kokkai

Introduction

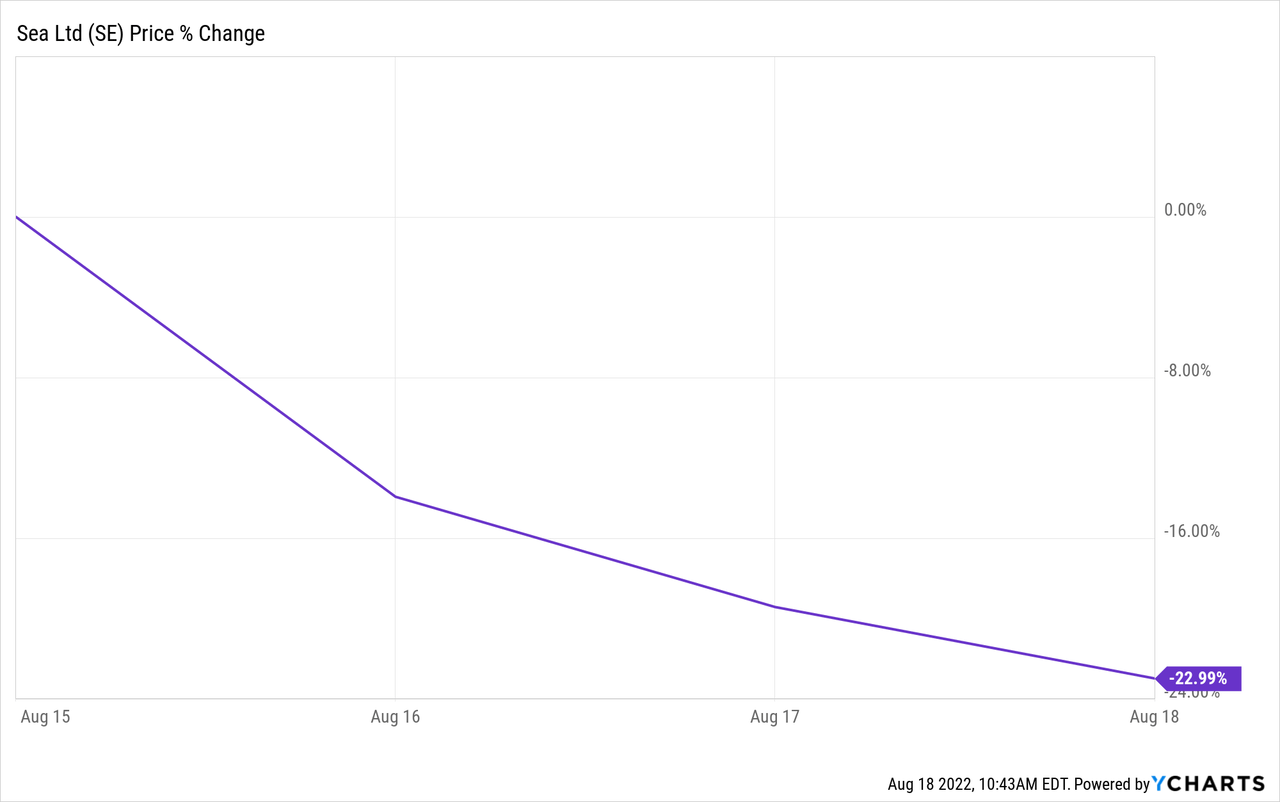

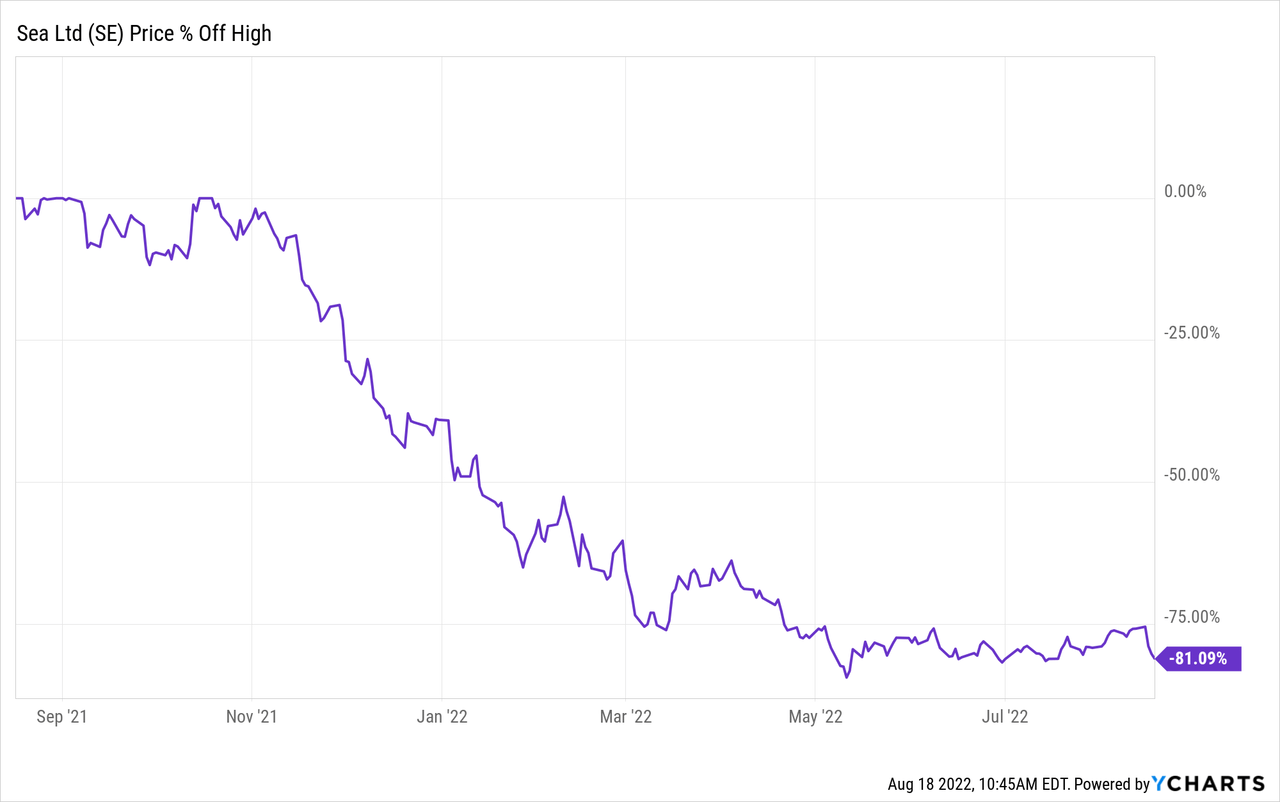

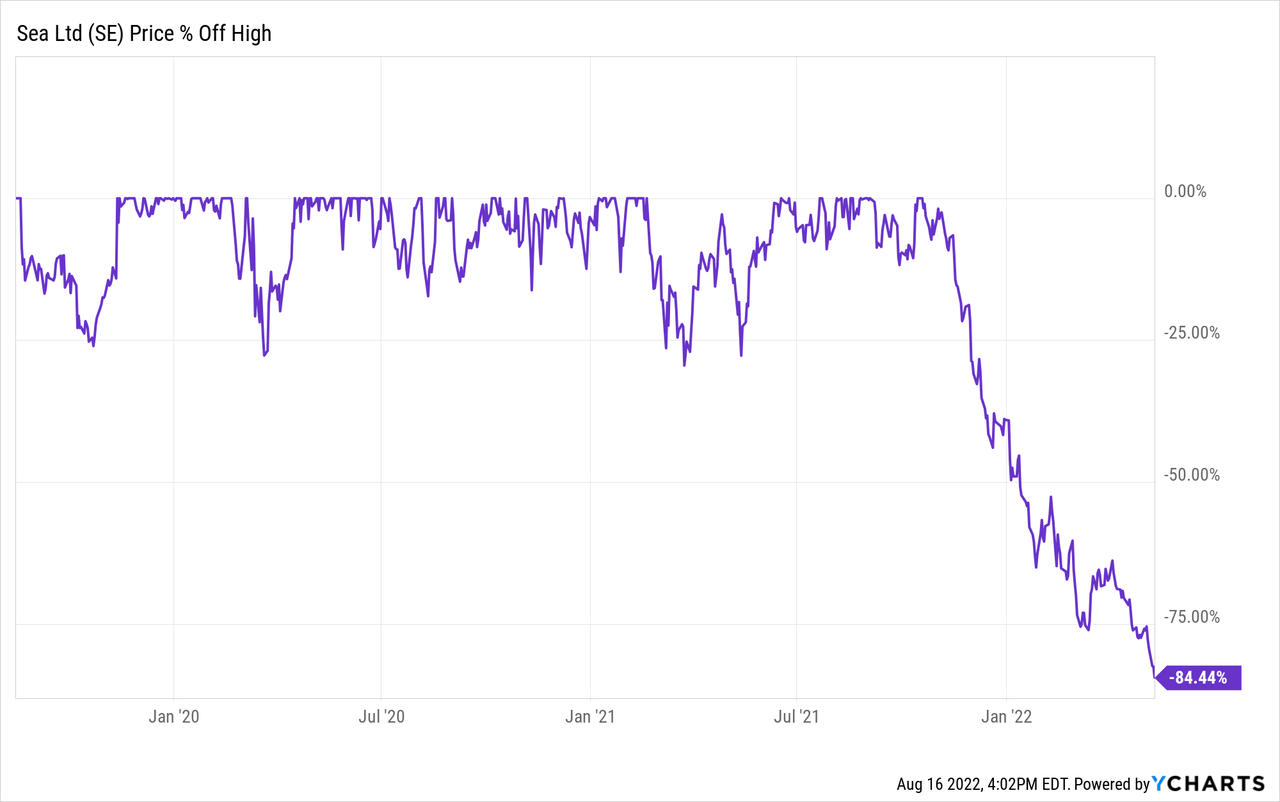

On Tuesday, before the markets opened, Sea Limited (NYSE:SE) reported its Q2 2022 earnings this morning. The stock took a serious beating and it’s down 23% (at the moment of writing).

When we look at the all-time high, it’s down even more by 81%.

Is this a broken company? I’ll give my opinion right away here: to me, it’s not. I think the long-term potential is still outstanding for Sea, but at the same time, we must acknowledge that the risks have also increased. I hope you understand what I mean at the end of the article but we need to dive into the numbers first.

The Numbers

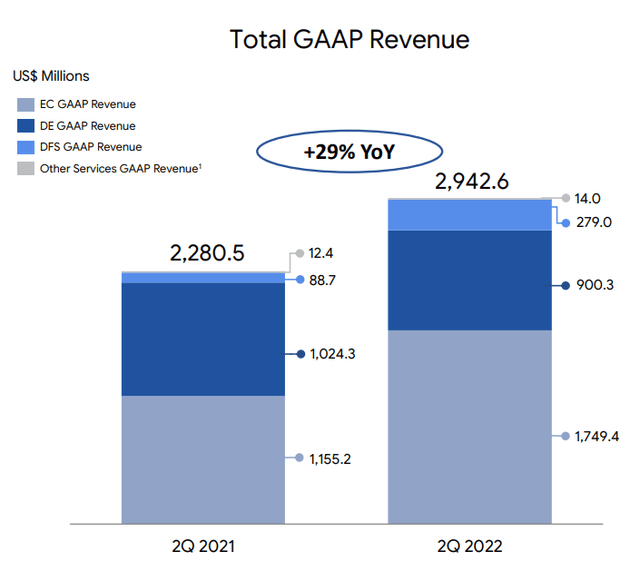

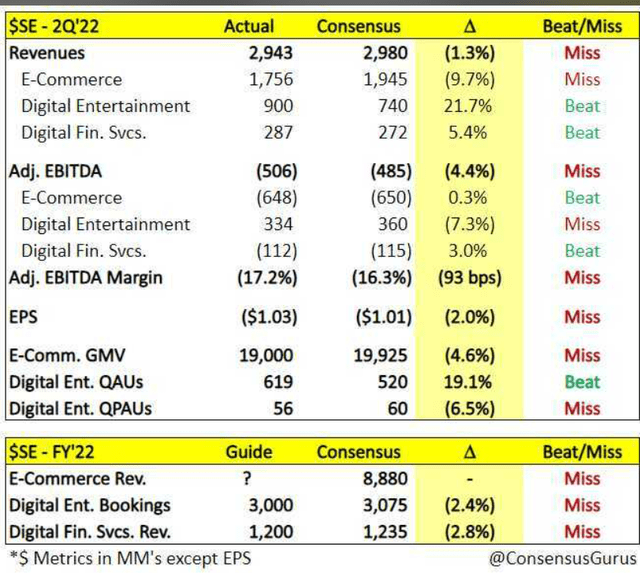

Sea’s Q2 2022 revenue came in at $2.943B, up 28.9% YoY, and a 1.3% miss on the consensus of $2.980B.

Sea’s Q2 2022 Earnings call presentation

The overall EBITDA margin (of the Group) was -17.2%, slightly worse than the -16.3% consensus. EPS came in at -$1.03. I have checked multiple sources for the consensus and all had other consensus numbers, so I’m not sure if I should say it’s a beat or miss. For Seeking Alpha, it’s a beat, for Consensus Gurus it’s a miss, Earnings Whispers indicates a miss, but on the GAAP EPS and so on. It’s not that important.

Shopee

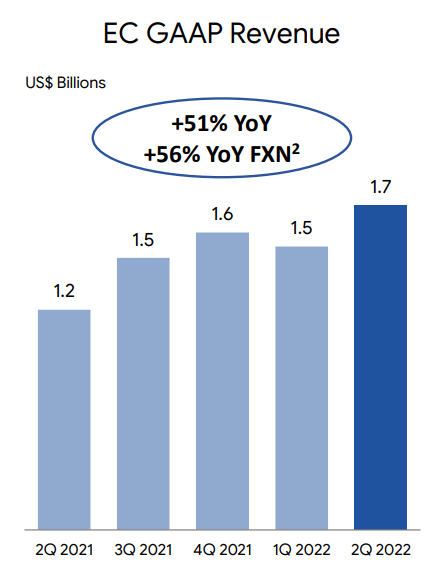

This time, not Garena but Shopee was the reason for the revenue miss. While there was a consensus of $1.945B of revenue, it was just $1.756B, a miss by nearly 9.8%. There was a 4% currency impact, though.

That e-commerce was weaker was not a big surprise, as we have seen that all over the board. Even Amazon (AMZN), the giant in this space, had a weak e-commerce quarter, with revenue down 4% YoY. Nonetheless, 9.8% is quite a bit to miss. EBITDA was -$648M, slightly better than the consensus of -$650M. GMV (=gross merchandise volume, the dollar amount of everything that is sold on the platform) was $19B, while the consensus was almost $20B.

Don’t let this make you think that Shopee is not growing anymore, though. Revenue still was up 51.4% YoY and even 56% on a currency-neutral base.

Sea’s Q2 2022 Earnings call presentation

The total number of orders was 2.0B, an increase of 41.6% Y/Y.

Garena

Garena’s revenue was down 13.8% YoY, from $1.2B to $900M, but this was almost 22% better than the consensus of $740M. QAUs (quarterly active users) came in quite a bit higher than expected, 619M versus the expectations of 520M. Quarterly Paying Users missed the consensus, though, with 56M versus the expectations of 60M. EBITDA for Garena came in lower than expected, as a consequence of the lower QPUs, with $334M, compared to the $360M consensus.

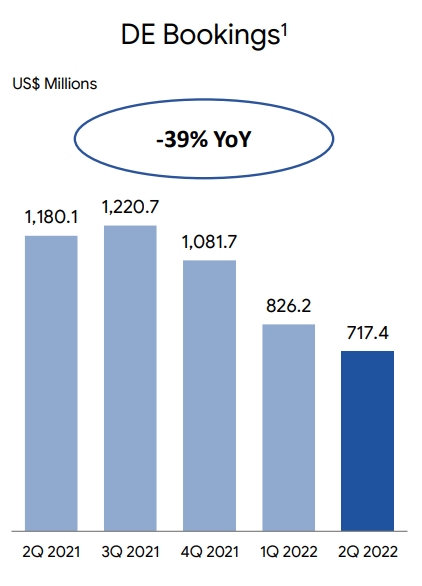

The lowlight was bookings, down 39% YoY. We see weakness in the gaming industry as a whole, but that doesn’t mean we can simply ignore this. Bookings provide a window into the future. They are the money players have already paid but not spent. If you take $50 of gaming credits, and you only use $5 in this quarter, revenue is $5, but bookings are $50.

Sea’s Q2 2022 Earnings call presentation

Forrest Li sees two factors, but remains positive for the long term:

While short-term gaming industry trends remain relatively uncertain due to reopening trends, as well as the potential impact from macro volatility, we are highly confident in the long-term structural tailwinds of the segment.

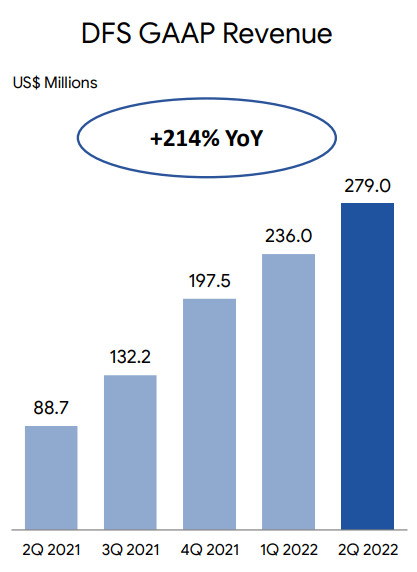

SeaMoney is still in a very early stage but it’s growing fast. The consensus was $272M in revenue but it beat estimates by 5.4% to $287M. That’s up a whopping 214% YoY.

Sea’s Q2 2022 Earnings call presentation

(From the earnings call presentation)

The number of users was up 53.3% YoY to 52.7 million and TPV (total payment volume) came in at $5.7B, up 35.7% YoY. The fact that TPV was up less than the number of users means that people have paid more lower-priced items with SeaMoney. For Shopee, you can see the same trend, more orders but GMV doesn’t grow as fast. This probably has to do with macroeconomic uncertainty and inflation.

But at the same time, it shows that people are using SeaMoney (and Shopee) more for smaller purchases as well and in that way, it gets ingrained in their daily lives. The much higher revenue shows that Sea can leverage that and take more revenue without damaging the usage of the service. Sea Money EBITDA came in at -$112M, 3% better than the -$115M consensus.

Just as a comparison, Mercado Pago has a TPV that is 6 times bigger than that of Sea Money and revenue that is 10x higher, while Sea’s core market (Southeast Asia and Taiwan) is a bit bigger than Latin America.

This is what Forrest Li said on the conference call about Sea Money:

Synergies between Shopee and SeaMoney also expanded, as we continue to cross-sell more financial products and services to our underserved user base across more markets. Close to 40% of Shopee’s quarterly active buyers in Southeast Asia used the SeaMoney products or services during the quarter.

To me, SeaMoney is an important part of the investment thesis. It could grow into something similar as Mercado Pago for MercadoLibre. But of course, just as it took years for Mercado Pago to become a meaningful contributor to MercadoLibre’s revenue, it will take years for SeaMoney too.

Guidance

Guidance was not given for Shopee. Management gave this reason:

In our efforts to adapt to increasing macro uncertainties, we are proactively shifting our strategies to further focus on efficiency and optimization for the long-term strength and profitability of the e-commerce business. Given this strategic shift, we will be suspending e-commerce GAAP revenue guidance for the full year 2022.

In other words, management has been focusing more on Garena’s engagement, which shows in the numbers, and it will continue to do so. On the conference call, it was made even clearer. Sea’s COO Yanjun Wang:

we will see the growth – top line growth more as an output at this stage not as a target.

That means we could see better numbers for Garena and slower growth for Shopee. That’s okay for me. 51.4% YoY growth, with such tough comps is still very impressive. Don’t forget that Shopee’s revenue was up 161.7% YoY in Q2 2021. This shows the strength, despite the rather big miss for Shopee’s revenue this quarter and the suspension of guidance for the rest of the year.

Analysts made a lot of fuss about the guidance withdrawal. Three questions came about it and it was for some the most important news about the earnings release. I think it was a good decision. Google (GOOG) (GOOGL) doesn’t guide, but no fuss about that. Many others also don’t guide now and Warren Buffett never gives guidance for Berkshire Hathaway (BRK.A) (BRK.B). The guidance withdrawal will probably have been an important driver of the stock price drop today.

For Garena and SeaMoney, guidance is 2.4% and 2.8% below the consensus but unchanged from previous guidance.

This is a summary of the numbers by ConsensusGurus.

More insight

Like in previous quarters, Sea says it will focus on efficiency and profitability much more. From the press release:

While we have strong resources and are well on-track to achieve our self-sufficiency targets, we are nevertheless rapidly prioritizing profitability and cash flow management.

That’s why Garena, which provides very strong cash flows for the company, was prioritized, resulting in much better gamer retention than analysts had predicted. There is weakness in gaming overall, which is why it’s not a big surprise that the quarterly paying users came in lower than expected, but the drop in quarterly active users was stopped, which is very important for the long term.

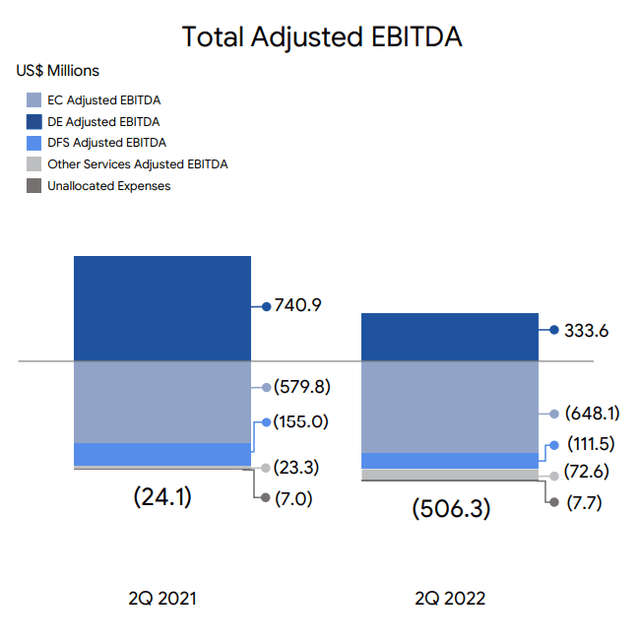

When you look at Shopee, you also see more efficiency, although it’s still far from profitable, of course. You can look at adjusted EBITDA for Shopee and see that it went from -$579.8M to -$648.1M. Your conclusion could be that this is bad, but on a per order basis, the EBITDA loss improved by 21%, now coming in at -$0.33. That still sounds like a disaster if you don’t know the context, but Sea still invests heavily in Latin America, particularly Brazil.

In Southeast Asia and Taiwan, Shopee’s core markets, adjusted EBITDA loss per order was less than $0.01, for the quarter, an improvement of 95% YoY.

Shopee’s expansion in Brazil is still much earlier. After all, it was just launched in December 2019, not even three years ago. There the EBITDA loss is -$1.42 per order. Similar losses were also showing up 5 years ago in Southeast Asia and Taiwan when the company was in a similar position with Shopee as it is now in Brazil. Nevertheless, the EBITDA losses in Brazil also improved by 35% YoY.

Worldwide, Shopee was the top-ranked shopping app on Google Play by total time spent in-app and 2nd by average monthly active users. That also shows the company’s strength. If you wonder why Google Play, you are probably American. In the US, Apple (AAPL) is the dominant player, worldwide, it’s just around 15% and as Shopee is not in the US, Google Play is much more important.

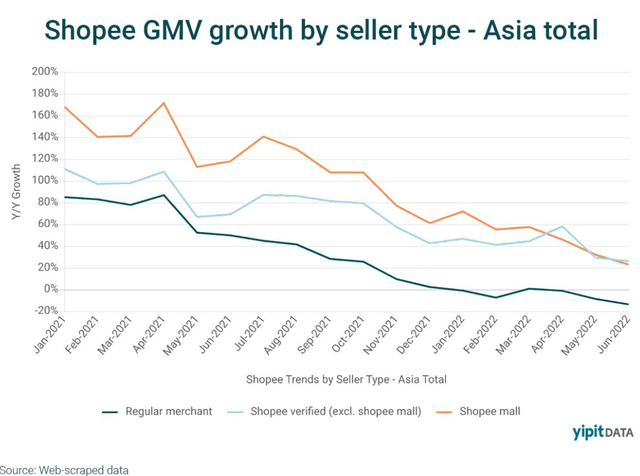

Punch Card Investor, who is a regular contributor to my marketplace Potential Multibaggers shared this graph on his Twitter account:

First, don’t be afraid of that dropping line. It’s normal that sellers can’t keep growing at a rate of 100% and more. But what’s obvious here is that individual merchants’ growth is negative. In other words, there are fewer individual sellers now than there were a year ago. Bigger sellers mean more take-rate and better margins, though. You can also see that in the numbers too. From the press release:

GAAP revenue and GAAP marketplace revenue as % of total gross merchandise value (“GMV”) increased from 7.7% and 6.1% a year ago to 9.2% and 7.7%, respectively.

So, yes, the take-rate has increased quite a bit YoY and that is of course why the company could improve its loss per order in Southeast Asia and Taiwan to less than $0.01. Management reaffirmed that adjusted EBITDA profitability in this core market is planned for next year.

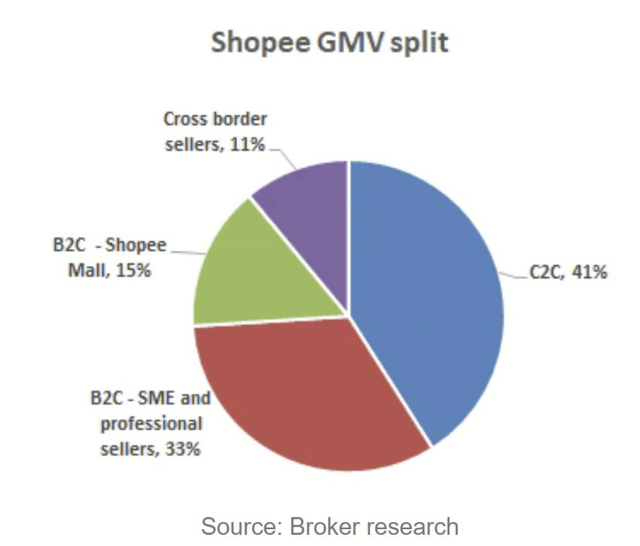

There was also this graph, with an estimate of the GMV split for Shopee:

As you can see, C2C (individual sellers) was estimated to be the biggest source of GMV. Probably that has already changed or it will change soon. That’s not bad at all, as the other categories are much more likely to take extra services, like ads to promote their products.

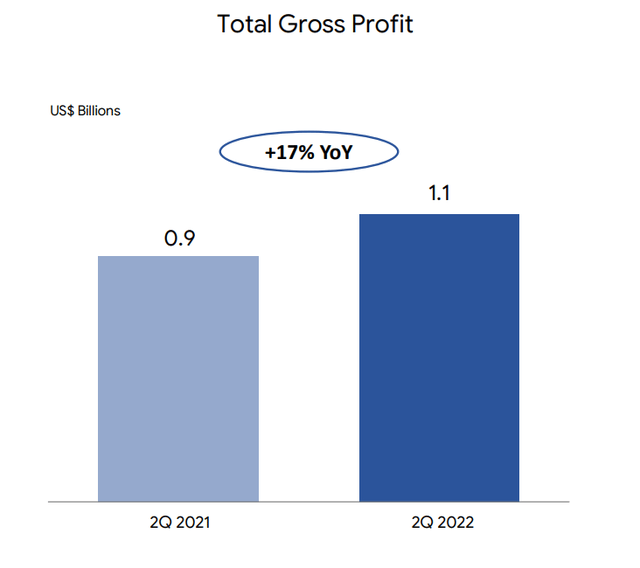

The gross profit for Shopee grew by close to 85% YoY. But overall gross profit, for the whole group, was up only 17%:

Sea’s Q2 2022 Earnings call presentation

That means lower overall profit margins. Of course, here too, the reason is Garena.

Sea continues to invest in Brazil and that yields results. Forrest Li on the earnings call:

in Brazil, we estimate that Shopee has become the main source of income for over 300,000 local entrepreneurs and has brought 430,000 new digital entrepreneurs to e-commerce. This has been partly driven by our investments behind training our Brazilian sellers with more than 60,000 sellers attending classes at the Shopee Education Center.

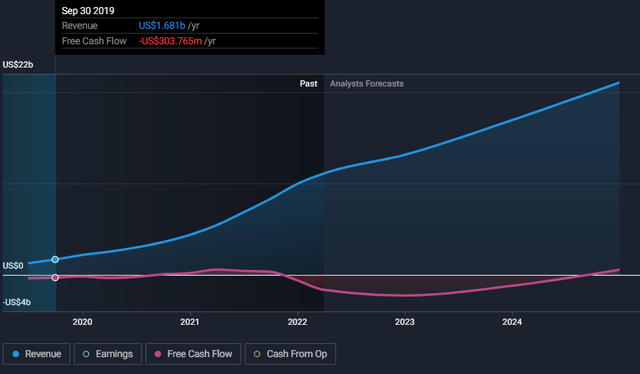

Cash: very important

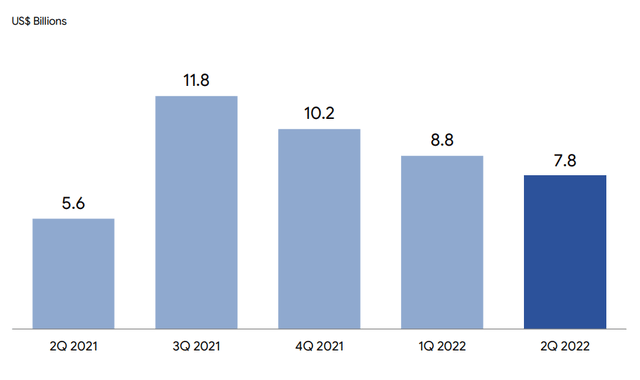

Cash is now very important for the company and you can see why in this graph.

As you can see, revenue is expected to continue to grow fast over the next few years, but free cash flow takes a hit in the next few years. The company will have to use its balance sheet to bridge that period.

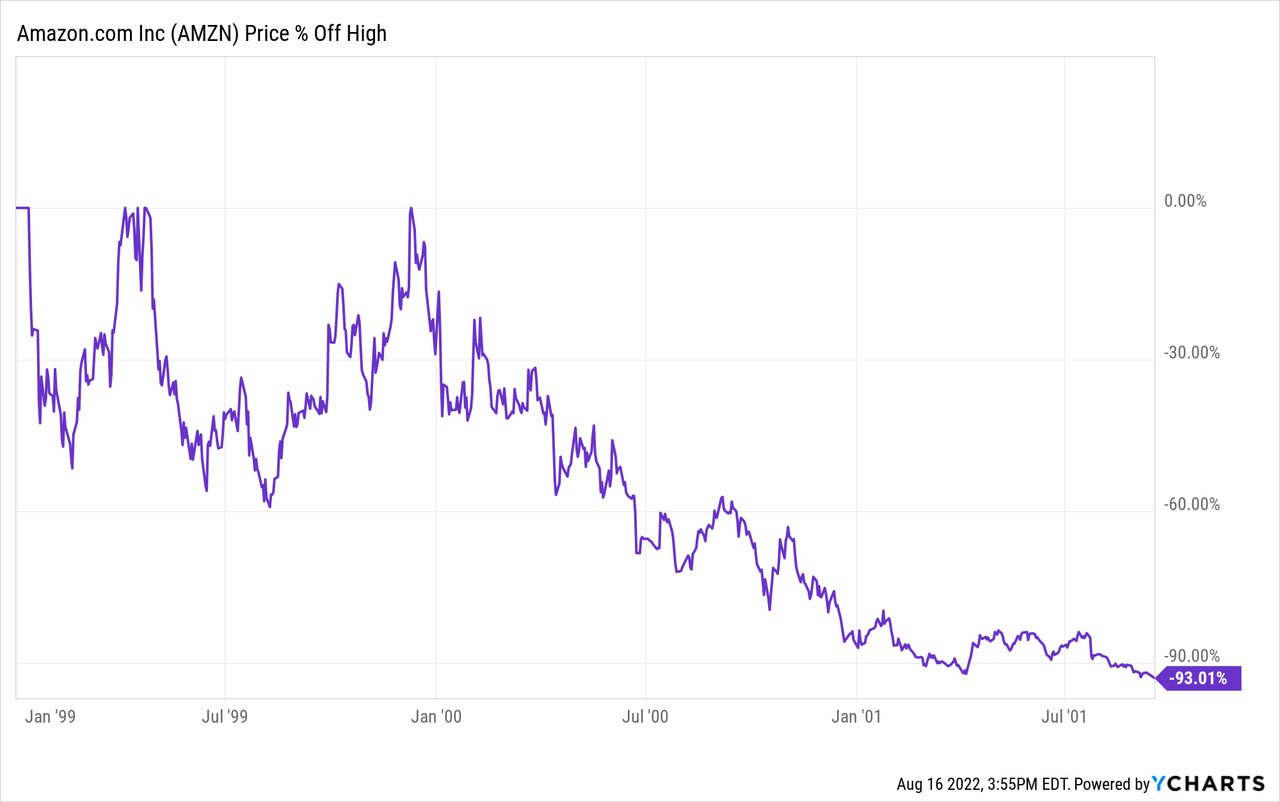

Fortunately, Sea did a stock offering in September 2021. It sold 11 million shares at $318 per share. That allowed it to rake in more than $6B in cash, fortifying its balance sheet. That was a genius move in hindsight. It reminds me of Amazon, which also raised money near the top of the dotcom crisis, which allowed it to survive the crash, unlike many of its peers.

While the cash position of Sea is strong, the investments and the lower profitability of Garena eat into its cash position.

Sea’s Q2 2022 Earnings call presentation

As you can see, the company lost $1B in this quarter, although that’s down from $1.4B in the previous quarter and $1.6B in the one before that. That’s what management means when it says it focuses on efficiency and cash flow. And that’s absolutely the right move in this environment. It’s essential for the company’s long-term story. I will follow up on this in the next few quarters, but it’s good to see that management is working hard on this. It’s an absolute necessity in this environment.

The reason why free cash flow is expected to be so weak in the coming years is Garena. You can see that well in this graph from the company’s earnings slides:

Sea’s Q2 2022 Earnings call presentation

The EBITDA loss for Shopee grew a little bit and Other Services as well (probably SAIL, Sea AI Labs) but all the rest came from the EBITDA decrease of Garena, as you can see.

Now, of course, if Garena could launch another hit game like Free Fire, this could help a lot to bridge the gap but that’s not as simple as it sounds. It doesn’t mean that Garena is not working on something, though. COO Yanjun Wang on the conference call:

In terms of the game pipeline, we do have things in the pipeline whether it’s our own self-development or published titles

While the company has been working to develop spin-offs of Free Fire, it says that there are no near-term elements that can help contribute substantially to the revenue. Again COO Yanjun Wang on the conference call:

From a financial perspective, we don’t think there will be anything that will have an immediate meaningful significant impact like that of Free Fire in the immediate future, because; A, Free Fire is already very long one of the largest mobile titles in the world; and B, for any game that we launched initially our focus is more going to be user engagement and building up the momentum and also the user base and solidify that before we focus more monetization.

Even for Free Fire it actually took the game quite a number of quarters, or I would say even more than a year to graduate and ramp up monetization and to develop into more full potential. So that’s our view.

At this moment, Free Fire remains the most downloaded mobile game and it was also the highest-grossing mobile game in Southeast Asia and Latin America during the Q2 quarter, marking the 12th consecutive quarter.

My thoughts about this quarter

This quarter resembled the previous one. Now Garena was a bit better than in Q1 but Shopee was a bit worse. Sea is clearly a victim of the changed circumstances in many ways. It was in full expansion and investment mode when all of a sudden almost everything changed much faster than everyone could have expected.

It has higher fulfillment costs, e-commerce is in a tougher space after the reopenings, people want to get out and game less, there is high inflation and energy costs and so on. These headwinds could go on for several more quarters.

Nevertheless, if you look at the three divisions, you know that people won’t play fewer games in 2032; they will not buy less online and will not pay more with cash. In other words, the secular tailwinds are still there. They experienced an air pocket, but they are not going anywhere. Focusing on the long term remains very important. But in the meantime, the company has to focus on controlling costs to come out unharmed.

Without the $6B+ capital raise in September 2021, Sea would be much more fragile right now and I applaud them for having done that. Again, this move reminds me of Amazon more than two decades ago.

The long-term thesis for Sea still stands but there could definitely be a lot of volatility and there is more execution risk now. Management has adjusted quickly to the new environment, which is a plus for them but it is a huge ship to turn around. Management says it wants to remain that small ship that can change course fast if needed, but the reality is that Sea has become too big to implement all the changes immediately.

Still, for such a big company, they acted fast. They moved out of Spain, out of India, out of France and started focusing on efficiency immediately. As long as Sea continues to adapt quickly, I don’t think the thesis will be broken. After all, the company operates in regions that have a strong secular tailwind for years to come. Latin America is the fastest-growing e-commerce market, just before Southeast Asia.

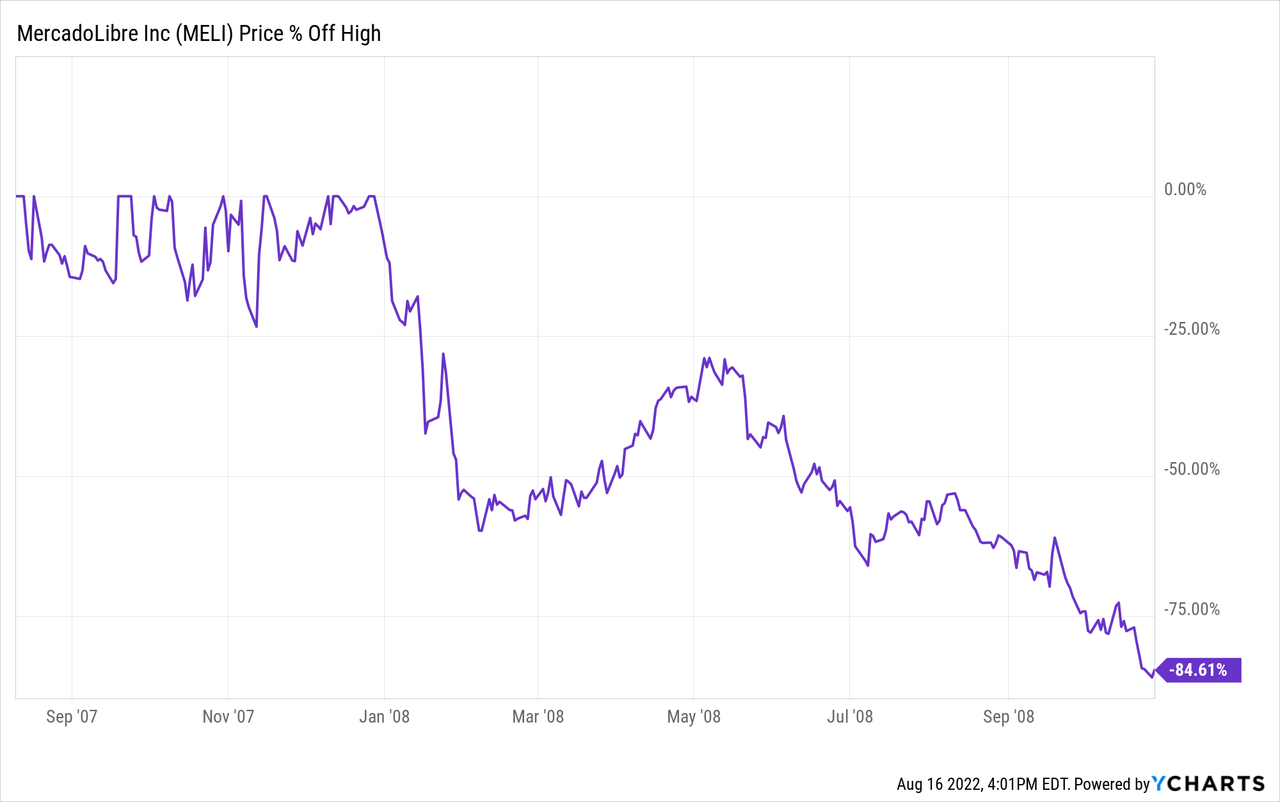

Sea is a much younger company than MercadoLibre (MELI). If you have followed MELI for some time, you see a similar evolution. In the 2008-2009 crisis, MELI went through tough times too but it came out stronger, as the competition had suffered more than MercadoLibre. And we all know what happened to Amazon’s competition in the dotcom bust. I think the same pattern might be visible for Sea when you look back in a few years.

Sea can grow for decades, just like Amazon and MercadoLibre have already done. Don’t forget that Shopee is just 7 years old and now already the leader in all of the markets in Southeast Asia and Taiwan. 7 years after starting was for Amazon in 2001 and MercadoLibre in 2006. That’s why I think it was appropriate that Forrest Li said:

As we have always maintained, we think about managing our businesses as more like marathons rather than sprints. Adjusting our pace to match the moment is therefore highly important. Our ability to navigate changing times will help us win this long race ultimately.

Because of the higher uncertainty, due to the negative free cash flow because of the decline of Garena, I will continue doing what I have been doing since the earnings release of Q1: I will add only very slowly. Measured on the original allocation, Sea is still my largest holding and by adding very slowly or not, other stocks may become my biggest position when it comes to the original allocation. And that’s fine.

But to put it very clearly, I’m not even thinking about selling. I still see a bright future for Sea and long-term, patient investors could be rewarded nicely over the long term. But it also doesn’t make sense to close your eyes and pretend nothing is happening. The conditions are just tougher and Sea will have to fight.

In 2000, Amazon’s stock fell by more than 93%.

YCharts YCharts YCharts

Does history repeat? No, but it often rhymes, as they say. I hear some investors who are afraid that they will be in the red forever with Sea and I understand that. But I think I’ve seen this movie before, as I just showed.

Of course, just like with Amazon and MercadoLibre, it may take time to get to new highs, but don’t forget that the all-time high of Sea is $372. Most of you will not have bought (only) on that particular day, right? So, just ignore the ‘it took so many years to break even’ as they all measure as if you (only) bought at the very top. Suppose you are 60% in the red now, then you are still 50% below the all-time high with average purchase price. And it’s just not a productive discussion.

Conclusion

This was not a good quarter, but not a terrible one either. The company tries to play the cards it was given in the best possible way. It will need time before trends reverse, but for the long term, there are no fundamental thesis-altering elements for me.

In the meantime, keep growing!

Be the first to comment