CaraMaria

A few months ago, I wrote a cautious article on Star Bulk Carriers Corp. (NASDAQ:SBLK), arguing that the shipping cycle has turned and that forward earnings and dividend yield will be lower.

So far, my thesis is proving correct, as SBLK reported lower YoY revenues and earnings. Importantly, its contracted shipping rates continue to decline, which will have a negative impact on future earnings and dividends.

Looking ahead, China demand for bulk commodities remains weak due to zero-COVID policies. That is not expected to change before March. In additional, we now have a looming global recession, which will negatively impact global economic growth. Bulk shipping is very economically sensitive, so the outlook for shipping rates and SBLK is not looking bright at the moment. I would stay away from dry bulk shipping companies until the global economic outlook improves.

Latest Quarterly Earnings Confirming My Thesis

My cautious view on Star Bulk Carriers is centered around my understanding of shipping cycles. Historically, once the Baltic Dry Index (“BDI”) peaks, momentum in shipping stocks drop quickly, despite reported shipping rates staying elevated for a few more months to quarters.

In my prior article, I warned:

However, we must note that shipping rates have since normalized, with the BDI falling to 965 recently. What this means is that in the coming quarters, we should expect Star Bulk’s revenues and earnings to normalize as well.

Although SBLK reported in its latest quarterly that 61% of the upcoming Q3 has been covered at a Time-charter equivalent (“TCE”) ~$29,000/day, we see spot rates are currently far below that level.

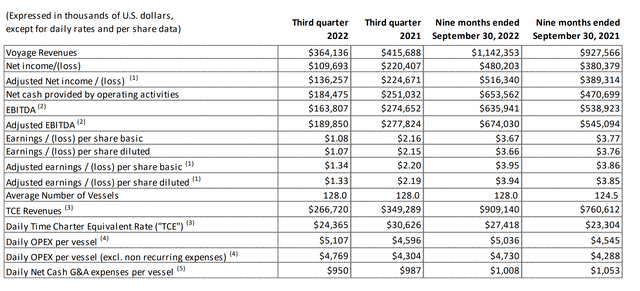

Sure enough, the latest quarterly report was a disappointment for the bulls, as SBLK reported a daily TCE rate of only $24,365 in the third quarter vs. the $29,000 figure they quoted in the August earnings report (Figure 1).

Figure 1 – SBLK Q3/2022 Financial Summary (SBLK Q3/2022 Press Release)

Overall, SBLK reported revenues of $364 million, a 12.4% YoY decline, and net income of $109.7 million, a 50.2% YoY decline.

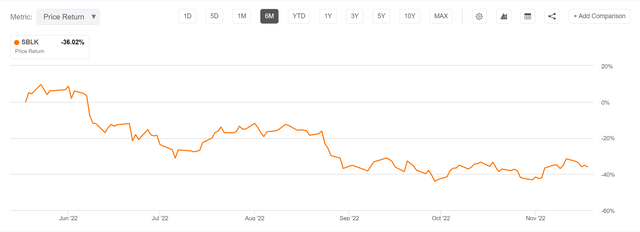

Although the company declared a $1.20 / share dividend (24% annualized rate), the stock has declined by 36% in the past 6 months, more than offsetting any dividends declared and paid (Figure 2).

Figure 2 – SBLK has lost 36% in stock price in last 6 months (Seeking Alpha)

Spot Rates Continue To Point Down

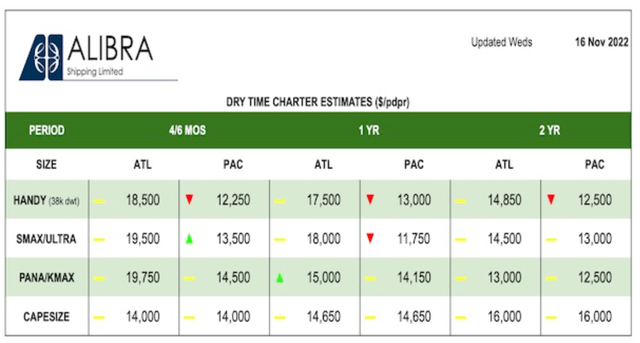

Looking forward, the company notes that it has covered ~66% of its available days at a TCE of $22,772 / day per vessel. However, with spot rates significantly lower than the company’s $22,800 figure, I suspect the upcoming fourth quarter will be a repeat of the latest quarter, with actual TCE rates coming in well below the $22,800 level the company has ‘covered’ (Figure 3).

Figure 3 – Spot shipping rates (hellenicshippingnews.com)

Baltic Dry Index Rolling Over

In September, we saw many bulls promote their favourite shipping stories, as the BDI rallied from oversold levels. However, in recent weeks, the BDI has begun to roll over, recently trading at ~1,200. What is going on?

Figure 4 – BDI rolls over (stockcharts.com)

China Continues To Be Weak

Recall, I wrote previously that dry bulk shipping rates are very dependent on the Chinese economy, as it is the largest consumer of many bulk commodities like iron ore, coal, and grains.

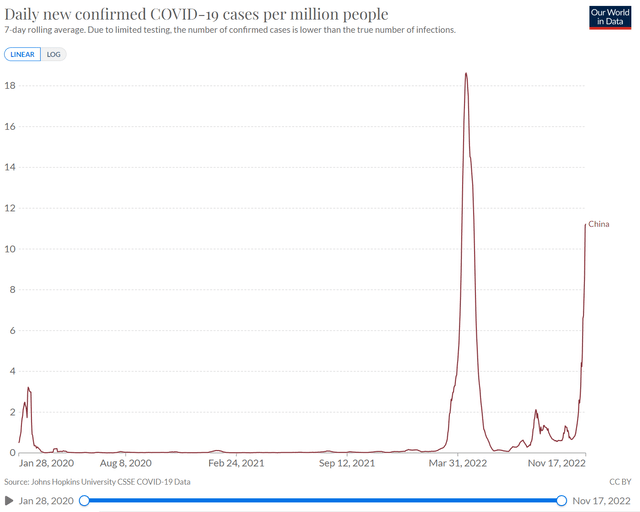

Despite market enthusiasm for China reopening rumours, the reality is that China’s covid cases have been spiking in recent days and are near record highs (Figure 5).

Figure 5 – China covid cases (Our World In Data)

While inevitable changes are coming to China’s covid policies (China cannot stay shut forever), investors need to understand that the design and implementation of new policies may take many months. In fact, the original social media screenshot which sparked the latest Chinese stock rally suggested officials were drafting a reopening plan for March of 2023, after the critical Jan/Feb lunar new year festivities, when hundreds of millions of Chinese citizens are expected to travel to their hometowns to visit relatives.

In the meantime, we continue to have lockdowns and mobility restrictions, which negatively impact China’s moribund real estate sector, curtailing demand for seaborne bulk commodities.

Global Recession In 2023?

In addition to weak demand out of China, recent economic indicators are flashing red on a potential global recession for 2023, sparked by central banks’ interest rate increases this year to combat inflation.

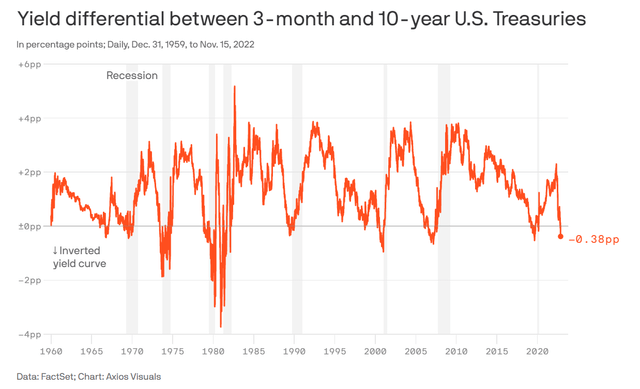

The 3M-10Yr yield curve, which has historically been a good leading indicator for recessions, have been the most negative in years (Figure 6).

Figure 6 – Inverted yield curve signals recession (Axios)

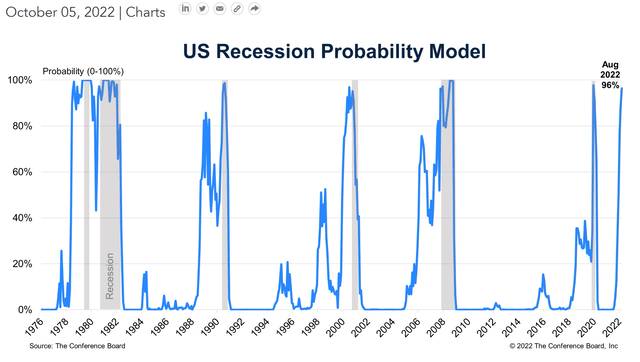

The Conference Board also released their recession probability a few weeks ago highlighting a 96% probability of a U.S. recession in the next twelve months. The last 6 times this indicator got above 90%, a recession shortly followed (Figure 7).

Figure 7 – Recession probability at 96% (Conference Board)

Risk To My Call

Obviously, there is upside risk to my call if China does reopen sooner than expected and are able to revive their real estate sector, driving renewed demand for bulk commodities. Also, if the global economy is able to achieve a soft landing, then demand for bulk commodities could rebound in 2023, spurring higher shipping rates.

Conclusion

With weak Chinese demand for bulk commodities and a potential recession looming for 2023, it is no wonder that the Baltic Dry Index has rolled over in recent weeks. Bulk shipping is very economically sensitive, so the outlook for shipping rates and SBLK is not looking bright at the moment. I would stay away from dry bulk shipping companies until the global economic outlook improves.

Be the first to comment