Dejan Marjanovic

Investment Thesis

Canopy Growth Corporation (NASDAQ:CGC) is one of those cannabis stocks that have been left for dead. The stock is down more than 95% since investors previously mass-clambered into the stock in 2018.

And there are very valid reasons for CGC to be down so significantly. Not only are its revenue growth rates negative, but its gross margins are negative too. How do investors even start to get bullish on a company with that type of profile?

That being said, yesterday, President Biden made a mass pardon for simple cannabis possession. Therefore, there’s now widespread speculation that there could be a revival of the cannabis sector.

If cannabis were to be legalized, this would most likely change its taxing status, which would make this sector’s profitability profile dramatically improve.

There are going to be a lot of ups and downs in this space in the coming weeks. But that will be a welcome change from these stocks just sliding down.

What’s Happened?

President Joe Biden pardons all people with convictions for simple possession of marijuana. Clearly, the timing of this pardon has seen all politicians from all walks of life come out with an opinion.

This led to stocks in this sector jumping higher. Tilray (TLRY) got a lot of attention and led the group higher, but the impact of this possession pardon was broad across countless cannabis stocks and ETFs.

Investors are now scrambling in an attempt to figure out how to best position themselves in this space.

Revenue Growth Rates Turn Negative

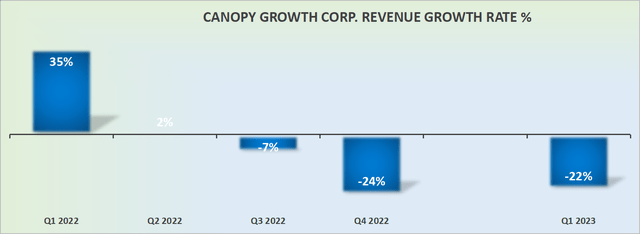

CGC revenue growth rates, in USD

However, here’s the problem for CGC. CGC is reporting negative y/y growth rates. In fact, fiscal Q1 2023 saw negative 22% y/y growth rates. These are “as-reported” figures, in USD.

One thing is for legalization to be widely accepted, the other important driver is how to get CGC to convince investors that it can resume its revenue growth trajectory. And therein lies the problem.

Remember, a lot of investors got truly euphoric about cannabis stocks back in 2018. And since then, we’ve seen investors get substantially burned. Why?

Because investors were pricing in too much hope in a sector that ultimately failed to deliver against that expectation.

CGC Stock Valuation — Difficult to Find Intrinsic Value

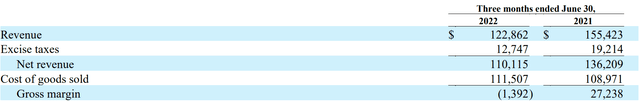

CGC Q1 2023, reported in Canadian dollars

What we can see above is that CGC’s gross margin is negative. There’s very little ambiguity, this business is hemorrhaging losses.

How does one even start to get comfortable with the risks of investing in such a speculative area of the market?

CGC does hold $1.2 billion in cash, but that’s offset by roughly the same amount of debt.

The other side of the argument is that given President Biden’s pardon, this will offer a lifeline to the cannabis market.

The Bottom Line

President Biden’s pardon gets investors very excited. Not only because of the likely broad acceptance of cannabis, but also the expectation that this could materially impact the taxation of cannabis players.

If cannabis gets downgraded from a Schedule 1 substance in the same category as heroin, this would see cannabis players embracing lower taxing status, which will drive CGC’s free cash flows higher.

The other obvious driver would be that this would open up the door for the broad legalization of cannabis, which would no longer compete with the illicit cannabis market to such a great extent.

There’s clearly going to be a lot of interest in this sector now. And since CGC has already its multiple fully compress, I’m inclined to believe that the risk-reward is now quite favorable.

Indeed, these stocks have all been so out of favor with investors, that “buy the dip” investors are desperate to get in at the bottom, buy at these lows, and “sell high“.

Be the first to comment