Jaiz Anuar/iStock via Getty Images

Crown Castle International Corp. (NYSE:CCI) is a real estate investment trust (“REIT”) that is a leading provider of shared communications infrastructure assets in the U.S. They own, operate, and lease over 40k towers and possess 80k route miles of fiber supporting small cell networks and fiber solutions.

The company’s tenants include the largest wireless and telecommunication companies in the U.S. Leases to these carriers benefit from long-weighted average remaining lease terms and built-in rent escalation provisions. As these companies continue to expend significant capital on their networks to support growth in mobile data demand, CCI is expected to benefit from double-digit annual AFFO/share growth.

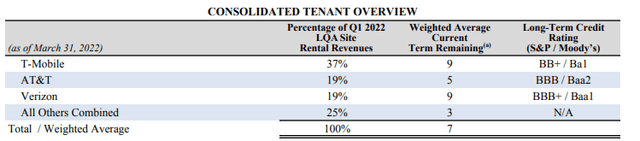

Q1FY22 Investor Supplement – Tenant Summary

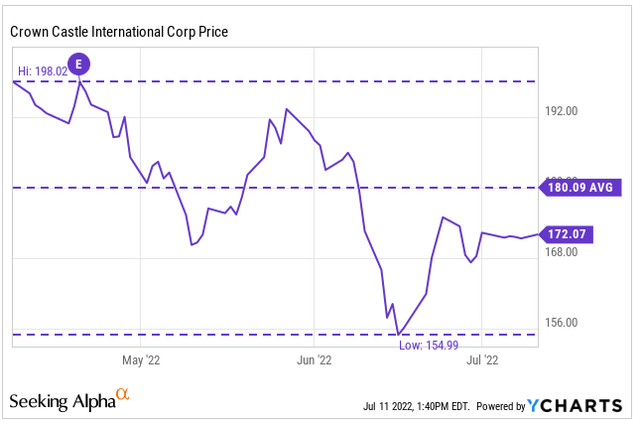

At present, shares are down about 17% YTD, which is slightly better than the performance of the broader S&P 500. With shares a little more than 10% off their 52-week lows, there is the possibility of further upside in the months ahead. Additionally, as a low-beta stock operating critical nationwide infrastructure, there is a defensive element in CCI. This could protect investors from large swings resulting from heightened market volatility. For long-term investors who seek an income stream from critical infrastructure assets at a reasonable price and a moderate level of risk, an investment in CCI makes sense at current levels.

CCI’s Solid Earnings Report

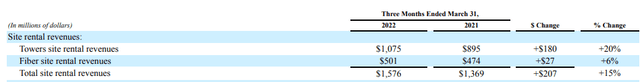

In the most recent filing period ended March 31, 2022, CCI reported total site rental revenues of +$1.6B. This was about 15% greater than the same period last year but +$120M short of consensus estimates. Driving revenues higher was over 9% growth from core leasing activities and contracted tenant escalations, offset by a 3.4% hit from tenant non-renewals. Additionally, revenues were favorably impacted by one-time items of approximately +$15M.

Within the individual businesses, Towers were up 20%, driven by their tenants’ ongoing efforts to improve network quality and capacity, which resulted in new additions and/or favorable modifications to existing contracts. The Fiber business, on the other hand, was up 6%. In future periods, this business is expected to represent a larger share of total revenues as increasing data consumption further supports the need for small cells and fiber solutions.

Q1FY22 Form 10-Q – Breakout of Site Rental Revenues

Overall income from continuing operations was up +$300M, due primarily to a loss reported in Q1FY21 on the retirement of long-term debt obligations. Excluding the impact of those losses, current period income would have been about +150M lower. In focusing on just AFFO/share, growth was 9% from the prior period.

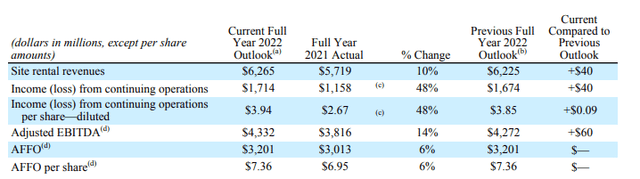

Looking ahead to the full year, management revised guidance upwards as a result of higher tower activity levels, which is expected to contribute +$40M in additional site rental revenues. Though higher revenue growth is expected, the outlook for AFFO remains unchanged due to the exclusion of higher straight-line rent in the AFFO computations and higher anticipated interest expense.

Q1FY22 Earnings Release – FY22 Full-Year Guidance

Following the earnings release, shares initially traded lower on the revenues and earnings miss but briefly recovered upon the boost to full-year guidance. Still, shares have declined approximately 13% from their trading levels at the time of release. With the next earnings release scheduled for Wednesday, July 20, analysts are expecting YOY FFO growth of 12.8%.

Though the company has a mixed record on earnings surprises, shares are generally less volatile than the broader market. As such, investors are unlikely to experience a significant swing one way or the other following the release.

YCharts – CCI’s Recent Price History Since Last Earnings Release

Strong Underlying Fundamentals

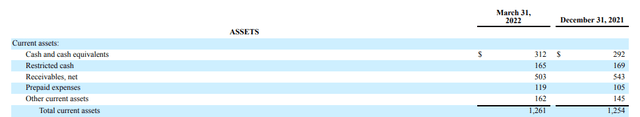

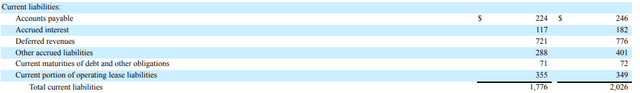

CCI’s balance sheet includes sizeable liquidity of over +$3B, comprised of cash and equivalents and availability under their credit facilities. Total current liabilities in aggregate do exceed total current assets, but the liability is driven by deferred revenues, which are simply obligations to perform a future service as opposed to monetary sums due to creditors. Excluding this item would yield a current ratio in excess of 1x, which indicates sufficient short-term liquidity.

Q1FY22 Form 10-Q – Partial Balance Sheet Q1FY22 Form 10-Q – Partial Balance Sheet

Total net debt at period end was +$20.8B. As a multiple of adjusted EBITDA, net debt was 4.8x. This is a lower multiple than the total leverage reported in Q1FY21. It is also in line with management targets. With just +$750M of debt due over the next 18 months, CCI faces limited near-term repayment risks.

Additionally, the company benefits from holding primarily fixed-rate debt. This provides protection during periods marked with rising interest rates. Though the company does have +$3.5B due in 2026, they have adequate liquidity and readily available access to capital markets, supported in part by their investment-grade credit rating.

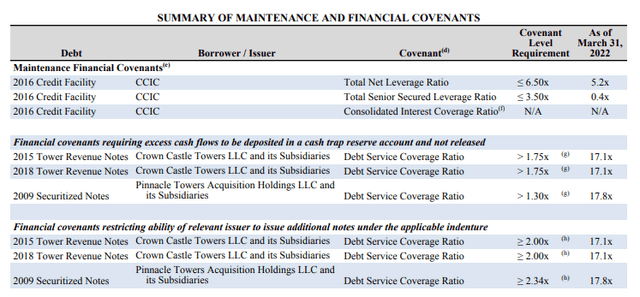

CCI is also comfortably in compliance with the requirements specified in their covenants. As such, the risk of a credit downgrade or default is minimal.

Q1FY22 Investor Supplement – Summary of Compliance with Financial Covenants

For income-focused investors, shares in CCI provide a steadily growing dividend that is currently yielding just under 3.5% at current pricing. Coverage appears adequate, with a payout ratio of 81% of forward AFFO. However, the ratio is higher than the sector median of 73%. Additionally, operating cash flows in the current period were insufficient to fully cover the total payouts, with the dividend accounting for 1.16x operating flows.

On a full-year basis in 2021, however, the payout was fully covered. Given the timing considerations of quarterly cash flows, it’s likely 2022 will end with full cash flow coverage.

At present, the dividend is growing at a 3-year CAGR of 9%, and management expects this rate of growth to average 7-8% in the years ahead. For dividend-growth investors, this is certainly one draw to the company’s shares.

Some Risks To Consider

Demand for CCI’s communication infrastructure is dependent on consumers’ and organizations’ demand for data. A slowdown in data demand due perhaps to certain technological changes or governmental regulations could negatively impact CCI’s operations. In addition, disruptions in financial or credit markets could negatively impact the ability of their tenants to raise adequate capital to fund their infrastructure expansion plans. Due to the capital-intensive nature of the industry, any declines in tenant CAPEX spending would, likewise, negatively impact CCI.

Substantial exposure to just three primary tenants presents significant concentration risk to the company. Though these three tenants, T-Mobile (TMUS), AT&T (T), and Verizon Wireless (VZ), are large publicly traded companies with time-tested business models, the loss of any one of these tenants because of consolidation, merger, or insolvency, among others, would result in a material decrease in revenues and an impairment in the company’s operating assets.

In recent years, CCI has allocated a significant amount of capital to their Fiber business, which now accounts for approximately a third of total site rental revenues as of the full year ended December 31, 2021. While the business is expected to be a growth segment for the company, it does face unique operational considerations that are different than their more mature Towers business. Some factors that could potentially affect future revenue streams in the business include the use of public rights-of-way and franchise agreements and the use of poles and conduits owned solely or jointly by third parties. In addition, continued technological advancements could enable tenants to realize an equivalent number of benefits with less utilization of the company’s fiber.

In recent periods, there have been several notable cybersecurity breaches, such as the SolarWinds hack, the Colonial Pipeline Ransomware Attack, and the Log4J security breach, to name a few. In an ever-interconnected world, the risk of escalating threats to critical infrastructure is one concern not to be overlooked. If CCI’s infrastructure were subject to a cybersecurity incident, they would face an adverse event either through lost revenues, damaged assets, or negative publicity. Ongoing disruption could also pose material risks to the company’s operating results.

Conclusion

CCI is a leader in the tower industry with a resilient business model that boasts of a favorable long-term outlook. Since 2010, cell site growth, mobile data usage, and available spectrum have experienced unprecedented growth and are projected to continue growing at 25% per year through 2027. To support this level of growth, U.S. carriers will need to continue expending significant capital on their networks.

As a domestically focused company, CCI benefits from the disproportionate share of global network capital investment in the U.S., with North America expected to account for over 30% of expected global wireless CAPEX through 2025. The lack of exposure to foreign operating environments also insulates the company from losses due to current market conditions. This is unlike other multinational S&P components, who face heightened earnings risk from a combination of a stronger dollar and geopolitical uncertainties.

With liquidity of over +$3B and limited near-term debt maturities, CCI’s balance sheet is well-suited to weather any setbacks in the broader macroeconomic environment. The low-beta nature of the stock provides further protection against market volatility. In addition, the current annual dividend payout of $5.88/share represents a yield of just under 3.5%.

With an anticipated growth rate of 7-8% in the years ahead, shareholders could be rewarded with outsized total returns. Even at a 3.5% dividend growth rate, shares would be valued at approximately $200 when applying a standard dividend discount model using the consensus 2023 dividend estimates and a CAPM-derived discount rate of 6.6%. For investors seeking critical nationwide infrastructure assets for their long-term portfolios, CCI provides great long-term value at a reasonable level of risk.

Be the first to comment