ipuwadol

Investment Thesis

Trimble Inc. (NASDAQ:TRMB) provides technology solutions to various industries such as geospatial, agriculture, architecture, transportation, and construction. The company has recently announced the acquisition of B2W software to expand its civil construction portfolio. I believe this acquisition can accelerate the company’s growth by increasing its market share.

About TRMB

TRMB deals in providing technology solutions that help professionals and field mobile workers by enhancing & transforming their work processes. These technological solutions are used by various industries, including construction, civil engineering, architecture, natural resources, agriculture, geospatial, survey & mapping, utilities, transportation, and government. The company’s representative customer base consists of engineering & construction firms, trucking companies, surveying companies, farmers & agricultural companies, energy & utility companies, and state, federal & municipal governments. The company’s solutions offer significant customer benefits, such as higher productivity, lower operational cost, and improved quality. The company conducts its business in four reportable segments: Buildings & Infrastructure, Geospatial, Resources & Utilities, and Transportation. The Buildings & Infrastructure segment includes solutions designed for the residential, industrial and commercial building industries. These solutions consist of software for 3D conceptual design & modeling, project management solutions, project collaborations, and BIM software for designing and construction. The Geospatial segment deals in solutions such as real-time communications systems, field-based data collection systems & field software, and back-office software used for data processing, monitoring, reporting, and analysis. The Geographic Information Systems (GIS) product line focuses on collecting field data and integrating it into GIS databases, enabling better decision-making. The Resources & utility segment focuses on serving customers working in agriculture, forestry, and utilities. The company’s precision products and services include guidance & positioning systems, information management solutions, autonomous steering systems, and automated & variable rate application, which helps farmers to improve crop performance and profitability. The Transportation segment provides capabilities for long-haul trucking and freight shippers. It includes transportation management systems, routing, reporting, analytics, mapping, and predictive modeling solutions, which help the transportation industry to increase operational efficiency.

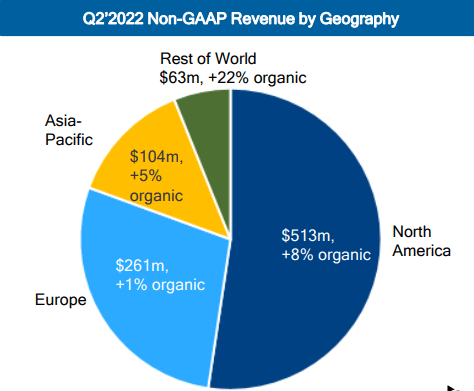

Revenue by Geography (Investor Presentation: Slide no. 18)

Acquisition of B2W Software

The Global Covid-19 Pandemic caused a dramatic demand increase in construction lines which has forced the construction players to reduce their costs and improve their productivity to get the maximum benefit from the rising demand. This has led them to digitize their operations, which helps them cut down the cost incurred on human resources significantly. The large-scale construction players were already heavily invested in technological solutions before the pandemic. But in the current scenarios, we can see that many small-scale players are investing in cost-saving software and technological solutions, which has led to intense competition in the technological market to cater to increasing consumer demand. Identifying this opportunity, the company recently announced the acquisition of B2W software, a leading provider of solutions mainly designed for the civil construction industry. This acquisition will enable the company to provide an enhanced end-to-end digital experience that can help civil contractors to improve their productivity, profitability, and sustainability. B2W’s application suite includes scheduling, estimating, equipment maintenance, field tracking, data capture, and business intelligence. By combining these advanced capabilities with the company’s technological solutions, such as project management, finance, rich field data & human capital management solutions, the civil contractors can highly benefit from bridging the gap between office & field, which can further promote transparency and efficiency in their business. These technologies have various benefits, which help the contractors to cut down costs and attract a large number of customers. I believe these combined capabilities can significantly help the company to maintain an edge in this competitive industry and create a strong presence in the market by diversifying its Buildings & Infrastructure segment. After considering all these factors, I think these enhanced technologies might act as a critical aspect to increase the company’s market share and accelerate its growth by catering to the massive demand for technological solutions, which can ultimately expand its profit margins. The rapidly growing demand for technological solutions can be sustainable for the next decade as artificial intelligence, analytics, and robotics are emerging as essential technologies required by every business sector. The company is also planning to expand its operations in developing Asian countries where civil contractors and firms are now highly switching from traditional methods to modern digitalized methods. This acquisition perfectly complements the company’s expansion plans into Asian countries.

What is the Main Risk Faced by TRMB?

Intense Competition

The company operates in a highly competitive industry, including direct and indirect competition. It faces direct competition from other software, optical, and laser suppliers, which can further intensify with the entry of new participants. The companies in this industry compete based on various factors such as price, quality, distribution channels, direct sales force, the performance of products, innovation, and product capabilities. Due to these competitive advances, TRMB may need to adjust quickly to technology and consumer preference changes, such as cloud computing, mobile devices, and new computing platforms that the company has not been exposed to yet. Such competition has historically resulted in price reductions, decreased margins, or market share losses. If the company fails to keep up with competitors and market development, it might lower revenue and growth rates or harm its operating performance and financial condition.

Valuation

The company has recently announced the acquisition of B2W software, which I believe can accelerate the company’s growth by creating a competitive position and strong presence in the market. After considering all the factors, I am estimating EPS of $3.5 for FY2023 which gives the forward P/E ratio of 15.96x. After comparing the forward P/E ratio of 15.96x with the sector median of 17.31x, I think the company is undervalued. I believe the company might fail to gain significant momentum as the company is operating in an intensely competitive market where high inflationary environment price wars can negatively affect the profit margins. Hence, I think the company might trade below its 5-year average P/E ratio of 24.41x. After considering all these factors, I estimate the company might trade at a P/E ratio of 19.90x, giving the target price of $69.65, which is a 24.6% upside compared to the current share price of $53.49.

Conclusion

The company operates in a highly competitive industry with low entry barriers. The competitors in the industry compete on the basis of price, quality, innovation, and product capabilities. The company has recently announced the acquisition of B2W software, which can benefit it to maintain a competitive edge in the market and increase its market share by further increasing its profit margins. I expect steady growth of the company in the coming years. After comparing the forward P/E ratio of 15.96x with the sector median of 17.31x, I think the company is undervalued. After analyzing all the above factors, I recommend a buy for the TRMB.

Be the first to comment