Editor’s note: Seeking Alpha is proud to welcome Julien Lefebvre as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Beo88

Introduction

Coty Inc. (NYSE:COTY) is one of the world’s largest beauty companies that produces and distributes fragrances, cosmetics, and skin and body care products in the personal care industry. The company sells its portfolio of brands, sub-divided into luxury and mass market products, in more than 130 different countries and territories.

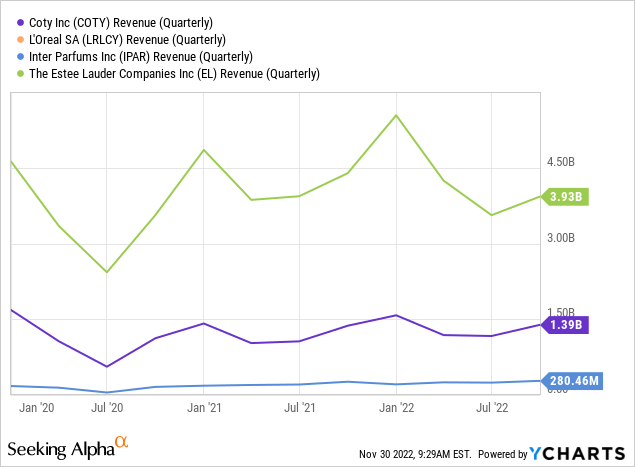

Coty is one of the industry leaders by quarterly sales, and ranks third amongst its peers. It is noticeable that the personal care industry seems fairly cyclical, and that while revenues grow, it is far from being in a start-up style growth environment. It is also noticeable that L’Oreal (OTCPK:LRLCY) generates sales outside the scale of the chart area (see below).

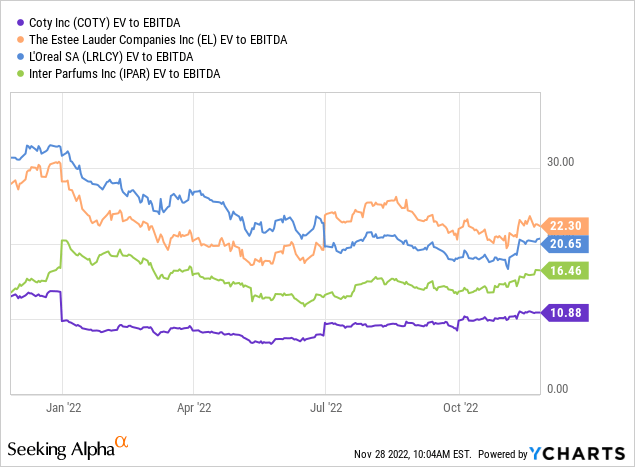

Regarding its valuation, Coty trades about 30% to 50% below its key peers based on its EV/EBITDA multiple, a gap that has started closing slightly in 2022 but remains remarkably high.

Coty has set in motion a comprehensive turnaround plan since 2020. Its poor performance and a deteriorated capital structure are the main drivers, and reflect the company’s discount compared to its peers.

In 2020, the shareholders appointed Sue Nabi as CEO and provided her with a well-aligned incentive package to bring the company back to profitability. She had successfully built a premium skin care brand prior to joining Coty and directed Lancôme for 4 years during her 18+ years at L’Oréal. The turnaround plan’s objectives focus on two main pillars, as can be seen in the 10-K (p. 31):

- Generate above-industry sales growth to recapture market share

- Re-organize and improve the company’s capital structure

In this article, we will discuss the second pillar and how it could lead to a significant appreciation in Coty’s share price. The reason for this is that competition is fierce, and the uncertain macroeconomic environment casts doubt upon the company’s ability to generate above-industry level sales growth. In consequence, we will assume that Coty’s top line remains flat for the next 5 years. I am aware that this is an extreme assumption, but it will show that even if failing to deliver on its first pillar, the stock remains a Strong Buy. Read more below on why I believe COTY stock is undervalued.

Investment Thesis

To understand how re-organizing Coty’s capital structure can increase its share price, it is essential to note that the company aims to deleverage its balance sheet down to 2x net debt to (adj.) EBITDA in CY2025 (calendar year). At the end of FY2022 (financial year) that figure was ~6x, down from ~12x in FY2021. Sue Nabi had this to say in the Q1 2023 earnings call.

[…] the Company continues to target leverage towards 4x exiting CY22 based on CY22 adjusted EBITDA approaching $950M, and continues to expect leverage of approximately 3x exiting CY23 and 2x exiting CY25.

Valuation – Assumptions

For this assessment on Coty, two simple and conservative assumptions will be made. Coty will grow its top line at merely 2% p.a. and only reach the $1 billion EBITDA objective in 2025. The company will succeed in deleveraging its balance sheet and stabilize at a 2.5x net debt to EBITDA in 2025. EBITDA will grow at a CAGR of 8.5% p.a. up until 2025. The baseline is $757 million, which yields an EBITDA of $1.05 billion in 2025. In addition, we will assume that the EV/EBITDA multiple is a reasonable metric to measure a company’s value.

To understand how changing the net debt to EBITDA ratio will increase the share price, here is a quick reminder (for those interested) of basic valuation principles:

EV = Market Cap + Net Debt

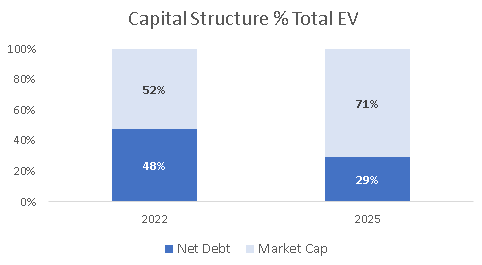

This investment case assumes stable Enterprise value, and a re-weighting of its underlying components. If Coty manages to reduce its net debt to EBITDA down to 2.5x at the end of CY2025, the EV’s share of net debt should plunge 19 percentage points down to 29%. The value of the equity (market cap) would then increase to 71% of the total EV. Consequently, and in the absence of dilutive shareholder actions, the price per share should increase.

Source: Personal Analysis, Coty 10-K

Valuation

In details, the appreciation of the share price looks as follows, according to the assumptions mentioned above:

Valuation Logic

- The 8.5% CAGR increases EBITDA to $1.05 billion in FY 2025

- I assume the company reaches a 2.5x net debt to EBITDA ratio (0.5x higher than management’s target), which implies that the total net debt sums up to $2.624 billion.

- I also assume that the EV/EBITDA multiple is a representative valuation metric, and create low, medium, and high scenarios (12x, 15x, 20x – see table below). This yields a target share price range which I find more indicative than an exact value estimation.

- The company’s shares outstanding are assumed to remain constant at 834.1 million over the period.

- Consequently, when multiplying the company’s EV and deducting net debt, successfully deleveraging the company would cause an appreciation of the equity value, and with constant shares outstanding, the share price should rise to ranges between $12 and $28.3, which mean a 54% to 265% appreciation compared to the share price as of writing this article ($7.76).

|

Deleveraging-based Valuation |

|||

|

EBITDA 2025 |

1,050 |

||

|

Net debt to EBITDA 2025 |

2.5 |

||

|

Net DEBT 2025 |

2,624 |

||

|

Low |

Medium |

High |

|

|

EV/EBITDA multiple analysis |

12.00x |

15.00x |

20.00x |

|

Implied Coty EV (USD million) |

12,596 |

15,744 |

20,993 |

|

Market Cap (EV – Net Debt) |

9,971 |

13,120 |

18,369 |

|

Shares (million) |

834.1 |

||

|

Fair Share value |

12.0 |

15.7 |

22.0 |

|

Implied Upside (baseline $7.76 per share) |

54% |

103% |

184% |

Reasons to Believe

Corporate Covenants and Deleveraging Progress

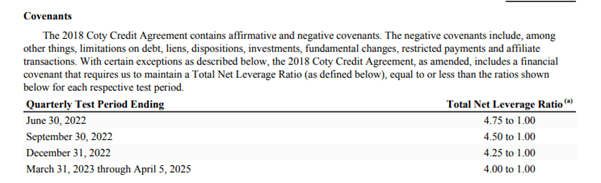

Coty’s deleveraging is not an optional procedure. Since 2018, the company has been constrained to reduce its Leverage ratio down to 4.25 at the end of 2022. Although it failed to comply in June (6x), it is now on track to successfully maintain these ratios at the end of the year and achieved a leverage ratio <4.5x in FY Q1-2023. The schedules for debt covenants are outlined on p. F-37 of Coty’s last 10-K.

Coty 10K

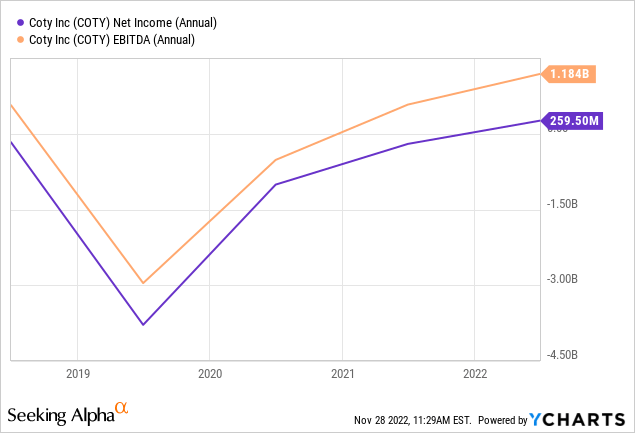

Coty’s deleveraging efforts rely on both an increase in EBITDA and a reduction in net debt. While EBITDA has considerably improved since 2020 (see below – financial performance), net debt also seems on track towards its target number. This is supported by the most recent tender offer to repurchase $200 million of debt at ~3%+ discount, caused by the increased yields in the market.

Shareholder Activism & Insider Transactions

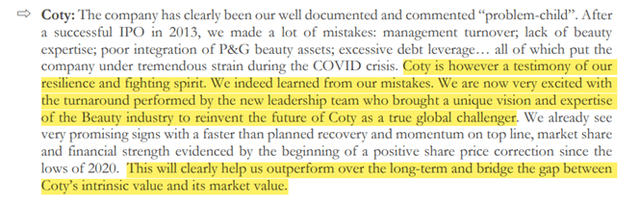

Coty’s main shareholder is a European investment fund that took its first stake in the company in 2011 and holds its position until today. The fund owns a ~60% stake in Coty’s outstanding shares. As a result, share price appreciation incentives are strong. The managers are aware of the mistakes they previously committed regarding Coty and decided to seriously revamp the company in 2020.

Source: JAB holdings investor letter 2022

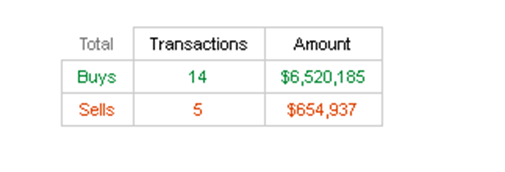

Insiders have bought $6.5 million of stock over the last 12 months. While this figure might seem minimal in today’s world, it still underlines the commitment and the fund’s determination to turn Coty around. It also suggests management’s confidence in achieving its goals.

Source: Dataroma

Management Incentives

Sue Nabi received an incentive package for succeeding in the turnaround efforts. In total, she received over 10 million shares (~$76 million) that vest during each year of her appointment. Needless to say, should the share price appreciate into the expected ranges, this compensation package would become considerably more attractive. In addition, other members of the board benefit from a $53 million equity-based compensation plan that would be triggered at a hurdle share price of $22.

Financial Performance

Coty has managed to return to profitability. Its gross margins remain stable around a juicy 63.5% of sales. EBITDA got lifted out of 2019’s deplorable results (~$-3 billion) and returned to a healthy $757 million in FY 2022 (11.6% of sales) and an annualized $1.184 billion for FY2023. It is forecast to reach $950 million in CY 2022 as per management’s latest guidance of FY Q1-2023, which makes this thesis’ model and assumptions even more conservative – and could imply an even stronger upside to the investment compared to this model’s estimations.

Risks and Limitations

- Competition: Competition in the cosmetics sector is fierce, driven by consumer trends and preferences as well as the ability to maintain exclusivity on licenses, and if Coty fails to continue regaining market share, it would put this case’s assumptions at risk.

- Macroeconomics: A downcycle in the global economy would most likely imply reductions in consumer spending worldwide, which would cause additional headwinds to the company’s growth ambitions.

- Revenue growth: Coty’s Reconquista (or turnaround) could require significant marketing expenditure if the company fails to generate the growth organically. Doing so would put its margins at risk.

- Financing: Coty’s turnaround and deleveraging plan relies on the premise that it manages to reduce net-debt to EBITDA. Should the company fail to grow EBITDA or reduce debt as per its targets (and covenants), it could risk falling into financial distress.

Conclusion

This article’s thesis supports the argument that Coty is undervalued and is a buy over a mid to long term period (3-5 years). Nevertheless, we currently face a period of significant uncertainty and risks in the markets (inflation, interest rates, recession fears). To account for this environment, I adapted my assumptions to be overly conservative. In contrast to claims that Coty’s share price could appreciate because of its expansion plans, this thesis suggests that even in the absence of growth, management’s current actions to re-organize the company’s capital structure could lead to a 54%+ to 184%+ appreciation in the share price.

Be the first to comment