Thomas Barwick

Investment Thesis

InterContinental Hotels Group (NYSE:IHG) is one of the world’s largest hotel companies with popular brands such as InterContinental, Holiday Inn, Crowne Plaza, and more. The company currently has a 4.2% share of the global room supply, only behind Marriott (MAR) and Hilton (HLT). Despite recent headwinds, IHG continued to invest heavily in its portfolio with 291 new hotels opened in 2021. The ongoing expansion cements its leading position and should fuel growth moving forward.

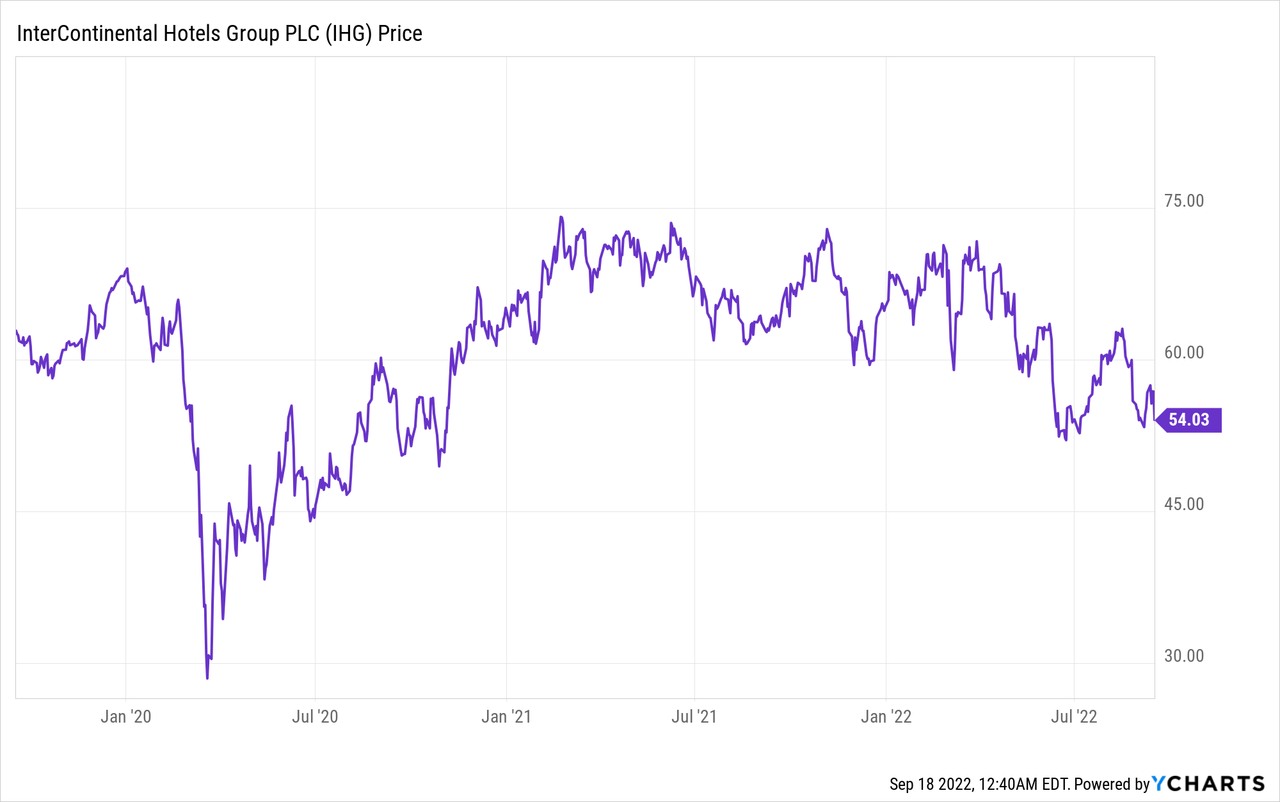

IHG was crushed during the pandemic as the world shut down and lockdowns were implemented across the globe. Shares plummeted over 40% in February 2020 as fear mongers. However, as we start to move on from COVID with broader restrictions being lifted, IHG appears to be a good rebound play for the travel industry. The company has a broad portfolio of brands targeting different demographics and it has shown significant growth as travel demand ticks up. The current valuation is also cheap when compared to other large hotel brands. Therefore I rate the company as a buy.

Strong Financials

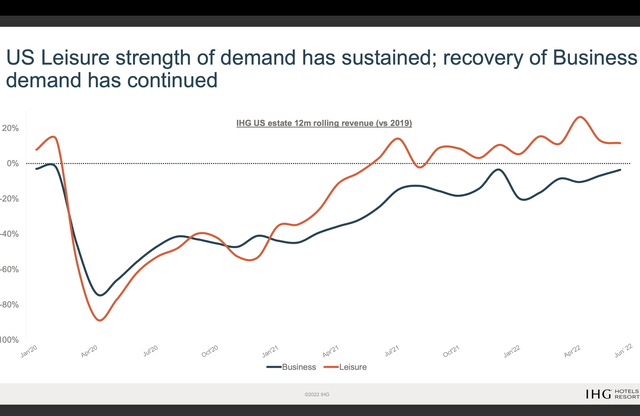

Strong pent-up travel demand continues to post significant tailwinds on IHG. The company recently reported its 1H financial earnings and the results are superb.

It reported revenue of $840 million, up 49% YoY (year over year) from $565 million. RevPAR (revenue per available room) was up 51%. The increase is primarily driven by higher occupancy rate and pricing, which were up 10% and 24% respectively. Leisure demand remains the strongest, while business demand continues to improve as corporate bookings returns. Revenue for the leisure segment has now returned to pre-pandemic levels. EMEAA (Europe, Middle East, Asia & Africa) was the strongest segment with a 184.5% growth in revenue. While China was the weakest segment as COVID restrictions tightened during the quarter. Revenue and RevPAR were down 39% and 27% respectively.

Keith Barr, CEO, on 1H results

“We saw continued strong trading in the first half of 2022 with increased demand for travel in most of our markets. This brought group RevPAR very close to pre-pandemic levels in the second quarter. Alongside leisure stays, the return of business and group travel demand continued to build over the period, and our hotels are seeing increased pricing power due to the strength of IHG’s brands, loyalty programme and technology platform.”

While top-line growth is solid, the bottom line is what impressed me the most. Operating profit was $377 million compared to $188 million, up 101% YoY. The operating profit margin increased over 1,000 basis points from 33.3% to 44%. The improving margin is mostly attributed to better costs and expense control. Adjusted EBITDA for the quarter was $413 million, up 77.3% YoY from $233 million. Operating cash flow was also up 29.7% from $259 million to $336 million. Adjusted EPS was $1.22 compared to $0.4, an increase of over 200%.

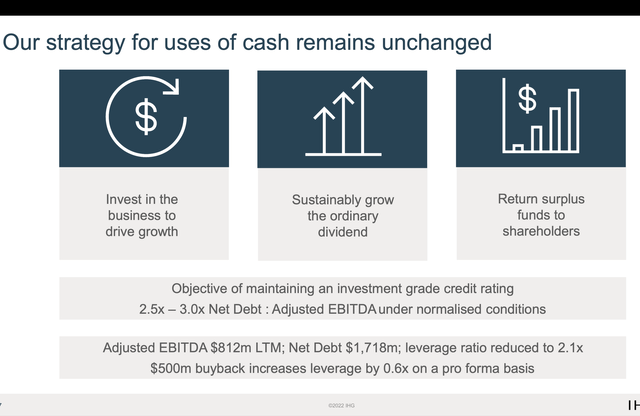

IHG continues to have one of the strongest balance sheets in the industry. The company ended the quarter with $1.36 billion in cash and $3.08 billion in debt. The net debt/adjusted EBITDA ratio was reduced to 2.1x. Thanks to its strong financials, IHG resumed its interim dividend payment of $0.44 and launched an additional buyback of $500 million, or 5.2% of its market cap. I believe we will see more dividend increases and buybacks in the future as the current net debt/adjusted EBITDA is still well below the company’s target range of 2.5x to 3x.

Attractive Valuation

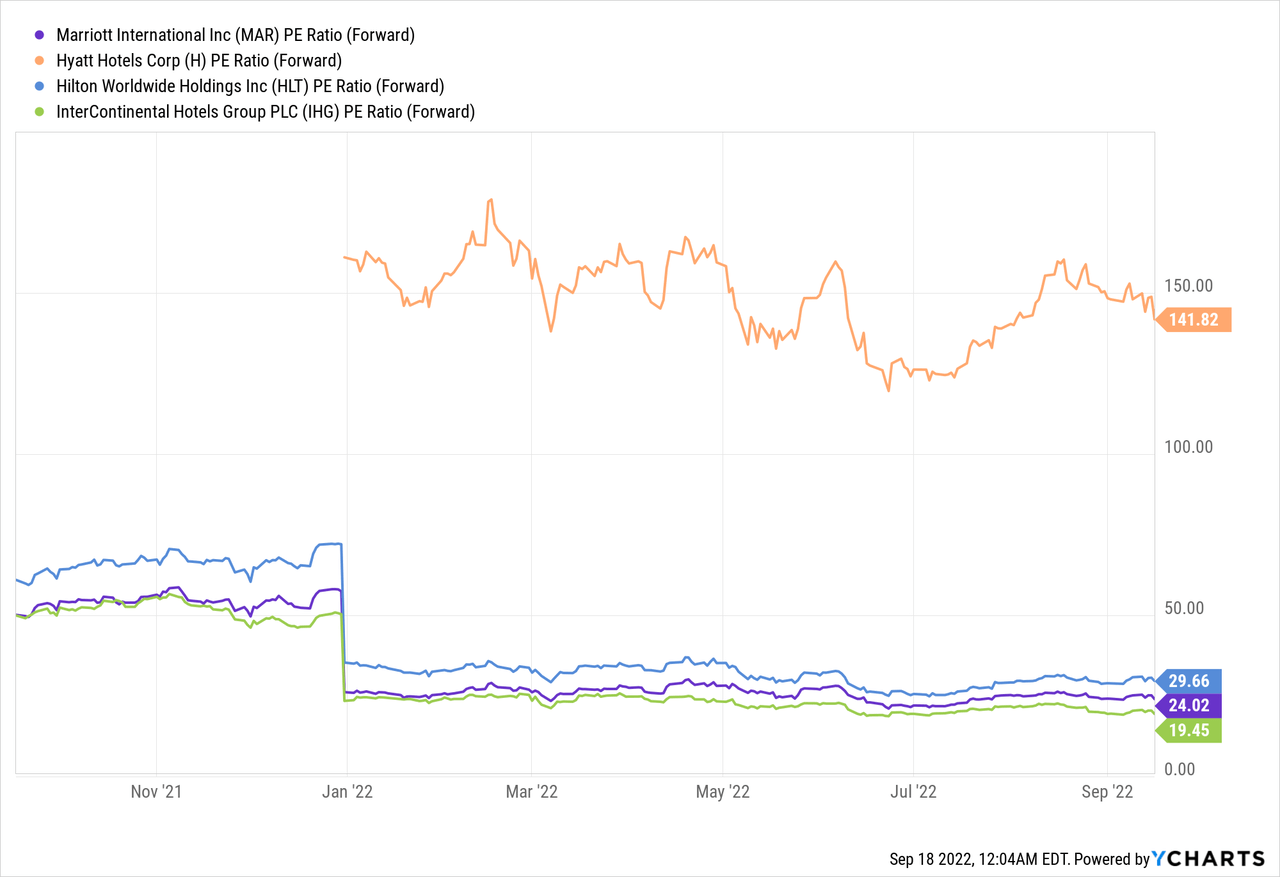

One of the main reasons I’m more inclined to IHG rather than other hotel chains is because of its compelling valuation. The company is currently trading at an fwd P/E of 19.5x, which is significantly discounted compared to its peers such as Hyatt (H), as shown in the chart below. Marriott, the second cheapest among the group at 24x fwd P/E, is still trading at a 23.1% premium above IHG. This is not to mention the robust growth rate IHG has been putting up lately. According to Seeking Alpha’s analyst estimates, the company is forecasted to post a 21.7% increase in EPS next year, which will further bring the P/E ratio down to 16x. I believe the current valuation is unjustifiably cheap which opens up significant opportunities for multiples revision back to peers’ level.

Risks

The biggest risk in regard to IHG is a recession happening. As inflation persists at high levels, the economy continues to weaken rapidly. Consumers now need to spend more on essentials due to higher prices which reduces the budget for discretionary items. The mortgage rate recently hit the highest level since the great financial crisis and most yield curves are inverted significantly. These indicators all point to a high probability of a recession happening in the near term. If a recession were to happen, consumers’ spending power would drop substantially and demand for travel would also wane. While management did reassure that current demand remains healthy, I believe this is still something investors should keep a close eye on moving forward.

Keith Barr, CEO, on the macro environment

While we understand there are uncertainties within the economic outlook, we are confident in our business model and the attractive industry fundamentals that will drive long-term growth. We have not seen signs of demand cooling. In fact, research shows that travel is among the most resilient areas of discretionary consumer spending.

Conclusion

In conclusion, I really like InterContinental Hotels Group as a travel rebound play. The company has made significant investments during the pandemic and the expansion is now paying off, cementing its leading position in the hotel industry. It reported robust top-line growth in the recent quarter and significantly improved its profitability as well. Thanks to its strong balance sheet, the company is now returning cash to shareholders through newly implemented dividends and buybacks. The current valuation is also extremely cheap when considering its recent growth, and its multiple remains well below peers’ levels. I believe the current share price offers meaningful potential upside therefore I rate IHG as a buy.

Be the first to comment