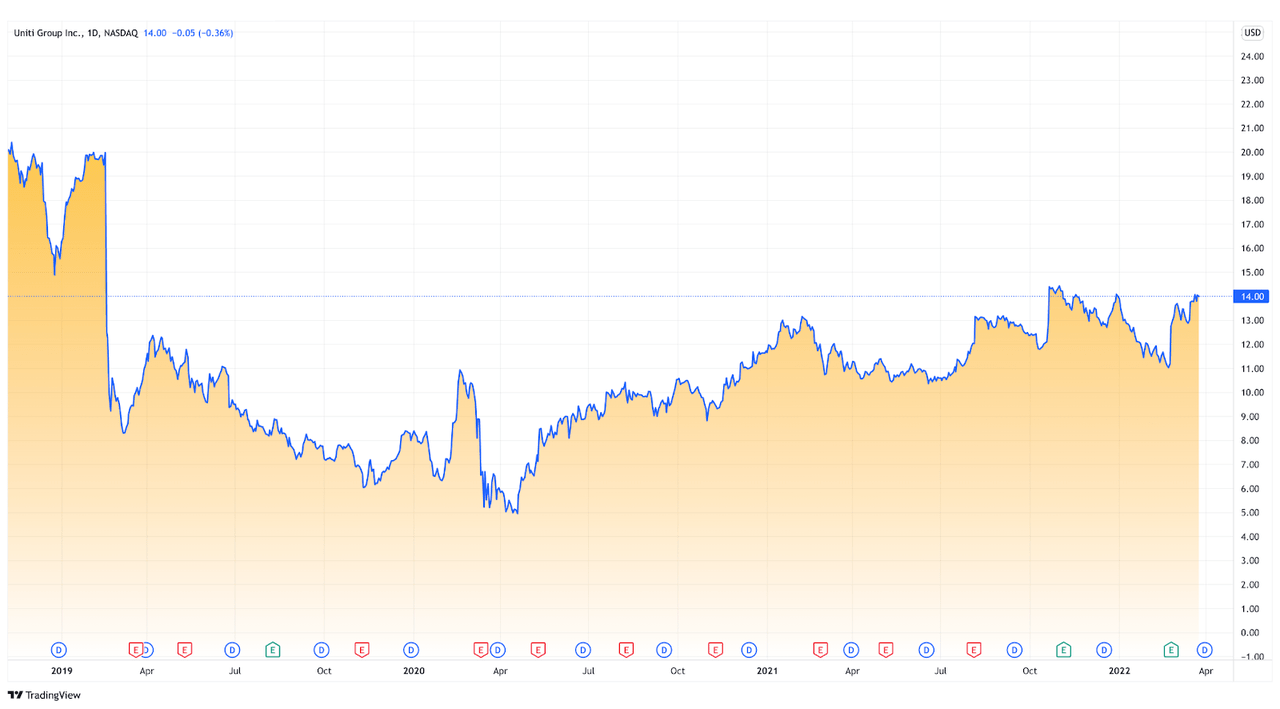

pp76/iStock via Getty Images tradingview.com

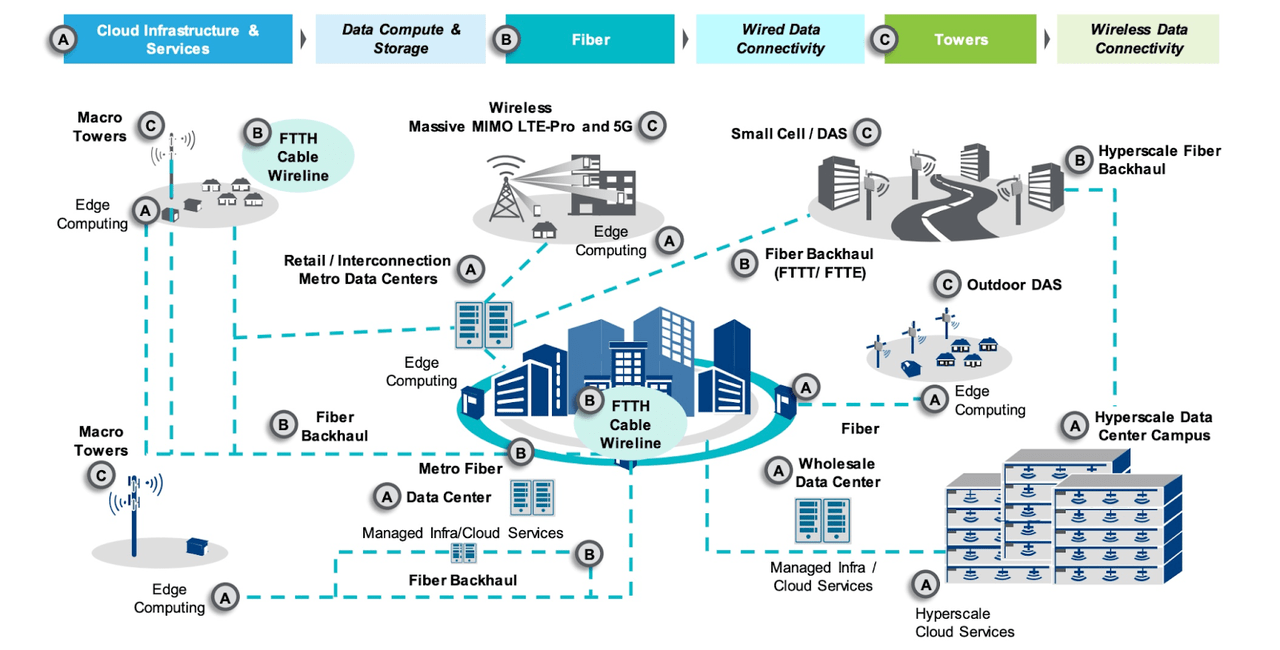

Founded in 2014, formerly as Communications Sales and Leasing Inc. (CS&L), Uniti Group (NASDAQ:UNIT) is an internally managed Real Estate Investment Trust with interest in the acquisition, construction, and leasing of mission-critical infrastructure in the communication industry. Uniti Group’s main business is acquiring and constructing fiber optic, copper, coaxial broadband network, and data centers.

investor.uniti.com

The company’s revenue principally comes from four different segments. The leasing segment is where the company acquires vital communication assets and leases them out long-term for anchor customers to manage. The other segments are the Fiber Infrastructure Solution (the fiber business arm of Uniti Group), the Tower segment (where the company constructs towers and tower-related estate and thereafter leases out communication space on the tower to wireless service providers), and the consumer segment (where the company provides local telephone and high-speed internet to customers in the Eastern and Central parts of the United States). The company has, however, divested a larger proportion of its tower business. Uniti Group Inc has maintained a cumulative cash yield of almost 3X within the last five years. This is a positive narration for a communication infrastructure company established in 2014. This could prompt both retail and institutional investors to take a bullish stand on the company and ride upward with its growth.

Mergers and Acquisitions Plan

The strength and growth of Uniti Group can largely be attributed to its Mergers and Acquisitions plan. Since its establishment in 2014, Uniti Group Inc. has acquired several companies. Southern Light LLC, which the company acquired on the 10th of April 2017, is its largest acquisition and most significant. The acquisition was a cornerstone in the strategic repositioning of the company. The deal, which was valued at $700 million, was vital as it gave Uniti Group a reach into the wholesale and enterprise service of the communication infrastructure business. It also brought Uniti Group closer to government deals as 14% of its revenues were from government agencies and E-Rate Customers. Before the acquisition, Southern Light, a provider of data transport service along the Gulf Coast region, was servicing markets across Alabama, Florida, Louisiana, Mississippi, and Georgia. These markets, however, were taken over by Uniti Group after the acquisition. In addition, Southern Light had been a critical military partner, which gave Uniti Group a deeper reach into the military sector, and strengthened the company’s position as a leading provider of data transport services. The acquisition of Southern Light and Hunt (Another data provider transport company that Uniti Group Inc. acquired almost at the same time) provides more than $250 million in annual revenue.

Before the acquisition of Southern Light, Uniti Group Inc. had acquired Summit Wireless Infrastructure LLC in the first quarter of 2016 in a deal worth $3 million. Uniti Group Inc. takes over the strong market Summit LLC had built in Mexico. The deal also included the construction of wireless towers for a major international wireless carrier. A contract that was recently awarded to Summit LLC before the acquisition. The Summit deal gave Uniti Group some economic leverage in the Mexico market and expanded its source of revenue.

In the last quarter of 2016, Uniti Group Inc. also acquired ‘Tower Cloud’ and its subsidiary ‘InLine’ in a deal worth $230 million in cash and stock. This deal was important for Uniti Group since it significantly accelerated its expansion of the backhaul network and its entry into small cell and dark fiber businesses. The deal also moved Uniti Group closer to the national wireless carriers.

Performance Overview

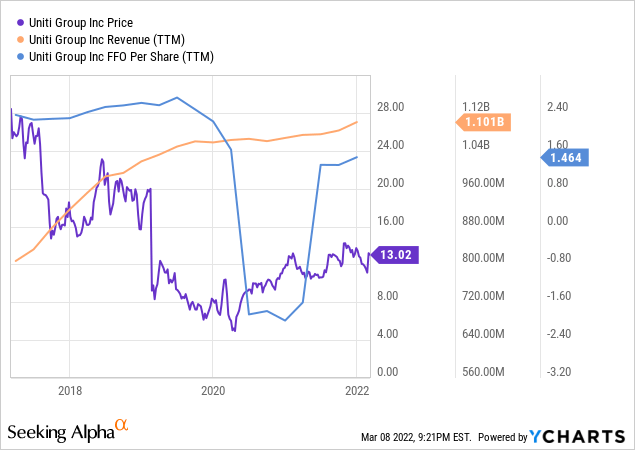

ycharts.com

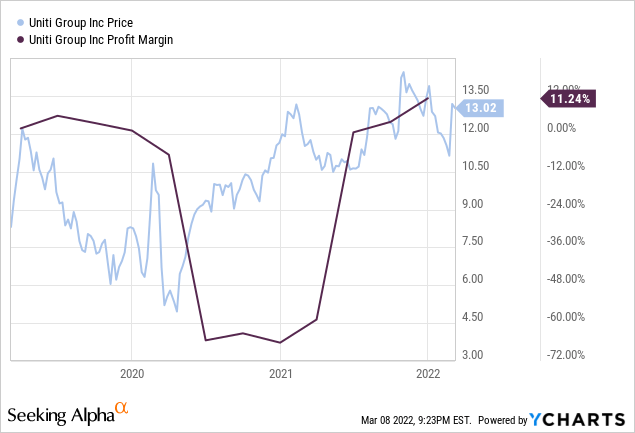

In 2017, after four years of its establishment, Uniti Group embarked on a strategic transformation to reposition the company. The result of the strategic repositioning is the promising performance the company has maintained in the last five years but most importantly, in the year 2021. The company had an outstanding performance in the last financial circle, particularly in the last quarter, with a consolidated annual revenue of $1.1billion and a Q4 2021 AFFO (adjusted funds from operations) of $0.40 per share. Several factors, including the successful addition of nearly 6000 fiber route miles to the company’s fiber portfolio, were responsible for the stunning performance. Recording a profit margin of 11% and $3.5 million of new consolidated bookings, a 40% booking increment from the previous year, Uniti ended the year positively. With a national network of 128,000 fiber route miles, the company has become one of the largest communication infrastructure providers in the United States.

ycharts.com

Going forward, the growing demand for the use of bandwidth-intensive devices and applications such as smart tools, mobile broadband, social media, and online video streaming will create a bigger market opportunity for Uniti Group. Coupled with the imminent massive deployment of the 5G network, Uniti Group Inc. will receive more market demands for its products and services in the coming years. This will therefore drive more sales for the company, and it is projected to increase its fiber portfolio effortlessly by more than twenty percent before the end of the year.

Furthermore, the prospect to unify Uniti Group Inc. and Windstream Holdings, Inc. (OTCPK:WINMQ) in a deal worth $3.5 billion could take the company’s market capitalization to $3.6 billion. An increment of $500 million, from its current size of $3.1billion. The negotiation, which started during the second half of 2021, involves Zayo Group LLC and a group of other companies. This deal has the potential to create more confidence in the company, and investors are likely to take a long position.

Meanwhile, Uniti Group Inc. reached an agreement of $40 million with Windstream Holdings on the 2nd of March 2022. This agreement will boost Uniti Group’s fiber portfolio with additional 4,100 fiber route miles from its current portfolio of 128,000 route miles. Moreover, the company’s liquidity is another bullish indicator for the company. With $419.4 million of unrestricted cash, cash equivalents, and untouched borrowing at the end of 2021, Uniti Group Inc. has enough liquidity to manage and maintain its operational growth.

Valuation and Risks

In terms of valuation from a fundamental standpoint, Uniti is in an excellent position. Looking forward, the company’s P/E ratio of 17.77 is expected to be well below the sector median of 42.22. This massive discrepancy suggests undervaluation at current price levels, and the story is only furthered by Uniti’s excellent price to cash flow of 6.38, a massive 62% improvement over the sector average of 17.08. This indicates that the company is well-geared to address any unplanned threats or downturns going forward, not that there are many of these risks to begin with.

The only major risk for Uniti is that it may face an indirect threat through Windstream. While Windstream serves as an asset to the company, it does introduce risk as a double-edged sword given its history. It’s no secret that Windstream faced a difficult bankruptcy back in 2020 – while they bounced back, it definitely does not paint the tenant in a good light. If Windstream were to face another bankruptcy, it would represent a significant hit to Uniti’s revenue, and this could cause unplanned conflict for the company. That said, based on the aforementioned valuation metrics, Uniti is anything but a house of cards fundamentally. If any issues do arise, there is enough of a buffer in the balance sheet to mitigate said issues.

Future Outlook

While Uniti Group reported a positive quarterly dividend of $0.15 and Earning Per Share for 2021 of $0.51, interestingly, Wall Street brokerages predict that the company will post sales of $276 million for Q1 2022 compared to $272 million reported for the same quarter last year. This indicates a possible growth of 1.3%. It is, therefore, safe to say that the long-term future outlook of Uniti Group Inc. looks very promising. With the above positive metrics, a higher number of institutional investors and hedge funds added to their portfolios while fewer reduced their stakes. For instance, Vigilant Capital Management LLC bought $96,000 worth of new shares position in Uniti Group in Q4 2021. Furthermore, Quad Cities Investment Group LLC purchased a new position of $167,000 worth of shares in Uniti Group in Q4 2021. Chilton Capital Management LLC also purchased a new position worth $79,000 share in Uniti Group in Q4 2021. No doubt, the stock performance of Uniti Group Inc. in Q4 2021 has opened a new floor of opportunity for both old and new investors. Institutional investors appear to have shown a renewed confidence in Uniti Group to drive more profit in the subsequent years. Currently, institutional investors and hedge funds own 82.41% of the company’s stock.

With the post-COVID renewed global interest in communication infrastructure and the possibility of Uniti’s largest client, Windstream, doing fine in the market, the future outlook of Uniti Group Inc. looks very bullish. Without much ado, Uniti Group is an undervalued communication infrastructure company that build, buy and lease fiber network to telecom companies, government agencies, small and big enterprises, and other types of customers on a long-term basis. Furthermore, Uniti Group has been able to lease fiber to top companies, including AT&T (T), Verizon (VZ), T-Mobile (TMUS), Google (GOOG) (GOOGL), and Amazon (AMZN). The company’s management is committed to its growth. Uniti Group’s strategic plan to first conquer the smaller markets and give a robust entry into the bigger markets is on course. The company is also well-positioned to benefit from the U.S. government’s multi-billion-dollar infrastructure plan to expand broadband access to the rural and underserved communities in the United States. Analysts’ perception about Uniti Group is positive, and investors’ sentiment about the company’s long-term performance is bullish. By and large, the company’s stock price could end the year with a solid double-digit gain. Based on this, I believe Uniti is a solid buy, and that a return to mid-2018 levels of approximately $19 from current prices is quite likely, given its fundamental undervaluation with respect to its sector.

Be the first to comment