hrui

After Senator Joe Manchin declared he wasn’t willing to support incentives for clean energy in a “Build Back Better’ bill, President Biden strongly implied he would declare a climate emergency in coming weeks.

“Climate change is literally an existential threat to our nation and to the world… This is an emergency, an emergency, and I will look at it that way.” President Joe Biden (Reuters)

If President Biden does in fact declare a climate emergency, that will unleash a wide range of executive powers to fight the dangers of climate change.

Declaring a climate emergency could unlock potent tools for Biden – Politico

Executive policies could include a temporary prohibition on oil and/or coal exports, further drilling limits on Federal lands and offshore, as well as surprises such as solar-powered desalination plants, Federal buildings to run on clean energy, and requirements for all Federally subsidized (almost all) mass transit vehicles to not be fossil fueled.

If a Senator Manchin can get pulled back to the negotiation table, incentives for EVs, battery research and solar tax breaks could still find their way into a streamlined “Build Back Better” bill.

More aggressive climate change policy would put a heavy thumb on the scale of stock winners and losers. Today I’ll briefly discuss decarbonization and some of the best exchange-traded funds (“ETFs”) for investing in a cleaner energy future.

Decarbonization Is A Megatrend

Clean energy is a catch-some description for what is more rightly called decarbonization. Along with digitalization and decentralization, decarbonization has been labeled as one of the megatrends of the next decade by governments, international organizations, major business services, research firms and various industrial companies:

Decarbonization, digitization and decentralization are accelerating the countdown to a new energy world faster than expected – EY.

Digitalisation and decentralisation: How to unleash the full potential of this synergy for decarbonization? – IEA.

How Decarbonization, Digitalization and Decentralization are changing key power infrastructures – Università di Palermo.

Digitalization and Decarbonization: Optimizing Humanity’s Largest Machine – Power Magazine.

Guest Article: Digitalizing Energy: The Way Forward for Decarbonized Systems – IISD.

Decarbonization – Siemens Energy.

Decarbonisation, decentralisation, digitalisation, top three trends across energy says Arthur D Little – Business Transformation.

Those pieces, from diverse sources, give you an idea of the depth of brain power and capital deployment that is currently going on to reduce humanity’s carbon footprint. A few simple searches can yield hundreds more links. I urge those looking to learn to look at the plans of most Russell 3000 and large international companies.

Ultimately, it does not matter what you believe about climate change and climate change policy. The movers of capital – government, financial institutions, private equity, industry and the very wealthy – are moving massive amounts of money to fight climate change.

What did (my and probably your) grandpa say about figuring things out. “If you want to know why things are happening, follow the money.”

Here are some things we know:

- there is a massive divestment movement away from fossil fuels.

- over 100 governments signed the Paris Agreement to fight climate change.

- thousands of companies are doing what they can to move towards clean energy, more efficient buildings and more carbon neutral processes.

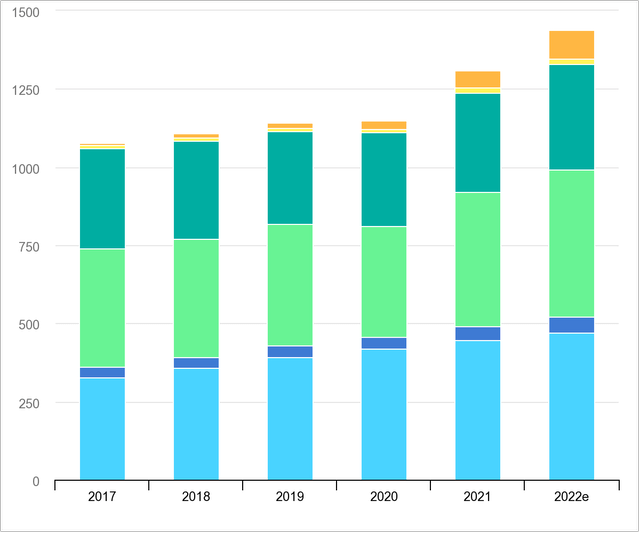

- Investment in battery energy storage is expected to more than double to almost $20 billion in 2022. [IEA]

- Clean energy investment has grown to over 12% per year since 2020 and is now over half of all energy spending despite recent rises in prices for oil and natural gas. [IEA]

- California is already at 60% of the state’s electricity from renewable and zero-carbon sources according to the California Energy Department.

- FERC (Federal Energy Regulatory Commission) has proposed new rules for interconnection of renewable energy sources to the grid, primarily solar, that could lead to up to 80% of U.S. electricity needs being fulfilled by alternative energy once the backlog was cleared sometime in the 2030s.

I will do a series of pieces on the future of energy after Labor Day, but given the news this week, I wanted to put this piece out about clean energy ETF investing right away.

Largest Clean Energy ETFs

For my initial screening and selection, I stuck with clean energy ETFs that offered at least a 5-year track record and had over $500m under management. I look for size of an ETF, along with average volume, to make sure that the funds are adequately liquid.

My simple screen reduced the field to:

- iShares Global Clean Energy (ICLN)

- First Trust NASDAQ Clean Edge Green Energy ETF (QCLN)

- Invesco WilderHill Clean Energy ETF (PBW)

- Invesco Solar ETF (TAN)

I added the ALPS Clean Energy ETF (ACES) as it has grown quickly in it’s just over 4 years, as well as, had competitive performance.

I excluded the largest wind ETF, the First Trust Global Wind energy ETF (FAN) mainly because growth is rolling over in the sector in favor of solar, as well as, the ETF did not meet my assets under management criteria, nor did it have strong investment performance.

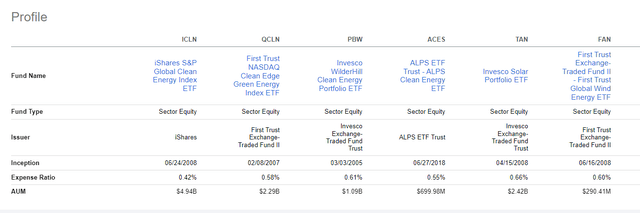

Here’s a summary comparison from Seeking Alpha.

Large Clean Energy ETFs (Seeking Alpha)

You can see that the expense ratios are relatively similar, so I do not see that as a significant differentiator.

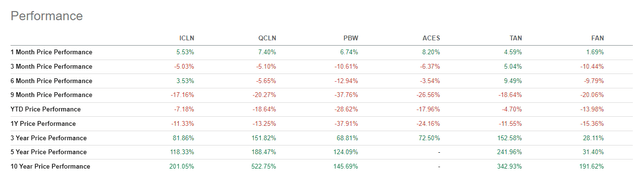

From a performance perspective, we can see the leaders over recent time periods. I focus on 5 years where I can.

Clean Energy ETF Performance (Seeking Alpha)

A few newer and smaller ETFs showed competitive 3-year performance, but are similar enough to at least one of the larger ETFs I am not including them either. I do continue to monitor though in case things change.

We see that QCLN and TAN were the largest winners over 3, 5 and 10 years. The obvious question is “why did those do the best?”

Ultimately, performance is based on security selection. Industry asset allocation, global vs domestic and market cap range are all important factors.

Here are the sector allocations for the five ETFs I’m focusing on.

| Sector | ICLN | QCLN | PBW | ACES | TAN |

| Utilities % | 39.38 | 10.81 | 9.06 | 31.68 | 19.73 |

| Technology % | 37.56 | 40.72 | 28.18 | 24.68 | 71.68 |

| Industrials % | 19.58 | 11.25 | 29.30 | 11.01 | 3.91 |

| Basic Materials % | 2.97 | 12.09 | 11.04 | 7.63 | 2.43 |

| Energy % | .08 | – | – | .15 | |

| Consumer Cyclical % | – | 23.82 | 21.42 | 21.33 | |

| Real Estate % | – | 1.15 | – | 3.4 | 2.33 |

| Financials % | – | – | 1.19 |

We can see that QCLN and TAN are both heavy in technology. Second for QCLN is consumer cyclical which was strong during the time frames identified. Second for TAN is utilities which are primarily Yield Cos.

Let’s take a comparative look at all top 10 holdings of the ETFs by percentage exposure (the ETFs may hold some exposure that is not in their top 10, in which case I did not track it down, also, I used Schwab’s data as it was the newest I could find):

| Company / Industry | ICLN | QCLN | PBW | ACES | TAN |

| Enphase (ENPH) | 8.3 | 9.4 | 5.6 | 11 | |

| SolarEdge (SEDG) | 7.3 | 4.4 | 9.8 | ||

| Consolidated Edison (ED) | 5.8 | ||||

| Vestas Wind Systems (OTCPK:VWDRY) | 6.7 | ||||

| Orsted (OTCPK:DNNGY) | 4.8 | ||||

| Plug Power (PLUG) | 4.0 | 3.4 | 5.0 | ||

| EDP Energias de Portugal (OTCPK:EDPFY) | 3.5 | ||||

| Xinyi Solar (OTCPK:XISHY) | 3.3 | 5.7 | |||

| First Solar (FSLR) | 3.1 | 4.9 | 6.3 | ||

| Adani Green Energy | 2.4 | ||||

| NIO Inc (NIO) | 9.4 | ||||

| Tesla (TSLA) | 8.8 | 5.4 | |||

| ON Semiconductor (ON) | 7.9 | ||||

| Albemarle Corp (ALB) | 6.7 | ||||

| Brookfield Renewable (BEPC) | 3.3 | 5.2 | |||

| XPeng Inc (XPEV) | 3.3 | ||||

| Wolfspeed (WOLF) | 3.2 | 1.6 | |||

| Canoo (GOEV) | 2.3 | ||||

| Lordstown Motors (RIDE) | 1.5 | ||||

| Joby Aviation (JOBY) | 1.5 | ||||

| Quant Services (PWR) | 1.5 | ||||

| QuantumScape (QS) | 1.4 | ||||

| EVgo (EVGO) | 1.4 | ||||

| Advanced Energy Industries (AEIS) | 1.4 | ||||

| Blink Charging (BLNK) | 1.4 | ||||

| ESCO Tech (ESE) | 1.4 | ||||

| Lucid (LCID) | 5.6 | ||||

| Rivian Auto (RIVN) | 5.4 | ||||

| Northland Power (OTCPK:NPIFF) | 5.3 | ||||

| NextEra Energy (NEP) | 5.2 | ||||

| Sunrun (RUN) | 4.8 | 4.7 | |||

| Daqo New Energy (DQ) | 3.8 | ||||

| JinkoSolar (JKS) | 3.0 | ||||

| Encavis (OTCPK:ENCVF) | 3.0 | ||||

| GCL Tech (OTCPK:GCPEF) | 6.9 | ||||

| Atlantica Sustainable Infrastructure (AY) | 2.6 |

As you can see, the ETFs have significantly different top holdings. Here’s what jumps out at me:

- ACES and PBW have significant start-up EV makers. I’m not a big fan of that. I believe that Tesla and the legacy automakers have huge advantages. Not that a few of the start-ups won’t make it into some niches, but I don’t see many, if any, of them growing to be very big and many will go bust. I also don’t like ACES big utility holding as I believe utilities will be challenged, as they have stated, in a decentralizing power grid. So, by virtue of big holdings in start ups and utilities, I won’t use ACES. PBW on the other hand has more holdings and smaller stakes. It’s also a global SMID cap fund which has a good outlook. I want some exposure to EV makers, but not much, and I do like the global SMID cap exposure, so I am going to have a small stake in PBW.

- QCLN has done well largely due to significant Tesla stake. Without that stake, the fund would fallen back in with the pack on performance. I typically own some Invesco QQQ (QQQ) which has a significant Tesla stake, so, the question I ask here is, do I want more via a clean energy ETF? The Albemarle, ON and Brookfield Renewable stakes might jump out to my readers. I have mentioned all three as potential buys at the right prices in recent years. Wolfspeed is interesting to me too. If you aren’t getting overexposed to Tesla, I think this is a good holding with other complimentary pieces around it.

- ICLN is popular, but I do not like so much utility exposure. There simply aren’t that many utilities that get me excited. If you want a slower go utility anchored approach, you can certainly mix this in. It’s just not for me.

- TAN is a specialty ETF in what I believe could be the fastest growing industry in the world the next 10-15 years. Enphase and SolarEdge act as a duopoly at the moment, although they are going to cede some market share to a handful of challengers over time. Still, inverters, storage and distribution are growing at huge clips, even with a little less market share they will do well. There is China exposure which I warned about in late 2019 and early 2021, but, as a couple recent member articles pointed out, it just might be time to own some Chinese stocks again within a basket. I will be using TAN as a small core holding and as a small trading position.

My Clean Energy Investing Summary

I am going to use the 3 ETFs mentioned in my portfolio:

- QCLN for large cap exposure.

- PBW for SMID cap exposure.

- TAN for solar overweight and trading.

I will also own a basket of about a dozen stocks for focus, to get my exposure to the decarbonization megatrend. That exposure will be broad and encompass some of the digitalization and decentralization themes in as much as they impact decarbonization.

Be the first to comment