MR1805/iStock via Getty Images

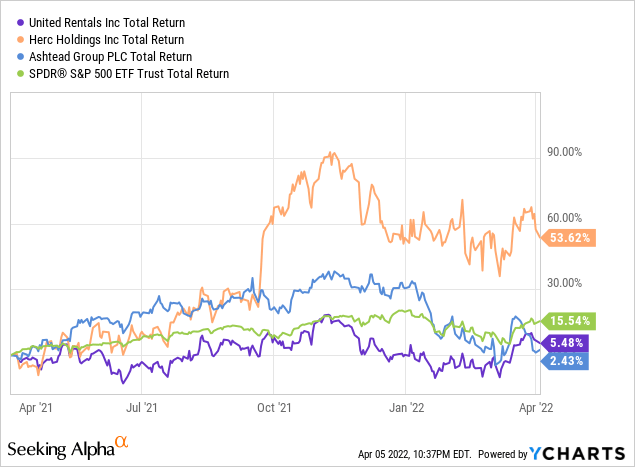

Over the last twelve months, United Rentals (NYSE:URI) delivered a total return of 5%, underperforming the S&P 500 by nearly 1,000 bps. Performance was roughly in-line with Ashtead (OTCPK:ASHTY) but well below Herc’s (HRI) 54% return, with the latter rallying from strong operational execution in new urban markets and improved guidance. At a forward earnings of 11.2x, United Rentals looks compelling from a valuation standpoint, especially since its fundamentals and economic moat are sold. While Herc trades at just 10.0x, its operating margins, at 18.1%, are substantially less than United Rental’s 23.4%. Moreover, United Rentals merits the trading premium given its market leadership position. Rental businesses tend to be hyper-cyclical to macroeconomic swings, since businesses rely on rental options over ownership precisely to be able to scale back during downturns. It is therefore not surprising that United Rentals is a volatile stock with a beta of 1.8.

According to Seeking Alpha data, the Street is split on the stock. 8 rate the stock a “hold”; 1 a “sell”. On the flip side, 10 analysts are calling the stock a “strong buy”, and 1 a “buy”. This sentiment has been consistent going back to just after the pandemic began in March 2020. In general, the bull story for rental businesses has been focused on the secular trend towards increased rental penetration, as more and more businesses seek to shift towards more flexible operational models. With the pandemic lifting, there is also resumption of greater construction activity, and, since the US has a very outdated infrastructure, there’s a large wave of business to be had. At the same time, the rental industry is heavily competitive. Although United Rentals, Ashtead’s Sunbelt Rentals, and Herc are the heavy hitters, the market is heavily fragmented and dominated by regional players that could be nimble in more local markets.

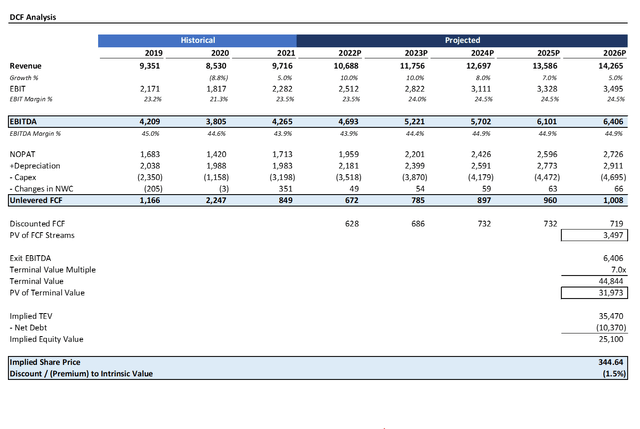

DCF Analysis Indicates Significant Upside

To get a sense of the company’s intrinsic value, I ran a DCF analysis. No DCF analysis can provide a perfect picture of future returns for shareholders; however, they can provide an illustrative “story” of the likelihood of different scenarios. I forecasted 10% growth in 2022 tapering to 5% by 2026. I assumed margins expanding minimally by 100 bps into 2026. Capex, increase in net working capital, depreciation, and taxes were flat-lined for simplicity. By 2026, I have EBITDA at just shy of $6.5 billion.

Source: Created by author using data from Yahoo! Finance

Assuming a terminal EBITDA multiple of 7x and a discount rate of 7%, I find that the stock is roughly fairly valued. In general, United Rentals and Herc have traded in the 6-8x range over the last 15 years. At a PEG ratio of 0.89, United Rentals is underappreciated though from a growth standpoint. And it is a cash cow, generating free cash flow conversion of 118% over the last decade, or 31% of EBITDA, according to my projection, by 2022 with a quick ratio of 0.8.

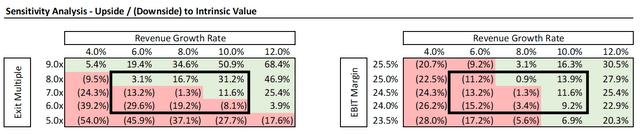

Source: Created by author using data from Yahoo! Finance

Looking at the sensitivity analysis, the top end of the historical trading multiple, 8x, would produce a 17% upside. This is meaningful since the market has become particularly lofty with valuation levels in the last two years; just not so for United Rentals. Should growth hit a 12% clip, at an 8x multiple, there is nearly 50% upside. Thus, while the stock is very risky at a beta of 1.8 and with no dividend, I believe valuation is reasonable, especially once considered against the rest of the market.

Upside Catalysts

There are several levers that United Rentals can pull to create value. Firstly, as the rental space is heavily fragmented, there exists significant opportunity for M&A deals. Rental is all about building regional density and trust with local businesses; there is thus significant synergy opportunity for United Rentals to solidify its network. United Rentals is the leading rental equipment business with 15% share, with Sunbelt and Herc rounding out the leaderboard at 11% and 3%, respectively. There is thus substantial opportunity for United Rentals to expand beyond its 1,149 branches and 780k unit fleet. Towards that end, I am optimistic about the company’s recent acquisition of a portable storage & mobile office provider that added $94 million in EBITDA. At an 8.8x post-synergy EBITDA multiple, the transaction also reflects United Rentals’ ability to do deals in a competitive transaction environment. Management has expressed an ability to turn its EBITDA margin in to the mid-40% range based on M&A.

Specialty looks promising, as it continued to generate double-digit returns across each segment and overall growth of 28%. In general, United Rentals has a strong opportunity in specialty solutions, as it augments the company’s “one stop shop” platform with differentiated capabilities. Customers are looking to have adaptive solutions, so the more niche oriented United Rentals can get with its equipment, the better.

Beyond the general secular tailwind toward rental penetration in equipment management, another key catalyst for the company is the onshoring of manufacturing capabilities. Onshoring drives demand for construction, and the pandemic sparked manufacturers to rethink how they operate. As the bipartisan infrastructure law gets underway, expect to find a lot more United Rentals equipment out and about.

Downside Catalysts

There are several reasons why investors may want to avoid United Rentals. Aside from the stock’s high volatility, the company is also particularly vulnerable to the labor shortage among blue collar workers and input inflation. Whatever benefits the company seems to get on the cost synergy side from expansion, the competitive environment will keep United Rentals honest in its pricing. Though the company saw net income rise by a stellar 55% in 2021, productivity gains could be at a limit after jumping 10.3% in the most recent quarter. I am also concerned about the company’s ability to stand out in local markets. As much as M&A is an opportunity, it’s also a strong risk for the company. Private equity is more than capable of creating platform investments to do bolt-on deals and gain local market dominancy.

Conclusion

Notwithstanding its stock volatility and the inflationary environment, United Rentals has underappreciated fundamentals. Since 2011, it has grown EBITDA by an impressive CAGR of 16.9% and expanded EBITDA margins by 1,300 bps since 2008. Fundamentally, this is a strong business. And as the market continues to better appreciate the flexibility of renting equipment versus owning equipment (the benefits of which the pandemic has made very clear), secular tailwinds look strong for United Rentals to capitalize on its market leadership position. With a strong mandate for M&A, healthy balance sheet, and differentiated technology platform, United Rentals provides compelling value at a forward earnings multiple of 11.2x.

Be the first to comment