Hoowy/iStock via Getty Images

Introduction

In this article, we dive into a true wild card. Tennessee-based U.S. Xpress Enterprises (NYSE:USX) is a small-cap trucking company that hasn’t done too well as it’s down 50% year-to-date, and more than 80% below its 2018 IPO price. The company has a very high operating ratio, indicating cost issues, and trouble dealing with ongoing inflation. As a result, the valuation seems extremely cheap as the company is trading below its book value. However, that has a good reason as investors can buy much better alternatives. In this article, I look at USX from a high-risk bargain point of view as the company has opportunities to improve its business. If demand remains strong, the company can improve its operating results while adding new capabilities and trucks to become more efficient. It’s a long shot, but if it works out, the company can benefit from a much higher valuation than it currently has, which makes it worth taking a closer look at this $153 million market cap trucking company.

So, without further ado, let us dive into the details!

What’s USX?

While a $153 million market cap does not seem like a lot, USX is one of America’s largest asset-based truckload carriers by revenue, generating over $1.9 billion in total operating revenue in 2021. This goes to show how fragmented this industry is as a lot of operators have less than 10 trucks.

The company became publicly listed in 2018. Before that, it was a wholly owned New Mountain Lake Holdings, LLC subsidiary.

USX covers the entire United States with a focus on the eastern half where it offers customers a broad portfolio of services using its own truckload fleet as well as third-party carriers through its non-asset-based truck brokerage network.

According to TruckingOffice:

A truck broker, also known as a freight broker, is the middle man. He’s in an agreement between a shipper who has goods to transport and a carrier who has the ability to move the load.

The company’s asset-based fleet consisted of roughly 6,400 tractors/trucks at the end of 2021 with 13,600 trailers. 1,200 of the aforementioned trucks are provided by independent contractors.

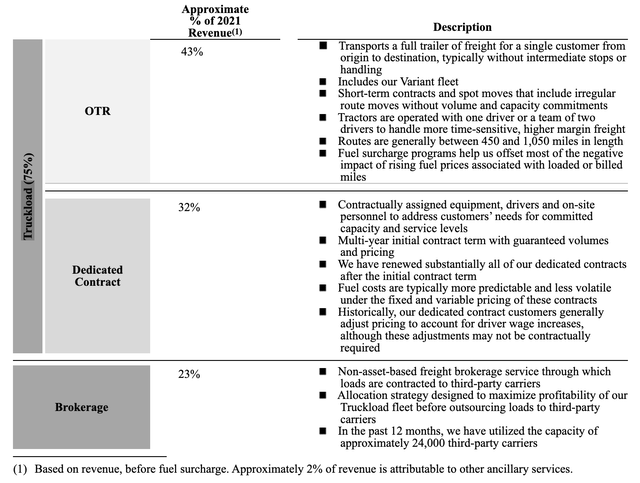

The overview below shows how the company makes money. First of all, roughly 75% of revenue comes from truckload operations, which basically means transporting full trailers of freight (otherwise it’s less-than-truckload or “LTL”) from a single customer to a destination. These trips are often long and it’s harder for truckload companies to attract employees – compared to LTL operators. Moreover, these deals are often done using spot contracts with fuel surcharge programs providing the company with the ability to offset fuel inflation.

In addition to that, the company offers dedicated contract services, which means it can engage in long-term contracts with guaranteed volumes and pricing by assigning equipment and drivers to certain customers.

Brokerage covered roughly 24,000 third-party carriers in 2021.

USX Is Struggling

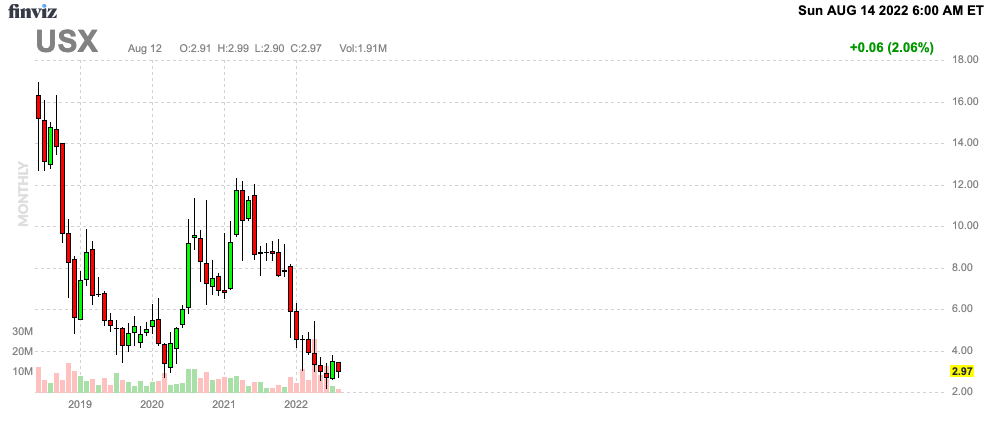

The stock price is truly something. USX is trading below $3.00 per share while I am writing this. That’s close to the 2020 bottom and a mile below the 2021 peak at $21 per share – let alone the 2018 IPO price of $16.

FINVIZ

USX is not necessarily a bad company, it is just struggling because the industry is highly competitive.

Truckload supply is highly fragmented, inflation is high, and it’s challenging to get sufficient labor.

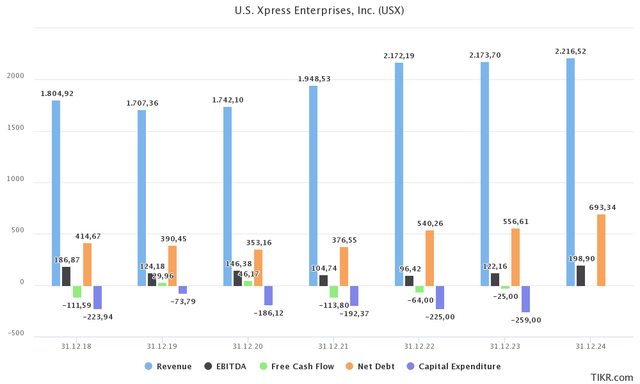

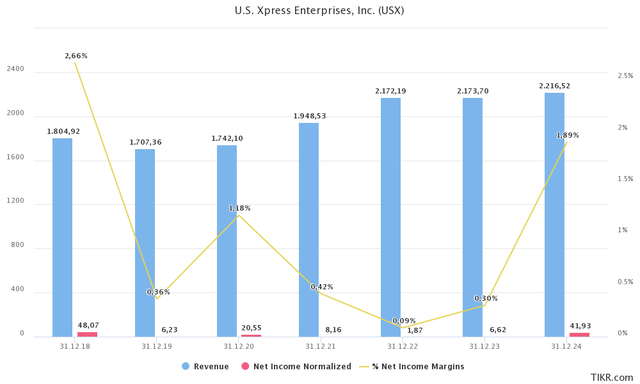

Over the past few years, the company was unable to generate consistent (positive) free cash flow as a result of high capital expenditures and the fact that consistent sales growth did not end up boosting the company’s bottom line.

Using normalized net income, we see that margins have been razor thin, which explains why high inflation is now becoming an issue.

In order to combat these problems, the company has launched Variant. As the company puts it:

Variant represents an entirely new paradigm for operating trucks in an Over-the-Road environment utilizing artificial intelligence and digital platforms to recruit, plan, dispatch and manage its fleet. The division’s operating model, powered by cutting edge technology, has generated improvement in utilization while significantly reducing driver turnover, and preventable accidents per million miles, all as compared to our legacy OTR fleet.

Unfortunately, at a time when it matters most, Variant fails to deliver.

FreightWaves hit the nail on the head when it wrote “U.S. Xpress shows no marked improvement at Variant” earlier this month.

FreightWaves

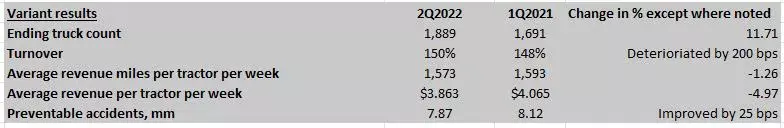

Variant now covers close to 1,900 trucks, which is half of the company’s over-the-road fleet.

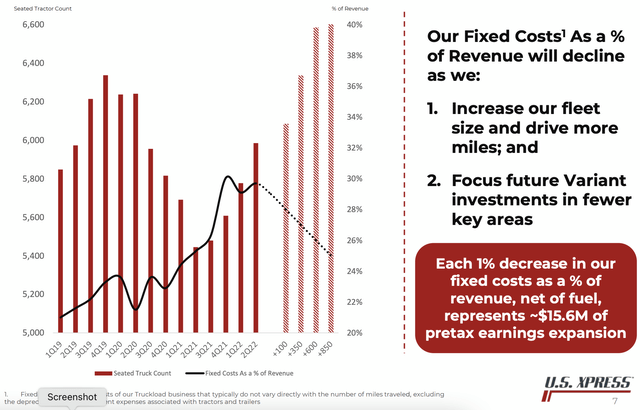

Variant is needed to spread the company’s fixed cost structure over more trucks with higher utilization rates. That makes sense.

Variant was up about 200 trucks since the end of the second quarter. If Variant is expanded by 850 trucks, the company estimates that it can lower fixed costs to roughly 25%.

The problem is that Variant isn’t that efficient in an environment where trucking demand is still high. The average revenue miles per tractor per week declined from 1,593 to 1,573 in 2Q22. Moreover, the employee turnover rose from 148% to 150%, as a result of reorganization according to the company.

The bigger picture wasn’t too good either as the truckload operating ratio rose to 99.8%. This means that it costs 99.8% of truckload revenues to operate the business. That’s dangerously close to breakeven.

FreightWaves

While pricing helped the company to improve average revenue per tractor per week, it saw a decline in average revenue miles per tractor per week.

The good news is that revenue growth per mile in its dedicated segment was strong, even though average revenue miles per tractor were down. Moreover, the brokerage operating ratio was improved by 610 basis points.

According to the company:

Our Brokerage segment gross margin benefited from the softening market conditions which allowed for a lower cost to cover loads. Additionally, we right-sized our technology investments and operational headcount in the second quarter, and we expect these changes to benefit our operating income beginning in the third quarter. If current market conditions persist, we expect this segment’s quarterly operating income in each quarter of the second half of the year to be consistent with the second quarter.

Moreover:

We’re in a much better place than when we began the year with our Brokerage segment profitable and our Dedicated division performing well. Seeing improvements in our Dedicated division and its ability to turn around its financial performance gives me the confidence that Variant will mature from a start-up to a stand-alone commercial business.

Without a doubt, the company is improving its dedicated and brokerage segments. However, Variant should be doing much better by now, which is why the first President of Variant has been fired late last year according to the FreightWaves article I quoted in this article.

The problem is that USX is in a very tough spot to improve its business. Inflation is making expanding hardware more expensive. Slowly weakening demand is making pricing harder in a competitive industry while high inflation, in general, is pressuring margins.

Hence, investors aren’t buying USX. The alternatives are better. There is no need to buy low-margin truckload companies.

This brings me to the valuation.

Valuation & Balance Sheet

We’re dealing with a typical valuation for struggling micro-cap companies. Either the turnaround works out, which makes USX way too cheap, or the struggling continues, in which case a “cheap” valuation can become even cheaper.

First of all, the company is trading below book value. The company has $273 million in equity book value. That’s total assets minus total liabilities. The market cap of $153 million is 0.56x the book value. There is no trucking company with a larger market cap trading anywhere below book value.

That has a reason, of course. The company’s assets are not that profitable. The much more profitable leader in the trucking industry Old Dominion Freight Lines is trading close to 10x book value as it has an industry-leading operating ratio.

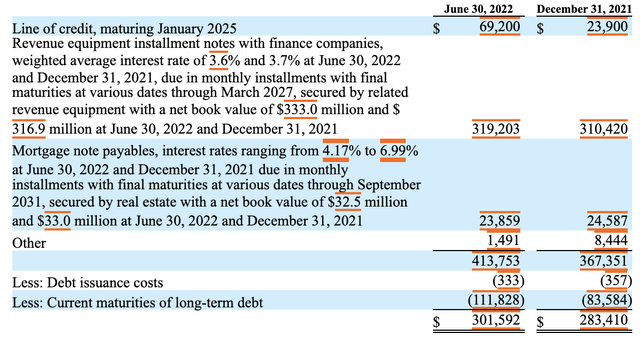

With that said the company has $1.0 billion in total liabilities. $414 million of this consists of long-term debt ($112 million of this is due within 12 months).

Most of this is yielding between 3.6% and 3.7%. The company’s mortgage notes yield 4.2% to 6.99%, which covers just $24 million in total debt.

The company has also access to a $75 million revolver credit facility as long as no event of default exists.

Incorporating total cash, the company is expected to end up with $557 million in net debt in 2023. That’s roughly 4.6x EBITDA. It is elevated, but the company is not distressed.

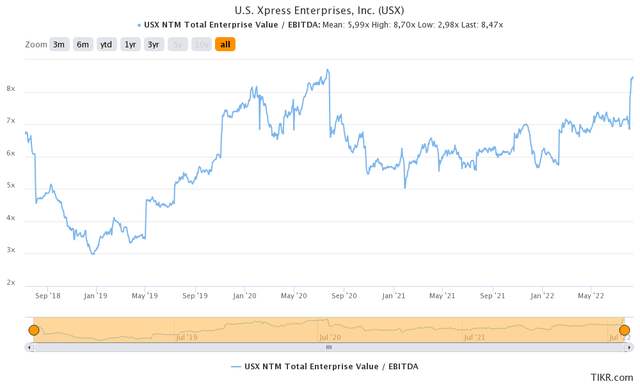

Using the $153 million market cap, $557 million in expected net debt, and just $2 million in minority interest gives the company an enterprise value of $712 million. That’s 5.8x expected 2023 EBITDA of $122 million.

That’s not cheap, which proves that the very low price/book value does not indicate deep value.

With that said, if the company is able to work its way up to an adjusted EBITDA margin of 10% again, it could do $180 million in EBITDA. That would open up at least 100% upside, especially because if margins improve, the market will likely bet on further margin improvements.

The problem is that we’re not seeing these improvements yet. While dedicated and brokerage are doing well, overall truckload margins are weak and economic conditions are not supportive of a rapid improvement.

I believe that the company becomes interesting after a renewed market sell-off. If the market weakens again due to potentially further slowing economic conditions, USX might see even more downside.

If the market cap falls towards $120/$130 million, I think USX is worth a shot.

However, whatever you do, please be aware that it’s a wild card. USX is volatile and risks are high. Keep your positions very small if you decide that USX is the right stock for you.

Takeaway

USX is in trouble, but it’s not hopeless. Its balance sheet isn’t in bad shape and its dedicated and brokerage segments are doing well. The problem is that margins are low while USX is unable to benefit from what is still a favorable business environment for a lot of peers.

While the valuation may sound cheap, it’s not deep value unless the company finds a way to improve margins. So far, this is not the case as even Variant has been struggling.

For now, I remain neutral on the stock, but if (not when) the stock market takes another dive, I think USX may be worth a shot if the market cap gets close to $120 million.

(Dis)agree? Let me know in the comments!

Be the first to comment