Fokusiert

Buy low, sell high. Easy to do in theory, but hard in practice. There are two main reasons for this. The first being that human nature tends to exude a lot of fear of missing out or FOMO. Hence, we tend to chase things after they have gone up. The other reason is that point one also makes it less likely that we have capital left to buy low. While the market as a whole remains expensive, there are of course opportunities today to pick up assets at bargain prices. One such sector is perhaps the cannabis sector. We will look at that today and an ETF that focuses on it.

Cannabis Sector

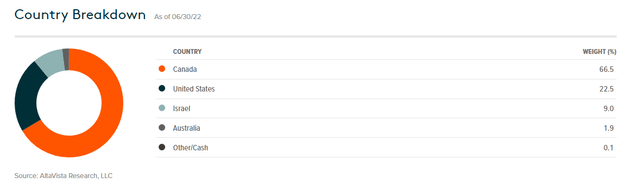

We have covered this sector before and generally focused on Canopy Growth Corporation (CGC) and the Canadian market (See 5 Lessons From The Pot Bubble Burst). If that title and the related articles sounded incredibly bearish, you were not hallucinating. The Canadian expansion for the most part turned out to be an extremely unprofitable venture for companies and one that left many investors scarred for life. The US is different in a few ways, and that’s where the protagonist for today comes in.

AdvisorShares Pure US Cannabis ETF – (NYSEARCA:MSOS)

The fund’s website starts off by telling you that the US Cannabis market represents perhaps one of the largest untapped growth areas in the world. While ETFs prop up all over the place and most do little other than get you into a common index chasing exercise, MSOS actually does serve some purpose. To start off, MSOS is the first actively managed U.S.-listed ETF with dedicated cannabis exposure focusing exclusively on U.S. companies. The portfolio manager allocates across Cannabis operators and related companies. While that may sound like an obvious endeavor, other Cannabis ETFs don’t actually do this. The reason being that it’s not allowed for ETFs to have direct exposure to what is illegal at a Federal Level. So Global X Cannabis ETF (POTX) the other ETF we have written about before, has dedicated itself to Cannabis exposure primarily in Canada.

The US side, while present, is mainly for Cannabis oil or CBD.

MSOS has managed to get this exposure via total return swaps, which surprisingly are not illegal (though direct investment is).

Holdings

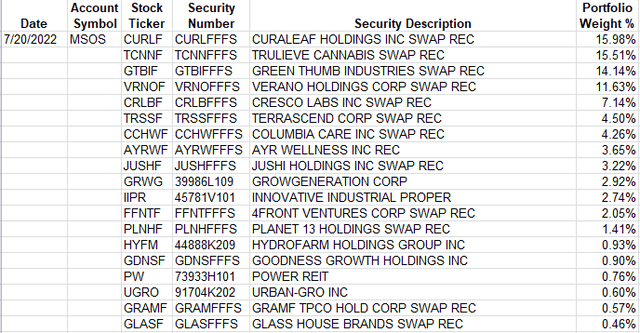

The manager understands that total return swaps are confusing for the average investor and has a page on their website dedicated to talking about this.

To help offset some of the counterparty risk, we may retain a portion of cash as collateral by not paying for the swap in full. For the amounts we hold back as collateral, the ETF is charged a small amount of interest, and conversely, the collateral cash we hold back is typically invested in a money market fund where we earn a small amount of interest.

For example, if the portfolio manager buys $10,000,000 of exposure to Green Thumb Industries (ticker: GTBIF) via a swap, the Portfolio Manager may only post $4,000,000 to the swap counterparty, the Fund will keep the rest as collateral cash. So the Fund may show $10 million of GTBIF, $6 million cash, making the ETF look like it has more investable cash, however that cash is only collateral cash.

Source: MSOS

This was a great idea as the MSOS roster is full of total return swaps.

The top 5 plays include

1) Curaleaf Holdings, Inc. (OTCPK:CURLF)

2) Trulieve Cannabis Corp. (OTCQX:TCNNF)

3) Green Thumb Industries Inc. (OTCQX:GTBIF)

4) Cresco Labs Inc. (OTCQX:CRLBF)

5) TerrAscend Corp. (OTCQX:TRSSF)

Investors might have noticed the fact that all of these have five-letter symbols (as in OTC markets), and that is another purpose that MSOS actually serves. You would have to go outside your regular comfort zone of major exchanges to buy these stocks, and MSOS provides a more liquid choice.

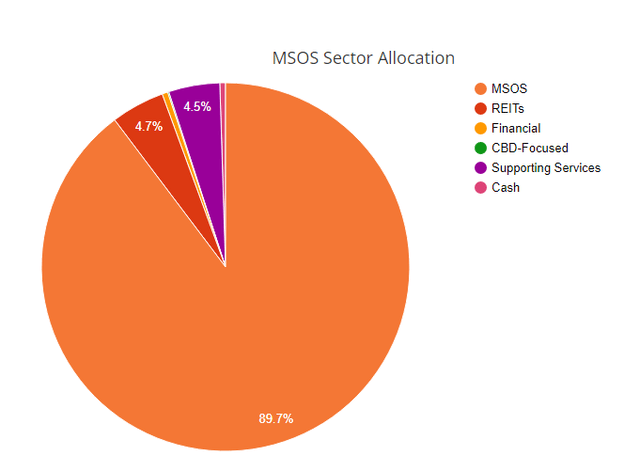

Outside the OTC companies, MSOS does have some exposure to CBD-focused companies and REITs that focus on Cannabis operators like Innovative Industrial Properties, Inc. (IIPR).

The REITs that focus on this space are actually very interesting in their own right as they’re likely to benefit in a “status quo” situation. IIPR is a prime example of that and the company has a compelling short case presented by Blue Orca which can be read here. The summary of that can be stated as the Cannabis-focused REITs can charge exorbitant above-market rents simply because the banks have stayed away from this business. So while the majority of the companies in this ETF would benefit if Cannabis legalization moves ahead, it won’t be all of them.

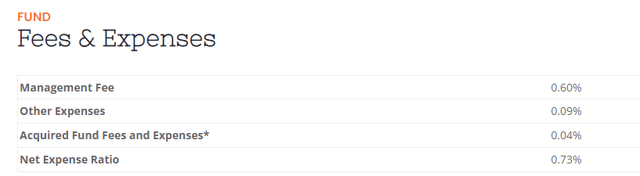

Fees

ETF fees have been trending down over the years, so 0.73% may come as a slight surprise to some.

We don’t think it is a lot in this case, as executing total return swaps is a far more complex area than the regular closet investing ETFs do these days.

Outlook

The extremely bullish outlooks that you see on most websites promoting the future of Cannabis tend to come from rather optimistic assumptions. The idea is that widespread legalization means that the market size can grow exponentially.

The North America legal cannabis market size is expected to hit USD 47.5 billion by 2030, registering a CAGR of 15.3% from 2022 to 2030, as per a new report by Grand View Research, Inc.

Source: PRN

15.3% compounded not good enough for you? Here is a projection for $72 billion total.

U.S. cannabis sales is estimated to rack up a whopping $57 billion by 2030, according to a top researcher. But hold up: That figure could top a whopping $72 billion if the 18 additional states that seem likely to legalize activate their markets.

Source: Forbes

Reality will likely prove these numbers to be way out of whack. Canada, which is trying this experiment out for some time, showed that the early entrants massively overestimated market potential. This led to huge overinvestment in capacity and extremely poor margins. In fact, CGC, the poster child for all that is wrong with companies investing for growth, had negative 32% gross margins in the most recent report. Revenues of $111.8M were 25% lower than last year. Not only Canadian market topped out years before anyone originally forecasted, but the largest incumbents are all loss making at this point, with no clear path to profitability.

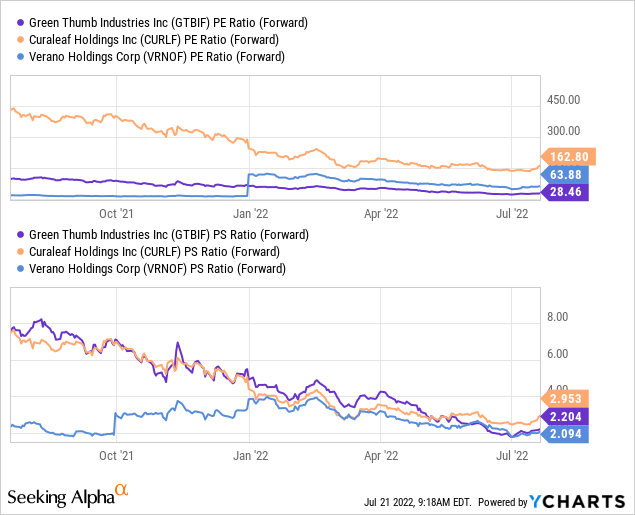

Of course, US has 10 times the population of Canada, and economies of scale are more likely to work here. The major operators, which are the top 5 holdings of MSOS, all show profitability today, despite some major headwinds. They are also quite cheap on a price-to-sales basis.

So on a longer-term basis, one does not necessarily have to “buy” into the super growth thesis to make money from here.

Legalization A Game Changer?

MSOS investors have long focused on legalization as the game changer, and it likely is to a good extent. The news this week once again ramped up speculation on this front.

The Senate Judiciary Subcommittee on Crime and Terrorism, chaired by Sen. Cory Booker (D-NJ), is expected to meet on Tuesday for the discussion.

The meeting titled “Decriminalizing Cannabis at the Federal Level: Necessary Steps to Address Past Harms” is expected to take up a long-anticipated measure that Senate Democrats planned to introduce this week to legalize marijuana at the federal level, Marijuana Moment reported.

Source: Seeking Alpha

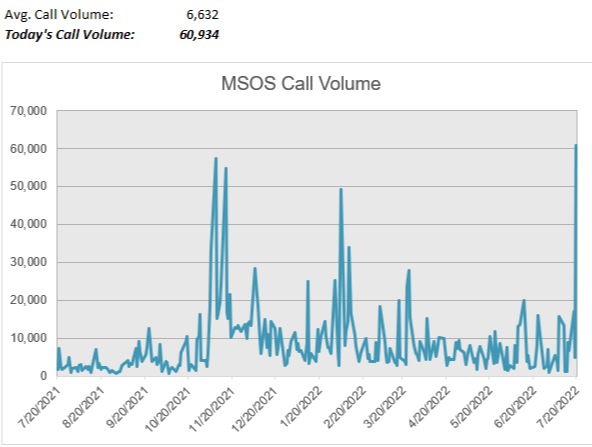

We would not get too optimistic in the short term, as these things take a lot of time. Investors have also heavily positioned for a big jump up as evidenced by the huge call purchases.

MSOS Call Volume

That is likely to act as a headwind to returns in the next few weeks. The chart of MSOS also shows how often investors have jumped in with the same idea. The rallies below correspond to the call buying above.

MSOS Chart- Twitter

Verdict

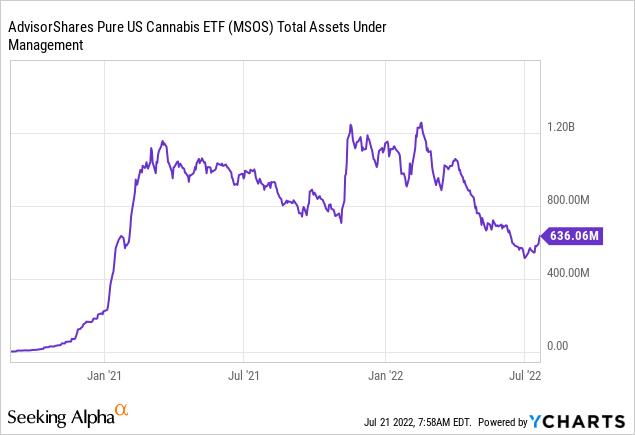

We think MSOS has long-term potential, and we could easily see it double or even triple in the next five years. The active management and access to OTC names make this worth the 73 basis points of fees. Current assets under management remain modest and hence suggest that the crowd has not got in.

Extreme call buying remains a shorter-term headwind for investors and quick legalization hopes are likely to be dashed. For longer-term profits, the legalization bills need to step beyond just removing the criminal aspect of the product, they need to do away with 280e taxes. This older article helps investors understand this.

While the latest bill offers cannabis companies some financial reprieve, Handwerger says it fails to address the biggest issue plaguing them – the Section 280E tax code, which prevents businesses from deducting conventional business expenses from gross income associated with the “trafficking” of Schedule I or II substances, as defined by the Controlled Substances Act.

“The industry needs this to change because otherwise, the cost of buying legal cannabis will forever remain above what it should be given that these businesses absorb the tax through their profits,” he says. “The result is that they have to charge accordingly in order to be able to turn an adequate profit at the end of the day for those investors, so it’s really unfair for the whole marketplace.”

Source: Newswise

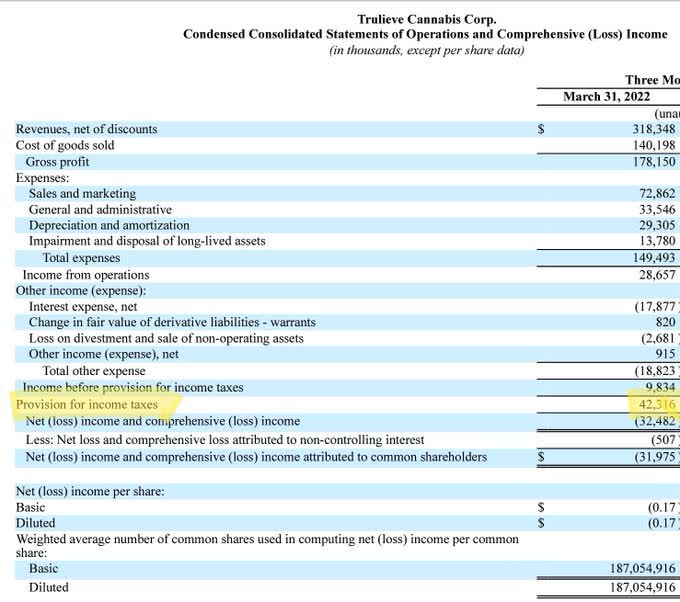

These taxes are brutal, and their potential reversal represents the biggest upside case we can see. TCNNF, for example, booked $42.3 million of taxes on $9.8 million of pre-tax income.

TCNNF Q1-2022 10-Q

The absurdity of this is pretty obvious.

We like MSOS here, but we would not expect mega returns that some investors are extrapolating.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment