davidf/iStock via Getty Images

Introduction

It’s been over 6 months since I last covered Energy Fuels Inc. (NYSE:UUUU) on SA, and I think that the fundamentals of the business have deteriorated since then. In January, I wrote that the company’s mixed rare earth element (REE) carbonate production business could be worth maybe $20 million, but now I think it could be worthless considering its unprofitable and its bringing in revenues of less than $0.5 million per quarter. Looking at the uranium business, Energy Fuels still hasn’t restarted its Pinyon Plain Mine despite claiming in its corporate presentation that this is likely the lowest-cost uranium mine in the USA at the moment.

Overall, I think that Energy Fuels is significantly overvalued. Let’s review.

Overview of the recent developments

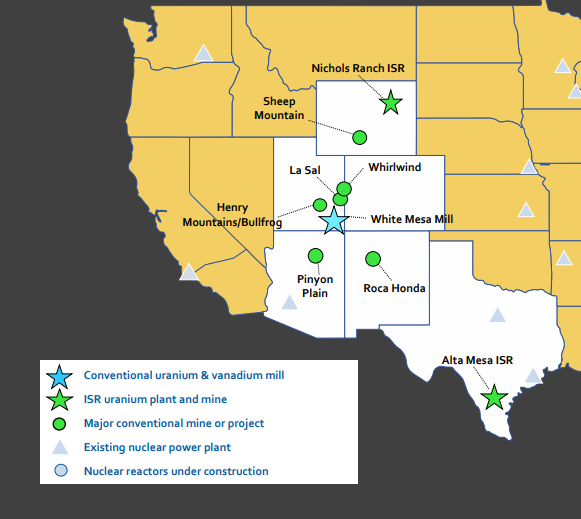

In case you haven’t read any of my previous articles on Energy Fuels, here is a brief description of the business. The company owns a total of 8 uranium projects in the USA as well as 3 mills. However, all of the projects are mothballed at the moment and only one mill is in operation, namely White Mesa in Utah.

Energy Fuels

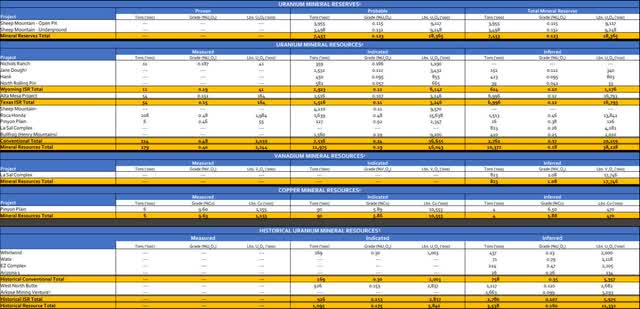

All of those uranium projects are small and their combined measured and indicated uranium resources currently stand at just 51.1 million pounds. The only one with grades above 0.5% is Pinyon Plain, but that property has measured and indicated resources of just 2.4 million pounds. I find it surprising that Energy Fuels still hasn’t put this project into production considering a technical report from 2017 showed that the total operating cost per ton was $329 which means the break-even cut-off grade is just 0.29% at $60 per pound of uranium.

As you can see from the table below, the projects of Energy Fuels also contain small amounts of vanadium and copper.

In December 2020, Energy Fuels announced a deal with U.S. chemicals company Chemours (NYSE:CC) to acquire a minimum of 2,500 tons per year of natural monazite sands for a period of three years. The source of this material is the Offerman mineral sand plant in southeastern Georgia and the idea of Energy Fuels was to use it to produce a marketable mixed REE carbonate by removing the uranium from it at White Mesa. Those 2,500 tons of monazite sands can be turned into around 1,050 metric tonnes of total rare earth oxides (TREO).

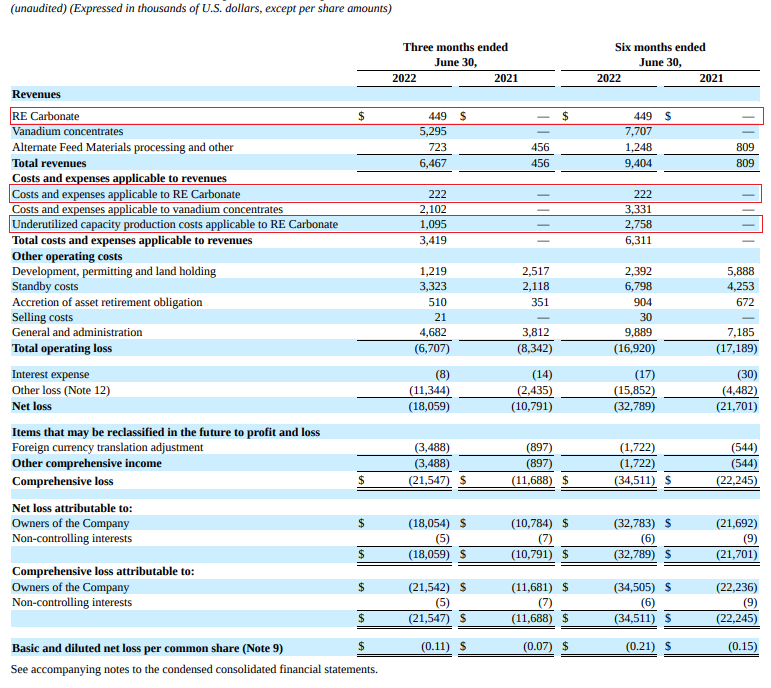

I talked about this deal in a SA article in March 2021, in which I said that the basket value for those 1,050 metric tonnes of TREO was worth barely above $11 million. However, it seems that figure was optimistic. In H1 2022, Energy Fuels sold only 18 tonnes of TREO of at an average price of $25,350 per tonne and expects to recover just 300 to 450 tonnes of TREO in 2022. When you add underutilized capacity production costs, the REE business was unprofitable in H1 2022.

Energy Fuels

In May, Energy Fuels announced the purchase of a 58.3 square mile heavy mineral sand position in Brazil which it says has the potential to supply 3,000 – 10,000 tonnes of monazite sand concentrate per year, containing 1,500 – 5,000 TREO. However, it’s unclear how much the company will need to invest to get this operation running. In addition, transporting the material all the way from Brazil is unlikely to be economically feasible due to the high logistics costs. Another concern for me is that even if Energy Fuels ramped up REE carbonate production, any profits from this business could be eaten up by G&A costs, as these stood at $9.9 million in H1 2022 and should increase exponentially when mining in Brazil commences.

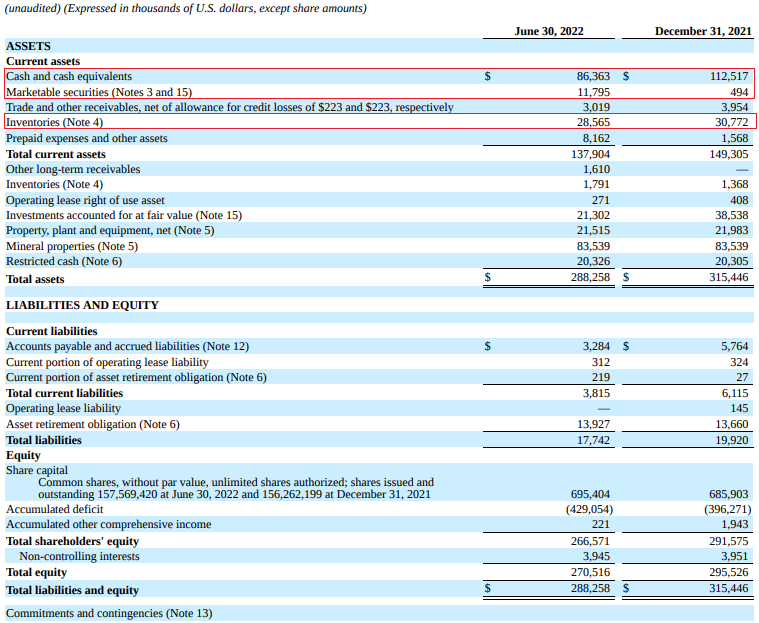

Turning our attention to the balance sheet, cash and marketable securities stood at $98.2 million as of June, but keep in mind that Energy Fuels still needs to pay $22 million for the REE project in Brazil. Inventories (mainly uranium and vanadium) were $28.6 million at the end of H1 2022.

Energy Fuels

The balance sheet looks strong, but I think that it’s likely that Energy Fuels will need to carry out a capital increase in the near future. The company recently revealed that it secured three new long-term sales contracts with U.S. nuclear utilities, which means that it could be getting ready to start uranium production at some of its projects soon. Unfortunately, we don’t know at what price Energy Fuels will be selling that uranium.

So, how much should Energy Fuels be worth? Well, I think that the answer is not much. The performance of the REE business has been disappointing so far and I don’t expect the purchase of an early-stage project on another continent to fix this. Sure, the company had $126.8 million in cash and inventories as of June but about $22 million of that amount will go for the REE project in Brazil, and standby and G&A costs are currently about $33 million per year. In addition, Energy Fuels has inked long-term sales contracts for uranium which means that it could be gearing up to restart production soon. Yet, the only uranium project in its portfolio that has high enough grades to be profitable at the current spot price of $49 per pound is Pinyon Plain. And this project has measured and indicated resources of just 2.4 million pounds of uranium, which means that it’s unlikely to make a difference.

Investor takeaway

In 2020, Energy Fuels decided to pivot to REE carbonate production, but the results have been underwhelming and the company’s cash balance is shrinking rapidly. Now, the company wants to mine and ship material from Brazil, but this doesn’t sound economically feasible, and I think that this business is likely to remain unprofitable.

Looking at the uranium business, Energy Fuels has signed supply deals with U.S. nuclear utilities and this means that a restart of production could be just around the corner. However, the company has only one high-grade project in its portfolio, and that one has measured and indicated resources of just 2.4 million pounds. I doubt that any of the other uranium projects of Energy Fuels has a positive net present value at $50 per pound of uranium.

That being said, I think that short selling Energy Fuels stock could be dangerous as uranium prices are notoriously volatile. In addition, most uranium producers and developers are valued at above 1x NAV at the moment. Avoid this stock.

Be the first to comment