sankai

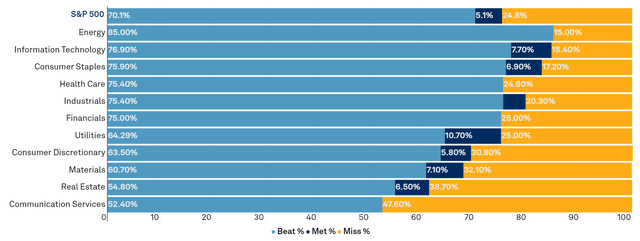

EPS Beats and Misses %

In Q3 2022, 70.1% of S&P 500 index constituents surpassed EPS expectations vs. S&P Capital IQ estimates, a 5.7% decrease from Q2. Energy led the individual sectors with 85% of firms exceeding expectations — not surprising given the success of the Energy sector this year. Information Technology which held the top spot last quarter was the second highest sector in Q3 with 76.9% of firms surpassing EPS estimates (87.8% in Q2). Information Technology was followed closely by Consumer Staples with 75.9%, Health Care and Industrials both with 75.4%, and Financials with 75%. The lowest performing sector in Q3 was Communication Services with 52.4%, edged out slightly by Real Estate with 54.8%. Following Real Estate and rounding out the bottom three was Materials with 60.7%, which is notable given that sector appeared in the top four last quarter with 77.8% of firms exceeding analyst expectations.

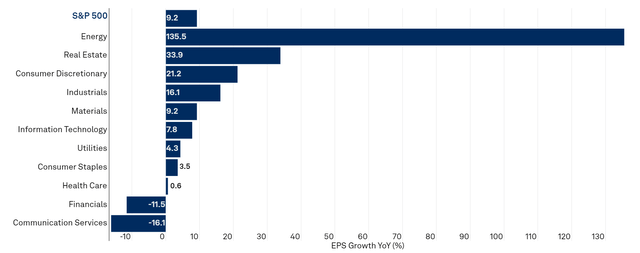

EPS Growth %

Year-over-year, the S&P 500 index recorded an EPS Growth rate of 9.2% for Q3 2022, down 1.5% compared to Q2. Energy was once again the highest growth sector with 135.5%, continuing their success this year attributed to the rising demand for oil and gas. Following Energy was the Real Estate sector with 33.9% — interesting given they were one of the lowest sectors in surpassing EPS estimates. After Real Estate we had Consumer Discretionary with 21.2%, Industrials with 16.1%, and Materials with 9.2% year-over-year EPS growth. The sectors with the lowest growth this quarter were Communication Services with -16.1% and Financials with -11.5%.

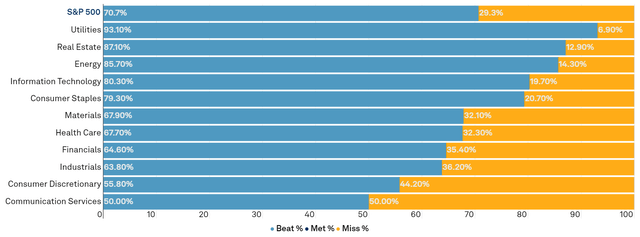

Revenue Beats and Misses %

70.7% of firms in the S&P 500 beat S&P Capital IQ Estimates for revenue in Q3 2022, down slightly from 71.5% in Q2. Utilities led the individual sectors with 93.1% of firms surpassing revenue estimates in Q3, followed by Real Estate with 87.1%, and Energy with 85.7%. These sectors all appeared in our top three for revenue estimate beats in Q2, although differing slightly with Energy first, Utilities second, and Real Estate third. The sectors with the lowest percentage of firms surpassing revenue estimates were Communication Services with 50%, Consumer Discretionary with 55.8%, and Industrials with 63.8%. Financials which was the lowest sector last quarter improved quite a bit from 53.8% in Q2 to 64.6% in Q3.

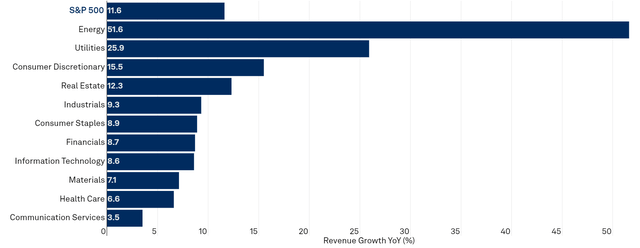

YoY Revenue Growth %

Overall, Q3 revenue for the S&P 500 grew at 11.6% year-over-year, improving slightly from 11% in Q2. The Energy sector had the strongest revenue growth with 51.6% but slowed down quite a bit compared to the 76% growth it experienced in Q2. After Energy, the next highest revenue growth sectors were Utilities with 25.9%, Consumer Discretionary with 15.5%, and Real Estate with 12.3%. The lowest growth sectors for Q3 were Communication Services with 3.5%, Health Care with 6.6%, and Materials with 7.1%.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment