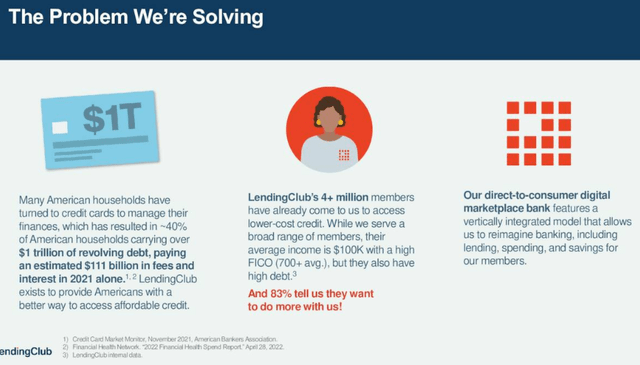

LendingClub (NYSE:LC) has the best of both worlds. It’s a fintech platform where it originates consumer loans that it sells to financial partners, generating origination and servicing fees.

But since early 2020 it is also a bank since its acquisition of Radius Bank in 2020. There are several advantages to this dual business model (bank and marketplace):

- The bank provides the company with cheap and stable sources of capital (customer deposits), rather than having to rely entirely on the funding market’s ups and downs.

- Their own underwriting loan business generates superior returns (up to 3x those of marketplace loans), given that it produces recurring revenues rather than one-time fees.

- Lending is essentially a data problem, according to management, and their marketplace offers big data advantages over every stage of the lending cycle (from marketing to underwriting, pricing, and servicing), producing an advantage versus traditional banks (in terms of customer acquisition cost, risk assessment, etc.).

- The data also tends to cement their relationship with members which tends to return, lowering the company’s acquisition cost.

- These one-time fees basically cover the operating cost which makes their own loan book very profitable (corrected for up-front reservations for credit losses) and provides huge operational leverage (much better than your average bank).

- The company can make shifts between these planks according to changing circumstances

- While creating much better economics over time, a shift towards its own portfolio decreases profits initially as the revenue stream materializes over time and also due to the upfront reservations for credit losses.

They summarized this in their earnings deck:

Growth

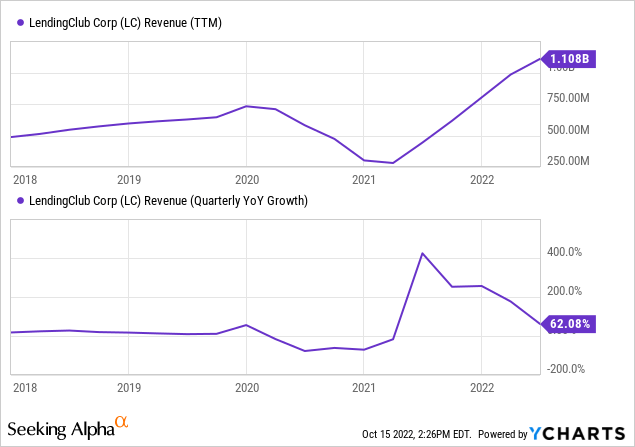

Here one immediately sees the main vulnerability of the company, the pretty spectacular decline in revenues during the first pandemic year. The subsequent growth is inflated by the closing in February 2021 of their bank acquisition, but is still very firm.

More importantly, as we explained above, the vulnerability of their previous fintech (marketplace) alone business model has been addressed with the acquisition of the online bank, fundamentally changing their business model.

It still remains to be seen how much a significant worsening in the economic environment will affect LendingClub, but we think there are reasons to be optimistic.

The dual track business model basically gives the company the best of both worlds and enables them to make a number of adjustments to changing (deteriorating) circumstances:

- Shifting towards underwriting versus marketplace

- Partnering with loan investors who are less exposed to rising rates

- Their bank net interest margin expands in a rising rate environment, and it did rise to 8.7% in Q2 from 5.5% a year ago.

- Half of their expenses are variable and growth of these (like marketing, hiring) can be slowed if necessary.

- As demand from their marketplace finance partners is affected by the rate increases and there is still a lot of credit demand (for instance from people wanting to refinance their credit cards cheaper and increase their credit score), this enables the company to be more selective in their underwriting business.

Here is management on their dual track model (Q2CC):

In a bull market, we can leverage the capitalized advantages of our pure FinTech to seize market share. And in a bear market, we can lean on the funding stability and advantages of a bank to drive resiliency and profitability. In today’s environment, we are leaning more towards the bank model, being conservative on credit and using our low-cost deposit funding to hold more loans for investment and drive recurring revenue. As the economy improves, we’ll be ready to lean into our FinTech advantage, dialing up the marketplace to drive scale capture market share.

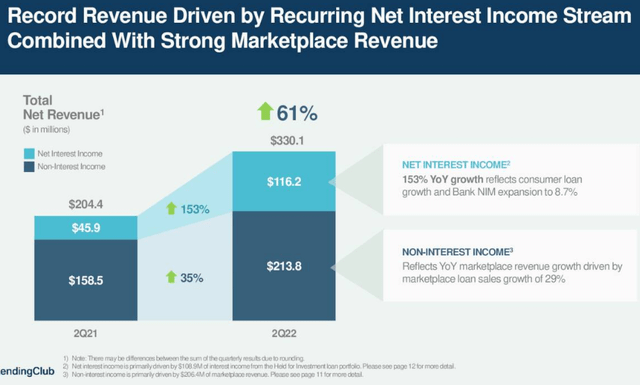

And revenue is already shifting from their marketplace to their online bank:

While loan originations grew at 41% y/y in Q2 to $3.84B whilst retained loans grew by 89% to $1.02B. They are retaining more of their originated loans themselves, normally that’s between 20% and 25% but it was 27% in Q2.

They could do so because average deposits increased 79% y/y, although the cost of these deposits increased to 61bp, up from 29bp a year ago.

The company is actually benefiting from rising rates on credit cards, which is leading to a surge of people looking for cheaper refinancing options and that is one of the main reasons people use LendingClub, from the earnings deck:

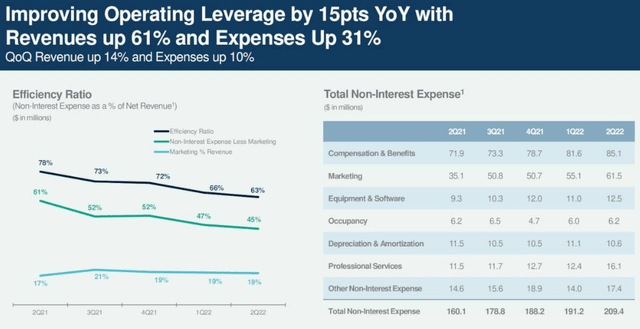

And there is indeed solid operational leverage with expenses growing at half the rate (+31%) of revenues (+61%).

Their efficiency ratio (the ratio of non-interest expense to total net revenue) also increased by 300bp to 63%).

In the rapidly rising rate environment of today, the company needs to bridge a gap between fast rising rates for many of their loan investors (who will require more yield as a result) and the lagging rates charged to company members (the borrowers); here is management on how they bridge that gap (Q2CC):

First are the coupons to borrowers. We are continuously testing and implementing increased price points to drive up yields to investors, while making sure we maintain expected credit quality. We’ve made a series of price increases already, and we plan to continue to do so through the back half of the year. A second tool to increase investor returns is credit adjustments, where we’re leveraging the strong borrower demand to trim lower returning segments, especially in near prime to drive up asset returns.

The company is really quite profitable, delivering $47M in net earnings, after deducting the one-time gain from a tax benefit. The latter also increased their tangible book value by $152M and their regulatory capital by roughly $85M, enabling them to continue increase their lending portfolio.

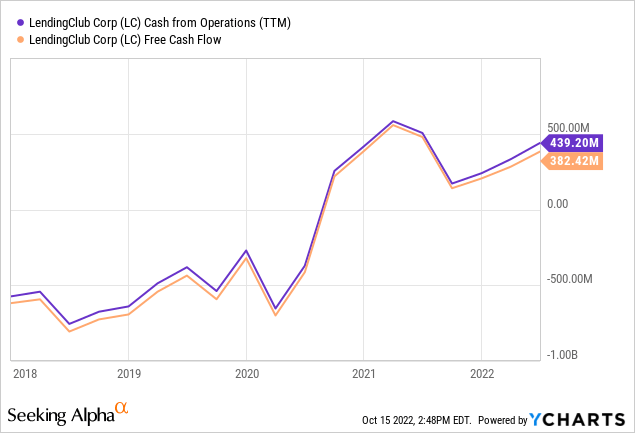

The company has seen a marked improvement in cash flow:

Although, one might keep in mind that from the $232M in operating cash flow in H1/22 over half ($123M) are from provisions for credit losses. There was also of course a huge increase ($1392M) in cash from deposits and savings accounts from its banking arm, but that goes mostly into loans and leases ($881.2M) and securities for sale ($222.5M) as part of its banking operations.

Outlook

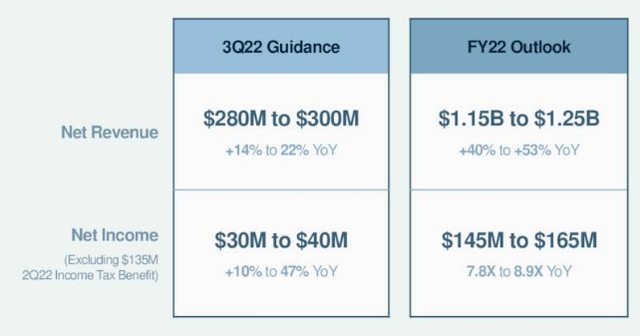

The company reaffirmed their FY22 outlook

Even though the shift towards their banking arm will affect net income short-term, it hasn’t changed the guidance for Q3 or FY22.

Risk

With rapidly rising interest rates and a deteriorating economic environment, risk can emerge, more specifically:

- Funding for marketplace loans might become more expensive and/or more difficult to get.

- A deterioration in credit quality.

The way to deal with the first risk is shifting more towards the bank model in downturns, apart from the other flexibility features discussed above. But in the bank model they have to assume credit risk themselves and maintain capital reserves, even if they can be more selective as the demand from financing partners for loans is affected by the increased financing cost they face.

Starting with the latter, their Tier 1 capital buffer at 13.4% isn’t hugely above the minimum required 11% of their loan portfolio so there is no abundance of capital to increase lending.

Being a bank and having low cost and stable deposit financing (deposits were up $500M-$600M in Q2) enables the company to be more selective in a rising rate environment, from the Q2CC:

our ability to actually go up in the quality spectrum in this environment is really the result of all the work we’ve done to become the marketplace bank we are today. And that’s a real competitive advantage for us.

Indeed, they can be more selective in the types of loans they underwrite, from the Q2CC:

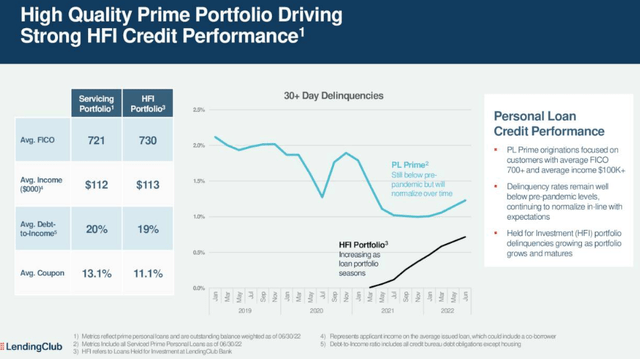

we are primarily focused on time borrowers who’ve proven to be more resilient through economic cycles. Our core consumer has an average income of 112,000 and a FICO score of 7.21. We further believe there is an element of positive selection in our member base. As they have made a conscious decision to strengthen their financial position by refinancing out of higher cost debt.

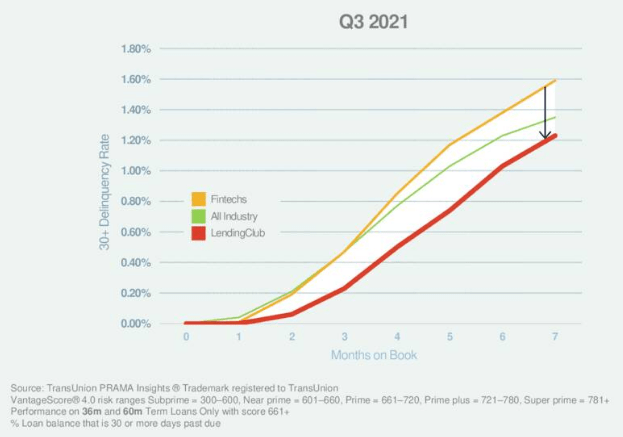

And there are other indications that show little reason for concern about credit quality:

In terms of delinquency rates, this is well below industry average and well below pre-pandemic levels.

LC earnings deck

The company increased the provision for credit losses to $71M from $35M a year ago.

Valuation

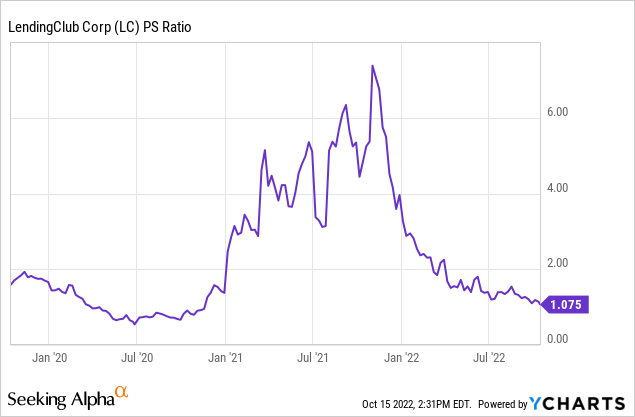

The company is trading on single-digit earnings multiples as analysts expect earnings to go down a tad to $1.61 per share in 2023, from $1.73 this year. It seems to us that while the company has the best of both worlds from fintech and bank in its business model, its valuation is very much as a bank.

Conclusion

- The company has a very attractive business model that provides the best of both worlds, combining a data-based fintech marketplace generating one-time fees and an online bank with its own low-cost deposit base and loan portfolio generating recurring revenues.

- In a rising rate environment, demand for origination from marketplace financial partners slows as they face rising financing cost (even though LendingClub tends to select partners which are less sensitive to this).

- This enables the company to be selective in the expansion of their loan book, which is up to 3x more profitable over the lifetime of the loan versus marketplace loans.

- So, the shift away from marketplace to their own underwriting business should significantly boost profitability in years to come, albeit taking a hit short-term. It’s a big advantage versus other fintech companies which struggle to attract funding in this environment.

- As the one-time marketplace fees basically cover the operating cost of the company, expansion of their underwriting business produces tremendous leverage and is a big advantage versus banks.

- None of this is apparently reflected in analyst expectations, and we can only surmise they expect a rapid deterioration of credit quality and delinquency rates.

- It seems to us that an awful lot of credit deterioration is already priced in whilst there are, as of yet, no signs that it is happening, but it could increase if rates increase further and economic circumstances deteriorate.

- Still, their business model provides multiple levers to soften any blow and they are also making substantial reservations for bad debt.

- We think the shares are quite attractive here already.

Be the first to comment