baranozdemir/iStock via Getty Images

It is not the first time that we’re covering Clearwater Paper Corporation (NYSE:NYSE:CLW), we initiated coverage of the stock with a target price of $32 per share and since then Clearwater Paper arrived at our internal stock price assumption. We would like to comment on the Q4 results and see what might be coming next.

Source: Mare Evidence Lab’s previous publication

We do have a pretty good understanding of paper mills. To sum up, last time we were not very confident based on the following concerns:

- Inability to pass through cost increases, in particular in the more challenging sector of their consumer product division;

- Energy price and raw materials accounted for almost 84% of Clearwater Paper’s COGS. More specifically, pulp is the key input in its major category, the consumer division.

- “Since 2015, significant capacity additions have been added by producers targeting the private branded market”.

What has happened? Q4 and FY comment

Long story short, we were right. Demand is solid, but Clearwater Paper has found it very challenging to fully pass on inflationary pressures. Looking at Q4, this is pretty evident.

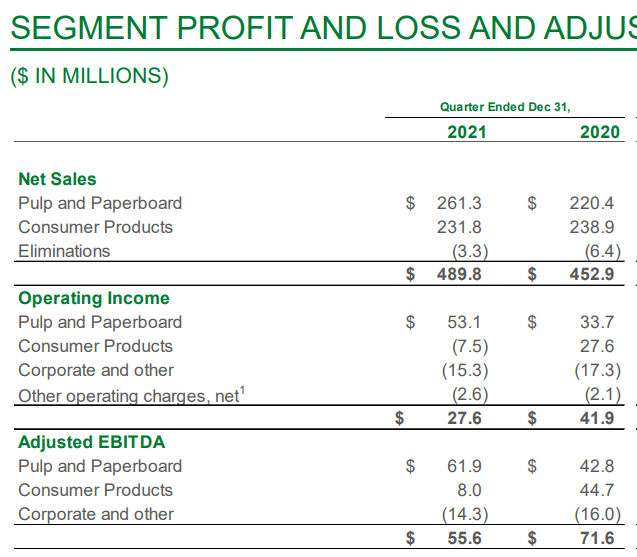

Clearwater Paper EBITDA

Source: Clearwater Paper Q4 Results

In addition and to reinforce our understanding, the management has highlighting what’s going on: “Our paperboard business reported strong Adjusted EBITDA with increased pricing and sales volume. Tissue demand stabilized, and we are implementing previously announced price increases. Our continued focus on operating efficiencies, combined with higher pricing, is helping offset some of the significant cost inflation that we are experiencing in both of our businesses.”

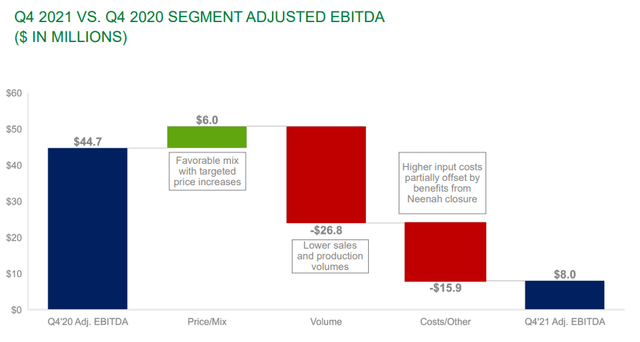

At an aggregate level, we note an increase in top-line sales of 8% and a decrease in EBITDA from $72 million to $56 million compared to the previous year-end quarter. Looking at a segment level, as we were expecting, the consumer products segment performed poorly with volumes down due to higher competition, and price increases were not sufficient to cover the inflationary pressure. This was also due to the closure of the Wisconsin facility.

consumer products segment EBITDA bridge

Source: Clearwater Paper Q4 Results

Conclusion:

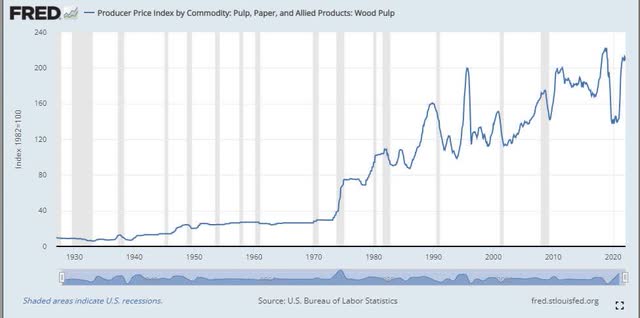

As we mentioned last time, we are expecting a sales rebound starting from Q2 (mainly driven by price increase). The company experienced a level of inflation in pulp y-o-y by 49%. A very violent adjustment compared to the PPI.

Source: Fred

Having said that and adjusting our financial forecast, we lower our target price to 30 dollars per share, maintaining a neutral rating based on EV/EBITDA of 5.5x. An additional risk is the gas price dynamic in the US which has been less severe than in Europe, but Clearwater Paper is a small company within the sector and in paper mills, size matters. For the above reason: we prefer Kimberly-Clark Corporation (NYSE:KMB) in the consumer division and International Paper (NYSE:IP) in the Industrial Packaging division.

Source: Fred

If you are interested in our previous paper mills coverage, please have a look at our recent publications:

- International Paper: Looking At The Russian Exposure

- WestRock: It’s Getting Better All The Time

- Mondi Has Ecommerce And Infrastructure Winds In Its Sails

- Clearwater Paper: Input Costs Not Priced In

Be the first to comment