monsitj/iStock via Getty Images

Investment Thesis

Modine Manufacturing Company’s (NYSE:MOD) stock price has significantly outperformed broader markets, gaining 14% vs. S&P 500 (SPY) down by ~17% since I last recommended buying it in March. The company has experienced strong demand for its products, which resulted in higher sales volume in Q4 2022. In April 2022, the Biden Administration launched its $500 mn grant program from the Bipartisan Infrastructure Law Program to improve the air quality at schools. To take advantage of this funding, the company is increasing its production capacity at its Rhode Island plant. This should be beneficial for the company’s sales growth. Other than this, the company is focusing on its 80/20 strategy to reduce the complexity across its business portfolio and eliminate lower-margin product lines. The company is also implementing price hikes across its business portfolio to offset the cost inflation, which should benefit the margins. Modine’s valuation still remains attractive, with the stock trading at 6.52x FY23 consensus EPS estimates and 5.18x FY24 consensus EPS estimates. I believe the stock is a good buy as its turnaround continues to gain traction.

Last Quarter Earnings

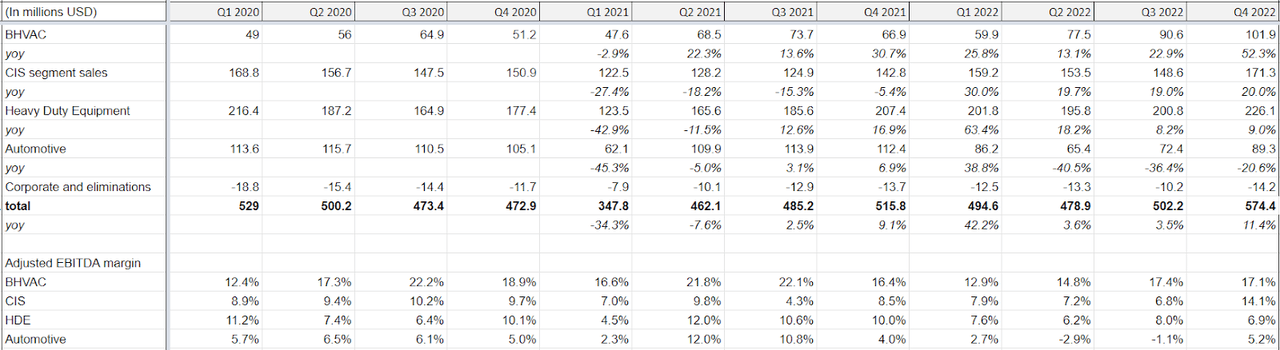

Modine reported better-than-expected financial results for the fourth quarter of 2022. Sales for the quarter totalled $574.4 million (up 12% year over year), exceeding the consensus estimate of $538 million. The adjusted EPS increased 12% year over year to $0.57 (vs. the $0.50 consensus estimate). Building HVAC, Commercial & Industrial Solutions (CIS), and Heavy Duty Equipment (HDE) all saw significant growth, resulting in a sales increase of $60 mn Y/Y. The $60 million increase was due to a $41 million increase in volume, $33 million in pricing, and material pass-throughs, offset by a $14 million negative impact from FX. Higher sales volume, increased pricing, and a $2 million favorable impact by managing SG&A costs resulted in an adjusted EBITDA margin of 9.9% in the quarter, up 170 basis points year over year, resulting in improved adjusted EPS during the quarter.

Revenue Growth Potential

The Building HVAC (BHVAC) segment’s sales increased 52% year over year to $101.9 million in Q4 2022, owing to strong volume growth in the data centre and heating and ventilation businesses (both up 30% year over year). The Commercial & Industrial Solutions (CIS) segment had a strong quarter, with sales up 20% year over year to $171.3 million. Due to strong demand across the markets, revenue in commercial HVAC, refrigeration, and coatings increased by 27%, 21%, and 20%, respectively, year over year. The Heavy Duty Equipment segment saw a 9% increase in sales year over year, with half of the increase due to higher volume and the rest due to pricing and metals pass-through adjustments. However, supply chain issues and volume declines due to semiconductor shortages impacted the Automotive segment, resulting in a 21% Y/Y decline in sales in the quarter. In addition, due to the sale of the air-cooled automotive business in Austria earlier in FY22, the segment had a difficult Y/Y comparison. The sale of this business contributed $18 million to the segment’s total revenue decline of $23 million.

Heating, indoor air quality, and data centre products remained in high demand in BHVAC in Q4 2022. Sales of school ventilation products are benefitting from federal funding aimed at improving indoor air quality in K-12 schools. In April 2022, the Biden administration launched a $500 mn grant program to protect the health of children and save schools money by improving energy efficiencies at schools. Modine’s school ventilation products business has traditionally been small, but with the infrastructure spending over the next few years, the company has a good opportunity to grow. To take advantage of this opportunity, the company has shifted its engineering resources to this business and is increasing production capacity at its West Kingston, Rhode Island plant by consolidating production lines. Given market demand, the company expects this business to double in the next three years.

By strengthening its marketing activities with targeted campaigns for products used in greenhouses and warehouses, the company is increasing its market share in the heating business. In addition, the company is developing new product lines for the upcoming heating season. The data centre industry is also experiencing strong demand, but the company is experiencing shortages of components such as fans and controllers due to supply chain constraints. This shortage impacted productions and this disruption will likely affect the first quarter of FY23 as well. We believe that this short-term headwind will dissipate over time, improving the sales of the data centre business. The company is developing a strong pipeline of orders at its new production facility in Virginia which is expected to start shipping orders by the end of the calendar year 2022, supporting the sales growth of the company. This segment’s sales is expected to grow 15% to 20% Y/Y in FY23.

The revenue growth in the CIS segment was aided by volume gains and pricing improvements. In addition, the company benefited from the commercial actions including reducing complexity and making key managerial changes taken under the 80/20 strategy in Q1 2022. Product rationalization efforts under 80/20, on the other hand, are expected to have an impact on revenue growth in FY23. The segment’s volume growth should be slowed by SKU reductions and product line eliminations, which should be partially offset by higher pricing across other products. Sales in the CIS segment are expected to be flat to down 5% in FY23.

Although the HDE and Automotive segments are seeing strong demand for their products, the segment’s growth has been hampered by a near-term supply chain headwind for the past few quarters. Furthermore, the Chinese manufacturing plant closures in March and April as a result of COVID lockdowns in China should have an impact on Q1 FY23 results. However, these plants in China have reopened but are currently producing at reduced levels. The company is addressing these supply chain constraints and expects to increase production levels at these facilities soon. The HDE and Automotive segments are expected to grow by 10% to 15% on a year-over-year basis.

Looking forward, the company has reorganized its segment structure into two separate reporting segments and will begin reporting under this structure from the first quarter of FY23. The first segment is Performance Technologies which comprises Heavy Duty Equipment, Automotive, EV, and coatings businesses. The second segment is Climate Solutions, combining BHVAC and CIS segments. Both the segments have three subsegments. Consolidating these businesses allows Modine to better focus on growing its business in key target markets. Given the positive trends in the end markets and the volatility in the current environment, the management has guided for FY23 sales growth of between 6% Y/Y and 12% Y/Y. Longer-term as the supply chain constraints ease and management turnaround plans continue to gain traction, I believe the company can post mid to high single-digit growth over the next few years.

Modine’s segment-wise revenue and EBITDA margins (Company data, GS Analytics Research)

Margin Improvement Prospects

The commodity metals, freight, and packaging costs increased by $32 million in Q4 2022 compared to the previous year, but the company’s pricing actions recovered $33 million, resulting in improved adjusted EBITDA margins. This, combined with higher volumes, helped the company improve its adjusted EBITDA margins by 170 basis points to 9.9% year over year. Despite the impact of higher material costs, supply chain constraints, and higher SG&A costs, the BHVAC segment saw a 70 basis point improvement in margin during the quarter due to higher volume and increased pricing. The CIS segment’s adjusted EBITDA margin increased by 560 basis points to 14.1%, due to higher volumes, commercial pricing initiatives, improved mix, and operational improvements. During the quarter, the HDE and Automotive segments’ margins fell 310 basis points and 120 basis points, respectively. Lower gross profit and higher SG&A impacted the HDE segment, while lower sales volume impacted the Automotive segment.

Through the 80/20 strategy, the company implemented multiple pricing adjustments in FY22 and improved commercial agreements with its customers. The company was able to simplify its processes and resource its best-performing businesses using 80/20 which should help improve the margins in FY23 and beyond. The product rationalization that the company has done over the past few quarters should benefit the CIS segment’s margins. The company is focusing on improving profitability in the HDE and Automotive segments through price realization and cost reduction. In addition, the company is undergoing restructuring to reduce SG&A and operational costs. As a result, margins in the vehicular businesses (HDE and Automotive) are expected to improve in the future. Furthermore, the recent downtrend in metal markets should benefit the company by allowing it to obtain raw materials at lower prices. Higher pricing, restructuring initiatives, and higher sales should drive the adjusted EBITDA margin, partially offset by cost inflation and higher SG&A costs.

Valuation & Conclusion

The stock is currently trading at a P/E of 6.52x FY23 consensus EPS estimate of $1.62 and 5.18x FY24 consensus EPS estimate of $2.04, lower than its five-year average forward P/E of 12.10x. The revenue growth of the company should benefit from the federal funding for improved air quality at schools. The company is offsetting the cost inflation in the market through price hikes, which should be beneficial for the margin improvement along with its 80/20 strategy implementation. I believe the company’s valuations, as well as long-term prospects, are very attractive. Hence, I believe the stock is still a good buy after the recent run-up.

Be the first to comment