Editor’s note: Seeking Alpha is proud to welcome Value Guardian as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Getty Images

Many investors like BYD (OTCPK:BYDDF) because they think it is anti-Tesla (TSLA); low-profile, pragmatic, has good R&D and decent products, and is leading in EV market. However, it should be noted that BYD is far below Tesla in terms of competitiveness. BYD still faces major challenges, which are the failure for internalization, the bad cost control, the uncertainty of new business, and the potential earning quality problems. However, the current market valuation is extremely optimistic, which in our view is likely to be corrected.

We acknowledge that BYD’s long-term efforts on R&D and branding are gradually paying off

BYD entered the new energy industry in 2003. With the continuous investment in research and development in recent years, BYD now has certain advantages in certain technology compared to local peers. The fact that the Blade Battery, a LFP type battery invented by BYD, will be booked by Tesla is the best proof for the argument because it will make BYD become the second Chinese name in Tesla’s battery supplier list (after CATL).

In addition, BYD has made breakthroughs in branding as its premium EV models, represented by Han, have gained major popularity in the local market. China is currently the world’s largest NEV market. With the rise of local brands in China in recent years, the brand effects of local OEMs have been enhanced. BYD Han, with the target price of CNY 200,000 to 300,000 (about USD 30,000 to USD 45,000), which is almost the highest level of Chinese brand models, sold 117,665 units in 2021, ranking the top model in the premium EV models among Chinese brands. We think BYD Han gradually realized product differentiation by the emphasis on its technology edge as well as the successful marketing of authentic Chinese history elements. BYD NEV sales remained solid in the first half of 2022, ranking the first place in the country. Certainly, BYD’s past efforts are currently being paid off.

BYD is still a local company and lacks international competitiveness

Relatively low brand acceptance, unconvincing product quality and cultural barriers make BYD entrenched in local market. A reasonable investor should not forget that BYD receives the third most complaints related to products and services among local brands. Although BYD has made breakthroughs in local premium market in recent years, the majority of its products are still cheap models, such as Qin and Song. We think BYD lacks international competitiveness, and we don’t think a company entrenched in one market is a great company.

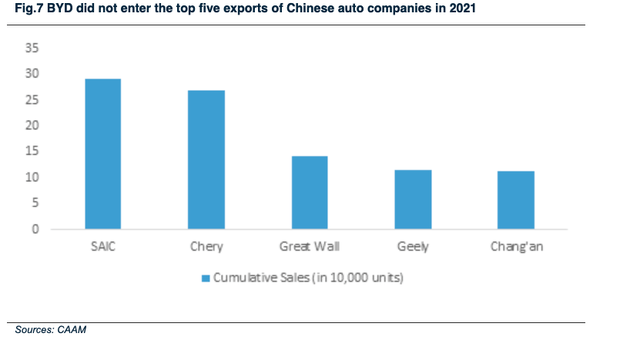

One may argue that most Chinese car brands do not possess a strong international presence either. However, local brands such as Geely (OTCPK:GELYF), which we deem mostly comparable to BYD (in terms of background and size), have far more exports.

The current marketing strategy of BYD also raises questions how it can compete overseas. As we know it, BYD markets its models according to the names of ancient Chinese dynasty—Qin, Han, Tang, etc. While a such marketing strategy could attract certain local consumers, it could be less impressive or even confusing for global customers.

BYD’s low export (Image created by author with data from CAAM)

BYD is heavily dependent on government support. In subsidy alone, BYD’s 2021 Annual Report shows it received CNY 2.3 billion government grants in 2021, accounting for about 57% of its net income in that year. Other kinds of government support that benefit BYD include business purchases motivated by local government. For example, most of taxi running in Shenzhen (which is where BYD based on) are BYD EV models.

Bulls like to say BYD will beat Tesla, at least in terms of sales volume. While it is true that BYD deliveries (638,157) exceed Tesla in 1H22, it should be noted about half of them are PHEV (314,638). Is PHEV really EV? It depends. For example, Shanghai stipulates that from 2023 PHEV will not be qualified to receive green plates, which are important for many EV privileges.

BYD’s overall operation efficiency has been limited by its close-loop system

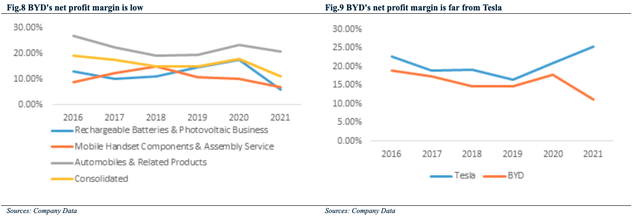

BYD is famous for its establishment of a closed-loop, self-supplied system (analysts like to call it the vertical integrated system). Although such a system ensures stability of supply and production, it is at the expense of long-term operation efficiency and cost control, not mentioning the above-mentioned conflict of interest concern. As a result, BYD’s net profit margin has been consistently at a low level (though the low margin mobile phone parts and assembly business explains part of that) and could be further halved by adjusting the said government grants BYD received.

BYD’s low margin (Image created by author with data from Company data)

Contributions of power battery business are uncertain

BYD’s blade battery is said to be able to improve the performance of electric vehicle batteries in terms of safety, cycle life and range, which is predicted to have a broad market. Not disagreeing with the view, we expect BYD’s power battery business to grow rapidly from 2022. However, the power battery sector is experiencing margin squeeze due to rising competition and material cost (mainly lithium etc.). CATL’s gross margin falls from 36% in 2017 to 26% in 2021. In general, we think this sector lacks major barriers to fend off the threats of new entrants and is in a weak position to negotiate terms with either supplier (especially lithium) or NEV producers. Given the tight supplies of upstream materials such as lithium and cobalt, we think the margin squeeze of the battery sector will continue. In addition, BYD, as a disruptor in the power battery industry, may be willing to make more aggressive pricing strategy in order to gain market share in our view. Therefore, we think it is not wise to be too optimistic about how much benefits the battery business can contribute to BYD in the future.

One additional key point that the market ignores is the conflict of interest concern for its power battery business. BYD has long made power batteries for internal use only, and we think there are good reasons for this. The most significant factor is the fact that BYD is making and selling vehicles as well. This is important because potential customers (if any) of BYD’s battery business are also competitors in its EV business. Hence, we are concerned that the underlying conflict of interest naturally prevents BYD from expanding the power battery business externally, at least to some extent. (Just imagine how it goes if Intel makes PC at the same time). In this regard, such a concern will put BYD’s power battery business in poor positions as well when competing with CATL, which is the leader and more importantly pure play in this field. Therefore, we think it is not wise to be too optimistic about how much benefits the battery business can contribute to BYD in the future.

Valuation and investment thesis

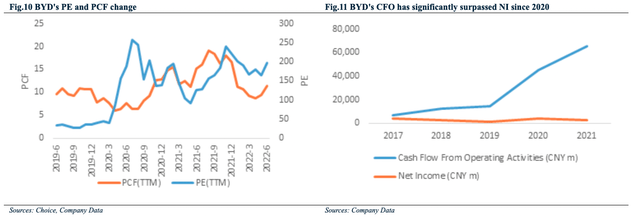

BYD’s valuation (P/E ratio) has diverged from the historical normal level since 2020. We believe the main reason is that the market has revalued it due to BYD’s fundamental improvement (including industry positions, future growth expectations, etc.) by PCF multiple instead of past valuation of PE multiple. This is consistent with BYD’s trend in cash flow from operating activities (CFO) since 2020 as shown in the charts below.

BYD’s valuation multiples (Image created by author with data from Company data)

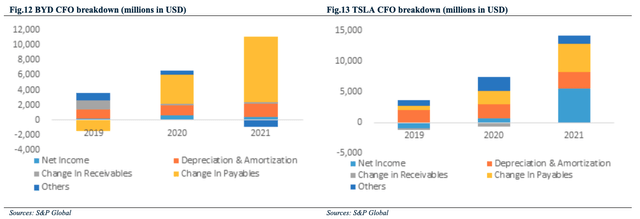

However, we believe that there are risks underlying its CFO. According to the financial report, BYD’s surge in CFO since 2020 was mainly caused by the increase in payables and other payables, which reached CNY 29.1 billion and CNY 19.3 billion respectively in 2021. We believe that, in terms of normal business practice, delaying payments to suppliers could bring more cash flow in the short term, but it is not sustainable in the long term–the bills have to be paid anyway. Moreover, BYD’s large change in the other payables is deemed unusual, and no explanations are provided in the annual report. Compared with peers (like Tesla), we think that these two above-mentioned accounts are considered too sizable, leading to earning quality concerns. To sum up, we believe that BYD’s future CFO is highly uncertain, which means the current valuation based on PCF is also highly uncertain.

BYD CFO vs Tesla CFO (Image created by author with data from S&P)

In general, we believe despite that BYD’s past efforts in R&D and branding are currently being paid off, BYD is no more than a local company without much international competitiveness which is heavily dependent on government support, not to mention that even in China market Tesla is the leader. Furthermore, BYD’s close-loop system is not only at the expense of its overall operation efficiency, but it also creates inherited conflict of interest for its power battery business’s expansion. Last but not the least, there are earning quality concerns for BYD that the market generally ignores in our view. Going forward, investors should be aware that drops in Tesla’s stock price, China’s weaker-than-expected economy, increasing competition in China’s EV market and even Warren Buffett’s decisions on BYD holdings are likely to trigger major correction in BYD’s stock value in our opinion. In conclusion, we think BYD’s current valuation lacks solid fundamental supports and is hard to sustain, so we warrant it a Sell.

Be the first to comment