Lemon_tm

There are some times where companies do things that make me shake my head. Today, that comes from communication services company Lumen Technologies (NYSE:LUMN), which was my top income play for this year. The name has had the highest dividend yield in the S&P 500 for some time, but in Wednesday’s Q3 earnings announcement, the board eliminated the dividend in favor of a potentially large buyback. This news sent shares to a new 52-week low, and it significantly changes the narrative regarding this stock moving forward.

For Q3, reported revenues came in a little under $4.4 billion, slightly missing street estimates. This was a more than 10% decline over the prior year period, but the overall state of the business is messy right now due to two major divestitures that were completed in Q3 and Q4, respectively. When looking at things on a pro forma basis, the top line was down 5.5% over Q3 2021. Adjusted earnings per share came in at $0.14, badly missing street estimates for $0.35, and down significantly from $0.49 in the year ago period. However, GAAP earnings were actually up 6 cents per share to $0.57, largely driven by a gain on the sale of the Latin America business.

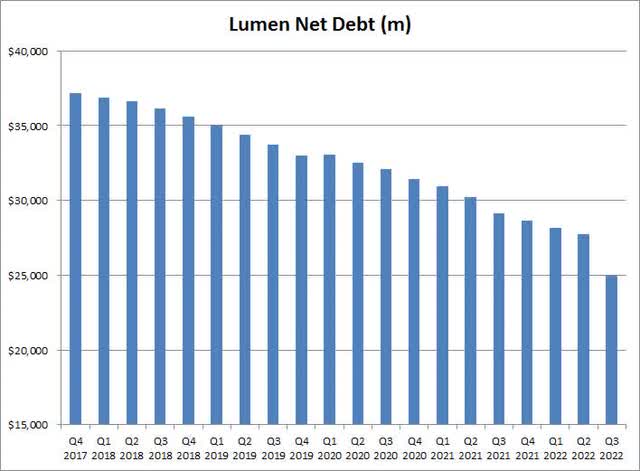

One of the reasons I was a fan of Lumen in the past was that strong free cash flow has led to the great dividend as well as significant debt reduction. The company did use some of its proceeds from the Q3 asset sale to further reduce debt, as seen in the graphic below. Another roughly $3.3 billion of debt has been repaid during Q4 thanks to the 20-state ILEC business sale that was completed in early October.

Lumen Net Debt (Company Earnings Reports)

The key for Lumen here was that this massive debt reduction would lower interest expenses, helping the long-term profitability picture. In the last four years, quarterly interest expenses have come down by about $200 million. However, there was a tick upward in Q3 thanks to the surge in LIBOR rates costing the company more on its variable rate debts. That headwind has continued during Q4, but these debt repayments will also help lower interest expenses to a point. The company also announced a proposed sale of its EMEA business to Colt Technology Services for $1.8 billion, so that could further reduce debt once it is complete.

With Lumen shares dropping throughout this year, the annual dividend climbed into the double digits and was over 14% going into the Q3 report. However, the board has announced that the dividend is being eliminated, and for the next two years, will be replaced by a share repurchase plan of up to $1.5 billion. Lumen shares have fallen more than 14% in the after-hours session, meaning that the buyback, if executed in full at current prices, could retire more than 20% of the company’s shares. The earnings release talks about investing in growth, maintaining a strong balance sheet, and repurchasing shares at attractive valuations as the current financial plan.

The dividend elimination is a complete shock in my opinion. I know the bears have been calling for a dividend cut recently, but the buyback clearly shows that free cash flow production is still fairly decent. In fact, management actually raised its forecast for free cash flow for this year by $200 million as a result of a capital expenditures cut. There was certainly room for both a dividend and a buyback, but it appears that debt reduction remains the top priority at the moment. I believe that the dividend could have been more than supported by free cash flow plus the cash brought in by the divestitures, but apparently the board has decided to change things up a bit. Income investors will now likely leave the name, and it will be interesting to see if this buyback goes through and how quickly.

In the end, Lumen’s Q3 results featured a number of surprises. Revenues and adjusted earnings were worse than expected, and the situation here remains complicated due to ongoing divestitures. Management is certainly working to get the debt pile down, but the capital return plan was turned upside down on Wednesday with the dividend being eliminated in favor of a buyback. Shareholders obviously voiced their frustration with the stock dropping to just over $6 in the after-hours session, and this situation will have to be re-evaluated in the coming months as we get a better idea of how 2023 might look.

Be the first to comment