A-Shot-of-Bliss/iStock Editorial via Getty Images

Earlier this year, we published two articles on Colgate-Palmolive (NYSE:CL), rating the firm’s stock as a “buy” both times. In our first article, published in June, we highlighted CL’s track record of relatively strong performance during times of low consumer confidence in relation to the broader market. In our second article, we gave our views on the Q2 financial results and have underlined the main headwinds, which have been and are still causing challenges for the company. These headwinds have included: elevated raw material prices, unfavourable FX environment and inflationary pressures. We also mentioned the importance and advantages of the expansion of the pet food business.

Today, we are revisiting CL’s stock with the aim of giving a brief overview about the latest earnings report and to take a closer look at the firm’s current valuation.

Q3 results

At the end of October, CL announced their Q3 results for the quarter ending 30th of September 2022.

While the firm has been able to achieve a net sales growth of 1% year-over-year and an organic sales growth of as much as 7%, their GAAP EPS has declined by 1%, while their base business EPS declined by as much as 9%, reflecting the unfavourable FX environment.

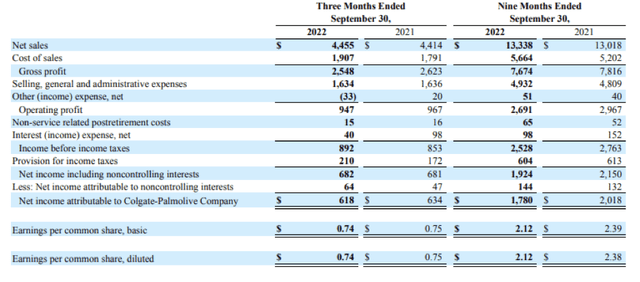

Income statement (CL)

The driver of the sales growth has been primarily the net selling price increases of 11.5%, partially offset by volume declines of 4.5% and negative foreign exchange of 6.0%. Also important to mention that CL has managed to gain market share in both the toothpaste and toothbrush market:

The Company’s share of the global toothpaste market was 39.7% on a year-to-date basis, up 0.3 share points from the year ago period, and its share of the global manual toothbrush market was 31.6% on a year-to-date basis, up 0.6 share points from the year ago period.

A substantial contributor to the decline in earnings has been the contracting growth margin, due to the elevated raw and packaging material costs.

Worldwide Gross profit margin decreased to 57.2% in the third quarter of 2022 from 59.4% in the third quarter of 2021. This decrease in Gross profit margin was due to significantly higher raw and packaging material costs (920 bps), partially offset by higher pricing (440 bps) and cost savings from the Company’s funding-the-growth initiatives (260 bps).

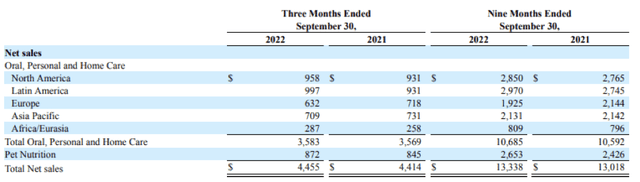

Net sales by region (CL)

The European segment has been the worst performer in Q3, which is understandable in light of the ongoing geopolitical tension and the energy crisis in Europe. We, however, believe that both of these factors are temporary in nature. Lately, there has been positive news regarding the possibility of peace talks between Ukraine and Russia.

While we believe that the situation is not going to change from one day to another, we are optimistic that the situation in Europe may normalize by the second half of 2023.

Further, the table once again illustrates that a substantial amount of the company’s revenue is generated outside of the United States, meaning that the relative strength of the USD against other currencies is likely to keep negatively impacting the financial results in the near term.

All in all, we believe that the firm’s latest quarterly results are not particularly impressive. While they have managed to increase net sales, total volume has fallen, which is an indicator that the demand for the firm’s products with higher prices is not as strong as before. While in our opinion that headwinds are temporary, the elevated costs and inflationary pressures, along with the unfavourable FX environment are likely to keep hurting the financial performance in the near future.

Valuation

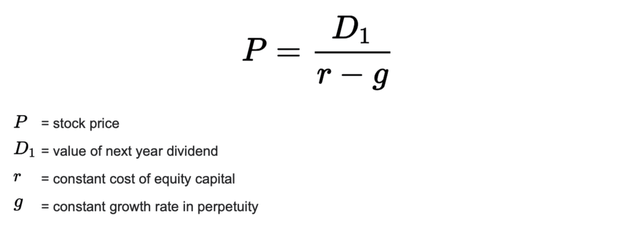

To value CL’s stock, we will be using the Gordon Growth Model [GGM].

Gordon Growth Model

The GGM is a simple and widely recognized dividend discount model, used to value the equity of dividend paying firms. The main assumption of this model is that the dividend grows indefinitely at a constant rate. Due to this criterion, the growth model is particularly appropriate for firms that are:

1.) Paying dividends

2.) In the mature growth phase

3.) Relatively insensitive to the business cycle

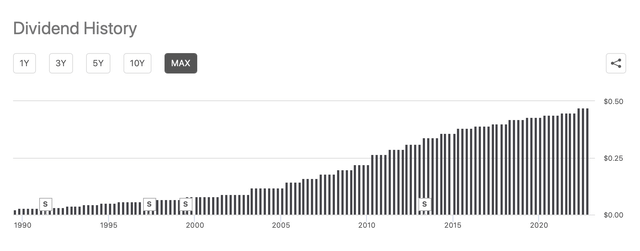

A strong track record of steadily increasing dividend payments at a stable growth rate could also serve as a practical criterion if the trend is expected to continue in the future.

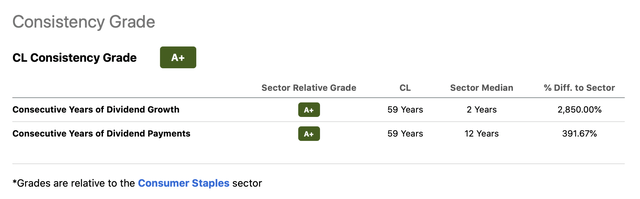

In our opinion, Colgate-Palmolive is relatively insensitive to business cycles and has a strong track record of paying dividends and growing its dividend payments. The firm has been paying dividends each year in the last 59 years. On top of that, they have even manage to increase these payments each year.

Consistency grade (Seeking Alpha)

Dividend history (Seeking Alpha)

While the current Dividend Payout Ratio [TTM] (Non-GAAP) is around 62%, about 8% higher than the company’s 5Y average, we believe that it is not likely that the dividend will be cut in the near future, even if earnings slightly decline.

As a result, we believe that the GGM is a suitable method to value CL’s equity.

But to do so, first we have to understand what is behind the GGM. The model is described by the following formula:

GGM (Wallstreetprep.com)

And in order to make a useful evaluation of the fair value of CL’s stock, we have to establish a few assumptions:

1.) Required rate of return

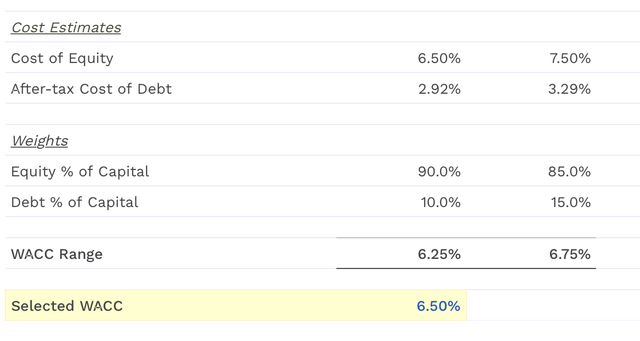

We normally like to use the firm’s WACC as a required rate of return, which is estimated to be 6.5% in CL’s case.

WACC (finbox.com)

2.) Dividend growth rate in perpetuity

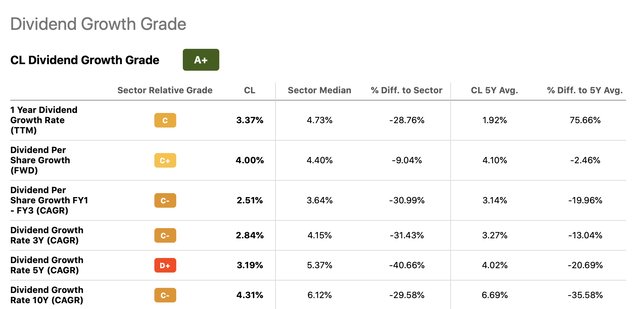

Historic trends and growth rates could be helpful to define the perpetual growth rate. Important to underline that the growth rate has a substantial impact on the calculated fair value. Assuming unrealistically high growth rates can lead to a significant overestimation of the fair value. For this reason, we rather like to stay on the conservative side.

Dividend growth (Seeking Alpha)

Based on historical dividend growth rates, a range of 2.5% to 4.5% appears to be an appropriate choice.

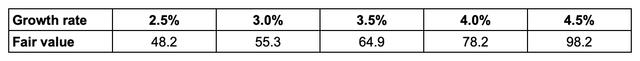

Plugging in these numbers to the GGM formula gives the following results:

Results (Author)

CL’s stock is currently trading around $76 per share, which is within our range, but on the higher end.

In our opinion, the current stock price is justified and there is even some upside potential. We cannot forget that this model does not fully capture the potential growth associated with the pet food business expansion for example. Also, once the temporary headwinds ease, the dividend growth rate may become somewhat higher for a certain period.

Conclusions

CL has reported mixed Q3 results. While net sales have slightly increased, earnings have substantially decreased, mainly driven by the challenging macroeconomic environment, including elevated raw material and packaging prices, combined with the unfavourable FX environment.

The stock appears to be trading close to its fair value according to the GGM, however the model does not capture the growth potential associated with the pet food business expansion.

We maintain our “buy” rating.

Be the first to comment