Robert Way/iStock Editorial via Getty Images

Since the Russian invasion of Ukraine, luxury stocks plummeted. The sector is one of the most affected by international geopolitical tensions. In addition, Russia has always been an important outlet for fashion and luxury products, although we need to recognize that market dimensions have greatly reduced over the last few years. Recently, we have been publishing a few articles on fashion companies; as a recap, we are positive about the sector for the following macroeconomic reasons:

- We see these fashion / luxury companies as being positively impacted by the inflationary environment, LVMH has already raised price tags across the globe and we believe many others will follow. Of course, we acknowledge a negative economic momentum but we have no doubt about a solid client base.

- Across the globe, we note famous “revenge” shopping after the pandemic outbreaks. Many companies have still not fully recovered from lower tourist flow and top-line sales and profitability are still lagging.

Taking a closer look at the Italian brand, Moncler (OTCPK:MONRF, OTC:MONRY) engages in the design, production and distribution of clothing and related accessories. Its product portfolio offers not only clothing but also bags and accessories such as sunglasses and perfumes.

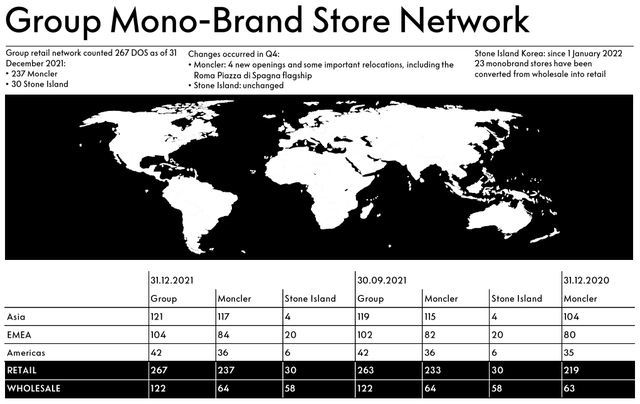

As of December 2021, the company operated 267 retail directly operated stores and 122 wholesale, including also their Stone Island brand. The company also sells its products through moncler.com, an online store. Moncler S.p.A. was founded in 1952 and it is headquartered in Milan, one of the worldwide fashion capitals.

Why are we raising our estimates? Based on our internal DCF model, we value the company €75 per share.

- At the stock price level, Moncler has suffered more than the sector average. The main reason was entirely due to seasonality and the lack of tourist flows, but we have seen quite the opposite.

- We think that in the long term the market is underestimating Moncler’s pricing power and continued store openings, which will likely lead to an upward revision of the consensus,

- We should also remember that 2022 will be an important year for Stone Island. If this first acquisition proves successful, it will be able to give management the confidence to seek other opportunities for inorganic growth.

- Due to the strong cash generation and the robust balance sheet, Moncler will further evaluate acquisition opportunities.

- Strong management is another important plus

- In Italy, family-owned businesses have better performance than the market.

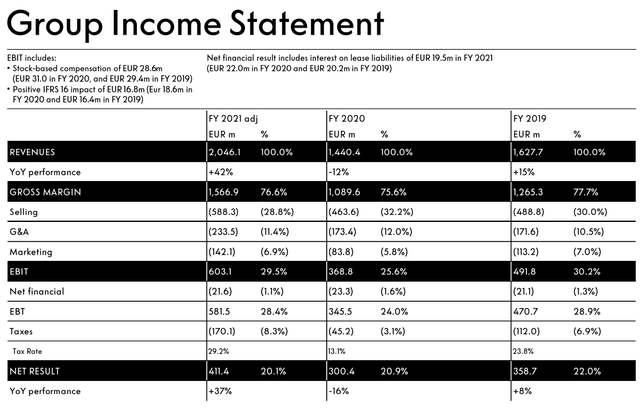

Q4 and FY Results

Revenues increased by 42% to €2.046 billion, a figure that includes the 9-month Stone Island revenue consolidation equal to €221.9 million. Net operating income almost doubled to €603.1 million compared to €368.8 million in 2020 and to €491.8 million in 2019 with an increase in percentage of 29.5% (and 30.2% compared to the 2019 result). Going down to net profit we see the same positive trend. At the end of 2021, the net financial position was positive at €729.59 million. For the outstanding result achieved, Moncler’s management proposed the distribution of a 2022 dividend of € 0.6 per share, equivalent to a total of €161.7 million, with a pay-out ratio of 41% on consolidated net profit. The dividend will be paid in late May.

ESG concern and Conclusion

Moncler has joined the fashion brands that will no longer use fur in their collections. The announcement came on the occasion of the launch of Moncler Born To Protect new collection which uses materials with low environmental impact (such as recycled nylon, polyester and organic cotton). This reflects the brand’s commitment to protecting the future of the environment.

In detail, the company has announced that it will stop purchasing fur already this year and the last collection with fur garments will be the one for autumn-winter 2023. Becoming fur-free is just one of Moncler’s moves toward a more sustainable future. Corporate objectives with the Sustainability Plan 2020-25 also include the use of 50% sustainable nylon in Moncler collections by 2025 and recycling of more than 80% of nylon production waste by 2023. In addition, 100% renewable energy will be used in all company sites around the world. No less important is the commitment to protect 100,000 people who find themselves in uncomfortable situations from the cold.

Supported by the buyback program just launched, we believe that for MACRO to MICRO reasons the company is undervalued. Based on our DCF and based on P/E ratio, we see no justification that Moncler is trading below its peer’s average sector with Prada (OTCPK:PRDSY) and Ferragamo (OTCPK:SFRGF)(not even to mention Brunello Cuccinelli (OTC:BCUCF)). We initiate coverage with €75 per share versus €50 per share at the time of writing.

If you are interested in our research in the luxury sector, please have a look at our recent articles:

- Ralph Lauren: The Polo Horse Starts To Gallop

- Capri Holdings: On Hold For Now

- Zegna: Solid Numbers Ahead Of Planned IPO

- Kering: Trading Multiple Too Low

Be the first to comment