Marvin Abdon/iStock via Getty Images

Intro

We wrote about Tutor Perini (NYSE:TPC) back in March when we stated that the company needed to begin to turn over capital faster. Although the fourth quarter last year was disappointing from a sales and earnings perspective, the company’s recent first-quarter earnings report was more encouraging for a number of reasons which we will get into.

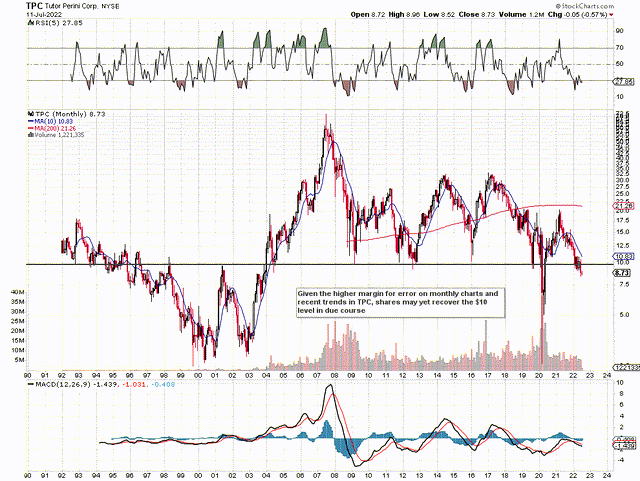

From a technical standpoint initially, however, shares have continued to lose ground since the announcement of those first-quarter earnings back in May. Shares are now trading well below the $10 level so it will be interesting to see if shares can bottom here over the near term. We state this because the company finally managed to generate a sizable amount of operating cash flow ($121 million) in the first quarter as a result of multiple cash collections and ongoing disputes which finally came to an end. Management will now be hoping that this record Q1 cash flow can act as a catalyst for sustained improvement to come.

Investors who follow this company will be well aware of the various external factors which can affect this company’s operations. Trading conditions, as well as the speed of collections all, obviously tie into how fast sales and earnings can be internally generated. Although the timing of a long-play may still be off here, TPC’s risk/reward profile from both a profitability and valuation standpoint is beginning to stack up here for the following reasons.

Tutor Perini Trying To Recover Support (Stockcharts.com)

Tutor Perini’s Profitability

Despite the fact that the company reported a bottom-line loss of $0.42 per share due to a legal ruling which did not go the company’s way, full-year guidance was maintained which was encouraging. From an investor’s standpoint, the Q1 reported loss is temporary in nature and we expect roles to be reversed later this year when decisions from other disputes should go the company’s way. Furthermore, backlog trends clearly demonstrate the strong demand the market has for Tutor Perini’s services (Backlog stood at $8.3 billion at the end of Q1) with multiple award wins (Eagle Mountain pipeline, etc.) in the building and civil segments following on into the second quarter. This bullish trend should have legs given the fact that funding from the federal infrastructure bill is expected to be spun out over the next five years or so.

Earnings revisions are starting to be dialed up with the company’s Q2 estimate of $0.42 per share up over $0.11 over the past 30 days alone. The third-quarter estimate of $0.56 per share also has gotten a boost over the past 30 days which leads us to believe that if these trends continue, the market sooner rather than later will begin to price the shares upward.

The most significant trend however concerning Tutor Perini’s profitability is its increasing cash flow. To put this in perspective, the bumper $120+ million of operating cash flow in Q1 this year was only the second quarter of positive cash-flow generation in the last five reported quarters with Q4’s print only coming in at +$4.2 million. Management now sees a clear line of sight with respect to resolving its various disputes so cash flow is expected to remain strong for the remainder of the year and going into fiscal 2023. Long-term investors focus more on cash flow than earnings because of the potential to invest in assets which consequently results in the growth of sales and earnings over time.

TPC Stock Valuation

This brings us to the company’s valuation which now has a different feel to it due to the company generating cash flow once more. Tutor Perini now trades with a forward GAAP multiple of 7.37, a forward book multiple of 0.25, and a forward sales multiple of 0.10. These ultra-low multiples did not carry huge weight in the past because of the problems the company had encountered with respect to generating cash flow. Now, however, the tables have turned which means the company can fully exploit the demand out there in the market and grow its backlog significantly. Suffice it to say, despite the evident risks, we expect the market to begin to price shares upward in TPC before long.

Conclusion

Free cash flow is the most important metric in finance bar none in our opinion and now Tutor Perini finally has the wind in its sails with respect to the generation of same. Considering the company’s growing demand and present valuation, downside risk has to be limited here. We look forward to continued coverage.

Be the first to comment