KanawatTH/iStock via Getty Images

Bitcoin (BTC-USD) topped at around $69,000 in November last year. Last weekend Bitcoin hit a low of about $17,500, roughly a 75% drop from its all-time high. So, is this it? Is the Bitcoin run over? While this wave is coming to an end, it’s only a matter of time before the next one starts.

While Bitcoin’s decline has been epic, it may be a matter of months before the next bull market begins. Bitcoin is the closest thing the world has to a global currency; perplexingly, it is also the ultimate risk asset right now. Therefore, despite its long-term potential, Bitcoin will continue facing challenges through the tightening monetary phase. Bitcoin has gotten hammered in recent months, and while it may be time for a near-term rally, the ultimate low could come at around $10K. Nevertheless, I wouldn’t bet against Bitcoin for too long. The next bull market should propel Bitcoin significantly above $70,000.

Bitcoin – The Global Currency

Bitcoin doesn’t need to produce anything because it is the closest thing the world has to a global currency. One thing that has been universally true about all fiat currencies, they all eventually return to their intrinsic value, which is zero. In recent history, hyperinflation and devaluations occurred in Germany, Zimbabwe, and several post-Soviet republics. Even the mighty USD has lost about 95% of its value since the Fed took over the U.S.’s monetary system in 1913. Moreover, recent inflation readings in the U.S. have been exceptionally high, pointing to the probability of future problems for the fiat monetary system.

The dynamic is bound to be abused if you have a currency backed by nothing, with an unlimited supply. Sooner or later, the participants, or victims, catch on to this scheme, that the money supply is perpetually increasing, which leads to diminishing purchasing power of the currency and ultimately culminates in a loss of confidence and a devaluation of the paper money. Does this sound familiar? That’s right. We may be on the precipice of the fiat monetary system’s decline.

Bitcoin does not share such problems, as the digital currency is decentralized and has a finite amount that can ever be mined. Moreover, BTC exhibits all the significant characteristics indicative of a desirable currency. Bitcoin is durable, easily divisible, highly transportable, extremely scarce, widely recognizable, and impossible to counterfeit, and when it reaches its long-term value potential, BTC will become stable and consistent.

Bitcoin – A Leading Risk Asset

Bitcoin topped out in November and has dropped by about 75% (peak to trough). Incidentally, the Nasdaq topped out in November, with many top tech stocks declining by 40-50% or more.

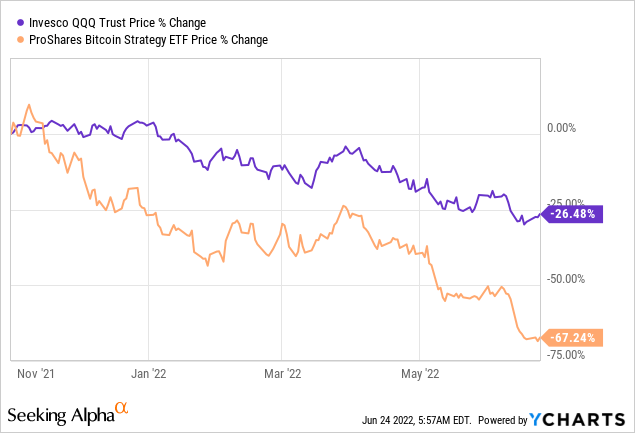

ProShares Bitcoin Strategy ETF (BITO) vs. The Nasdaq 100 ETF (QQQ)

We can see how similar the Nasdaq 100’s and Bitcoin’s price actions have been since both topped in November 2021. Their trajectories have essentially been the same, but Bitcoin has been more volatile and has dropped by a substantially more significant margin during the risk-off environment. Bitcoin had a remarkable run-up when the Fed’s monetary approach was ultra-easy. However, now that the Fed is tightening monetary conditions, we see a risk-off theme, and lots of money has flowed out of Bitcoin. Therefore, we see that Bitcoin acts as a risk asset. Thus, Bitcoin’s upside is likely limited while the Fed remains hawkish, and there is more risk to the downside until the Fed’s tightening cycle concludes. On the other hand, once the Fed switches monetary policy and begins lowering interest rates, Bitcoin should see a massive new up-cycle.

When Bitcoin Could Bottom

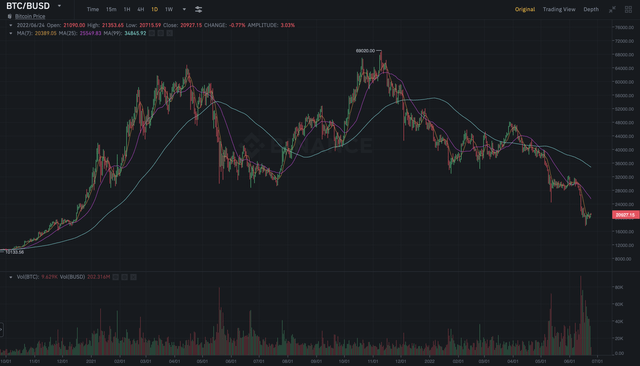

BTC – Long-Term Chart

If we look back at Bitcoin to about 2013, we see several peaks and waves. The first peak was in late 2013 when Bitcoin peaked at around $1,300. Then we had a bear market where Bitcoin bottomed at approximately $170, roughly an 85% peak to trough decline. Then we saw a massive wave into the 2017 high of around $19,500. After the 2017 peak, Bitcoin cratered to a low of approximately $3,200, illustrating another 85% decline. Next, Bitcoin surged to nearly $70,000 in its latest run-up. We’ve seen about a 75% peak to trough decline thus far, but it probably is not enough. I’m looking for a bottom at around $10,000, roughly an 85% decline from Bitcoin’s ATH. $10,000 is also a psychologically important level, and its arrival could coincide with the conclusion of the Fed’s tightening cycle.

Many Digital Assets Will Likely Not Succeed

There are approximately 20,000 different cryptos now. Some of these are functional coins, transactional tokens, stablecoins, but many are probably useless coins. Therefore, we will likely continue seeing failures in the industry, and the recent $60 billion Terra-Luna disaster is not the first or last time a popular cryptocurrency has or will collapse.

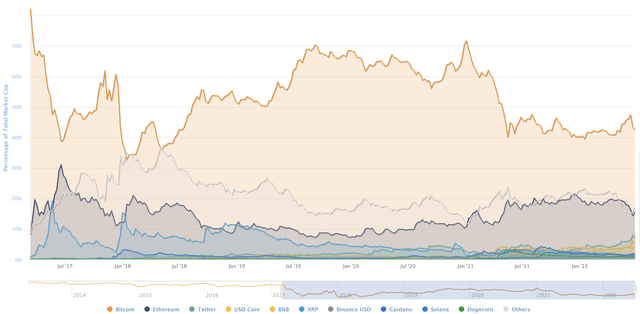

While the crypto industry’s market cap stands at about $1 trillion, Bitcoin and Ethereum (ETH-USD) account for nearly 60% of its weight. Moreover, Bitcoin and Ethereum have accounted for approximately 50-75% (or more) of the industry’s weight since about the time the digital asset industry went “mainstream” in 2017.

Bitcoin Dominance Chart

BTC dominance (Coinmarketcap.com )

While the top 10 coins account for approximately 84% of the industry’s market cap, the other 19,990 (roughly) cryptocurrencies account for only about 16%. Furthermore, this distribution ratio is not a new phenomenon. Bitcoin and the top coins continuously hold the lion’s share of the industry’s market cap, while the other currencies have about 20% or less. Therefore, new coins may come and go, but Bitcoin, Ethereum, and other time-tested systemically important tokens are here to stay.

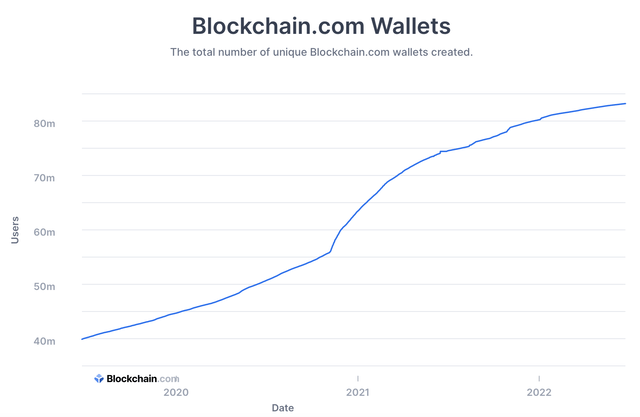

Bitcoin: The Next Bull Cycle Should Be Massive

We’ve seen about a doubling in Blockchain wallets for Bitcoin users since 2019. This dynamic illustrates robust growth, but we see only about 83 million wallets on the Bitcoin network right now. Eighty-three million is not a significant percentage when you consider that there are around 5 billion internet users around the globe. This data suggests that only about 1.7% of Bitcoin’s applicable market has been penetrated. Bitcoin’s price benefits from the network effect, and as more users jump on the blockchain, its price should rise. Eventually, we could see 5%, 10%, 15% or more of the world’s population using Bitcoin, equating to 250-750 million or more Bitcoin wallet accounts. This growing popularity dynamic should lead to waves of popularity accompanied by higher prices for Bitcoin.

Bitcoin’s price is highly dependent on Fed policy. As the Fed increases interest rates borrowing costs rise, decreasing demand for risk assets. However, there is a limit to how high interest rates can go, and once the economy is close to a recession, the Fed will likely need to reverse its monetary policy. As the Fed switches from tightening to easing to assist economic growth into and after the downturn, demand for Bitcoin and other risk assets should increase, leading to substantially higher prices for Bitcoin in the next bull market.

We’ve seen several Bitcoin bull markets, and the price appreciation from trough to peaks has been about 2,000-10,000%. Two of the three recent bull runs have appreciated by approximately 2,000% ($70 – 1,300, and $3,200 – $69,000). The huge run between 2015 – 2017 was much more, approximately 10,000%. However, if we stick to the lower-end range of estimates, going with a 2,000% appreciation from our $10,000 proposed bottom for Bitcoin, we arrive at a price target range of about $200,000 for the next top. Therefore, despite the probability of an intermediate-term decline to around $10,000, Bitcoin could appreciate to roughly $200,000 (longer-term) in its next bull cycle.

- Bear Market Bottom Price Target: $10,000

- Next Bull Market Top Prediction: $200,000

Why should you listen to my predictions?

I called for a prior bear market bottom of around $4K and the next bull market top of about $50K – 100K in early and mid-2018, and I called the Bitcoin bottom in late 2018 and reiterated my price target of approximately $75,000 for the next bull run. The rest, as they say, is history, and yes, maybe I got lucky, but you know what, I am feeling lucky again!

Risks to Consider

Bitcoin remains a volatile asset and is not suited for everyone. Numerous factors like increased government regulation, hacking, functionality issues (such as speed, cost, and scale), fraudulent activity, and other detrimental elements could impact Bitcoin’s popularity/sentiment and affect its price negatively.

Therefore, for investors with low to mild risk tolerance, a position size of 3-5% of total portfolio holdings may be appropriate. For investors with higher risk tolerance, a position size of 10% of portfolio holdings may be suitable.

It remains unclear exactly how Bitcoin’s future will play out. The digital asset could be worth a lot more than it is now several years down the line, or it could be worth a lot less.

Be the first to comment