Editor’s note: Seeking Alpha is proud to welcome Matt Mercer as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

JHVEPhoto/iStock Editorial via Getty Images

Insperity, Inc. (NYSE:NSP), is a payroll and HR software services provider that targets primarily small and medium-sized businesses. I believe it’s currently a hold because it presents sounds financials and a fair valuation, but is facing some notable headwinds and risks in 2023. In this article, I’ll give an overview of their business and revenue model, financials, a competitor and market analysis, and the risks they face in 2023.

If not for current macro conditions, I would rate NSP a buy considering its strong intrinsic value and historic growth. However, current market and interest rate conditions might drive the price lower, and offer buyers a better deal within six months, which leads to my hold rating.

Business Overview

Insperity is a comprehensive business performance solutions provider targeting primarily small and medium-sized businesses. It offers business management solutions, such as:

-

payroll and benefits administration

-

health and workers’ compensation insurance programs

-

personnel records management

-

employer liability management

-

assistance with government compliance

-

access to Insperity Premier, a cloud-based human resources system

-

sponsored 401(k) retirement plan

Insperity drives revenue primarily from its client service agreement. The typical term is one year for small businesses and two years for medium-sized businesses. The nature of these contracts creates a particular risk of inflationary pressures, as it’s difficult to increase prices in response to cost inflation, and it might take time for this to reflect on the income and cash flow statements from the newer book of contracts they sign going forward. The revenue structure of these contracts is based on two factors: 1) the number of worksite employees (increases total payroll), and 2) the total payroll of worksite employees (increases percentage of payroll cost that NSP earns).

NSP structures their contracts with a comprehensive service fee, which includes the payroll of worksite employees and a percentage of the payroll cost. A worksite employee is an employee of the business whom NSP will manage the payroll for. Therefore, an increase in both the number of worksite employees and the wages of worksite employees will drive revenue growth for NSP.

Financials

NSP’s current market cap is $4B with a P/E ratio of 29.17. The forward P/E is at 25.92 right now, suggesting there might be some downward pressure on the stock in 2023. NSP earns a D+ valuation grade by the Seeking Alpha quant model, which is driven by mostly bad earnings-related valuations. When looking at sales and cash flow metrics, there are better valuations. Enterprise value/sales is 0.72 (-55.9% difference vs. the sector), price/sales is 0.76 (-40.97% difference vs. the sector), and price/cash flow is strong at 13.16 (-15.29% difference vs. the sector).

I believe the price/cash flow valuation specifically at 13.16 is strong for NSP and demonstrates their ability to weather tough economic conditions. This isn’t a defensive pick due to the natural risks of their business model (serving small to medium-sized businesses in a recessionary environment), but they have sound financials and a sound valuation. With a current free cash flow yield of 7.34%, this stock looks undervalued relative to its peers – primarily Automatic Data Processing, Inc. (ADP) and Paychex, Inc. (PAYX).

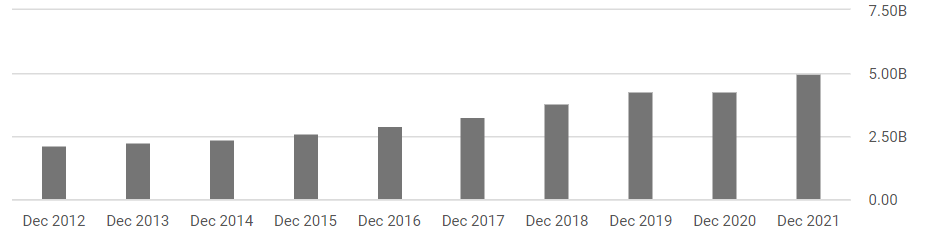

Now let’s look a bit at the historic growth patterns. NSP has seen healthy revenue and profit growth for the past 10 years, achieving gross profit growth each year from 2012-21, and missing revenue growth only in 2020. In absolute terms, NSP has seen more than a doubling in revenues:

2012-2021 NSP Revenues (Seeking Alpha)

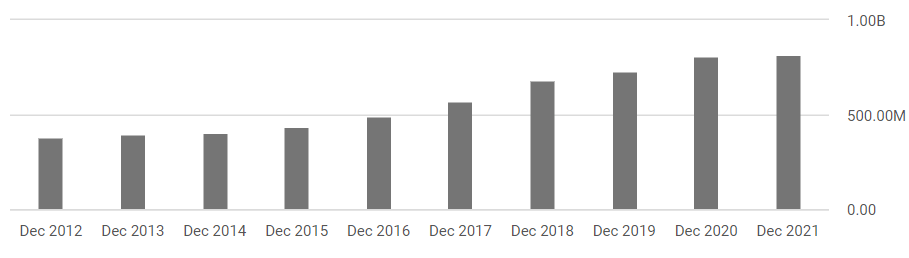

Profit has seen a similar absolute increase:

2012-2021 NSP Profits (Seeking Alpha)

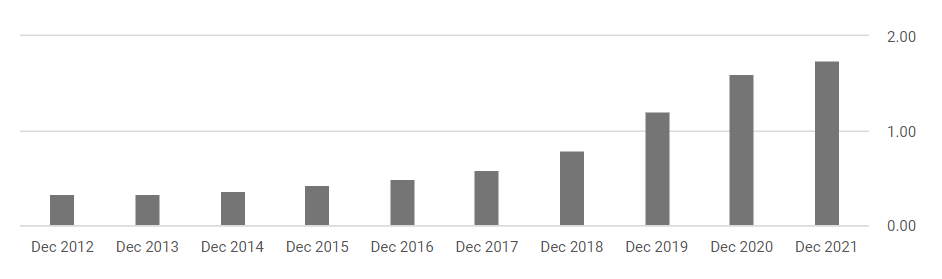

Net income, revenue per share, and EBITDA have all more than doubled in the past 10 years. NSP pays a safe and growing dividend (both receive an A grade from the Seeking Alpha quant model):

2012-2021 NSP Dividend Per Share Growth (Seeking Alpha)

They have also been able to decrease their effective tax rate from 40.8% in 2012 to 26.3% in 2021 due in part to lobbying efforts that allow these payroll companies to declare worksite employees as employees of the company itself. In other words, NSP can declare all worksite employees as employees of NSP and realize tax benefits as such.

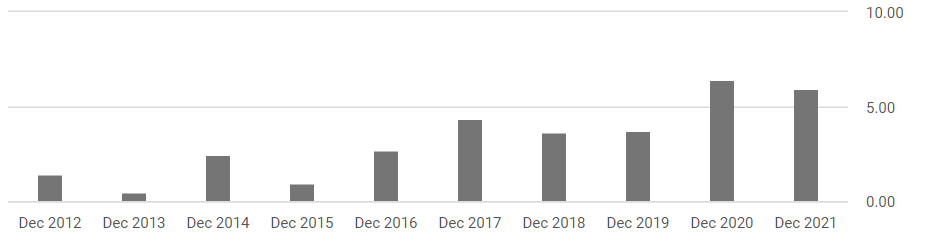

Free cash flow per share has increased to $7.48 in December 2022, an 18.80% year-over-year increase. It’s currently at the highest its been in the past 10 years:

2012-2021 NSP Free Cash Flow Per Share Growth (Seeking Alpha)

In all, the financials look good. They are healthy and point to effective management, effective implementation of the business strategy, and continued growth and success in the future. The free cash flow yield currently suggests upward of a 7% return, and given that, coupled with a healthy and growing dividend yield of 1.83%, NSP looks undervalued compared to the sector.

NSP’s financials are great in a vacuum. But how do they look in terms of their market and competitors?

Market and Competitor Analysis

NSP is one of many firms in the professional employer organization (PEO) space. The two largest in terms of market share and market cap are ADP and PAYX. Let’s briefly compare and discuss the revenue growth prospects for NSP against these competitors, comparative value, and historic returns.

Revenue Growth Prospects

As mentioned in the business overview, as the number of worksite employees that NSP services grows, their revenue will grow organically. Furthermore, wage increases provide additional revenue. Widespread headcount reductions would hurt NSP, so labor market conditions will be important to monitor for any buyer. Let’s look at current market share, worksite employee growth (industry-wide), and a comparison to ADP and PAYX.

Current Market Share

According to the industry statistics section of the National Association of Professional Employer Organizations (NAPEO) website, there are 4 million worksite employees industry-wide as of 2020. Using 4 million as the base for market share, we find the following:

| ADP | PAYX | NSP | |

| Number of Worksite Employees | 700,000 | 730,000 | 268,978 |

| Market Share | 17.50% | 18.25% | 6.72% |

| 2021 Revenue | $16.8B | $4.7B | $5.74B |

| 2021 Levered Free Cash Flow | $6.62B | $1.74B | $316.6M |

| Market Capitalization | $99B | $41B | $4B |

| Forward P/E | 29.18 | 26.95 | 25.92 |

Note: Table created by the author. The number of worksite employees pulled from the most current 10-K filing for each company.

PAYX has 22% less revenue despite having 64% more market share. ADP has 66% more revenue with 62% more market share (see calculations below). Considering ADP and PAYX have market caps of 25x and 10x of NSP, respectively, this suggests NSP is undervalued relative to these competitors. This trend is similar in the free cash flow of these companies, with NSP boasting the highest FCF yield at ~7%, compared to ~6% for ADP and ~4% for PAYX. The forward P/E for 2023 also confirms that NSP provides more value currently than these competitors.

Here’s a look at the calculations I used:

PAYX vs. NSP

- (1-(5.74/4.7)) = 22% less revenue

- (1-(6.72%/18.25%)) = 64% more market share

ADP vs. NSP

- (1-(5.74/16.8)) = 65% more revenue

- (1-(6.72%/17.50%)) = 62% more market share

Industry-Wide Growth

According to Industry Statistics from the NAPEO website, from 2008 to 2020 the number of worksite employees employed in the PEO industry grew at a compounded annual rate of 7.6%. This suggests organic market growth, which helps all market participants in general and further solidifies my estimate of 7% returns for NSP. Insperity need not even outpace rivals – the average industry growth will be sufficient to achieve strong returns. If you compound effective management and a history of above-average growth, the picture only gets prettier.

One key metric in which NSP is a laggard is retention rate. In general, it’s cheaper to keep a client than to gain a client. There might be any number of acquisition costs, so suffice it to say it’s preferable to retain the largest share of current customers as possible. NSP has the worst retention rate of the three companies being discussed at 82%, while PAYX is at 84% and ADP leads with 92%.

The retention rate will be an important metric to weather the inflationary pressure caused by the structure of a contract-based revenue model. NSP’s client service agreements lock in pricing for one to two years, meaning they can’t easily increase prices in response to cost inflation. NSP has noted that cost inflation is eating into profit. This pressure can be alleviated over time by price increases in contract renewals; however, with a retention rate lagging behind its two primary competitors NSP could experience a slower revenue growth rate.

A key risk that NSP details in its annual report are that customers might transition to traditional in-house services. Although NSP presents a clear value added by drastically simplifying employee management, a recessionary environment (as is expected by many in 2023) could cause a higher rate of company cost-cutting by switching to in-house employee management. Although I don’t expect this to pose a material risk to NSP’s business model, it’s a headwind worth mentioning.

Furthermore, headcount reductions can pose a risk to revenue growth while wage inflation can bolster it. Although CPI data is trending downward, the Fed has yet to indicate a pivot. Inflation can viciously spiral as workers request pay increases and companies increase prices to offset the cost, but NSP actually benefits from that wage-price spiral. There’s a somewhat lagging effect in wage increases, as many employees are dependent on year-end reviews to request pay raises. It’s likely that this is a factor in the Fed’s hesitance to announce a pivot.

As noted in the above-linked “yet to indicate a pivot” article, the Fed doesn’t believe interest rates have rippled through the economy entirely. There’s also the lagging, cyclical impact of inflation on wages. We are currently in the midst of the year-end review cycle and should expect some resulting wage inflation. The first quarter of 2023 will help paint a clearer picture of the steps forward for the Fed. Regardless, wage inflation helps NSP. However, if recession concerns are realized and layoffs spread throughout the economy driving total payrolls down, NSP could take a revenue hit. They are diversified throughout sectors and have a lot of cash on hand to help weather any challenges that lie ahead.

In all, when considering the market caps of these three companies, NSP presents the best value. NSP has more revenue with a smaller market share and a smaller market cap by a factor of 10 than PAYX. Compared to ADP, which has a market cap is 25x with only 3x revenue, it’s better to look toward free cash flow (ADP has revenue from operations other than PEO services). Comparing levered free cash flow, which gives insight into the cash-generating abilities of the business, we see that ADP is below what its 25x valuation should be. ADP’s free cash flow should be (316.6 * 25) = $7.92B, but it’s currently 17% below that. NSP has a stronger cash flow relative to its market cap. Furthermore, NSP has a much stronger P/E ratio than these competitors.

Historic Returns

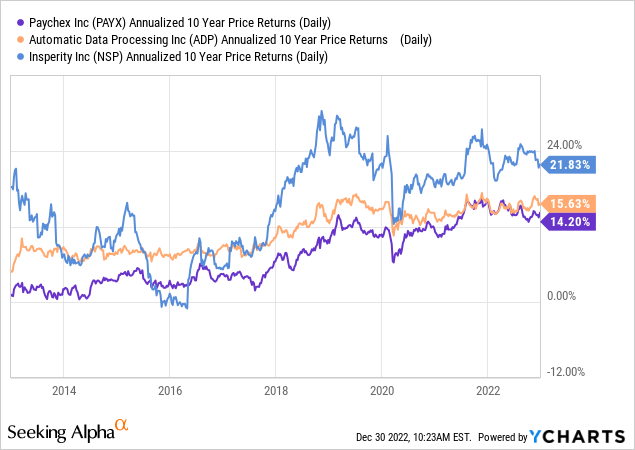

With a 10-year runway, NSP outshines both ADP and PAYX at a 21.83% annualized return:

It also offers a strong dividend:

| ADP | PAYX | NSP | |

| FWD Dividend Yield | 2.09% | 2.73% | 1.83% |

| Payout Ratio | 57.62% | 76.13% | 41.10% |

| 5-year growth rate | 13.31% | 9.55% | 28.44% |

The slightly lower forward dividend yield is supplemented by a significantly higher five-year growth rate and higher historic returns.

Taking this all into consideration, an investment in NSP currently looks much more attractive than an investment in ADP or PAYX.

Risks

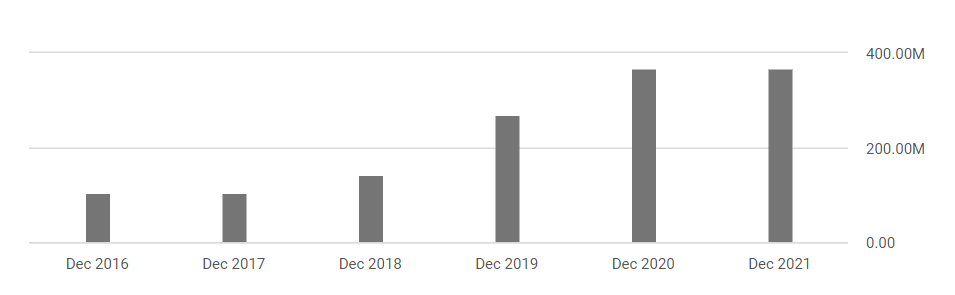

Long-term debt has grown from $104.4M in 2016 to $369.4M in 2021, attributed primarily to NSP drawing on a revolving credit line. This revolving credit facility matures on Sept. 13th, 2024 (see page 89 of the annual report).

2016-2021 NSP Long-Term Debt Growth (Seeking Alpha)

This line bears interest at either 1) the prime rate as reported by the WSJ, 2) the fed funds rate at +0.5%, or 3) the 30-day LIBOR rate at +2.00%. They paid an average interest rate of 1.9% in 2021, which is going to significantly increase in 2022.

Here’s a snapshot of the beginning of 2022 vs. the end of 2022 rates.

WSJ Prime Rate:

- Dec. 12, 2021 – 3.25%

- Dec. 12, 2022 – 7.5%

- March 17, 2022 – 0.25% to 0.5%

- Dec. 14, 2022 – 4.25% to 4.5%

- Jan. 4, 2022 – 0.10371%

- Dec. 1, 2022 – 4.17229%

Since the interest bears at the company’s chosen rate and the fed funds rate +0.5% is the lowest rate, let’s assume they select that and have an effective annualized rate of 4.75%. This means they will be accruing $17.5M in interest per year. If the interest compounds monthly or semiannually, it’s an even worse situation. NSP does have ample cash on hand compared to this debt expense, and ultimately it’s important to consider whether the debt is driving further revenue growth. The debt does not pose insolvency or illiquidity concerns but could harm future growth prospects.

In other words, their debt burden ballooned as the Fed began this rapid hike cycle. It will be in any investor’s best interest to continue monitoring the levered free cash flow to gauge the impact of the rate hikes and this debt burden on their financial condition as more financial reports come available. Currently, NSP has a very healthy spread between the levered and un-levered free cash flow, which suggests debt is not playing a major role in the cash flow generated by their operations. I expect that spread to widen to the downside, with the levered free cash flow yield dropping considerably throughout 2023. It’s something worth noting for all potential buyers. The weight of the interest rate hikes has yet to hit the income and cash flow statements, but I expect interest expense to impact levered free cash flow in 2023.

|

Datapoint |

$ Amount |

FCF Yield (FCF/Market cap) |

|

Market cap |

4.31B |

|

|

Un-levered free cash flow |

323.3 |

7.50% |

|

Levered free cash flow |

316.6 |

7.34% |

There’s a growing narrative of significant macroeconomic headwinds in 2023. Many analysts are expecting a recession, there’s an ongoing inflationary environment (7% inflation is still 7% inflation even if it’s a downside surprise), and the lagging effects of interest rate hikes will begin to ripple through the economy. This paints a grim picture for small to medium-sized businesses, which make up NSP’s target market. This could cause a higher default rate on service contracts, a slowdown in new contract bookings as potential customers turn to in-house solutions (which accentuates the inflationary pressure on the existing book), and an overall downward pressure on the cash flow and bottom line of NSP.

Conclusion

At this time, I rate NSP a hold. It will be worthwhile to wait on the sidelines if you don’t already own some and interpret the impact of interest rate hikes on the levered free cash flow. Furthermore, the current macro environment might pose risks and cause downward pressure on revenue generated by new contract signings. With a retention rate lagging behind its two foremost competitors, NSP could encounter some rocky roads ahead. However, if the macro environment clears up and there’s less uncertainty six months from now, this is a strong company with a strong dividend that can be a good long-term dividend growth pick.

Be the first to comment