JHVEPhoto

Science Applications International Corporation (NYSE:SAIC), a leading tech, engineering, and security services provider for the US Department of Defense, delivered a positive surprise in its latest quarter, surpassing its prior guidance and consensus expectations heading into the print. Management was justifiably cautious in setting the financial bar low beyond this fiscal year, though, with the book-to-bill at just ~1x (on a trailing twelve-month basis). Even with the raised guidance, the outlook remains choppy for the next few quarters amid headwinds from recompete roll-offs and working day normalization, limiting the near-term visibility. Given SAIC’s relatively lower-margin portfolio as well, the discounted valuation seems justified at this juncture. Pending further evidence of consistent organic growth and a mix shift toward higher-margin growth and technology accelerants (GTA) projects, I would remain on hold.

Demand for Defense Solutions Intact as SAIC Clears a Low Q2 2023 Bar

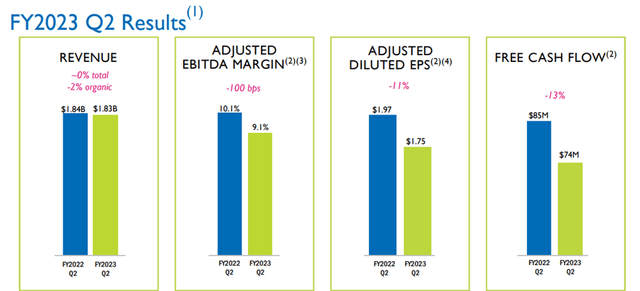

SAIC delivered flattish YoY revenue growth at $1.8bn in its latest quarter, although the headline number was helped by the contribution from the recent Halfaker acquisition. On an organic basis, revenue would have declined ~1.5% YoY due to contract completions and a modest working day headwind (i.e., one fewer day than last year). Still, this was better than expected (relative to both consensus and internal expectations), as resilient on-contract growth offset recompete losses from the NASA AEGIS contract loss. The backlog stands at a solid ~$24.3bn (up from ~$24.1bn at the end of April), helped by ~$2.1bn of contract awards for the quarter, including the $319mn Falconer Air Operations Center contract. Coupled with >$20bn in submitted proposals outstanding, the demand side looks surprisingly resilient, even with the book-to-bill ratio at 1.1x for the quarter (or a modest ~1x on a trailing twelve-month basis). Of note, management sees fewer tasking headwinds than peers but acknowledged emerging signs of awards being delayed – a potential source of downward revisions given the ongoing macro challenges.

Helped by the strong revenue result, SAIC’s profitability also came in ahead of expectations, with adj EBITDA of ~$166m or a 9.1% margin. While this still implies ~100bps of YoY margin compression, the QoQ margin expansion relative to the 8.7% in the prior quarter is a positive result. Plus, most of the YoY decline was down to one-offs like lower net favorable contract estimate changes and accelerated amortization on off-market liability contracts last year. Adj EPS and cash flow also saw declines for the quarter due to transitory factors (e.g., a ~$25m cash headwind due to a delayed customer payment will reverse, as SAIC has already received the funds in Q3), but still cleared the low Street expectations heading into the print. Helped by its consistent cash generation, SAIC repurchased ~$62m in stock for the quarter, bringing the YTD total up to ~$130m for the fiscal year (~2.5% of the market cap).

Positive Guidance Update but Risks Remain

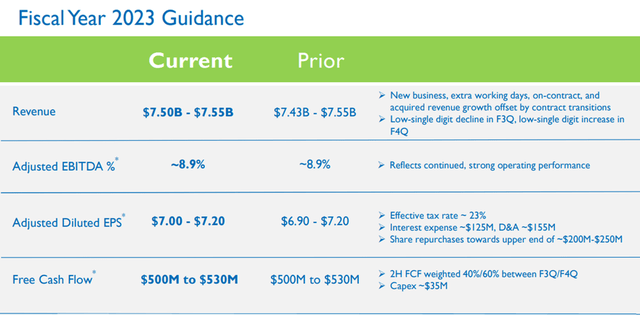

Despite the YoY organic growth decline, revenue growth is guided to turn positive in the fourth quarter and remain positive through the next fiscal year. Of note, revenue guidance was increased to a $7.5bn to $7.55bn range (up from $7.43bn to $7.55bn previously), implying a ~2% organic growth at the midpoint. Before the Q4 upturn, however, SAIC sees a low single-digit YoY revenue decline in Q3 before hitting low single-digit growth in Q4. Rather than a change in fundamentals, the choppy outlook is mostly due to the additional working days in Q4, which equates to an ~8% YoY tailwind. Looking beyond this fiscal year, the potential Vanguard contract restructuring is the key unaddressed hurdle in H2 2024, representing an up to ~1%pt annualized organic growth headwind should SAIC fail to retain the contract.

The margin outlook is better, with management calling for margin expansion through FY25. Cost cutting in the near term presents low-hanging fruit, while over the long run, the key lies in SAIC’s ability to navigate a structural product mix shift. Execution will be key on the latter – management is focused on business development efforts on GTA projects, which carry a higher margin profile than SAIC’s typical engineering and supply chain programs. While the recognition of lower-margin material sales could swing profitability relative to SAIC’s guidance, management commentary on the call indicates confidence in outperforming the near-term guidance bar. In the meantime, buybacks are trending higher as well, with the FY23 target now at $200m-$250m. The rollback of the section 174/R&D tax change will be a swing factor here, with the cash impact sized at up to ~$90m; but over the long run, my base case is for more cash generation driving more buybacks.

Zeroing on the Key Growth Drivers

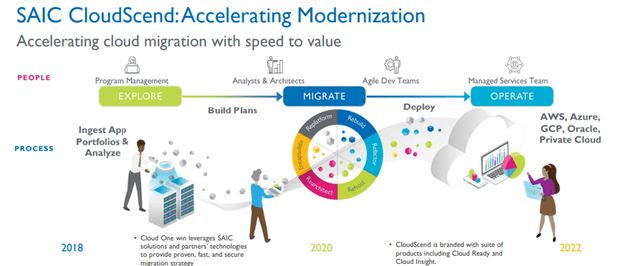

Like many other spinoff stories (recall SAIC separated from Leidos (LDOS) in 2013), the company has suffered from a lack of clear strategic direction. This seems particularly concerning today – relative to its peers, SAIC has a foothold in many competitive markets but has yet to establish a dominant position in any vertical. To its credit, management is drilling down on several key focus areas in response. Of note, SAIC’s counter-drone Valkyrie solution, which integrates systems from several commercial vendors, was called out on the quarterly call as a potential future growth driver. Within its ‘Joint All-Domain Command & Control’ (JADC2) technologies, cloud migration and data integration are key themes – the ‘Secure Cloud’ offering, in particular, is showing good promise, having generated ~$1bn in revenue.

Going forward, the demand backdrop seems favorable, but execution will be key if SAIC is to translate these exposures into sustainable organic growth. Still, the clear delineation of key growth drivers is a positive step in SAIC’s investor relations efforts. With an investor day event on the horizon as well, more color on the company’s long-term aspirations will go a long way toward improving visibility.

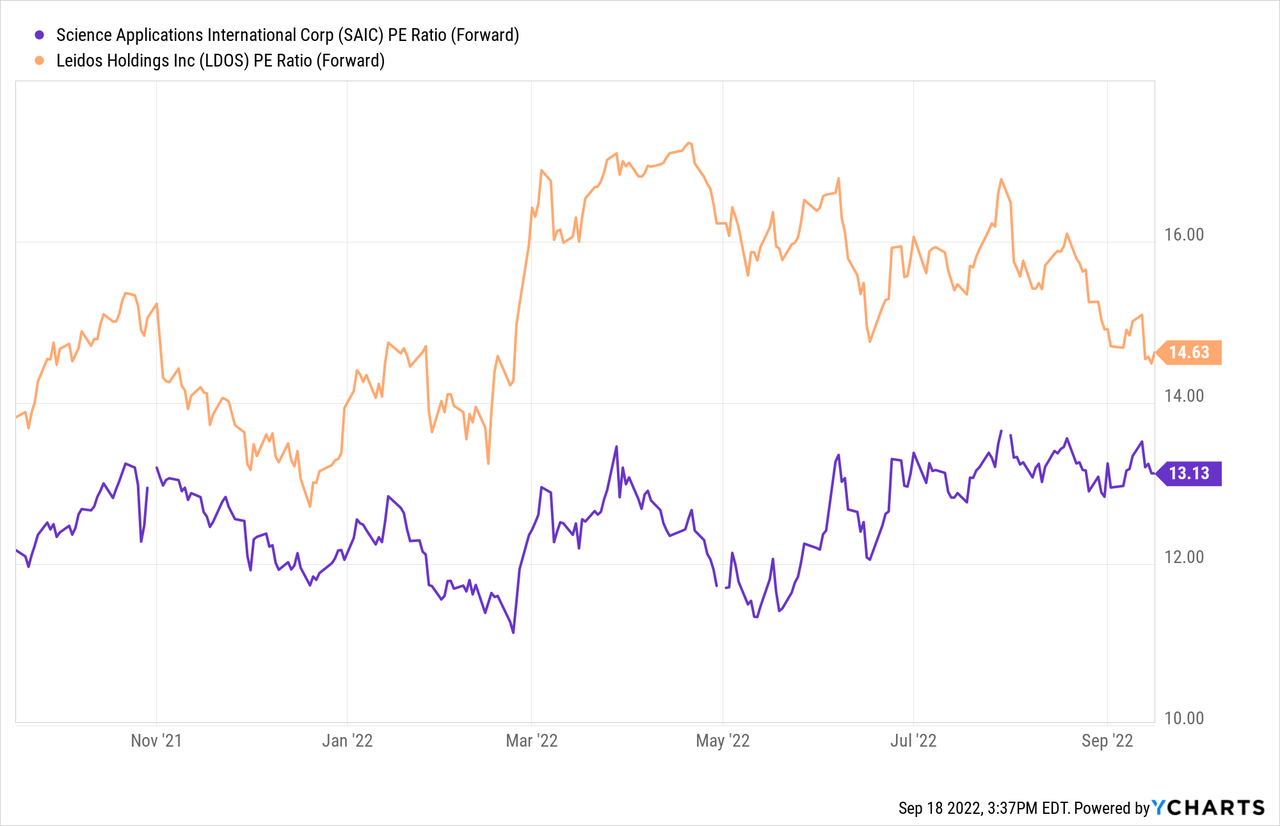

Still a Relative Underperformer

With the US government in the midst of a multi-phase cloud migration and actively upgrading its systems to accommodate the rapid advancements of cyber and data analytics capabilities, there is a bull case for owning SAIC stock. Yet, it’s hard to see the company outperforming its government services peers, given its lower-margin contract portfolio and persistent organic growth challenges in the core business. Coupled with the higher leverage levels, there are probably more attractive ways to ride the secular defense budget growth tailwind. The valuation discount to peers is, thus, warranted, in my view, until SAIC narrows the relative growth gap to its peers. Pending a step up in the company’s ability to grow organically (and to do so consistently), as well as visibility into future contract losses/delays, I would remain on the sidelines.

Be the first to comment