Xsandra/E+ via Getty Images

Few industries have taken the beating that the restaurant industry has since 2020, seemingly caught in a tornado, with new headwinds thrown at these companies from each direction. It began with traffic declines and was followed up by higher commodity costs and a mini-exodus of workers from the industry. Now, restaurants must try and navigate the difficulties of holding the line on margins while still offering value to consumers. To date, Kura Sushi (NASDAQ:KRUS) seems to be managing this balance well, being more conservative on pricing than peers and not prioritizing margins. However, with the stock trading at nearly 3x forward sales, I still don’t see enough of a margin of safety here.

Kura Sushi Restaurant (Company Website)

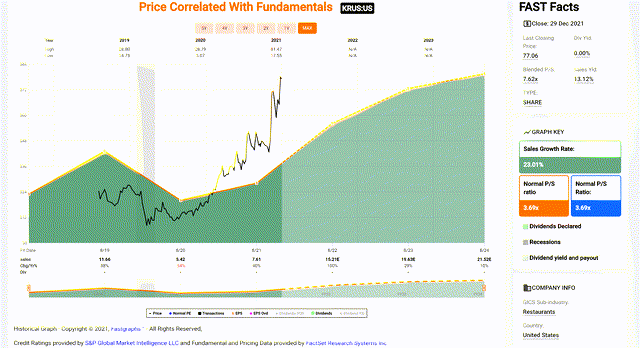

Just over six months ago, I wrote on Kura Sushi (“Kura”), noting that the stock was priced for perfection at a share price of $80.00. This is because it was trading at 5x FY2022 revenue estimates, and the stock’s violent 100% plus rally looked to be running out of gas. Since then, KRUS has seen a drawdown of more than 50%, attributed to the softness in the general market and the fact that industry-wide headwinds are increasing and not improving in the slightest.

The latest negative development is the rapid rise in gas prices and a sharp increase in mortgage rates which are pinching consumer wallets even further in a period of declining personal savings rates. Kura may not have seen the effects of this in its Q1 results, but we appear to be seeing a slight pullback in traffic for casual dining, and I don’t see Kura being immune from this dip in demand. Let’s take a closer look at recent developments below:

Kura Sushi – Revenue Multiple (December 2021) (FASTGraphs.com)

Q2 Results

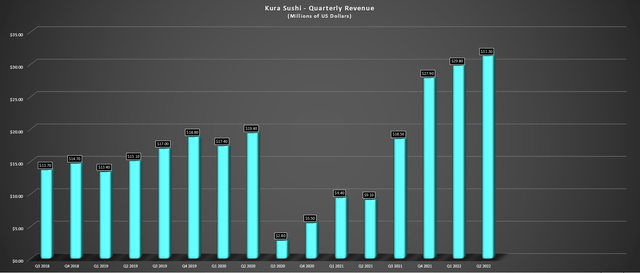

Kura reported solid fiscal Q2 2022 (calendar year Q1) results, posting record Q2 sales of $31.3 million, a 245% increase year-over-year, and a 62% increase on a two-year basis (Q2 2020: $19.4 million). This was driven by a sharp increase in new restaurants opened and impressive same-restaurant-sales performance, with a low double-digit growth rate (11.3%) on a two-year basis. While same-store sales growth rate on a two-year basis isn’t all that unusual, most of this has been accomplished by somewhat aggressive price taking depending on the brand. Kura has remained relatively conservative from a pricing standpoint, ensuring it continues offering its guests a value proposition.

Kura Sushi – Quarterly Revenue (Company Filings, Author’s Chart)

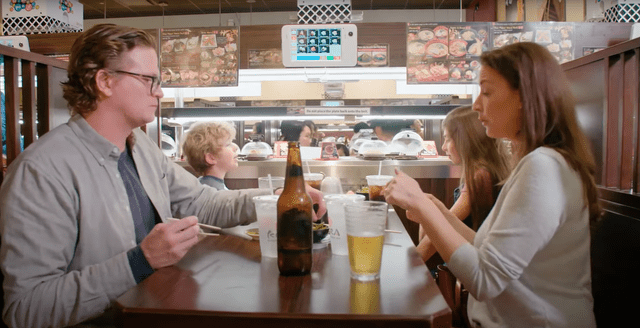

In fact, Kura seems focused on maintaining margins with productivity gains, including the implementation of table-side payments, touch-panel drink ordering, and the roll-out of robot servers in 20 restaurants or roughly half of its system. In a period of rising wages and increased hiring/training costs due to a tight labor market, this is a big deal from a productivity standpoint and could lead to slightly quicker table turns and drive labor savings long term. Given Kura’s small size, this focus on innovation through technology is commendable and has helped the company protect its margins.

In fact, despite rising commodity costs and minimum wage increases, Kura’s labor costs came in at just 33.1% vs. 31.7% in Q2 2020, only a slight increase. Meanwhile, food and beverage costs came in at 30%, down from 31.5% in Q2 2020. The relatively muted increase in food/beverage/labor costs can be attributed to sales leverage and some menu price increases in the two-year period, but also to Kura’s diverse market basket (~100 items), which has made it more susceptible to spikes in certain commodities. Although labor was up, the full roll-out of robot servers by year-end should help with some labor gains in FY2023.

Industry-Wide Headwinds

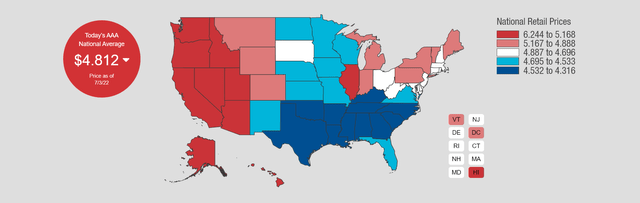

Although Kura appears to be doing a phenomenal job of offsetting three key headwinds (commodity inflation, staffing shortages, wage inflation) through technology and automation (robot servers, revolving sushi bar), the most recent headwinds are out of the company’s control. These two recent developments are rising gas prices, with national gas prices near $4.80/gallon and above the average in two of Kura’s key markets (Texas and California). Meanwhile, mortgage rates have surged to multi-year highs, increasing mortgage payments for many consumers. If we combine this with already high food inflation (groceries), discretionary spending budgets are shrinking and could shrink further.

Kura Sushi Revolving Sushi Bar (Company Video, Youtube.com)

This is not ideal for the restaurant industry, and we’ve already seen a pullback in traffic. Black Box Intelligence reported that late June marked the 15th consecutive week in which the industry experienced negative traffic, and the industry has only posted seven weeks of positive traffic growth this year, with the last one being in March. The recent trend in traffic suggests that gas prices have hurt restaurant traffic. While Kura Sushi may offer a better value proposition than other casual dining restaurants and other sushi restaurants due to its ability to keep prices lower (technology/automation), it could suffer from a trade-down effect.

National Gas Prices (AAA Gas Prices)

As discussed by Kura in its Q1 results, it has not seen any impact, and in fact, per customer plate consumption rates were up on a three-year basis, suggesting no resistance to higher menu pricing and no check management. However, this was over two months ago, and I would be shocked if the company didn’t see a slight change in consumer behavior in the back end of fiscal Q3 (May sales) and fiscal Q4 (June through August).

If this is the case, this will impact sales leverage, making it a little harder to hold the line on margins. While this isn’t a huge deal from a revenue standpoint, given that Kura is opening new restaurants at a torrid pace (eight-plus this year), and the long-term margin outlook is solid, the stock does not look priced in for any slowdown at nearly 4x FY2022 sales. Besides, even if Kura does somehow buck the traffic trend, stocks typically follow their industry groups quite closely. If casual dining stocks see another leg down, it will take a herculean group of buyers to hold KRUS above $50.50 and allow it to buck the performance of the group. Let’s take a closer look below:

Valuation and Technical Picture

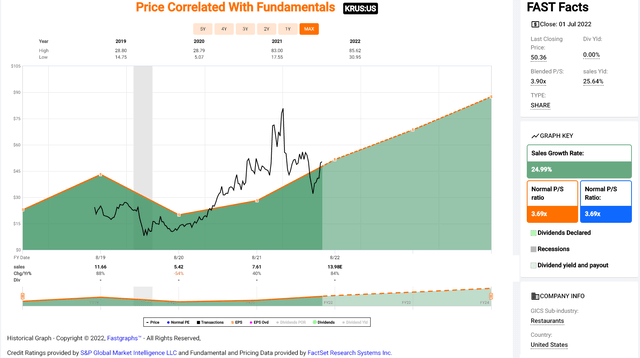

Based on ~9.7 million shares and a share price of $50.50, Kura trades at a market cap of ~$490 million. Historically, the stock has traded at 3.7x sales, and it currently trades at ~3.6x FY2022 sales based on the mid-point of its FY2022 sales guidance ($135 million). I would argue that given the industry-wide headwinds that Kura Sushi cannot control (a potential change in consumer spending habits and the multiple contraction that we’ve seen in growth stocks), a more conservative multiple for the stock is 3.0x sales. If we multiply this figure by FY2023 revenue estimates of $180 million, this translates to a fair value of $55.70.

Kura Sushi Historical Revenue Multiple (FASTGraphs.com)

While a 12-month target price of $55.70 points to a more than 10% upside for the stock, I prefer a minimum 35% discount to fair value for small-cap names to bake in an adequate margin of safety. After applying this discount, the low-risk buy zone would come in at $33.40 or lower. So, while Kura Sushi may be one of the best growth stories industry wide, I still don’t see enough margin of safety here given the continued negative headwinds for the industry, with the most significant one coming down the pike (a pullback in demand).

Moving to the technical picture, this corroborates the view that Kura is not sitting in a low-risk buy zone, with the stock trading in the top-fourth of its expected trading range based on support/resistance. In fact, at a current share price of $50.50, Kura’s reward/risk ratio comes in at an unattractive 0.17 to 1.0, with $3.80 in potential upside to resistance ($54.30) and $21.50 in potential downside to support ($29.00). Generally, I prefer a minimum of a 6.0 t 1.0 reward/risk ratio to justify entering new positions in small caps, and Kura doesn’t come close to meeting this criterion currently. Hence, I would view any rallies above $55.00 as profit-taking opportunities.

Kura Sushi Restaurant (Company Website)

Summary

Kura Sushi put together solid fiscal Q2 results (December to February). Still, the real test will be its fiscal Q3 and fiscal Q4 results (March through August), which should give us a glimpse into whether we have seen any pullback in demand. I think a pullback seems likely across the board for casual dining, given that consumers are not nearly as strong as expected, with personal savings rates dipping to multi-year lows. Worse, this decrease in discretionary budgets is coming up against price increases for most of the casual dining group.

Fortunately, Kura has been more conservative with pricing, and its value proposition is improving as many casual dining prioritize protecting margins. However, better positioned or not, it’s very rare for a stock to buck the performance of its industry group or the weakest segment within that industry group. So, just as a rising tide lifts all boats, a perfect (negative) storm capsizes them or at least impedes the upside share-price progress of the leaders (like Kura). Therefore, while I think Kura Sushi has a bright future, I would view any rallies above $55.00 as profit taking opportunities.

Be the first to comment