David Ramos

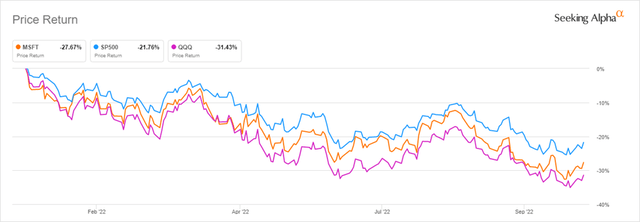

The world’s largest software company has not been immune to the sell-off and bear market of 2022. Despite its incredible financial strength and resilience, in addition to bright future prospects, Microsoft (NASDAQ:MSFT) has sold-off more than the broader market as measured by the S&P 500, although it is slightly ahead of the NASDAQ year-to-date.

While recent stock performance has been terrible, dragging the stock from an all-time high down to a multi-year low, the underlying fundamentals of the business have never been stronger. Of course, there are some macroeconomic concerns, but what is a better place to park your capital? In over-extended speculative names, or well-established businesses with exceptional fundamentals and incredible future prospects?

YTD Performance of MSFT versus the S&P 500 and QQQ (Seeking Alpha)

Sustainable Business Lines and Growth Prospects

Microsoft has moved from disks and single purchases to a SAAS model for its most important offerings. This is not only more efficient and profitable but makes decisions and the lives of customers that much easier. As a university professor and freelance analyst, the subscription model is fantastic. It allows me to do my work for both the university and me personally while not worrying about updates and costs. I love it. That said, I’m old school and what I find novel won’t necessarily be the future of the company.

Microsoft continually evolves. From operating systems to business software packages and gaming, the company and its management have proven to be not only competent but forward-looking. I pay my annual subscription for Office, as does my employer (on a much larger scale), and we also pay for our son’s Minecraft and related subscriptions, Xbox and games, etc. For one family and our respective employers and games, we literally pay Microsoft at least hundreds of dollars per year.

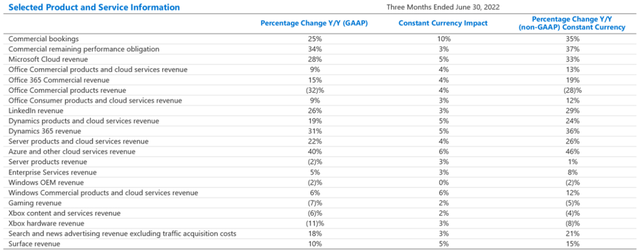

Beyond these legacy revenue sources, Microsoft has developed its cloud computing service, Azure, into an industry leader. Microsoft’s cloud computing offerings, including Azure, represented nearly 50% of total revenue for the quarter ended June 30, 2022, and is growing north of 30% annually with 70% gross margins. Effectively all lines of business have been growing double digits except for Xbox content and services, and Office Commercial Products. The decrease in revenue was hurt in part by the strengthening dollar but would have been negative just the same.

Year-Over-Year Revenue Growth (Microsoft)

Furthermore, Microsoft has made inroads into the lucrative online ad business. It purchased Xander, a global advertising marketplace, from AT&T (T) last year, an initiative that helped it win the ad placement business for Netflix’s (NFLX) new ad-supported model for lower monthly subscription prices. The company’s search and ad revenues are growing at about a 20% annual pace. Also, during the last quarter, the company returned a significant amount of capital to shareholders. Between share repurchases and dividends, Microsoft returned $12.4 billion in the quarter, a year-over-year increase of 19% percent. In recent weeks, the company also announced a dividend increase of about 10% for the next dividend with an ex-dividend date of November 16. Over the last nine years, Microsoft has increased its dividend at a compound annual growth rate (‘CAGR’) of over 11.6%.

Potential Netflix Acquisition?

This may be speculative, but Microsoft is the only major tech or communications company without a streaming service. The ad relationship with Netflix could provide Microsoft with the insight it needs to make an acquisition. As I have noted in other articles, Microsoft could purchase Netflix at its current market cap effectively in cash. Furthermore, given that a Netflix acquisition would likely not harm any segment of the market, anti-trust issues would likely not be a concern in my opinion, even for such a large purchase.

Valuation

From a valuation perspective, Microsoft is compelling. While trading above many of its peers in terms of multiples, it is largely trading below its own history. When looking at fundamental factors, I am an advocate for comparing current metrics to the company’s own history more than the peer group or industry. The peer group and industry provide some context, but the health of the company should be compared to its own history because every company is different, and those differences often legitimately explain valuation differences. So let’s look at some key metrics for Microsoft and compare them to years past.

The stock is trading at a meaningful discount to 5-year averages for both its forward and trailing P/E. For several valuation multiples, Microsoft is trading at a 20-25% discount relative to the last five years.

|

Valuation Metric |

MSFT |

MSFT 5-year Average |

% Difference to 5-Year Average |

|

P/E GAAP (‘TTM’) |

25.09 |

34.62 |

-27.53 |

|

P/E GAAP (‘FWD’) |

24.06 |

30.77 |

-21.81% |

|

Price/Sales (‘TTM’) |

9.15 |

9.71 |

-5.70% |

|

Price/Sales (‘FWD’) |

8.24 |

9.01 |

-8.55% |

|

Price/Book (‘TTM’) |

10.85 |

11.76 |

-7.73% |

|

Price/Book (‘FWD’) |

7.81 |

10.26 |

-23.89% |

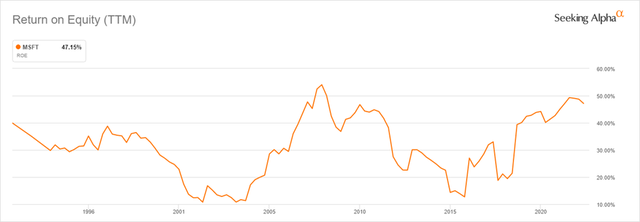

While valuations are below multi-year levels, returns have been stable and in line with years past. For example, returns on total capital over the last 12 months was 22.2% compared to a five-year average of 16.9%. Similarly, over the last twelve months, ROE and ROA were 47.15% and 19.9% compared to 5-year average figures of 38.9% and 14.5%, respectively.

Gross profit margins have been maintained at a long-term average of about 67-68% while net income margins have increased from a 5-year average of 29.7% to 36.7% over the last twelve months.

I expect the earnings released on Tuesday the 25th to reflect continued strength across the board with similar growth and margins to what the company has consistently generated.

Returns on Capital and the Connection to Growth

Given the current valuation and returns on capital and equity as described above, the sustainable growth rate of the company is strong, stable, and likely to grow in the coming quarters and years. Microsoft has paid a dividend for about 20 years, growing each of those years. With that said, the current dividend is funded through a payout ratio of only 25%, below its long-term average. This is positive for at least two reasons: the dividend is well covered by current earnings and operating cash flow, and secondly, this allows the company to either accelerate dividend growth and/or share buybacks, both of which benefit current shareholders. Frankly, given the current valuation of the equity, increasing share buybacks would probably be advantageous.

Return on Equity (Seeking Alpha)

Dividend

The current yield of 1.15% is not overly compelling. However, the growth of the dividend over the years makes this attractive. In addition to the safety and coverage mentioned above, the dividend has grown at a compound annual growth rate (‘CAGR’) of 11.6% over the last 9 years, 9.7% over the last five years, and 10% year-over-year in the coming twelve months (including the dividend increase recently announced.) In addition to the underlying fundamental strength of the business, including a large cash balance of nearly $105 billion, this signals to the market that the business is strong and that senior leadership is confident in future growth initiatives, prospects, and opportunities.

Catalysts

As mentioned in a previous article I wrote about Netflix, Microsoft has entered into the advertising space, previously helping Meta (META) and now Netflix. The company has bolstered its efforts in the space through the Xander acquisition from AT&T.

Beyond the ad business as an avenue for growth, Microsoft has several existing and potential new opportunities, that despite the company’s age, make this both a value and a growth business at these prices.

Leading the charge are Azure and other cloud-related services. This income stream already represents nearly 50% of revenue, is experiencing growth above 30% annually, and boasts gross margins in the 70% neighborhood.

What is perhaps a little surprising is the amount of revenue growth Microsoft has been able to generate from LinkedIn. Revenue for that business grew by 26% last quarter, driven by an increase in sessions and record levels of engagement. Microsoft paid $26.2 billion for LinkedIn in 2016, a business that generated $13.8 billion in revenue in fiscal 2022, although operating margins have not been released since 2019.

Risks

Risks faced by Microsoft are those common to all businesses here and abroad. However, Microsoft has the distinct advantage of selling products and services with a limited elasticity, meaning that business cycles are typically dominated by secular growth. Given the economies of scale, the business is able to achieve on essentially every product and service it offers, inflation is not a primary concern to the business. An economic slowdown that extends longer or is more severe than anticipated would certainly impact the business, but given its solid fundamentals, both on the balance sheet and continuing operations, it is reasonable to expect this impact to be mild and much less severe than that experienced by more cyclical businesses or those not as well positioned fundamentally at this time. In other words, the stock will either thrive in a recovering market, or hold-up better than most others in an ugly economic situation that drags the markets down further.

The strengthening of the dollar will continue to be a challenge for the company. As seen in recent quarters, and fiscal 2022, dollar strength has shaved about 2% off of gross and operating margins. The company expects revenue growth to experience a 4% negative impact from changes in foreign exchange.

Final Thoughts

I have been a shareholder of Microsoft for more than a decade. I originally purchased shares based on an analysis I conducted in about 2011/12 for a former employer. At the time, my suggestion was emphatically rejected. After all, there was that whole Greek debt issue or whatever that made financial markets volatile. I presented the idea as a value with a growth kicker at a time that the volatility provided an attractive entry point. Nearly laughing out of the room, I purchased shares immediately after for about $25 each. It hasn’t been a straight line, but the 10x in 10-11 years, excluding dividends served as nice validation. My anecdote aside, I typically prefer not to recommend individual stocks. For most investors interested in what I have discussed in this article, buying the Invesco QQQ Trust (QQQ) or SPDR S&P 500 ETF Trust (SPY) is likely a better approach. But for those interested in taking advantage of today’s depressed prices, especially for high-quality companies with excellent growth prospects, I think Microsoft is an excellent spot to park some capital, given that you size your position appropriately (i.e., don’t put all your eggs in one basket – diversification is best). Thank you for reading. I look forward to your feedback in the comment section below.

Be the first to comment