koto_feja/E+ via Getty Images

Investment Summary

We are bullish on AxoGen, Inc. (NASDAQ:AXGN) shares heading into the company’s earnings announcement tomorrow. The company has already released pre-results for its top-line expectations in July, affirming a period of growth. Backed by positive top-line readouts from the RECON trial earlier in May, the stock also displays several of the equity premia investors are positioned towards in FY22, whilst technical studies indicate the market is searching for further upside in the name. Here we demonstrate there is forward upside capture to be made in AXGN and the risk/reward calculus is tilted to bullish for the medium-term.

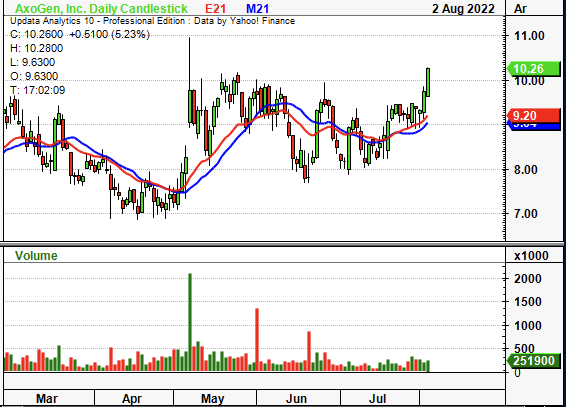

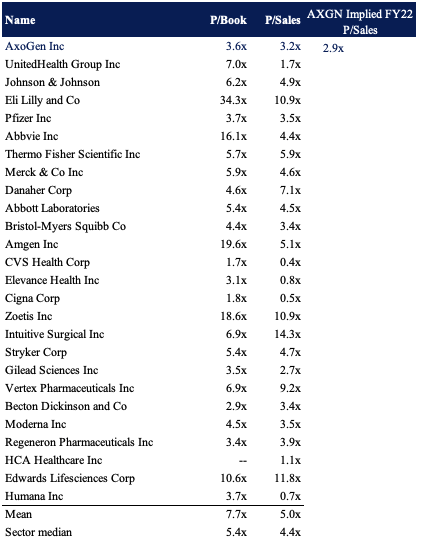

Exhibit 1. AXGN 6-month price action – has turned bullish leading into Q2 earnings

Data: Updata

Market Factors

We estimate the stock has yet to fully price in any earnings upside from AXGN’s earnings tomorrow. We are searching for a post-earnings announcement drift that would see the stock re-rate to the upside. We examined the market’s psychology leading into the event, as seen in Exhibit 2, and found that early money looks to have priced in additional growth down the P&L to the bottom line.

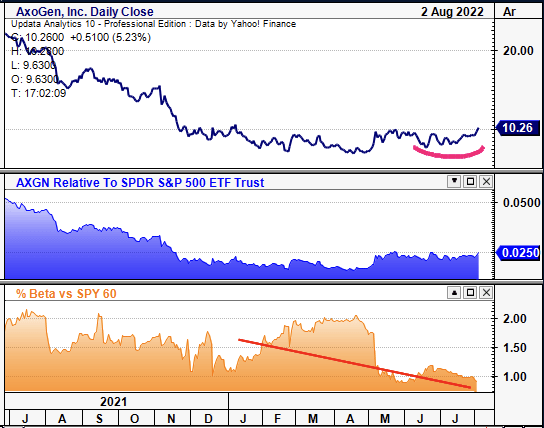

Firstly, note AXGNS’s uptick in strength relative to the benchmark since June. At the same time, its covariance structure relative to the SPX has shifted downward, whilst the stock looks to have found a bottom. Note, that investors have rotated out of high-beta/growth names in FY22, focusing on bottom-line fundamentals over top-line growth instead. If we are to value the market’s judgement, then sentiment leading into AXGN’s Q2 FY22 earnings certainly isn’t bearish.

Exhibit 2. AXGN looks to have found a bottom whilst downshifting covariance structure

Data: Updata

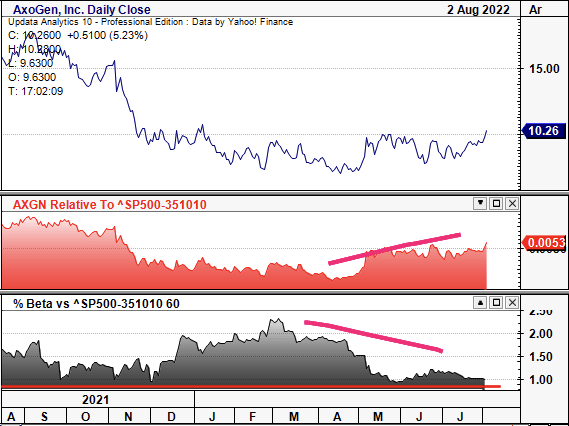

The data to these points strengthens when comparing AXGN to peers in the medical devices and health care supplies sector. As seen below, the AXGN share price has begun to outperform its peers, however, this isn’t attributable to sector beta. In fact, the stock has gained relative to the sector whilst reducing its covariance structure, suggesting the returns are idiosyncratic in nature and that investors are expecting a strong Q2 earnings from the company.

Exhibit 3. Strengthening vs. medical devices sector whilst reducing correlation suggests returns are idiosyncratic in nature

We estimate these trends imply the market is expecting a strong performance in Q2 FY22 from AXGN and have begun to position on the long side accordingly

Data: Updata

Pre-announcement Exhibits Growth Trends

In its earnings pre-release back in July, the company outlined preliminary Q2 revenue estimates of $34.4 million, calling for ~200bps YoY growth at the top. The result is ~145bps ahead of consensus that forecasts $33.3 million in revenue for the company this quarter. AXGN also reaffirmed its FY22 guidance of $135-$142 million which falls ahead of the Street’s estimates of $138.8 million. It does maintain a run-rate of $142 million at the upper end, this represents top-line growth of ~12% from FY21.

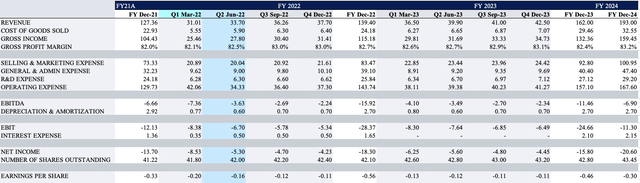

We are projecting the company to print revenue in the ranges of $33-$38 million, carrying this to an 82.5% gross profit margin, ~40bps YoY gain. As seen in Exhibit 4, we’ve also modelled operating expenses to narrow by ~18% from the first quarter to $34 million, leading to a net loss of $6.7 million – up from -$8.53 this time last year. At that run rate, this would see AXGN recognise $139 million at the top for FY22 in the forecasts below. Our estimates are ahead of consensus at the top and EBITDA level, and therefore, any result ahead of the Street’s estimates could push the stock further.

Exhibit 4. AXGN forward estimates leading into Q2 earnings

Valuation

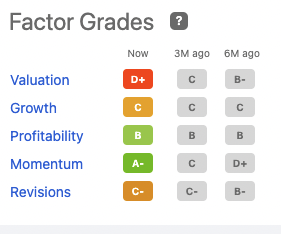

Despite the optimism, earnings momentum leading into the quarter lags peers, whilst valuations are a potential headwind to this investment thesis. Seeking Alpha’s quantitative factor grades rate the stock lowly in terms of valuation and earnings revision. This challenges our investment thesis and also suggests that if we are wrong, there is a likelihood the trade could turn against us to the downside. Moreover, whilst it is rated highly on profitability, we note there is no comparison to the sector in this section, which could skew the data.

Exhibit 5. Seeking Alpha Quant ratings imply a large hurdle to overcome

Data: Seeking Alpha

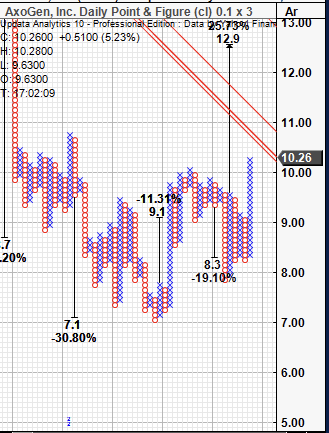

Moreover, the stock trades at a discount to peers in the health care sector at 3.6x book value and 3.2x P/sales. If it hits our forecasted $139 million sales, it implies a forward sales of 2.9x, well below the peer median. It is therefore crucial for the company to recognize revenue at the lower bound of its previously-outlined guidance ($135 million) in order to prevent a further de-rating to the downside.

Exhibit 6. AXGN trades at a discount to key multiples and needs to recognize $135 million in Q2 FY22 revenue to maintain a 3x P/Sales valuation

Data: HB Insights

Technical Studies Indicative of Buying Action

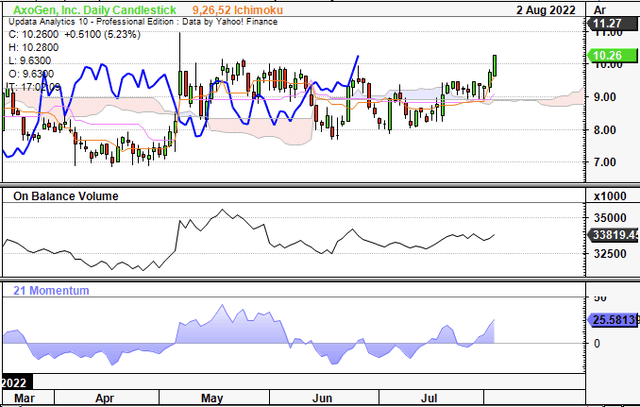

Perhaps the best gauge of the market’s positioning in AXGN leading into its earnings is seen in the charts below. In Exhibit 5, we examined price action and investor psychology using point and figure charts to remove the noise of time. Findings show there are multiple upside targets clustered towards the $12.90 mark. There have also been three major upthrusts since the stock bottomed in July, and shares are pushing towards the outer resistance lines seen on the chart below. With the uptrend in price action coming into earnings, we estimate that investors are positioned net-long in the stock and have sized up this exposure within the last few weeks, as seen below.

Exhibit 5. Price action supportive to upside targets at $12.90, testing longer-term resistance channels

Data: Updata

Meanwhile, on the 6-month daily cloud chart, price action has clearly turned bullish in late July. The uptick is supported by rising OBV and momentum as seen in the chart below. As observed, prices have punched through the cloud and the lag line (blue line) has also notched up above cloud support. Both of these markers above the Ichimoku Cloud are confirmation of bullish support in the stock, and this is backed by OBV and momentum. With that in mind, there’s strong buying support heading into the earnings announcement, providing a solid bedrock for the stock to re-rate afterwards.

Exhibit 6. Further evidence of investor buying support as long-term trend indicators and momentum suggest buyers are active up until today’s prices

In Short

We are bullish on AXGN heading into the company’s Q2 earnings announcement tomorrow. The company is expecting a 2% YoY growth in revenue. With the pre-release implying a period of growth for the company, we envision the market to react favourably should the company come in with upsides at the bottom line. Studies examining price action indicate there is strong buying support up until $12.90 and that long-term trends are bullish. Shares have also ticked upwards in late July, in what we estimate is investors positioning on the long side also forecasting an earnings beat for the company. We rate AXGN a buy and look forward to providing a more concrete valuation post-earnings.

Be the first to comment