MicroStockHub

Stocks gave up early gains midday after the Bank of England’s central bank chief warned investors that support for its bond market would end on Friday. Andrew Bailey’s comments drove long-term interest rates and the dollar higher, while the pound tumbled again. The Fed’s monetary policy tentacles have a global reach that is having adverse impacts around the world. This is another reason I think Chairman Powell will be forced to pivot before year end, realizing that a slower rate of global growth in the coming year will weigh heavily on the price increases of the past 12 months. This concept seems to be lost on Fed officials like Loretta Mester, who just yesterday said she sees little or no progress on inflation, requiring the Fed to continue raising interest rates. Mester should be explaining that monetary policy works with a long lead time, while the rate of inflation is the most lagging of all economic indicators. She speaks as though the two should be on either end of a seesaw, suggesting inflation should go down at the same time rates go up, when they do not.

Finviz

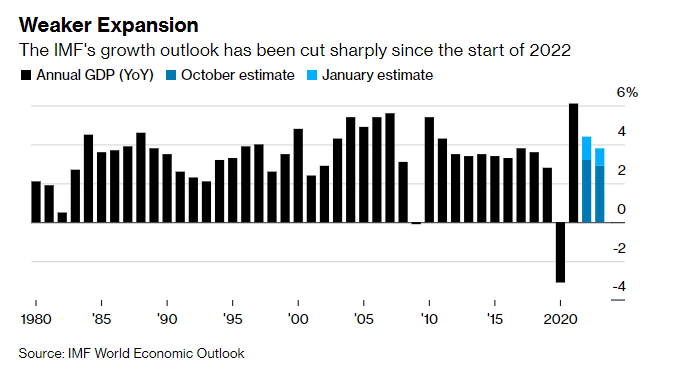

Meanwhile, the International Monetary Fund has been ratcheting down its global growth outlook since the beginning of the year with the rate expected to fall to 2.7% in 2023. It also sees one third of the global economy at risk of contracting next year, while the euro area economy grows just 0.5% and the U.S. expands at a rate of 1%. That sounds like a pretty good outcome, considering how poorly the S&P 500 has already performed in 2022.

Bloomberg

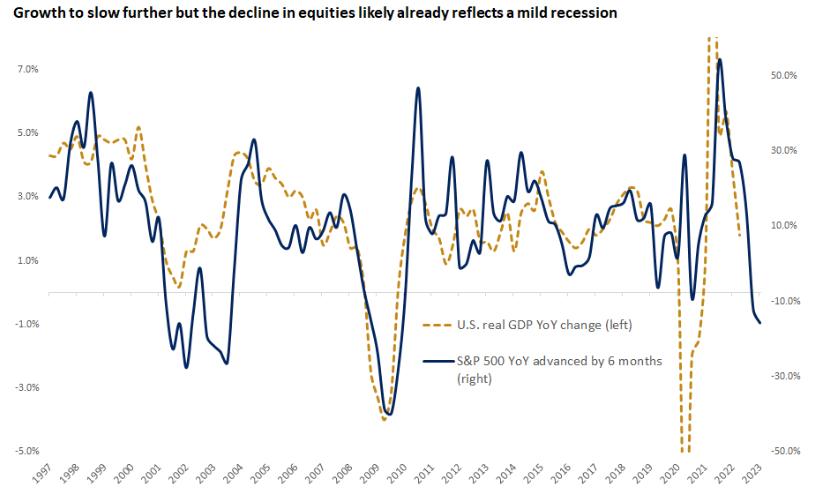

I argue that the S&P 500 has already priced in a mild recession for 2023, considering it tends to discount real economic activity by 6-12 months. If the U.S. economy avoids a recession, which is my base case, then the upside in the market from current levels is significant, as it reverses the recessionary outlook. Yet in order for this to materialize we need interest rates and the dollar to peak, while corporate profits continue to grow modestly and in line with the ongoing economic expansion. That may seem like a tall order, because it is predicated on inflation measures falling, but I think the path has been paved for such over the coming months. Tomorrow’s Consumer Price Index report should be another small step in that direction. What should be confirmed at this point is that the peak rate is behind us.

Edward Jones

A lot was made of JPMorgan CEO Jamie Dimon’s dire outlook for the economy and markets during an interview on CNBC yesterday. Let us remember that he is a disgruntled CEO who is not happy with the miserable performance of his stock and even less enthused with the stringent capital requirements being imposed by bank regulators, which he feels are weighing on the bank’s ability to grow profits. He is not an economist or market strategist. In fact, the individuals he employs for both positions have far more optimistic outlooks. Michael Feroli, his chief economist, sees real GDP expanding through 2023, while Marko Kolanovic, his chief market strategist, expects resilient earnings growth with stocks proving to be an effective inflation hedge in the coming year. I concur on both counts.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment