Kittisak Kaewchalun /iStock via Getty Images

Overview

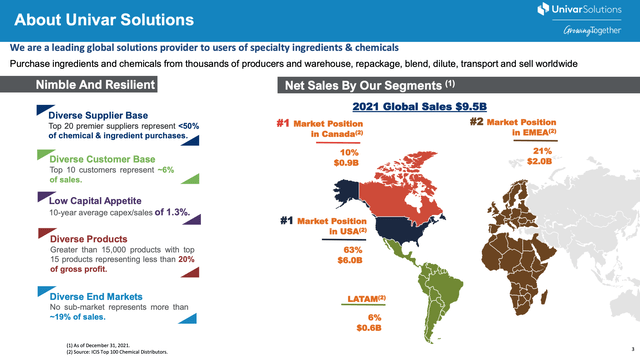

Univar Solutions (NYSE:UNVR) is the second-largest global chemical distributor behind Germany’s Brenntag (OTCPK:BNTGF). The company purchases chemicals from over 1,300 chemical producers worldwide and warehouses, repackages, blends, transports and sells those chemicals to more than 100,000 customers in over 100 countries.

Overview (Univar Investor Presentation)

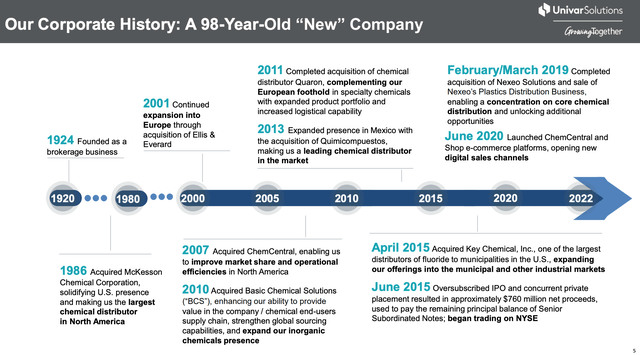

Univar has been built via a series of acquisitions over the past several decades. Acquisitions have provided Univar significant operational synergies in terms of both scale (greater purchasing power, ability to reduce duplicate logistical and overhead costs) & scope (broaden product and geographical capabilities). Further acquisitions have typically been done with attractive economics (sub 7x EBITDA on post-synergy basis).

M&A history (Investor Presentation)

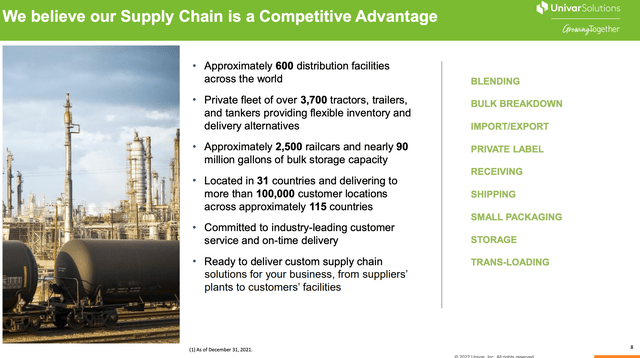

Chemical distribution is a many-to-many distribution business. Univar is not overly reliant on any one supplier of chemicals, and no customer represents a significant percentage of sales. This limits the threat of disintermediation. Moreover, there is a significant logistical component to the service that third-party chemical distributors like Univar provide. The company purchases chemicals in large lots from suppliers, repackages into smaller lots, customizes formulations, and makes timely/weekly deliveries to over 100,000 customers from over 700 locations via a fleet of 3,700 delivery vehicles.

Logistics are a Competitive Advantage (Investor Presentation)

The company has numerous competitive advantages versus smaller players, including:

- Better purchasing terms (Univar purchases $7+ billion worth of chemicals annually) which allow the company to provide competitive pricing and earn higher gross and operating margins

- Logistics – having a large market share increases route density (more deliveries per truck, per day) and lowers the operational cost of delivery

- Ability to invest in digital sales offering – while smaller chemical distribution companies have limited resources to invest in e-commerce initiatives, Univar has a leading e-commerce platform which offers improved customer service and lowers the cost of doing business.

- Breadth of offering – Univar provides a wider product offering – customers have access to thousands of chemicals

Long-Term Success

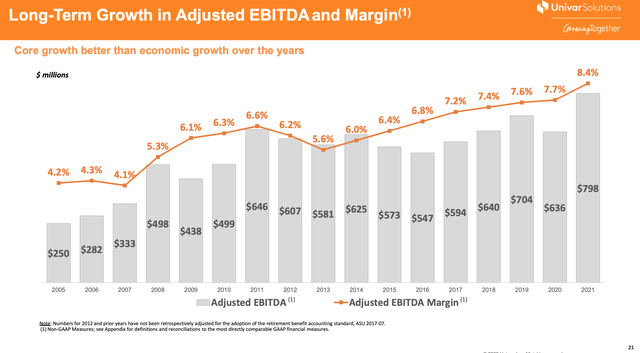

While chemical producers tend to have very cyclical results due to changes in specific end market demand (product & region), volatile input costs, and overall macroeconomic cyclicality, as shown below, chemical distributors like Univar produce much more stable results.

Long-term Financial history (Investor Presentation)

The relative stability of Univar’s results comes from:

A/ Diversified end market demand – the company serves customers across industries and geographies.

B/ Ability to pass price changes on to customers – while a chemical producer will generally see significant contraction in profitability if prices decline (while most costs remain fixed), distributors generally earn a more stable level of profitability per unit delivered.

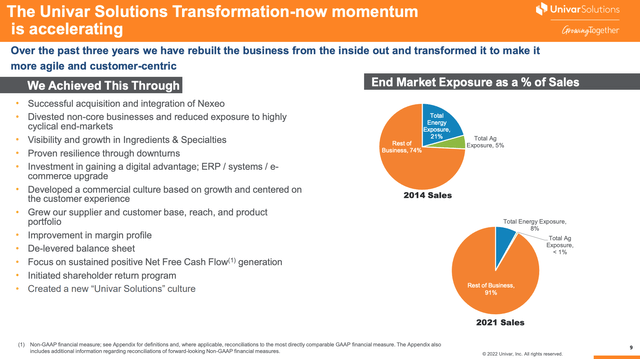

That said, the company has been impacted by industry-specific and macroeconomic conditions (albeit to a lesser extent than chemical producers). As you can see above, Univar experienced declining profitability from 2011 to 2016. Univar was a smaller, less diversified company at the time and had outsized exposure to the oil & gas industry, which experienced a significant downturn on the back of falling commodity prices. As the graphic below illustrates, Univar is much less reliant on the volatile oil & gas industry – as such, I expect results will prove less susceptible to a downturn in the oil & gas sector:

Commodity exposure (Investor presentation)

Valuation

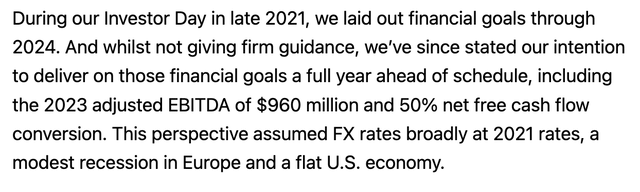

At a price of $28 per share, Univar trades at just 6x 2022 expected EBITDA at less than 11x free cash flow per share. However, 2022 results are above normal as Univar has been a beneficiary of inflationary trends which have boosted gross profit margins (and operating margins) and (until recently) a strong economy which has driven EBITDA to $1,050 million. The company has guided to a more normalized result in 2023, expecting EBITDA to come in around $960 million.

2023 EBITDA Guide (Seeking Alpha transcript)

For the purpose of my valuation, I take a slight haircut to management’s 2023 guidance and assume $900 million in EBITDA, which implies that Univar is trading at 7x ‘normal’ EBITDA and just under 12x free cash flow per share.

Given the company’s strong (and improving) market position, slightly above GDP on an organic basis (as it incrementally gains market share) with further upside from accretive M&A, I think the fair value for Univar shares is about 15x free cash flow per share which equates to $36 per share. This suggests that at its current price of $28.35, Univar trades at about a 20% discount to intrinsic value.

Conclusion

I view the chemical distribution business as attractive and see Univar as a long-term winner in the sector. As a value investor, I look to buy in at a 30% or greater discount to fair value. As such, I’d be interested in buying the stock if it falls below $25 per share.

Be the first to comment