MarsBars/E+ via Getty Images

Not all dividend investors are the same, as some are willing to live with a low yield with the promise of higher future income, while others prefer high income now. REITs, MLPs, and BDCs are ideal choices for those who fit into the latter category, and this brings me to the large BDC, Owl Rock Capital (NYSE:ORCC). In this article, I highlight why the recent dip provides an attractive entry point for high income, so let’s get started.

Why ORCC?

Owl Rock Capital is one of the “younger” BDCs on the market, having been founded in 2015. It’s externally managed by Owl Rock Capital Advisors, and since its founding, has grown to become the number 3 biggest BDC by asset size.

ORCC is focused on providing direct lending solutions to the middle market in the U.S., as defined by those companies with annual EBITDA in the $10 to $250 million range. It has a solid track record of performance, with an annual loss rate since inception of just 13 basis points.

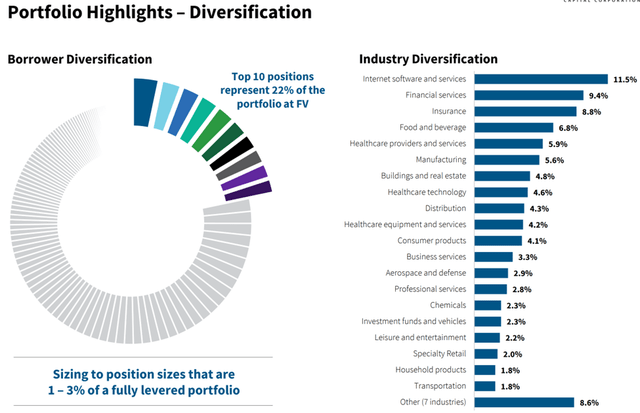

ORCC has a rather large portfolio with a $12.8 billion fair market value spread across 157 portfolio companies. This is up from $12.7 billion and 143 portfolio companies at the end of last year. The portfolio is also well-diversified across primarily non-cyclical and technology industries.

As shown below, ORCC’s top 10 positions represent just 22% of the portfolio fair value, and its top 5 borrower industries are in the durable and growing segments of technology, financial services, insurance, food and beverage, and healthcare.

ORCC Diversification (Investor Presentation)

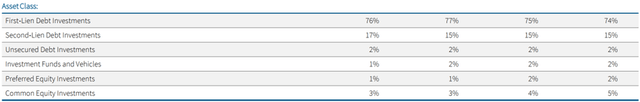

ORCC is also well-prepared for potential macroeconomic headwinds, as its portfolio is comprised primarily of senior secured debt with 74% first lien, 15% second lien, and with the remainder comprised of unsecured, preferred, and common equity (5% of portfolio) for capital appreciation upside potential. Also encouraging, non-accruals remain very low, with just 1 portfolio company on non-accrual status, representing just 0.1% of the portfolio fair value.

ORCC Portfolio Mix (Investor Presentation)

Moreover, 99% of ORCC’s debt investments are in the form of floating rate debt, making it well-positioned for a rising rate environment. This is meaningful, considering that recently Barclays (BCS) predicted a 75 basis point hike by the Federal Reserve at its June meeting. Management’s comments appear to support this thesis, as they expect to realize benefits from higher rates in the second half of the year, as noted during the recent conference call:

I’d also like to spend a minute on how we expect rate increases to impact ORCC. We expect to benefit materially from rising rates in the second half of the year. As I discussed last quarter, once rates rise through the floors on the asset side, and are reflected in our borrowers’ interest rate elections, we expect investment income to increase meaningfully. LIBOR started the year at 21 basis points and increased roughly 80 basis points over the course of the first quarter. The majority of our borrowers have 100 basis point floors, so this increase did not benefit our interest income in the first quarter.

The majority of our borrowers also reset their borrowing rate quarterly at the end of each calendar quarter. Further, as LIBOR was at roughly 100 basis points at the beginning of April, we expect the benefit to interest income to be limited in the second quarter. As LIBOR has continued to rise in the second quarter and based on our observation of the forward curve, we do expect rising rates to benefit interest income in a more material fashion, once borrowing rates reset for the third quarter.

One concern that investors may have with ORCC relates to the fact that its NAV per share declined by $0.20 to $14.88. I’m not too concerned, however, as it was related to an unrealized decline in the fair market value of the portfolio due to wider credit spreads in the market.

Looking forward, ORCC may see further asset write-downs considering macroeconomic challenges. However, there may be a silver lining, as the current equity market challenges may delay liquidity events for portfolio companies in the form of IPOs and leveraged buyouts. This could, in turn, heighten demand for debt financing solutions provided by BDCs such as ORCC.

Meanwhile, ORCC maintains a healthy balance sheet, with a debt to equity ratio of 1.17x, sitting well below the 2.0x statutory limit. Recent share price weakness has also driven the dividend yield to 9.4%. It’s worth noting, however, that dividend coverage is tight at a 100% payout ratio. I would like to see coverage improve in the coming quarters as ORCC sees the benefit from rising interest rates.

I see value in ORCC at the current price of $13.26, which sits well below its 52-week high of $15.33 achieved as recently as April. This translates to a price to book value of just 0.89x, sitting on the low end of its valuation range, which has trended at close to 1.0x for much of the preceding 12 months. Sell side analysts have a consensus Buy rating on ORCC, with an average price target of $15.34. This implies a potential one-year 25% total return including dividends.

ORCC Price to Book (Seeking Alpha)

Investor Takeaway

Owl Rock Capital is a very large BDC that’s seen material share price weakness in recent months. It enjoys a very low historical loss rate, and with non-accruals representing just 0.1% of its portfolio fair value. Looking forward, ORCC should see material benefits from a rising rate environment. ORCC is a Buy at the current price for high income.

Be the first to comment