Viorika

United Bancorp (NASDAQ:UBCP) reported solid results Q2 ended June, with +5.3% YoY EPS growth. This performance was better than that of Q1. The prior year comparisons for UBCP remain tough, following +19% EPS growth reported in 2021, and two years of strong results despite COVID. A key positive, which we mentioned in our prior notes, is that UBCP is a beneficiary of rising interest rates, which we discuss further in this note as well. For Q2, UBCP indicated that it was able to invest surplus liquidity into higher yielding bonds [superior quality and relatively low risk bonds such as tax-free municipals, agency securities, etc.] this year, thus enhancing interest income.

UBCP, to its credit, has been patient in this reinvestment process, avoiding such investments during the abnormally low interest rate period throughout the pandemic, in order to attain higher reinvestment yields today. Specifically, UBCP’s net interest margin rose up to 3.54% [from prior 3.45%], and we expect this trend to continue in the 2nd half. In fact, UBCP’s management mentioned that they are “highly optimistic” that this positive trend will continue. As investors may recall, UBCP’s margins have typically been in the ~3.80% range during normal interest rate and economic environments.

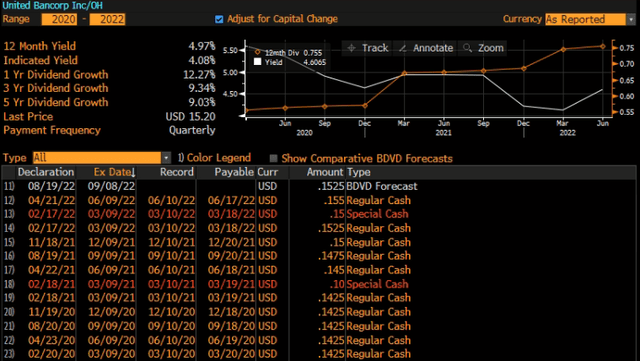

5.0% Dividend Yield after 7 Hikes

Remarkably, UBCP has reported 3 dividend hikes YTD. The regular dividend is now 15.50 cents per quarter, or an annualized level of 62 cents. Combined with the 15 cent Special Dividend declared earlier this year, full-year 2022 total dividend run-rate amounts to 77 cents, or a 5.0% dividend yield. This year’s 15 cent Special Dividend was an increase from last year’s 10 cent Special Dividend. In total, there are now the 7 dividend increases [five regular dividends plus two Special Dividends] by UBCP during the past 18 months, which is phenomenal given that many financials are still at reduced [or even zero] dividend payout levels due to COVID-19. Very few stocks, globally, can boast of seven dividend hikes during the past year!! In our opinion, the company is clearly sending a signal to investors that they are quite confident about their financial position and outlook.

Bloomberg

Despite having performed very well following our February 2021 Initial Recommendation, rising 21% in total return [versus the Russell 2000 small-cap index being down -11%], we still see further 40% total return potential. As we have highlighted in our previous notes, UBCP is a very attractive dividend story in many ways. First, the total dividend yield, at 5.0% this year, is clearly among the tier of all listed stocks in the USA. Second, management has been quite aggressive in raising its regular and Special Dividend the past couple years.

Finally, the company has a rich tradition going back 39 years of paying dividends to shareholders – they appear to recognize that retail individual investors make up a large segment of their shareholders, and dividends are important to them. We would also note that UBCP is not just a yield story, there is above-average growth as well, coming off of a relatively small base. We continue to remain confident UBCP will attain its $1 billion asset mark within a few years, which target management has reiterated in its earnings press release. This goal would imply 38% growth from current asset levels.

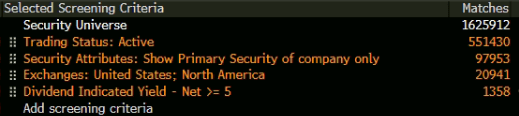

As can be seen in the following Bloomberg screen which we ran, out of 20,941 stocks in the USA [which comprise 21% of the entire world’s 97,953 listed stocks], only 1,358 stocks have dividend yields higher than UBCP’s. Thus UBCP is among the top 7% of all USA dividend yields:

Bloomberg

Major Catalyst: Rising Rates Beneficiary

In our view, a key catalyst for UBCP is that its balance sheet is well positioned to benefit from rising interest rates, both higher Fed Funds rate as well as higher market rates. The company’s results for the past two quarters YTD has reinforced this point. UBCP stands to benefit from higher rates as it changes the mix of assets on its balance sheet, and redeploys investments in bonds and securities, and excess funds held at the Federal Reserve, at higher yields. From the Q2 earnings release, UBCP witnessed 7.4% YoY jump in overall pre-provision interest income [with post-provision interest income up 11.1%].

Reiterate $21 Price Target, suggesting 40% total return

We are reiterating our $21.00 price target, which implies about 40% total return. Investors should note UBCP touched a 52-week high of $20.70 as recently as April, so we believe our target price is both very credible and imminently attainable. The stock has performed very well following our February 2021 Initial Recommendation, rising 21% in total return, over 30 points ahead of the Russell 2000 Index over that same time horizon. The overall return potential makes it worthwhile to accumulate this small-cap and low volume stock, in our opinion. The recent market-driven decline from its 52-week high during the past few months is an opportunity to accumulate the stock, in our view.

We arrive at our $21.00 target price using a 12.4x multiple on our 2023 EPS expectation of $1.70. We believe the P/E multiple assumption implied by our price target is reasonable given the 13.6x P/E multiple of various banking indices, and the overall 19.4x forward P/E level of the Russell 2000 Index. On today’s stock price, UBCP is trading at an attractive and “deep value” levels of 8.9x P/E, and 5.0% regular dividend yield [not including any likely Special Dividend], all based on year 2023 likely results.

Strong Growth Record & Future Prospects

Please see earlier Seeking Alpha update notes for detailed discussion on this topic.

Solid Asset Quality & Low Charge-offs

Given economic uncertainties and headwinds in the USA economy, any bank’s asset quality needs to be carefully assessed. High inflation, rising interest rates, and sagging consumer confidence are key concerns, despite very low unemployment rates. In fact, unemployment is the #1 factor determining asset quality for any bank’s retail lending book, which is still a very bright spot in the USA. UBCP’s asset quality has remained stellar, thus enabling the bank to be in a comfortable position of being overprovisioned in the face of below-expectations nonaccrual levels, which was a major factor leading to strong earnings growth in Q2, as well as the last couple years. However, we don’t expect further positive provisioning expenses going forward.

Nonaccrual loans [loans past due 30 days] stood at 0.9% of total loans as of June-end, which rate was flat sequentially. For Q2, net charge-offs were actually positive, i.e., below 0.00%, with a slight recovery of $19,000. This is even better than net charge-offs for full-year 2021, excluding overdrafts, which were a minimal 0.02% annualized. Even after the provisioning expense write-back in the last four quarters, UBCP’s total allowance for loan losses to non-performing loans stands at 66%. Total allowance for loan losses to total loans remains at a very comfortable level of 0.59%.

Conclusion: Dividend Yield + Growth

UBCP’s stock is a very attractive mix of deep value metrics, strong 2021 and 5-year growth, solid capital and leverage metrics, and a stable and conservative management team. With a 5.0% total dividend yield [including the Special Dividend announced a few months back] for the current year, and the prospects for continued dividend growth, investors are getting a great mix of both yield plus growth. Seven dividend hikes plus strong earnings results have highlighted UBCP’s banner performance during the past 18 months. The stock continues to look quite undervalued trading at 8.9x P/E on forward likely EPS. We see 40% total return potential for UBCP’s stock assuming conservative multiples at a discount to the market as well as the financial sector.

Be the first to comment